At the time of this writing on May 17, 2024, with the VIX at an all-time low for the year at 11.98, I would say this is a good time for the double diagonal – as long as it is configured correctly.

Contents

Configuring the double diagonal is not a trivial task.

This is because the double diagonal is the most flexible four-legged option spread ever invented.

It has at least six degrees of freedom.

The double diagonal consists of selling a put option and selling a call option at a near-term expiration.

Then it has a long put and a long call at a further dated expiration.

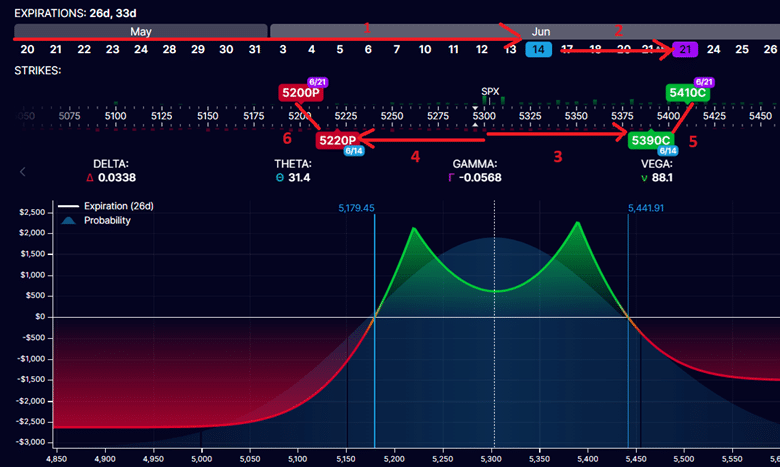

Look at the following double diagonal on the SPX when it trades around the 5300 on May 17.

Buy one Jun 21 SPX 5410 call

Sell one Jun 14 SPX 5390 call

Sell one Jun 14 SPX 5220 put

Buy one Jun 21 SPX 5200 put

The P&L graph at the near-term expiration of Jun 14 looks like this:

What is nice about modeling the double diagonal in OptionStrat is that we can easily drag the short and long puts and calls around and see how the graph and the Greeks change.

Note that the net Greeks shown is not available in the free version of OptionStrat.

The Six Degrees Of Freedom Of The Double Diagonal

There are six variables for me to adjust and play with:

- The time till the near-term expiration (in this case, 26 days)

- The time difference between the near-term and far-term expiration (in this case, one week)

- The strike price of the short call (5390)

- The strike price of the short put (5220)

- The width of the short call to the long call (in this case, 20 points)

- The width of the short put to long put (also 20 points)

It is typical that the wing width (in this case, 20 points) is the same for the calls and the puts.

What is always a given is that the long options always expire later than the short options, similar to that of calendars.

For the double diagonals, we are considering today, the long put and the long call strike prices are further away from the SPX price than the short put and short calls.

However, they do not need to be.

For the new practitioners of the double diagonals, you want the expiration graph to be fairly symmetrical; they should look similar to the above, ensuring that the graph’s center curvature does not dip below the zero-profit horizontal.

The double diagonal trade is a market-neutral strategy where we want the underlying price to be range-bound, preferably between the two expiration graph peaks.

Double Diagonal and Volatility

For the advanced practitioners of double diagonals, you want to consider volatility and the vega/theta ratio.

Double diagonals have positive theta and generate income via the passage of time.

The double diagonals that we are considering today all have positive vega, although it is possible for double diagonals to have negative vega.

The amount of positive vega represents the amount of volatility exposure (or risk) in the trade.

Theoretically, if volatility increases, the trade should profit (if all other factors remain unchanged).

If volatility decreases, this would hurt the P&L.

In this sense, the larger the vega, the greater the volatility risk.

But if the volatility of the SPX, as indicated by the VIX, is at an all-time low, then the trader can reason that volatility will not drop much lower.

Hence, less danger of volatility dropping and hurting the P&L.

This is exactly why double diagonals are a good trade when volatility is low.

Another reason is that the options’ implied volatility, extrinsic value, and price are related.

When volatility is low, the implied volatility of the option is low.

This affects the extrinsic value of the option and the price of the option.

Both will be lower.

Because the price of options is lower, it is okay to spend money to buy more extrinsic value options.

That is why we are buying the long call and the long put, which have further expirations.

We are willing to spend money to buy these options with more time.

Note that the double diagonal is similar in structure to the iron condor, except that the long call and long put are at a further expiration.

In the iron condor, they are at the same expiration as the short options.

Because the long call and long put of the double diagonal are further dated, they are more powerful and offer more protection.

As such, we are willing to bring the call and put spreads closer to the money.

We like to place the short options of the double diagonal around 25 to 35 delta on the option chain.

Meanwhile, they are typically at the 10 to 15 delta in the iron condor.

Vega/Theta Ratio Of The Double Diagonal

We can learn a few things about the double diagonal configuration variables by playing with the six double diagonal.

1. Decreasing the time till expiration increases the theta. This typically reduces the vega/theta ratio because theta is now getting big enough to compensate for vega.

2. Increasing the time difference between the near-term and far-term expiration increases the vega volatility exposure. It has the effect of increasing the vega/theta ratio.

3. Moving the call spread further away from the current price increases the expiration breakeven point.

4. Moving the put spread further away from the current price increases the expiration breakeven. The trade-off is that it decreases theta slightly.

5. Increasing the width of the call wing decreases the vega/theta ratio.

6. Increasing the width of the put wing decreases the vega/theta ratio. In effect, you are moving the long put further away from the money. It becomes less powerful, and the vega is lower.

Conclusion

By understanding how each of these six knobs affects the Greeks, we can tune each knob to get the Greeks that we want.

As we advance in our practice of options, we start to take volatility into account (not just worrying about delta as we used to when we were just starting).

By knowing the volatility of our underlying, we can decide how much volatility exposure we want to give the double diagonal.

When volatility is low, as in the case now when VIX is low, we are willing to initiate a positive vega double diagonal trade on the SPX, knowing that volatility should not go much lower.

We can tolerate a higher vega/theta ratio when volatility is low.

Some double diagonals can have vega/theta ratios as high as 8.

When volatility is high, and there is a good possibility of dropping, a vega/theta ratio of even five may represent too much of a volatility risk for some traders.

In that case, they can dial down the vega/theta ratio to 2 or 1 or even less.

Some may even configure a double diagonal to have negative vega if they feel that volatility will drop.

As configured above in our example double diagonal, its vega/theta ratio is 2.8, calculated by 88.1 / 31.4 = 2.8

The double diagonal is an advanced strategy.

If all this is too confusing, don’t worry.

Study the iron condor first.

Then, the double diagonal is the next level up.

We hope you enjoyed this article on the double diagonal.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.