Dan Zanger is regarded as one of the most successful investors of all time.

It’s not hard to understand why.

In just 23 months, Zanger achieved an incredible 3.8 Million percent increase in the stock exchange.

Yes, you read that right.

It was a 38,000X on his money.

This insane multiple was not done in one straight shot, though.

The DotCom boom helped the first part of this meteoric rise in 1998 and 1999.

Here he took $10,000 and turned it into 18 Million in just under two years.

The second part of this huge return was over a much longer period of time and ended in 2020 when it was said to be worth a total of $42 Million.

The initial push from $10,000 to $18 Million has been independently verified by Both Fortune Magazine and by an Asset Management firm named Effron Enterprises.

Zanger currently holds the record for the highest single-year stock market return.

Effron Enterprises Inc. acknowledged his record and noted that it was difficult to map his returns using standard stock market indices because his returns could not be charted using standard scales.

The gains he experienced would be called ludicrous, and the whole thing would seem like a made-up story if it was not for these two independent audits of his record.

Contents

- Where It All Started

- Dan Zanger Strategy Basics

- The CANSLIM Method

- Momentum Masters And His Other Ventures

- Conclusion

Where It All Started

Most people, when they hear about gains like the ones described above, think of a prodigy or some type of quantitative math wizard.

Maybe someone trained in a trading style only known to the largest banks, but Dan was none of these things.

He started as a college dropout and went into construction, where he finally found a home designing and working with pools in Beverly Hills, California.

He never had any kind of special advantage and never made more than a modest salary while working in construction.

So how did someone with no special skills of note become a world record holder for a market gain?

One word: Obsession.

His interest in stocks goes way back to the 1970s when he became interested after seeing a local channel run a segment on stock patterns.

It turned from an interest to a passion and eventually into an obsession, as he reportedly spent “3 hours on weekdays and up to 15 hours on weekends” looking at charts and chart patterns.

He read, watched, and attended to everything he could on the subject.

He felt like he had more to learn until he nailed a reversal on oil in 1997 and cited that this gave him the confidence to go live with it.

At the age of 45, Dan Zanger sold his Porsche for just over $10,000, and it was this seed money that would launch his new trading career.

As stated above, he enjoyed amazing success over the next few years, partly due to the DotCom bubble.

One of his most famous trades from this period is in CMGI stock.

In January of 1999, he purchased shares of CMGI, and a mere four days later, he sold it for an astronomical 210% gain.

This one trade has been memorialized in Trader Monthly’s 40 Greatest Trades of All Time list.

So other than obsession, the other part of Dan’s success is strategy.

Dan Zanger Strategy Basics

Dan Zanger’s strategy is a mix of technical patterns, the thing he is known for, and fundamental analysis he learned on his path to success.

On his website Chartpattern.com, he lays out the “10 Golden Rules” of his strategy, which are all pattern and management based.

Below is a summary of all ten rules:

- Make sure that the stocks have a strong base or basing pattern

- Buy a stock as it moves over a trendline or breakout pattern. Never pay more than 5% above the trend or break point.

- Be quick to sell if it falls back into the pattern/below the trendline

- Sell a portion of your position as it moves 15-20% from the breaking point of the pattern

- Hold the strong movers and sell the weaker movers as soon as they stop acting favorably

- Identify market leaders and only trade in those groups

- Sell your stocks as you see reversal patterns signaling tops/pullbacks

- Know the volume for the stocks and only buy when volume follows a move

- Watch the action on a break, don’t just blindly buy a pattern

- Never use margin until you have mastered your emotions and the charts.

The fundamental approach that follows the technical analysis is based on William O’Neil’s CANSLIM Method.

This method is something he learned when he was studying O’Neil’s book early on in his trading career.

The CANSLIM Method

As time has passed, Zanger has found that a lot of his own “Golden Rules” also fulfill almost all of the CAN SLIM methodology that he learned.

He has found that this modified CANSLIM method can identify stocks with a high probability of moving.

1. Look for Strong Fundamentals

This strategy filters for stocks with three main categories:

- Quarterly EPS growth of >20% compared to the year before, as well as >20% from the prior quarter

- >20% increase in sales over the recent quarter

- Annual EPS growth of >20%

These metrics are also considered to be “growth metrics,” so this is a version of growth stock investing.

These are important because they are often what larger investment firms like banks and funds typically look at for their own growth stock investing.

So this screening is meant to put you on the side of the bigger money coming into these names.

2. Limit Losses to 5%

A similar rule can also be seen above in Zangers’ 10 Golden Rules, which is why he said there is a lot of overlap between them.

5% is the recommended stop in CANSLIM; Zanger states that some can have some leeway on this stop, but it is imperative to close a position when it starts to fall.

This is a vital part of not just CANSLIM but of all trading strategies because there is no telling how far a stock will fall.

3. Know Your Setups

This is where Zanger’s list really shines.

Knowing what a bullish setup is vs. a bearish or neutral setup will be the differentiating factor of whether you are successful with it.

Technical analysis is mostly about market timing, so with the company’s strength confirmed through fundamentals, the setups will be when you enter the trade.

This is also part of the process that Zanger really excelled at.

He is quoted as saying, “Stocks are my buddies, I know when they feel good and when they feel bad” Stocks are inanimate, but all of the time spent staring at charts and the market gave him a refined sense of intuition on stock price patterns.

A note should be made that CANSLIM and other modifications work are based on a growth stock’s ability to grow and run.

These types of trading systems work better in bull markets, so it is vital that you know how to read overall market conditions to use them properly.

4. Mentality Is Everything

Mentality and risk management are another part of Zanger’s strategy.

This was a hard-won lesson for Dan, as he reportedly lost 75% of his portfolio at one point.

On the other hand, he reportedly made $5.2 million in his biggest single-day gain.

Sticking to your risk management can prevent most of the losses from getting that large, but it is always possible that a stock gaps below, in which case you need the mentality of a trader.

What kept Zanger pushing through tough times was his persistence and obsession.

He stated that it was not uncommon for him to scour over the chart of a losing trade to see what he missed, what he now noticed, and what will make him a better trader the next time the setup occurs.

Trading is almost entirely a mental game, no matter what strategy you use.

To be successful, you must have the ability to endure and the ability to persevere through hardship.

Zanger’s passion has allowed him to succeed in this industry.

If you don’t love the game, it will be difficult to survive it when it throws curveballs at you.

Momentum Masters And His Other Ventures

After finding such success later in his career (Zanger didn’t blossom as a trader until well past 40), Dan was part of a book interviewing “Momentum Masters” with three other large momentum traders: Mark Minervini, David Ryan, and Mark Richie III.

The whole purpose of the book is to assemble a brain trust and answer questions from traders so that the information that these market wizards have found can be passed on in a readable format.

The other three writers also have a stellar trading background, all of them boasting triple or quadruple-digit yearly returns some years.

In addition to this book, Dan Zanger started a market newsletter in 1996.

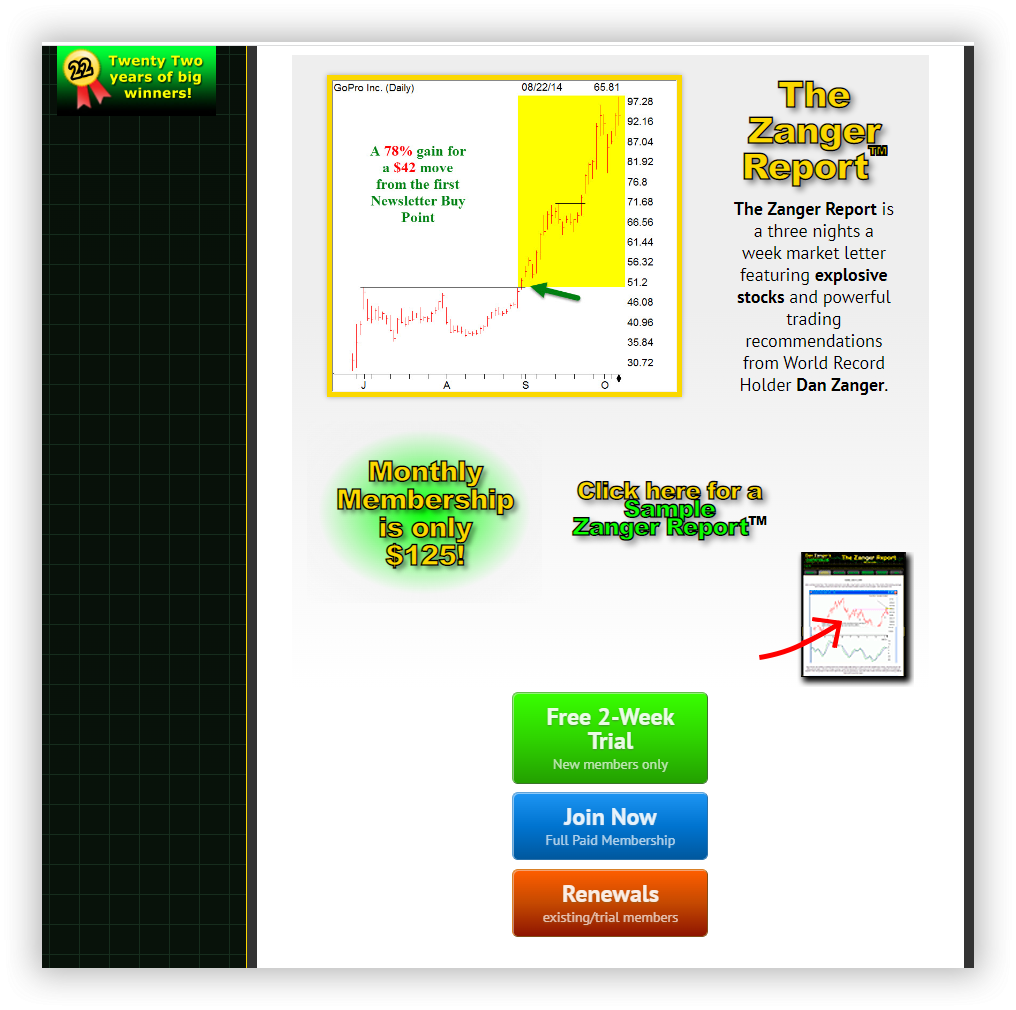

It started as a faxed monthly report but has evolved into the Zanger Report and can be found on his website chartpattern.com.

His website is all about education and learning to trade through chart patterns and other similar strategies to his own.

The Zanger Report has evolved into a three-times-a-week email that contains charts.

Dan is looking at, macro information, sentiment reports, and any other information he thinks would be relevant for his trading and the people who are trading it under him.

It is utilized by a wide range of trading talent, from beginner traders up to technical hedge funds.

The Zanger report is $125/Month and included in that is also access to his trading chat room.

It allows the subscriber access to other active traders who are using a similar methodology, and it is fairly well-maintained to keep the scammers, pumpers, and general disruptors out of the chat.

Conclusion

It is almost impossible to classify Dan Zanger as one of the most prolific traders of the modern day.

He has very little actual controversy around him and is one of few traders that actually allow the public to see his audited trade record.

Dan also still trades the same strategy that made him his money and makes no false promises about the validity of his system.

He goes so far as to say NOT to take every trade he sends out and to do your due diligence on the trade.

As for the services offered, there is a lot of potential value for new and veteran traders alike.

I think the expectations will make the experience in this case.

If you are looking for a signal service that takes all of the thinking out of your trading, this is not the correct service.

If you are looking for someplace to learn and grow as a technical trader and have access to other traders doing the same, there is a lot of potential value here for you.

Overall, I think that Dan Zanger and his products are the real deal for education and trading.

We hope you enjoyed this article on Dan Zanger. If you have any questions, please make a comment or send an email.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.