Here is a new twist on an old strategy involving cash secured puts.

Cash secured puts are a great strategy for beginners to start out as a way to learn options trading. For those of you who don’t know what a cash secured put is, it involves selling a put on a stock you wish to buy to collect the premium and / or reduce your purchase cost. For example, if there is a stock trading at $100 that you want to buy, you could sell a 1 month put option for $3 and leave the $10,000 in your account earning interest rather than buying the stock outright. Then in 1 month’s time, if the stock is trading above $100, you keep the premium and repeat the process. You’ve just earned a 3% return in one month or 36% p.a.

If the stock is trading below $100 at expiry your option will be exercised and you will buy 100 shares for $100, but you still keep the option premium which effectively reduces your cost per share to $97.

Now, in order for this strategy to work, you still need to be a good stock picker, and you still need to stick to your trading rules. If you sell a put, and the stock moves below your loss threshold, you need to cut your losses and move on to the next trade. One of my all time biggest trading mistakes was trying this strategy over AIG back in 2008. Yes, I’m ashamed to admit, I sold a $38 put on AIG for a premium of $1.95 back on May 13th, 2008. I figured AIG was too “big to fail” and the recent sell off had been overdone. Plus, with volatility so high, I received a nice juicy premium! Big, big mistake. Never get sucked in to an options strategy just because the premiums are attractive, you have to make sure you understand the stock and the company and most importantly STICK TO YOUR TRADING RULES!! In any case, the rest is history and we all know the story of AIG. I had lost $3214 or 84% on the trade when I eventually cashed in my chips on September 1st, 2009. Please, please, please heed my advice and don’t make this same mistake I did!

Anyway, back to the strategy and how you should trade it. Let’s assume you have $20,000 to trade and you want to buy 200 shares of the $100 stock. In the first month, you sell just 1 option which means if you’re exercised you only have to buy 100 shares. This way you have not risked all of you capital straight away. As we saw earlier, if the stock stays above $100, you keep the premium and have made $300 or 1.5% on your $20,000 in one month. Yes, this is less than the 3% you could have made if you sold 2 options, but your risk was also lower. By not buying all 200 shares at once, you can take advantage of dollar cost averaging further down the line.

In month two, if you still like the stock at the current price you write 1 new put option. You continue this process as long as you still like the stock and are happy to own it.

Now, let’s assume that the $100 stock has fallen to $95 after one month. It’s below your strike price, so you will be required to buy the stock, but it has only fallen 5% so shouldn’t have triggered your stop loss. You buy the stock for $100, with a net cost of $97 due to the option premium received. You now own 100 shares, and what you want to do is sell a 1 month call option with a strike price of $100 (or higher if you deem it appropriate) and receive around $2 in premium. At the same time you sell a put at $95 and receive around $3 in option premium, so in total you receive another $5 in option premium.

Here is a look at how the strategy will perform in various scenarios at the end of month 2.

Stock finishes at $110 at expiry

- 100 shares are called away at $100.

- You keep 3 lots of option premium. $300, $300 and $200.

- Profit on the trade is $800 in two months which is 4% (800 / 20,000), or 24% p.a.

Stock finishes at $99 at expiry

- You still own the first 100 shares

- You keep 3 lots of option premium. $300, $300 and $200.

- Loss on the share purchase is $100.

- Second put expires worthless.

- Profit on the trade is $700 in two months which is 3.5% or 21% p.a.

- As you still own the shares you can sell another call and another put to generate even more income

Stock finishes at $95 at expiry

- You still own the first 100 shares

- You keep 3 lots of option premium. $300, $300 and $200.

- Loss on the share purchase is $500.

- Second put expires worthless.

- Profit on the trade is $300 in two months which is 1.5% or 9% p.a.

- Notice how with this strategy, the stock has declined -5%, but you have actually made 1.5%

Stock finishes at $90 at expiry

- You still own the first 100 shares

- You will be exercised on the second put and be required to buy another 100 shares at $95. Your average cost on the shares is $97.50

- You keep 3 lots of option premium. $300, $300 and $200.

- Loss on the first 100 share purchase is $1000.

- Loss on the second 100 share purchase is $500.

- Total loss on the trade is $700 in two months which is -3.50%. Notice how with this strategy, the stock has declined -10.0%, but you have only lost -3.5%

- This situation is where the management of the trade gets a little tricky. If you have a stop loss rule of 8%, do you take that from the original price of $100, or do you take it from you average cost of $97.50? You could also take into account the option premium received of $800 which actually reduces your net cost to $93.50 (97.50 – (800/200)). Personally I set my stop loss at 8% of $97.50 so just below $90 in this case, but you would need to decide your own stop loss rules before you enter the first trade.

Planning in advance how you will deal with losing trades is really important. If you have certain criteria set for cutting losses before you enter the trade it allows you to take the emotion out of the decision making.

Stock finishes at 75 at expiry.

Realistically, the stock has dropped 25% and should have triggered your stop loss. But, if you’re still in the trade, this is how it looks.

- you hold 200 shares at an average cost of $97.50

- you have collected $800 in premium

- loss on first share purchase is $2,500

- loss on the second 100 share purchase is $2,000

- total loss on the trade is $3,700 or -18.50% compared to -25.0% on the underlying

- As you still own the shares you can sell another call and another put to generate more income

Stock finishes at $40 at expiry.

Hopefully, you’re not a Muppet like me and have long since cut your losses. But, if you are a Muppet and are STILL holding the position this is where you would stand.

- you hold 200 shares at an average cost of $97.50

- you have collected $800 in premium

- loss on share purchase is $6,000

- loss on the second 100 share purchase is $5,500

- total loss on the trade is $10,700 or -53.50% compared to -60.0% on the underlying.

- As you still own the shares you can sell another call and another put to generate more income, but really you should have been out of this trade long ago.

As you can see, the strategy will work well as long as the stock does not fall too far. Anything less than a 10% fall in the stock and you are still doing ok. However, from the last example above, you can really lose a lot of money if you don’t cut your losses. Stick to you trading rules and never fall in love with a stock, just because you have made money on it in the past. Likewise, don’t keep trying to trade a particular stock just because you have lost money on it in the past and you feel that you need to try and make your money back. There will always be plenty of opportunities out there and as mentioned on my post on the Top 10 Traits of Successful Options Traders, patience and being able to control your emotions are some of the keys to success in the stock market. You may feel really strongly that you are right and the market is irrational, but the market can stay irrational longer than you can stay solvent. You need to be able to live to fight another day. Below are some examples of successes I have had in the market using this options trading strategy.

Successful Cash Secured Put Option Trading Examples

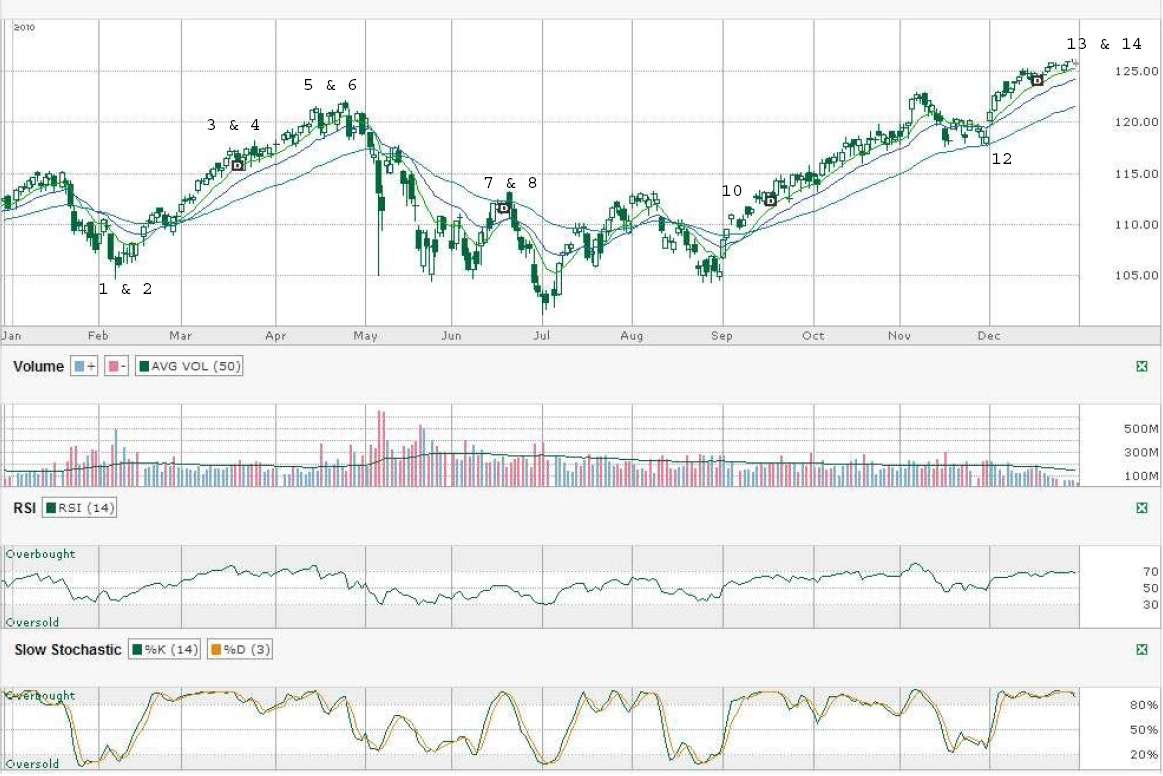

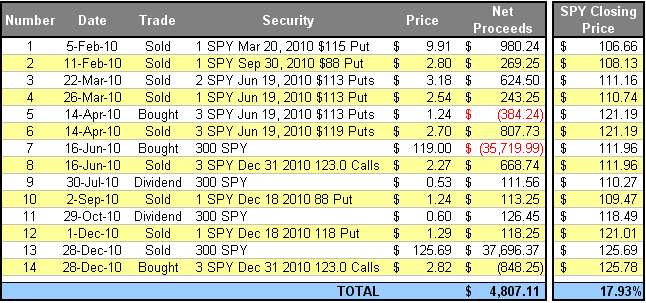

SPY 2010 – Options Trading Review (includes the effects of trading commissions)

My cash secured put trading strategy worked very well on SPY over a period of just under 11 months, returning +13.47%. This is how is played out and my rationale behind the each trade.

1. Opening Position. The market was in correction at this point and so I thought it was a good point to open the option trade. I was confident that the market would turn around soon and therefore I wrote a put that was in-the-money, rather than at-the-money or out-of-the-money as I would normally do.

2. Again, as the market had sold off, I thought I would take the opportunity to write a deep out-of-the-money put option. I was very confident that the SPY would not fall to 88 by September so I wanted to collect some extra premium. I needed to sell a long dated put option in order to generate enough option premium for the trade to be worthwhile.

3. My March put option had expired worthless and as the market looked like it had recovered from the recent correction I wanted to re-enter the trade. As the market was less cheap than it was a month ago, I wrote an at-the-money put option. This provided significant option premium.

4. As above, the market looked strong, IBD had just confirmed a new uptrend so I wanted to increase my exposure on this option trade.

5 & 6. At this point, I rolled my put options up to be at-the-money and generate some more option premium. Looking back on it, this wasn’t a very good time to be increasing my exposure as the market was very overbought on a number of indicators. But, saying that I had made some nice profits on my initial trades so I new I had a bit more margin for error.

7 & 8. On June 16th, my $119 puts options were in the money as the SPY was trading at $111.96 and therefore I was required to buy 300 shares for $119. At the same time I sold three Dec $123 calls. I could have sold calls that were at-the-money and generated more option premium but I was fairly confident that the SPY would recover by the end of the year. I wanted to give myself the maximum amount of profit and $123 was my year end target.

9. Dividend received.

10. As the market was fairly cheap at this point, I wanted to take advantage of that again. My September put from point 2. above was about to expire worthless, therefore I wrote a three month deep out-of-the-money put. I was very confident that the SPY would not fall to $88 by year end.

11. Another dividend payment

12. At this point the market looked like it was resuming it’s uptrend so I took advantage of that, wrote a short term put option and made a quick $118 profit in 17 days.

13 & 14. On December 28th I closed out the positions, I would have preferred to just let the my shares be called away, but I was having issues with my broker and was forced to transfer my account to Interactive Brokers who wouldn’t process the transfer if I had options with less than a week until expiry. Apparently TD Ameritrade view people based in the Cayman Islands as too much of a risk. Slightly annoying, but it didn’t make much difference to this trade anyway which was lucky. So in total I made $4,807.11 in just under 11 months. I had used $35,700 of my capital so my return was +13.47%. This compares with +17.93% for the SPY. Obviously I was a little disappointed to have underperformed the market on this trade but I think using the options trading strategy outlined above, my risks were lower than if I invested directly in the SPY without using options trading. As you will see in the next example, using the cash secured put stock and options strategy, you can even profit when the market or underlying stock goes down. Quite significantly in some cases as you will see.

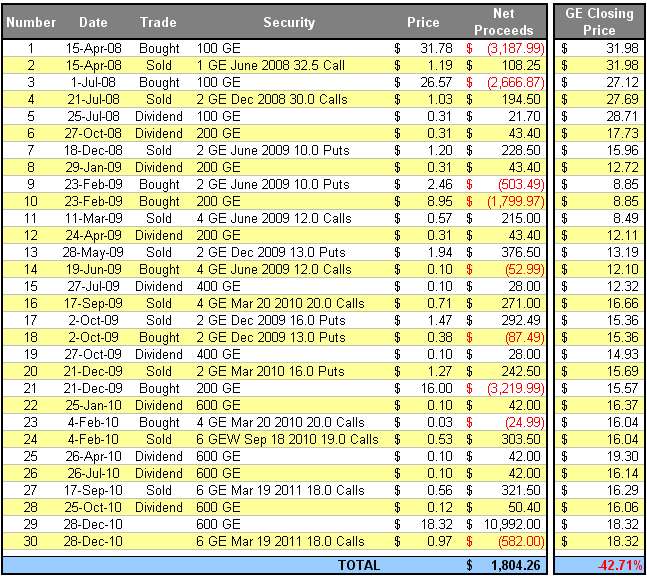

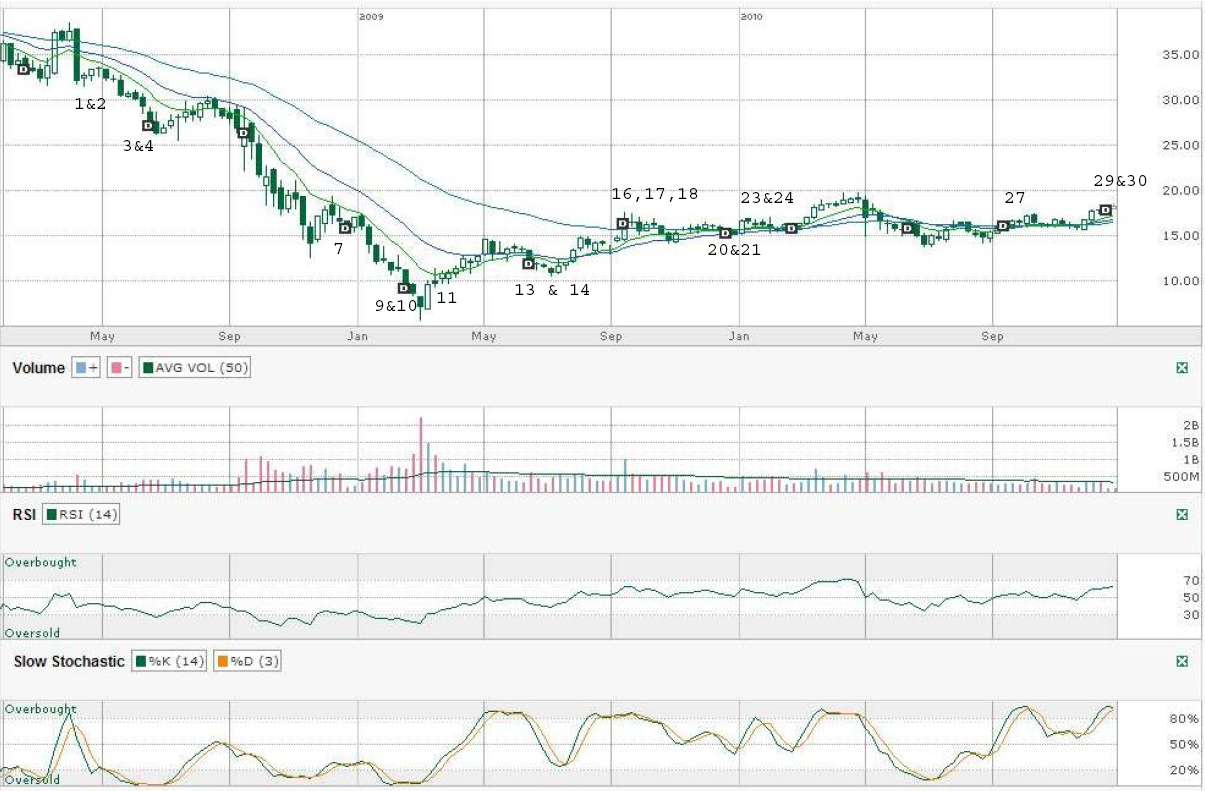

GE 2008 to 2010 – Options Trading Review (includes the effects of trading commissions)

GE was another stock over which I used this option trading strategy, although it played out a lot differently to the SPY trade. For this explanations on this trade I will ignore dividends.

1 & 2. On April 15, 2008 my opening trade was a covered call on GE rather than a cash secured put, but the effect is more or less the same. Unfortunately I opened this trade at a pretty bad time. GE had fallen from $42.15 to $32 and with an attractive dividend I thought it was a good buy. However, it was pretty much all downhill from here until March 2009.

3 & 4. After the June calls expired worthless I bought another 100 shares to reduce my average cost, and then later in the month sold a new batch of 2 calls.

7. By December, GE had fallen significantly, so I wrote another 2 puts well out-of-the-money. My view here was to generate some premium income to help offset my losses on the physical stock. I thought it was unlikely that GE would fall to $10.

9 & 10. By February 2009, GE was below $10. Rather than wait for the puts to be exercised, I closed the puts and bought 200 shares. I now owed 400 GE shares. The reasoning behind this trade was that I would increase my exposure to GE by owning the shares rather than the puts (which had a delta of less than 1), and that I would reduce my average cost on the overall position. I kind of broke my trading rules again here by doubling down on a losing stock, and I could have easily had another AIG on my hands. Thankfully it worked out ok though in the long run. My average cost was now $19.06 rather than $29.17.

11. In March I sold four $12 June calls and earned $215 in option premium. If the shares were to get called away at $12 I would have still lost money on the trade, but I didn’t think GE would get much higher than $12 by June.

13. At this point, GE and the economy in general looked like it was recovering well and that we had most likely seen the lows for the bear market. IBD had confirmed a new uptrend and I decided to write another 2 at-the-money put options to generate some premium. I was also be happy to purchase more GE shares for $13 if I was exercised as this would further reduce my average cost.

14. In June, it looked as though the bear market was definitely over and GE was starting to recover. With GE trading at $12.10, I was likely to have my shares called away. I felt like GE still had plenty of upside so I bought back the June calls for a profit of +$162. I decided not to write any new call options as I thought GE would continue to move up over the next few months and I didn’t want to restrict my potential profits.

16. By September 17, 2009 GE had experience a nice price increase which I benefited from with my long stock position. I thought this would be a prudent time to lock in some of these gains and also take in some more premium income. I sold 4 March $20 calls as I thought GE still had some potential upside which I didn’t want to miss out on. I received $271 in option premium.

17 & 18. On October 2, 2009 my December $13 puts were virtually worthless, so I rolled them up to a higher strike by buying them back and selling the December $16 puts. This meant a net increase in premium received of $205.

20 & 21. In December, with GE trading just below $16, my puts were exercised and I bought another 200 shares of GE, and at the same time sold another 2 March 2010 $16 put options. The average cost on my GE shares was now $18.04.

23 & 24. At this point, with GE trading at $16.04 it was fairly likely that my March $20 calls would expire worthless and were only trading at $0.03. I bought them back and rolled the calls out until September and also reduced the strike price to $19 (which was still above my average cost) in order to capture slightly more option premium. The net result was an increase in premium received of $278.51.

27. In September, my calls expired worthless so I rolled them out and again reduced the strike price to $18 in order to generate slightly more premium

29 & 30. At December 28, 2010, my open stock and option trades were long 600 shares at $18.32 and short 6 March 2011, $18 calls. My total net profit from these stock and option trades over GE was sitting at $1,804.26 and I still had another $390 in time decay between now and March. From my initial trade back in April 2008, GE had fallen in price by -43.53%, but my options trades had made +16.67%.

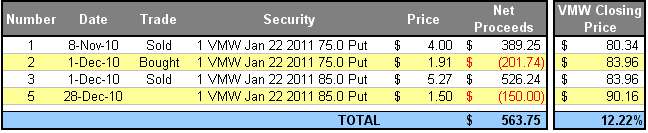

VMW 2010 – Options Trading Review (includes the effects of trading commissions)

VMW is another successful options trade that played out differently to the previous 2.

1. In November, VMW was a stock that had been on my radar for a little while and I saw the recent sell off as a good opportunity to enter an option position on this stock. It was a highly rated stock (17 in the IBD 100 at the time) that looked like it was forming a really nice base around the 50 day moving average line. I waited for a nice follow through day (a significant up day in significantly higher volume than the previous day), which came on November 8th, at which time I sold a 2 month $75 put. VMW also broke above the 50 day line here, so I thought it was a perfect time to enter the trade. Being a fairly new tech company, volatility is fairly high in VMW so I was able to earn a nice healthy premium while the put was still 6.65% below the current market value. I wanted to be fairly conservative on this trade due to the higher volatility. Higher reward = higher risk.

In mid November, VMW sold off pretty sharply and cut back below the 50 day line. I was a little concerned and did contemplate closing the trade. However, I held my nerve and left the trade open. The stock was still trading around my strike price and I was still happy to buy it for $75. The option was now worth around $8 which meant if it expired worthless I would earn 10% in 2 months so I still saw the risk reward as positive. Also, the sell off had not come with any significant volume so I decided to take a wait and see approach.

2. On December 1st, VMW was back above it 50 day moving average line and the technical indicators were improving. With the stock trading around $84 I had made some money on my short put and I decided to roll up to the $85 strike. With a positive technical and fundamental outlook, I was kind of hoping to get exercised as I really wanted a position in this stock. Rolling up the strike price meant I collected another $324.50 in premium for a total of $713. This also meant that if I did get exercised my cost on 100 shares would only be $77.87 ($85 – $7.13).

3. As at December 28th, VMW was trading at $90.16 and I was sitting on total profits of $563.75. With $8,500 at risk in the position this was a 6.63% return in just over a month. Admittedly, VMW had increase by 12.22% during this same period so I would have been better off buying the stock outright. However, with the slightly reduced risk of the cash secured put options trading strategy I was happy with this result.

I think these three examples give you a good appreciation for how this strategy will evolve based on a few different scenarios. The SPY trade shows how selling put and call options can help generate income, and reduce your average cost while you build a position in a stock. The GE example shows you how with this option strategy, it is still possible to make a profit even when the underlying stock declines significantly. VMW is a bread and butter example of how selling short term puts options on stocks you are bullish on can help you generate monthly income with the potential to build a position in a stock. Remember that you should only use this strategy on stocks you have a bullish outlook on and always stick to your pre-defined trading rules.

Do you find interactive brokers competent?