Options Flow or Unusual Options Activity has been a tool for options traders for many years.

Still, it has only been made mainstream recently with sites like Unusual Whales, BlackboxStocks, and CheddarFlow.

Before these tools existed, you would have needed to watch Level 2 for every ticker you wanted to trade, but now they scan the entire market and look for orders that could indicate something big is coming in a particular name.

In this brief article, we will go over some basics of Options flow, what the terms around it mean, and how it can be implemented in all types of trading.

Contents

Basic Terms

Before we get too far into this, there are some basic terms that we should go over so that we are all on the same page.

- Sweep: This is a trade that is broken up into multiple parts but will continue to be filled at the best possible price until the entire position is complete. Usually, these orders hit multiple prices for a contract, and they often show a desire to get in a trade regardless of cost.

- Single leg: This is a single-sided trade like a bought call or a sold put

- Multi Leg: This is a spread trade like a vertical or a condor

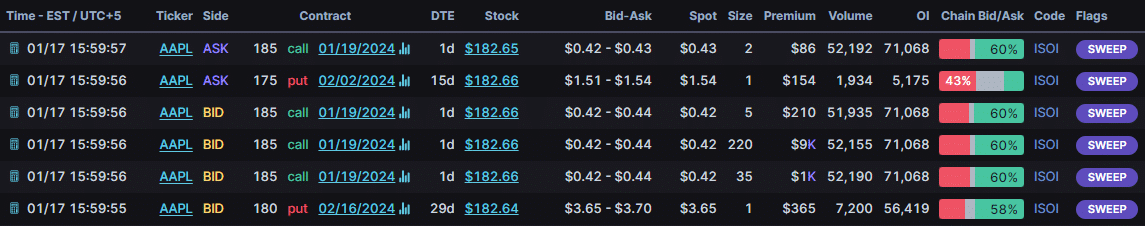

- Side: This is where the trade was filled, and the options are the Bid, the Ask, and the Mid. Trades executed on the Ask are often assumed to be buys, and trades executed on the Bid are assumed to be sells. The screenshot above shows the “Chain bid/ask” Column.

- Size: This is the number of contracts traded

- Volume/Open Interest: These are standard options terminology, but in the context of options flow, this can show you how many are being traded intraday vs what is recorded in Open Interest from the prior night.

There are other nuances to the definitions of options flow, but most depend on which service you use for your options flow.

What Is Options Flow And How Do You Use It?

So now that we have a grasp on some of the terminology let’s jump into what options flow is and how you can use it.

Options Flow, or Unusual Options Activity, is a term used to describe options trades that meet certain criteria that could indicate an opening position in an options contract.

Most often associated with Inter-market sweep orders, or sweeps for short, these orders indicate a trader’s desire to enter an options contract and enter it quickly.

With the advent of additional monitoring tools and services, this has expanded to block trades and spreads and now gives the end user a great view of the order flow traveling through the options exchanges.

This information can be incredibly helpful to an options trader, but it can also be incredibly daunting to see all this data streaming in front of you.

The sheer volume of data available makes it vital to know how to work it into your trading system, and there are a few basic ways to do that.

First, as a market scanner, some people use the options flow to dictate when to enter a position.

One way traders do this is by utilizing sweeps to indicate something important getting ready to happen.

This is incredibly difficult to do consistently, as sweep orders could also mean a trader is closing an open position.

With some time and practice, it is possible to discern the opening flow from the closing flow.

A recent example was from the week of January 15th, 2024.

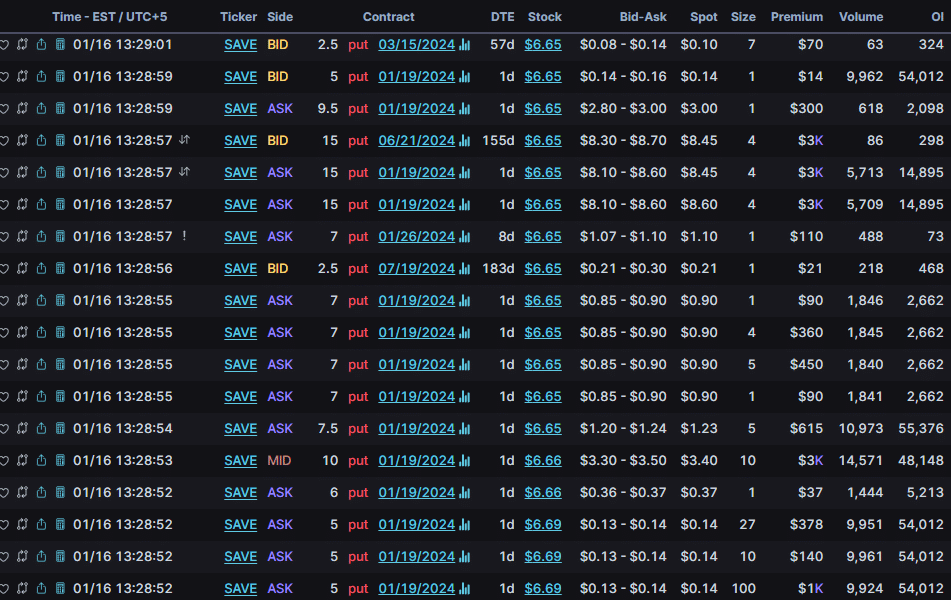

JetBlue and Spirit Airlines were waiting on regulator approval for an acquisition, and some weekly puts started lighting up the options tape in size greater than usually seen on the contract.

Soon, we knew why: regulators had squashed the acquisition, and Spirit Airlines took a nosedive (pun intended).

Those puts were up several hundred percent when all of the dust settled.

The picture below is from Unusual Whales and shows what some of that flow looked like.

Another way to use options flow to look for trades is to use it as a confirmation signal on a name you are already looking at.

This is a much more recommended approach to using it because it helps to eliminate all of the unwanted data.

For example, let’s say you are looking at Apple Stock for a long position via put spreads.

You see the technical lineup but aren’t sure if you are ready to enter the trade, yet when you see put selling, you come across the options flow followed by repeat call buyers.

While this is far from guaranteeing a good position, this can be a great confirmation that it is time to enter the trade.

A final way to use options flow is to help determine long-term positioning for a stock.

Using the information about the strike price, expiration date, open interest, and volume, you can build a picture of how larger traders are positioning for the future.

If there are repeat put sellers and long-dated call buyers in a name, then it’s possible to guess that larger players are bullish on that stock.

On the flip side, there are a lot of call spreads being sold and puts being purchased.

Larger funds may be either hedging their position or being bearish on a name.

Either way, it may be time to lighten your position size.

These are three common approaches to using the options flow, but they are far from an exhaustive list.

That is what makes options flow so interesting; there is almost an infinite number of ways to use them.

Where To Find The Flow

There are a few different options on where to access this options’ flow data.

The first and simplest is through a website that specializes in it.

A few were listed at the beginning of the article, but Unusual Whales is probably one of the more popular tools.

Some others include BlackBoxStocks, Cheddar Flow, Market Chameleon, and even Barchart, which has its version of it.

A second option is to go right through the CBOE Trade Alert service.

This is by far the most expensive, but if you want to go right to the source, this is the place to go.

Finally, some brokers are now integrating ways to view options flow for their customers.

ThinkorSwim, for example, has its “Sizzle Index” and “Trade Flash” modules that allow you to see large and unusual trades.

In addition, if you are watching a specific ticker, you can view all of the options trades for that ticker in real time under the “Options time and sales” feature on their Trade screen.

A few other platforms, like Interactive Brokers and TradeStation, have their variations of scans and tools for this. It should be noted that while these tools work and are free, they are nowhere near as reliable or sophisticated as some of the websites offered above.

Conclusion

As you can see, options flow can be an incredible tool to help level up your trading game.

Whether you are using a dedicated tool or just what your broker offers, it’s a great way to help get some insight into what’s happening under the hood on a given equity.

Options flow is something that every trader can benefit from learning. It’s just a matter of fitting it into your trading style.

We hope you enjoyed this article on decoding options flow.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.