The John Locke V32 option trade stands out as an intriguing and nuanced approach amongst the landscape of option income trades.

In this article, we delve into the principles and intricacies of Locke’s V32 strategy, exploring how it fits into the broader realm of options trading and the potential advantages it offers to astute traders.

Contents

Introduction

John Locke is an income-style options trader, which means that his primary strategies consist of non-directional positive theta trades.

While he is most known for his M3 butterfly strategy, he has a variety of broken-wing butterfly strategies. Some of them are more directional than others.

His bearish butterfly trade is the most bearish trade traders like to put on when they think the market will go down.

His V32 trade is the counterpart.

It is one of his most bullish trades with adjustment rules that maintain a positive delta throughout the entire trade.

John says that this trade can be traded non-subjectively or subjectively.

Non-subjectively, you trade the strategy “campaign-style” by entering based on the calendar or entering a new trade whenever the last trade is complete without looking at technical, VIX, or the market.

Subjectively means that the trader uses discretion as to when to enter and exit the trade and when and how much to adjust.

For example, the trader may enter on a bullish chart signal or exit based on price action.

Since the trade has a bullish bias, the trade may not do well in a bearish market.

Backtest the trade non-subjectively on the bearish year 2022, and you will see what I mean.

While the non-subjective style may work over the long run since the market goes up more often than it goes down, many traders prefer to trade directional trades subjectively.

Or, at the very least, some traders have a bullish market filter.

For example, they may enter only when RUT is above its 20-day moving average, etc.

John had mentioned that he also trades the V32 subjectively.

The V32 is a mechanical rule-based strategy with rules for initial configuration, when to adjust, and when to exit.

Because those full trade rules are only disclosed to paid students of his V32 course, this article will only provide you with the general principles behind the V32 instead of following the exact rules.

A lot of the trade mechanics can be gleaned from his public webinar on the V32 and his other YouTube videos.

Days to Expiration

Starting with around 30 days till expiration (DTE), the V32 is a shorter-term trade than John’s typical strategies (around 56 DTE).

There is even a “Short Term V32” version with anywhere from 3 DTE to 15 DTE.

Starting Configuration

The trade starts with a 40/60 broken-wing-butterfly on the RUT with the short strikes 17 to 27 points under the current price.

40/60 means that the upper wing of the butterfly is 40 points wide, and the lower wing is 60 points wide.

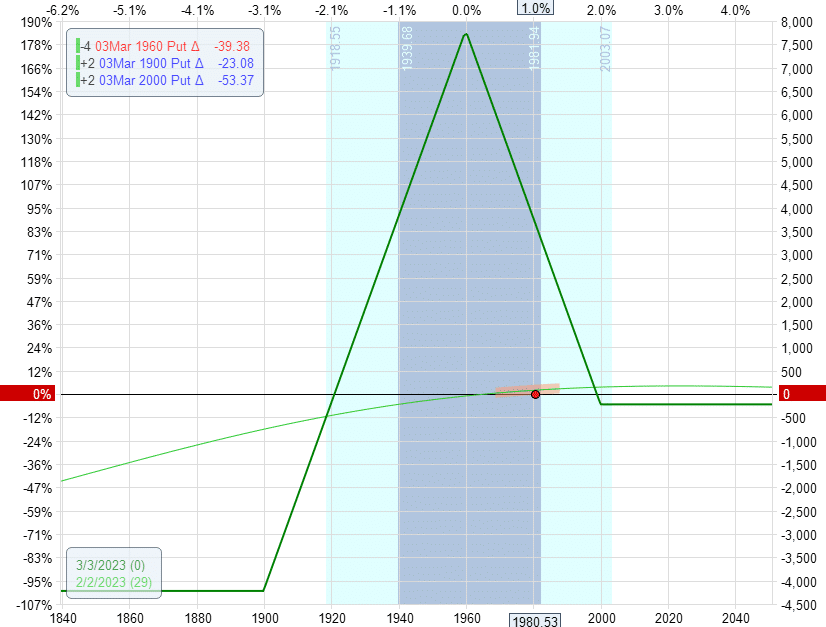

Here is a typical starting example of a two-lot put butterfly:

With the RUT trading at 1980, the center short put options are 20 points below 1960.

There is an upper long put at 2000. And a lower long put at 1900.

The Greeks in this example are:

Delta: 4.7

Theta: 21.7

Vega: -77

The delta must be positive to start.

If not, you can roll some of the upper long legs down until the criteria are met. You can also try later expirations.

Depending on the implied volatility skew, the starting configuration for the 40/60 fly can look dramatically different.

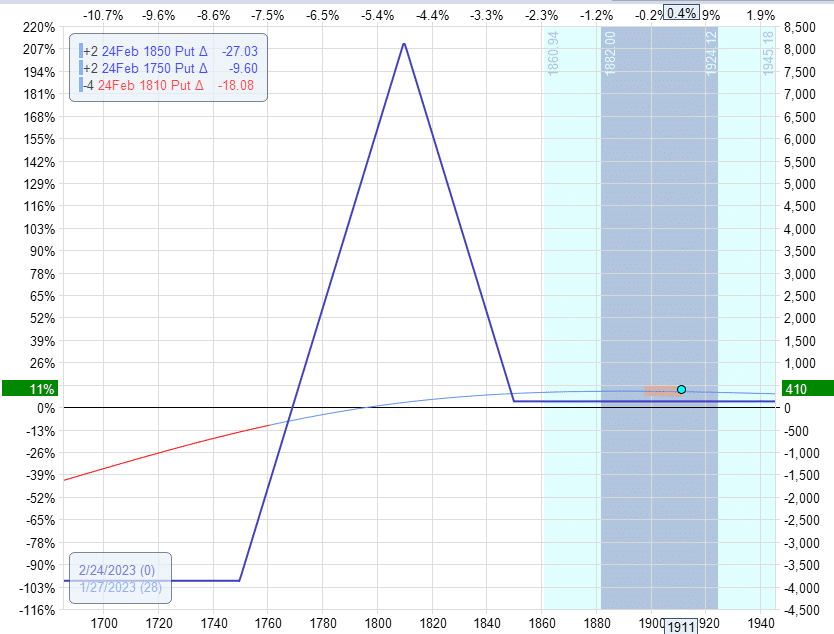

Here is another 40/60 fly with an initial delta of 6.45.

We get a credit for opening this fly – almost like a credit spread.

On the other hand, if the initial 40/60 fly has too much positive delta to your liking, you can subjectively modify the initial configuration and alter the strikes of the upper long legs as long as you end up with a positive net delta.

In the below, we have split the strikes of the upper longs to get an initial delta of positive 2.0.

Instead of having a typical two-contract fly with strikes at 1830/1890/1930 (which would have given us too much positive delta), we have a one-contract fly with strikes at 1830/1890/1930 and another one-contract fly with strikes at 1830/1890/1940.

Profit Target and Exit Loss Trigger

There is no profit target for this trade.

Sometimes, John will take the trade to expire (assuming all the trade criteria are met).

But a typical return on the trade might be around 5% of planned capital. And often, it can be higher.

The trade is monitored and adjusted only once a day at a particular “checkpoint time.”

If the P&L shows a loss of -7.1% of planned capital, that is an exit loss trigger to terminate the trade.

Why did John make it so specific at 7.1%?

He typically trades the V32 with a planned capital of $35,000, and he wants to exit if the loss exceeds $2500.

The $2500 exit loss trigger is 7.1% of the planned capital of $35,000.

Adjustment to Maintain a Positive Delta

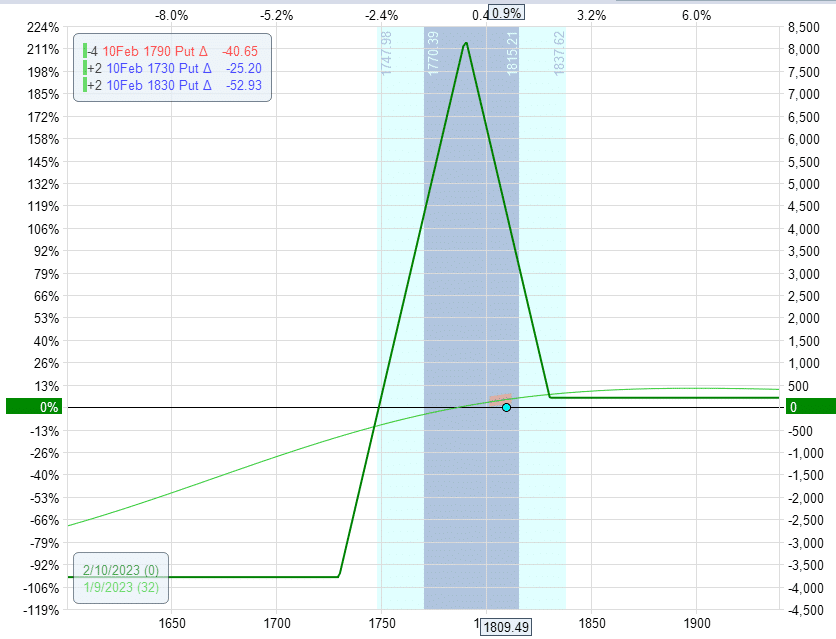

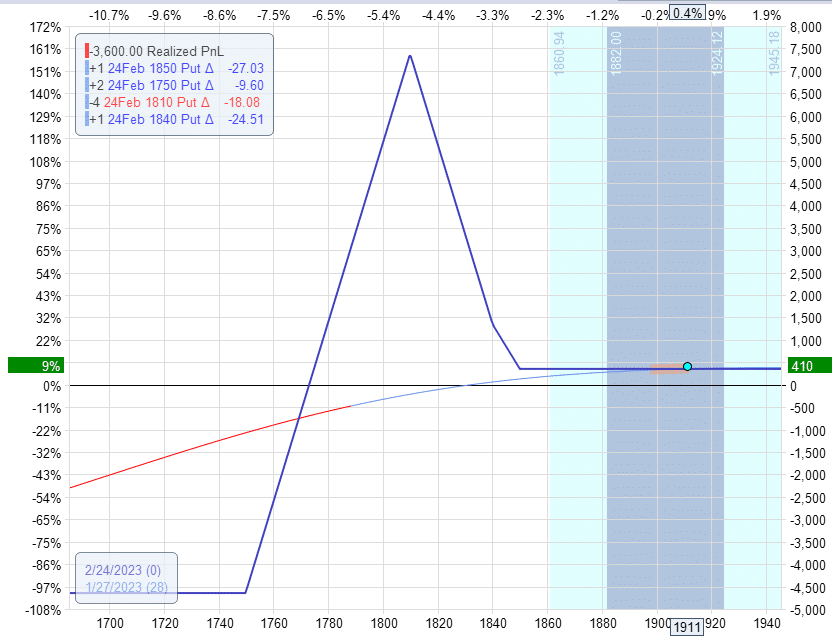

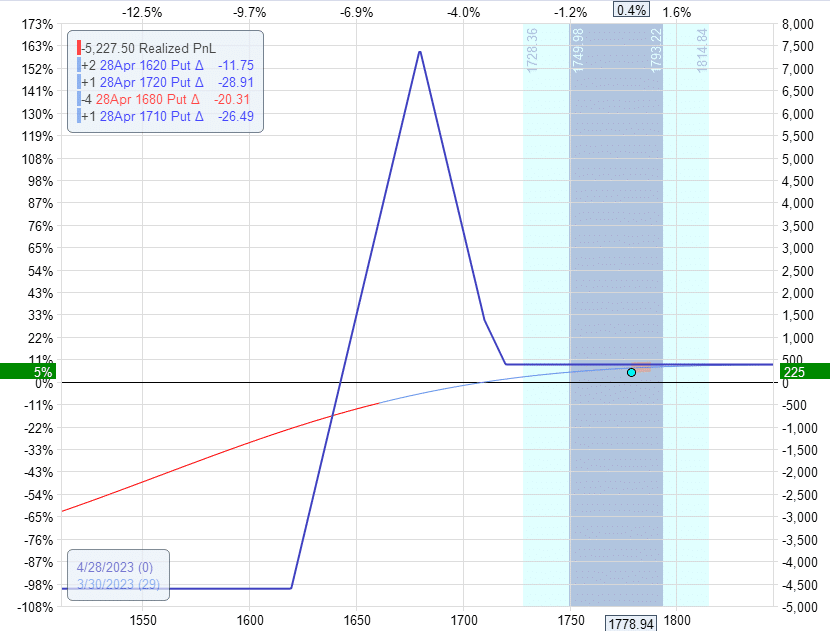

Consider the example below: The trade is already in progress.

It has four short puts at 1810.

Two long 1850 puts and two long 1750 puts.

The expiration graph shows that if RUT expires above 1850, we get a profit of $130.

This trade is supposed to maintain positive theta throughout.

As the RUT price moves, the delta of the trade will change.

If the delta of the trade becomes negative, we need to make it positive again.

Right now, the trade has a -1 delta.

So we need to roll one of the upper long puts down a bit to make the overall trade have a positive delta.

Sell to close one 1850 put

But to open one 1840 put

It is not necessary to roll all of the 1850’s puts. You can roll half of them. The result is the following with a positive 1.5 delta.

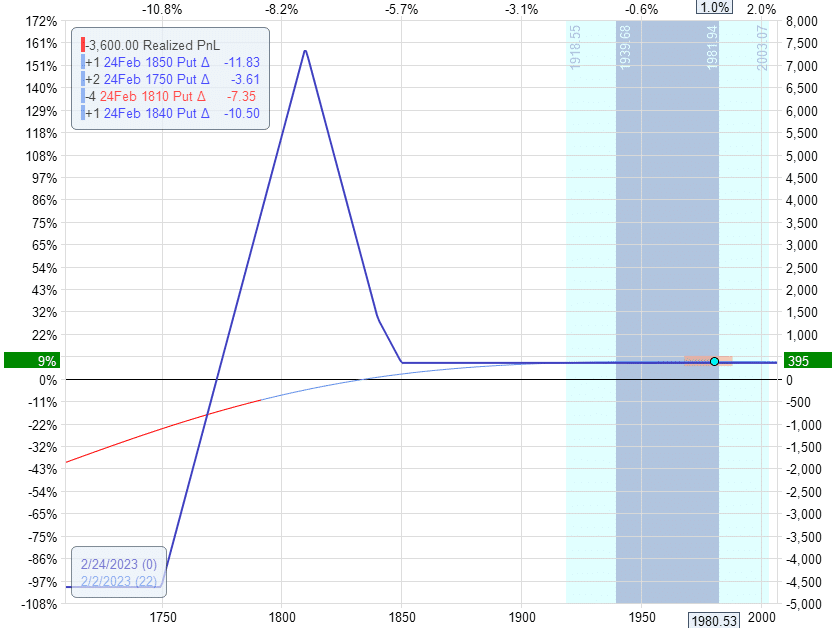

If the market continues to go up and delta becomes negative again, as in here:

We can roll the other 1850 put down to 1840, resulting in the 1750/1810/1840 fly:

The upper horizontal line in the expiration graph increases as the market goes up.

The expiration graph now shows that if RUT expires above 1840, we would get a profit of $435.

This is great if the price stays above the fly.

However, look at the downside risk.

The trade has increased its max risk to $5500, whereas it was $4000 before.

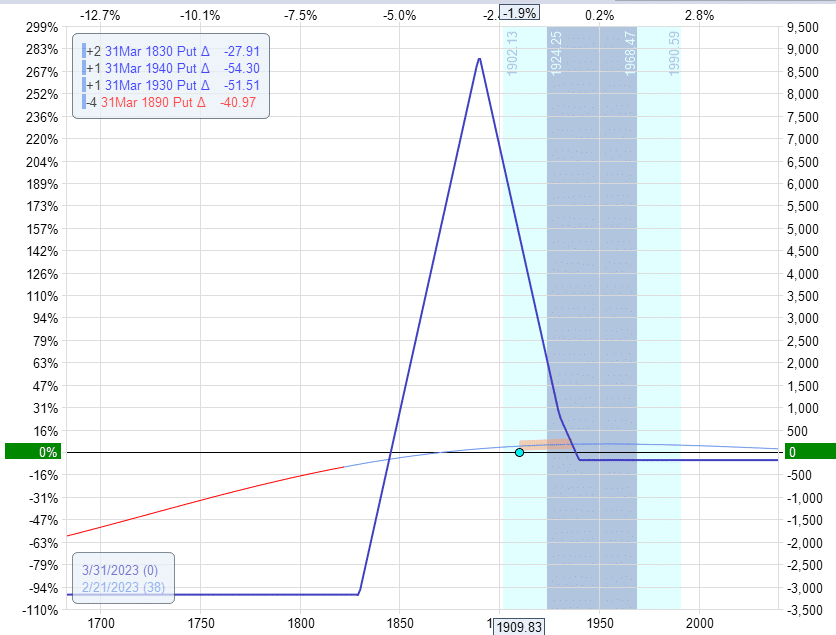

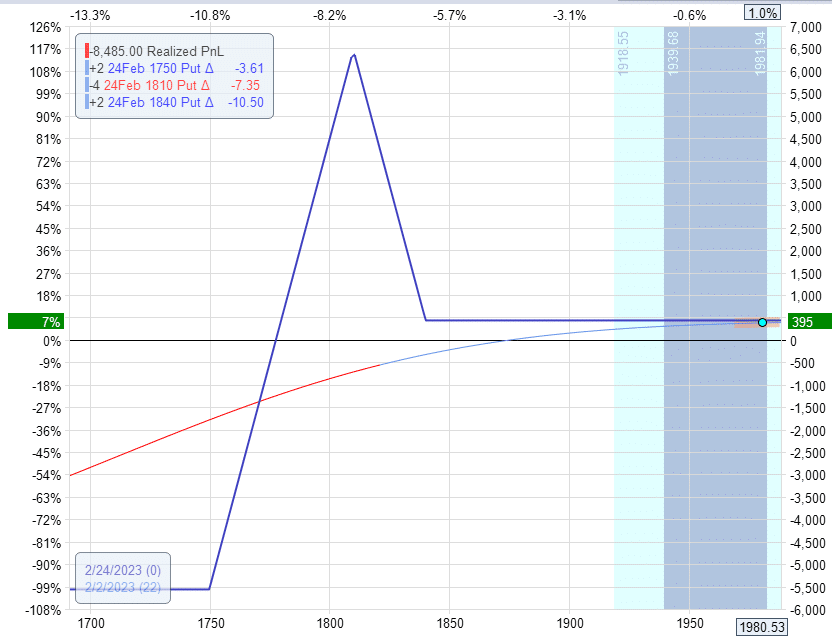

Capital Reduction Adjustment

As the downside risk becomes excessive, we need to reduce this risk by rolling the lower long put option up.

Continuing directly from the last example, we:

Sell to close two 1750 puts

Buy to open two 1760 puts

Resulting in the following.

Its max risk is now back down to $3600.

This capital reduction adjustment alters the delta of the trade.

It makes the delta less positive.

In this case, the delta dropped to 0.2, which is still positive, and we are fine.

However, if this delta had become negative, we would have to roll the upper long down more to maintain a positive delta.

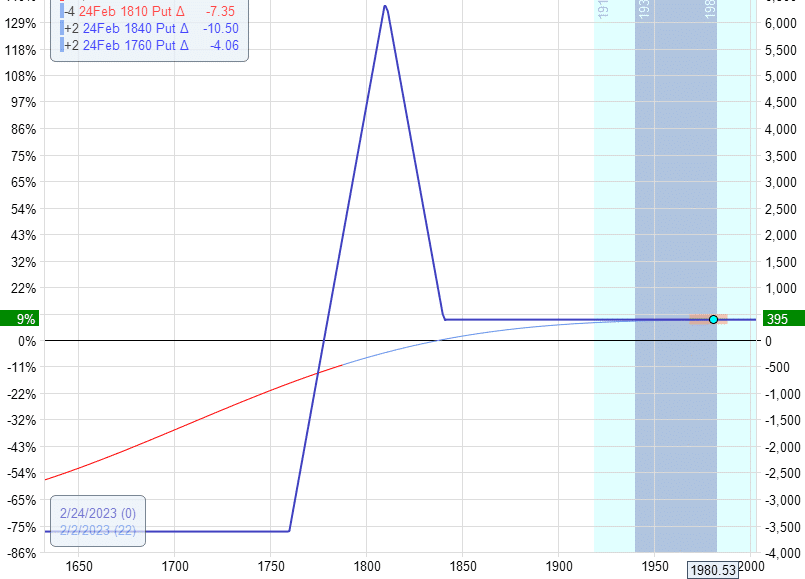

In actual trading, the trader would not be rolling the upper long down, then rolling the lower long up, then rolling the upper long down again; this would expend too much commission and slippage.

They would plan out in the analytical software how much to roll down the upper long and how much to roll up the lower long to maintain a positive delta while keeping max risk reasonable.

Some would then execute the roll-down of the upper long and the roll-up of the lower long in one order. Others would just place it as two separate orders.

Rollback Adjustment

Starting with the initial fly configuration, If the price of RUT goes below the short strikes of the butterfly, the trade is rolled back.

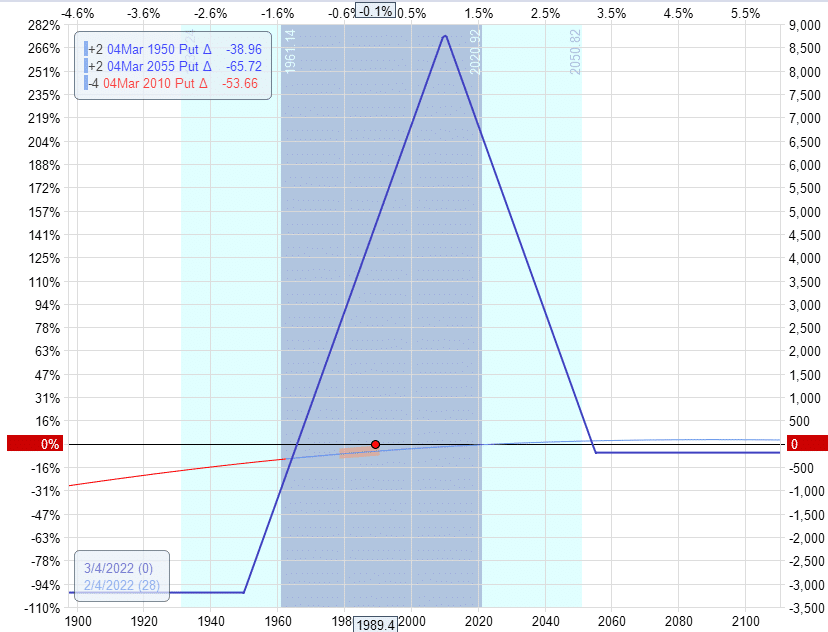

For example, here:

The RUT at 1989 is below the short 2010 strikes of the 1950/2010/2055 fly.

We close the strikes of the existing fly and open a new fly at the starting configuration.

This rollback trigger point is dynamic.

If the fly was in its initial configuration, the rollback trigger was at the short strike.

However, if the fly had been adjusted to a bullish configuration shown here:

Then, the rollback trigger was not at the short strikes of 1680.

That’s too far away.

The rollback trigger would be around 1720.

In other words, if the RUT price drops below 1720, in this case, take off the existing fly and open a new fly with the starting configuration but keeping the same expiration as the current fly.

Exit Loss Limits

Because this is a bullish bias strategy, it is very vulnerable to a market down move.

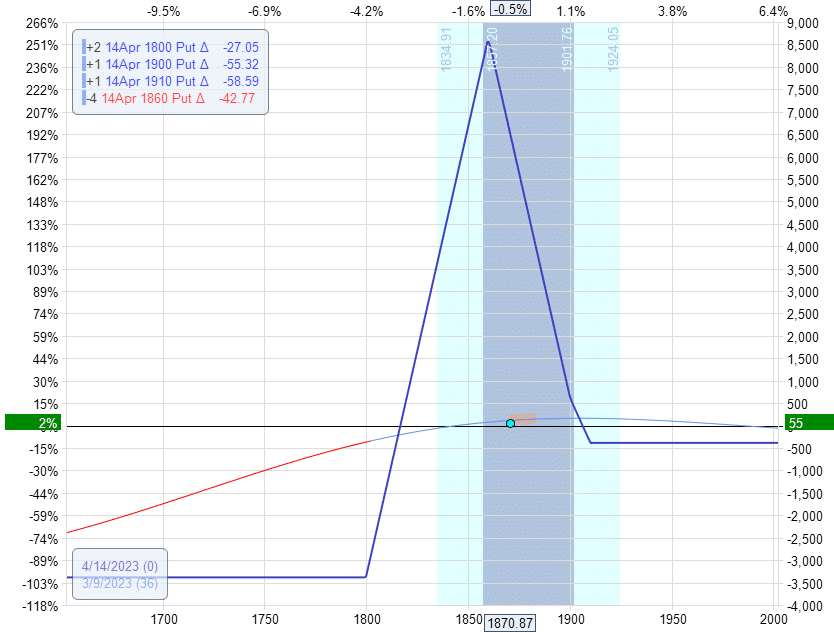

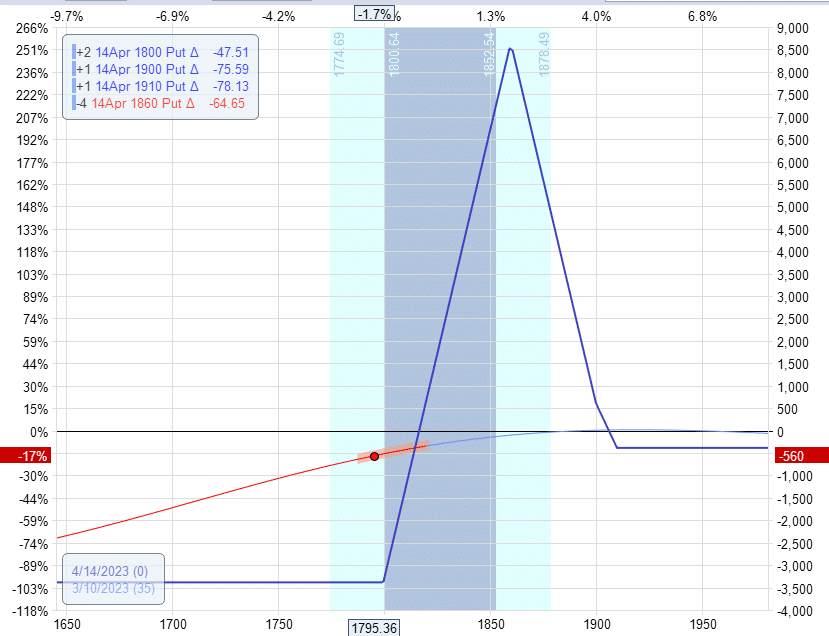

One day, the fly could be up $55 and well within rule parameters:

And the next day, it could be down -$560 as the market drop and volatility increased:

Due to pre-defined loss limits, this move would have forced the trader to exit the trade rather than perform the rollback adjustment.

Frequently Asked Questions

When rolling back, do you slide the whole fly down, maintaining the same wing widths?

No, you use the initial starting configuration wing width and can adjust it based on market conditions.

What is the difference between a rollback adjustment versus exiting a trade and starting a new one?

This may be just semantics. But the nuance difference is:

A rollback adjustment is when you close the existing fly and open a new fly at the same expiration as the existing fly.

The credits and debits are recorded as adjustments, and the P&L of the trade is not on record until the entire trade is completed.

You close the existing fly by exiting a trade and starting a new one. P&L is recorded as a win or a loss.

A new fly is open at normal days to expiration, not necessarily the same expiration as the existing fly.

How is the V32 different from the M3.4u?

While both are 40/60 broken-wing-butterfly strategies created by John Locke, the feel of the two trades is quite different.

You can get a sense of the two if you backtest both under the same period and under different market conditions.

The V32 is a bullish strategy, whereas the M3.4u is less bullish and more market-neutral.

As such, the V32 is more subject to the whims of market movement and can have a larger drawdown if the market makes a big downmove.

However, it can recover and profit quicker than the M3.4u in cases where the market makes a V-reversal after bottoming.

The V32 uses rollbacks for downside adjustment, whereas the M3.4u adjusts the strikes of the upper wing.

Rollback adjustments are more costly in terms of commission, fees, and slippage.

Like the V32, the M3.4u rolls its lower strike-up for capital/risk reduction.

Do you prefer the V32 or the M3.4u?

Asking one person’s preference is less meaningful. What is more meaningful is what most traders of these types of strategies prefer.

This is the question that John Locke has been asking his viewers for the last few years in an end-of-year poll of their favorite strategy.

For three consecutive years (2021, 2022, and 2023), the viewers selected the M3.4u as their favorite among John Locke’s strategies.

Asking this question to John Locke is like asking someone which child they like better.

Nevertheless, John Locke did mention that M3.4u is one of his favorite strategies.

Concluding Thoughts

While the V32 is an interesting strategy intended for a bullish market, the M3.4u is a more flexible strategy you might want to learn first.

We hope you enjoyed this article on the John Locke V32 trade.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.