Contents

The optimum position depends on the strategy.

Trader A (let’s say “Adam”) may like to trade iron condors two months out.

Trader B (let’s say “Betty”) may like to trade directional credit spread at zero DTE.

Trader C (let’s say “Charlie”) may like to trade non-directional butterflies at 14-DTE.

So, the optimum position for each of these traders will be different.

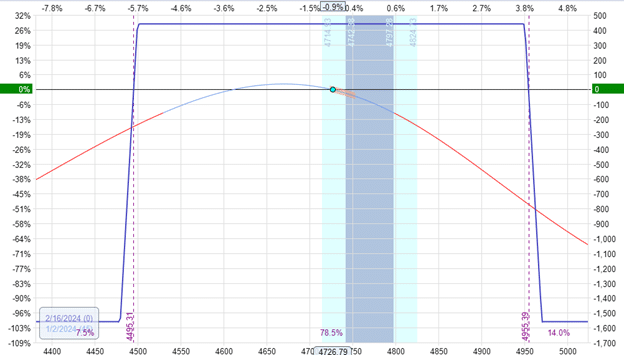

Take the classic example of the iron condor.

The short put is at 15-delta on the option chain. The short call is at 13-delta.

Delta: -1.34

Theta: 10

Vega: -76

Theta/Delta: 7

Just from looking at the graph, we can see that the above position is better than the following position:

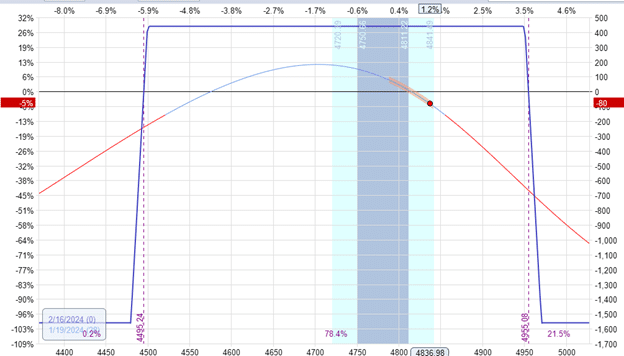

Short put at -6 delta. Short call at 25 delta.

Delta: -3.86

Theta: 14

Vega: -55

Theta/Delta: 3.7

By most measures, the first position is better.

The price has a lot of room to move before it reaches the short strikes on either side.

In the second position, the price is getting close to the short call.

The short call in the first position is at 13-delta, and in the second position, it is at 25-delta.

The closer the strike is to the 50-delta, the closer it is to the current price.

Since this is a delta-neutral strategy, the overall net position delta of the first position is much closer to zero at -1.34 delta.

And its theta-to-delta ratio of 7 is better – bigger theta/delta being better.

You get more theta with lower delta risk.

The Optimum Position Is The Starting Position

A strategy is a set of rules and initiating conditions based on a trade plan.

It tells you when to enter the trade, how to configure it, how to adjust, and when to exit.

I would claim that the optimum position of a strategy is the starting position of that strategy – with a few possible exceptions in the cases of strategies that have a scaling in process.

Logically speaking, if there were a more optimal position for the trade, the strategy would have specified to start at that more optimum position.

Why wouldn’t anyone start at the more optimum position if there was one?

Therefore, the creator of a particular strategy (and that could be yourself) would have felt that the starting position was optimal.

As the trade progresses, it will deviate from the starting position.

If it doesn’t deviate too much and its configuration looks fairly similar to its starting configuration, then we instinctively know that the trade is still in good shape.

By configuration, I mean the relationship between the price picture, the T+0 line’s curvature, and the expiration graph.

It also means where the trade’s DTE is from its initial DTE (days-to-expiration).

If a strategy says to start trade with 90 days till expiration (DTE), and the trade is now at 14 DTE, then that’s quite different from its starting DTE.

Is a trade that was designed to be optimal at 90 DTE also optimal at 14 DTE?

That depends.

Some trade plans may say to start trade around 60 DTE to 90 DTE and to exit at 21 DTE or before.

Other trade plans may say to take the trade to one day before expiration. It depends on the strategy.

If the trade plan does not specify, it is at the trader’s discretion.

The trader will also need to decide how far to let the trade deviate from the starting configuration before adjusting.

The second graphic of the iron condor expiration graph is not optimal.

However, is it still viable?

Is the iron condor able to handle this deviation from its optimal position?

When the condor is at this suboptimal position, how likely can it recover and return to a more stable position?

Or is it likely for it to continue to deviate more?

The answers to those questions can only be answered by the individual trader.

Trader A (Adam) may say that based on his experience trading many iron condors and his backtesting, about 55% of the time, the condor can recover from this position without adjusting.

And he may decide to hold this position for another day to see what happens.

Trader Betty may like to have a tighter rein on the condor and will adjust whenever the short strike exceeds the 20 delta on the option chain.

The condor has triggered her adjustment rule, and she has adjusted the position.

Other traders may have rules and metrics, such as looking at how much the position delta has deviated from zero.

Or they may make decisions regarding market conditions and price action.

Trader Charlie may see that the market has a resistance level above the current price at 4850 and is not likely to go higher than that.

So, he may not adjust the position, thinking that the call spread is still safe with the resistance level in place.

Yet other traders may conclude that they should close the trade for a loss and open a new one.

The trade, which started at 45 DTE and is now at 25 DTE, has run a good chunk of its course.

Why not replace an old sub-optimal trade with a new trade reset at its optimal position?

Final Thoughts

No matter how specific a strategy trade plan is, it is rare to find one that covers all possible scenarios and situations.

There will still be a lot of individual discretionary decisions to be made.

It is good to know that the optimal position is the starting position.

Practicing the strategy enough to know how far you can let the trade deviate from the optimal position is also good.

If you see that the trade is far from optimal, replace the trade with a new trade that is at optimal configuration.

For those who hate taking a loss, reframe to think of it as replacing a sub-optimal trade with a more optimal one.

After all, you are putting your hard-earned capital to work.

Do you want it working in a sub-optimal trade, or do you want to allocate it to trades that are in near-optimal condition?

On the other hand, you also can not replace trades too frequently and not give them any chance to profit; this is where balance comes in.

We hope you enjoyed this article on the optimum position for an option strategy.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.