Today, we are doing a Blackbox Stocks review.

We will review the software, discuss their product offerings and look at their education, pricing, tools and bonuses.

Let’s get started.

Contents

- Introduction

- What Services Do They Offer?

- Are the Tools Useful?

- Pricing

- Bonuses!

- Conclusion: Is it Worth it?

Introduction

Blackbox Stocks is an institutional-grade market scanning service and site for stock and options data.

They have many tools and features that are incredibly useful for all types of trading styles.

These include stock and volume scanners that let you adjust scanning parameters, and perhaps what they are most notably known for is their options scanners.

They have a customizable options scanner that lets you view real-time options data and look for trades using volume, unusual options activity (or flow as it is colloquially known), and open interest changes.

They even have a few proprietary indicators that alert you to potential trades in equities and options.

What Services Do They Offer?

We barely scratched the surface in the intro about the many services Blackbox Stocks offers its users.

Here is a much more in-depth look at those services.

Stock Services

Blackbox offers a significant amount of services to equity traders.

First off are their scanners; they have several scanners that alert users to stocks that could provide a trade. They have a pre and post-market scanner that does as the name implies.

It looks for stocks moving on volume in the pre and post-market hours.

For someone that trades during the off hours (if your broker allows), this has the potential to be an incredibly useful tool.

Blackbox also has an Advancing/Declining scan that is built into the platform and needs no initial setup.

This will let you know what is hot and what is not in real time.

In addition, you get a proprietary volatility tool that will populate with data once you click on a symbol.

This tool takes a snapshot of all level 2 data, including dark pool, iceberg, and hidden order data, and displays whether there is more activity on the bid side or ask side for that period of time.

This is often used as part of a greater trade plan but is a great way to visualize the tape in a 10-second snapshot and is a lot easier than staring at the Time and Sales!

In addition to all of the above tools for equities, you get real-time quotes and a built-in charting system that comes with a large library of indicators built in and a ticker-specific news feed.

Best of all, you can configure all of these things into an interactive web-based dashboard.

This lets you have all of your relevant trading data up at all times.

It is also all connected, so when you click into a new symbol, all the tools update at the same time, so you never need to worry about what ticker the chart, news feed, or volatility tool is pointing to.

Education

Blackbox also offers a solid base level of education to its subscribers.

When you sign up, you are able to click into any of their classes free of charge.

You just need to register on the calendar they offer for the class you want.

It is suggested to start with their New Member Bootcamp, though.

The Bootcamps are usually around 3 hours and cover many of the basics around trading and the BlackBox platform.

It is broken down by hour with a general breakdown as follows:

Hour 1: How to Trade Equities

- Basic Terms

- Buying and selling stocks

- Recommended brokers (they are affiliated with several)

- Tips for new traders

- The dangers of Penny Stocks and the PDT rule

- A few points on fundamental, technical, and volume analysis.

Hour 2: Options

- Options terms and basics

- How to read an options chain

- Different ways to trade them

- The different types of options accounts based on your account size

Hour 3: Blackbox Stocks Site use

- How to use all the scanners and alerts

- What different alerts mean

- How to set up your own dashboard

- How to use all of their proprietary scanners and tools

- All of the other features that Blackbox offers

In addition to the comprehensive Bootcamp, they also offer “Continuing Ed” classes that the user can sign up for including both stock and option classes that will help further refine your trading skills.

While the Blackbox educational tools may not be as robust as some other sites, it also does not come with any additional cost and has more than enough information to help you become and stay profitable in the markets.

Options

Blackbox also has some incredibly powerful options tools that it can offer its users.

This is one of the things Blackbox Stocks is best known for.

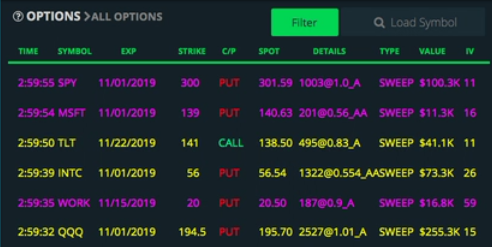

They have a few different tools based on options flow, first is the Options Trading Alerts.

Options Alerts is an options trading alert service built into the Blackbox ecosystem of tools.

It utilizes the flow and sorts it based on a few parameters to see if it measures up to its strict alerting standards.

The alerts will meet one of a few criteria, which will be listed next to the alert when it fires: Swift, Repeater, Large, Roulette, and Steady.

The Swift alerts trigger then there are multiple sweeps on a particular ticker inside a set timeframe.

The Repeater signal fires off when multiple larger trades happen in a contract in a set timeframe, regardless of whether they are sweeps or not.

The Large alert triggers when a contract with a trading volume exceeding its Open Interest is filled on the bid or the ask (depending on bullish or bearish) and meets certain dollar thresholds.

The Roulette alert is triggered when there are large sweeps in a contract that expires the current week.

These are highly speculative alerts.

Finally, there is the steady alert, which fires off when there is repeated activity on a contract over a longer period of time than the Repeater signals.

One important thing to mention about these Options Alerts is these are not buy or sell signals but merely alerts to activity.

After Alerts, Blackbox offers its users direct access to options flow data.

It can show you whether a trade is a block or a sweep, and which side of the bid or the ask it is executed off of.

They also color code their flow to display relevant information about the transaction, like if Open Interest has been exceeded in the trade, if the trade was canceled or if the trade was reported out of order.

Another feature about the flow data is that you can filter it to suit whatever criteria you are looking for: what to see only aggressive buys above the ask?

You can do that. Want to see short-dated put sweeps at the bid?

You can see that too. The options are limitless with the flow filters.

Blackbox also offers a few novel tools like the options news tool, which is very similar to the equities news feed, but it triggers off of the ticker for a selected options contract.

This is especially helpful for news traders.

Another cool feature is their options heatmap, which is a visual representation of active puts and calls.

Are the Tools Useful?

So now you can see that Blackbox offers top-notch tools for all types of traders, but are they actually useful?

The Short answer to this is yes!

There are many ways to utilize tools from Blackbox, and how you use them is totally up to your trading style, but overall the suite of tools Blackbox offers makes a great addition to any trading plan.

If you are an equities trader, their scanners and alerting tools will provide you with more action than you could ever need.

You can customize the alerts through their filtering tools, and once you select a ticker, all of the relevant information, including recent tape activity, will instantly display for you.

If you are an options trader, then the slow and algo alerts are a must-have if you are trading Unusual Activity, and similar to the equities tools, you can filter the alerts and flow to match your trading style.

You can stare at options tape from your broker and use traditional filtering techniques, or you can use the advanced tools available to you to help refine your edge and simplify your trade plan.

Pricing

Now that you know all of the tools that Blackbox Stocks offers and how they can be incredibly useful to an active trader, it’s time to answer the most important question: What’s the cost?

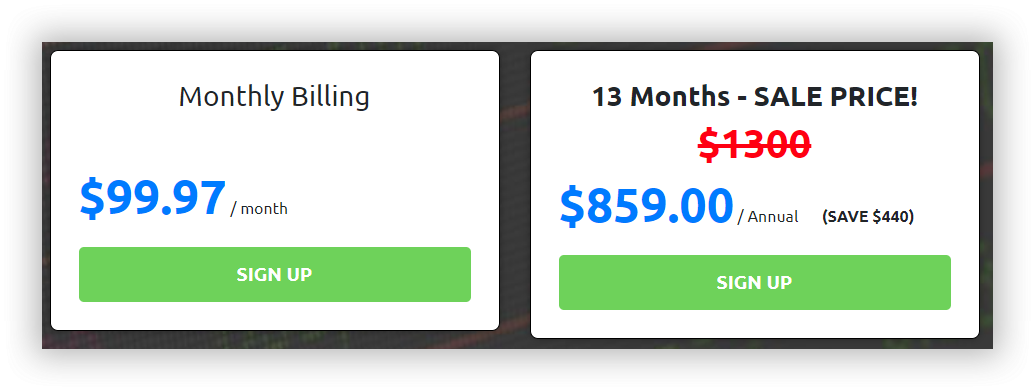

There are two membership options, and both have the same offering. It’s just how long you want to sign up for.

First, they have a $99.97 monthly membership.

If you are unsure about the service and the tools, then this would be a great option.

It will allow you to get in and see if it is the right product and community for you without a long-term commitment.

If you are already a member or know you like the product, you could opt for the annual membership.

There is usually a discount for the annual membership, and it’s currently going for $859 for the 13-month term.

That is an annualized savings of over $400. While both of these options are fairly reasonable for all of the tools you have at your disposal, this is the one downside of BBS.

They are on the more expensive end of options and stock services.

They are far from the most expensive, and I personally think there is tremendous value in the service, but for some, it may be prohibitively expensive, especially for newer traders.

Bonuses!

Blackbox has a few “Bonuses” that come with the membership, and it’s in parenthesis because they are not legitimate bonuses but more like perks to the BBS membership.

First is the market chat.

You will have access to a few different chat rooms focusing on different trading types.

This is nice for several reasons; first, many like-minded traders are using all the same tools you are.

Second, the more eyes on the market, the higher the odds someone sees something you missed.

While it is not smart to blindly trade off someone else’s word, it can be helpful to point you toward tickers and options that are moving.

The second so-called bonus is their affiliation with brokers.

Once you sign up with BBS, you can use their size and prestige to open an account with a partner broker and receive discounted rates on your trading.

While this is not a solid reason to join on its own, it’s a fantastic perk of membership.

Conclusion: Is it Worth it?

There you have it, all of the features that Blackbox Stocks offers you as a trader.

So now comes the ultimate question: is it worth it?

The short answer, I believe, is yes, there is a lot of value in the tools and services.

BlackBox has to offer a trader, and I feel the price is fair for the services offered. The long answer is: It depends on your style of trading.

If you are an extremely active trader, this is a great suite of tools to have in your repertoire.

If you are a longer-term trader, then there is potentially less value there for you.

It still can offer multiple tools that will help you filter out solid trades, but there are some tools that you will not find as useful for swing trading.

Overall it is a very solid service at a very reasonable price.

We hope you enjoyed this Blackbox Stocks review. If you have any questions, please leave a comment or send an email.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.