What is implied volatility in options trading?

Implied volatility stands as a pivotal concept in the realm of options trading, exerting a profound influence on the pricing dynamics and behavior of these financial instruments.

Today you will learn the intricacies of implied volatility, and examine how it shapes option prices and trading strategies.

Contents

What Is Implied Volatility (IV)?

Definition and Basic Concept of Implied Volatility

Implied Volatility (IV) is a basic metric in the world of options.

It looks to quantify the market’s anticipation of how much the price will move of the underlying asset.

It is typically expressed in one of two ways: as a percentage or as a decimal.

Implied Volatility readings are also not bound at 100% (or 1.00) and theoretically have no maximum value.

As expressed above, implied volatility is an anticipation or expectation of how much the underlying asset’s price will move.

As a result, implied volatility is important in options pricing and trading.

Higher volatility numbers often correlate with higher options prices.

The calculation for Implied volatility can be complicated but is anchored in the concepts of Standard Deviations.

In stock, the implied volatility is often used as a measure of what it can be expected to move over a year.

Options are more complicated because of the addition of time decay (theta) and other pricing factors.

Historical Volatility vs Implied Volatility

Next, let’s talk about another type of volatility in trading: historical volatility.

Historical and implied volatility are two sides of the same coin, yet they serve distinctly different purposes.

Historical volatility measures the actual price fluctuations of an asset over a specified period and implied volatility gauges the market’s expectation of the asset’s price movement in the future.

It is important to note the difference because many newer traders assume that all volatility is the same, and it is not.

While historical volatility is often used to help create and gauge current volatility, there is a divergence between the two occasionally.

This disparity can provide insightful narratives about market sentiment.

For instance, higher implied volatility compared to historical volatility might signify heightened price uncertainty or anticipation of substantial price changes.

Conversely, lower implied volatility suggests smaller ranges with less violent price swings.

Understanding this divergence can be crucial for traders looking to harness volatility in their trading.

The Significance Of IV In Option Pricing

Now that the basics are understood, and we know the difference between historical and implied volatility, let’s examine one of the most important uses for implied volatility: options pricing/premiums.

It was touched on above, but here we will go into more detail about how it affects pricing.

Impact of Implied Volatility on Option Premiums

Most traders already know how implied volatility affects options, whether they know it or not.

As a stock gets more energetic and price moves in wider ranges, options prices increase.

This is implied volatility at work. An option price is made up of two main factors: intrinsic and extrinsic value.

Intrinsic value is determined by the difference between the stock’s current price and the option’s strike price.

When an option is out of the money, it has an intrinsic value of 0.

The extrinsic value is influenced significantly by Implied volatility and trend (among many other factors).

A higher Implied Volatility indicates a greater potential price swing; this boosts the option’s extrinsic value and, consequently, its premium.

Utilizing Implied Volatility In Trading Strategies

High Implied Volatility vs Low Implied Volatility Options Strategies

While there are numerous trading strategies, especially regarding options spreads, most can fall into one of two trading buckets: high or low volatility.

First, let’s look at a purchased call option; while the trader wants the stock price to increase, this would be considered a low implied volatility strategy.

The trader wants to buy an option when implied volatility is low because they get a better deal on the premiums they pay.

Consider buying an option before an earnings call to see why this is so important.

It is possible for the trader to get everything right on direction and magnitude but still lose money on the option because the price was so inflated in Implied Volatility.

Selling options or spreads would be considered high implied volatility strategies.

As a trader, when you sell an option, you make money as the price decreases towards zero.

One of the best times to sell is when implied volatility is extremely high, as this increases your potential PnL and can make the trade profitable even if the stock price goes against you.

Managing Risk With Implied Volatility

Implied volatility can also be used as a way to help position size and manage open positions.

Position Sizing

One way to use implied volatility outside of options pricing is in position sizing.

As discussed above, a higher implied volatility often means higher options premiums.

Based on the implied volatility rank, a trader can gauge how many contracts to purchase.

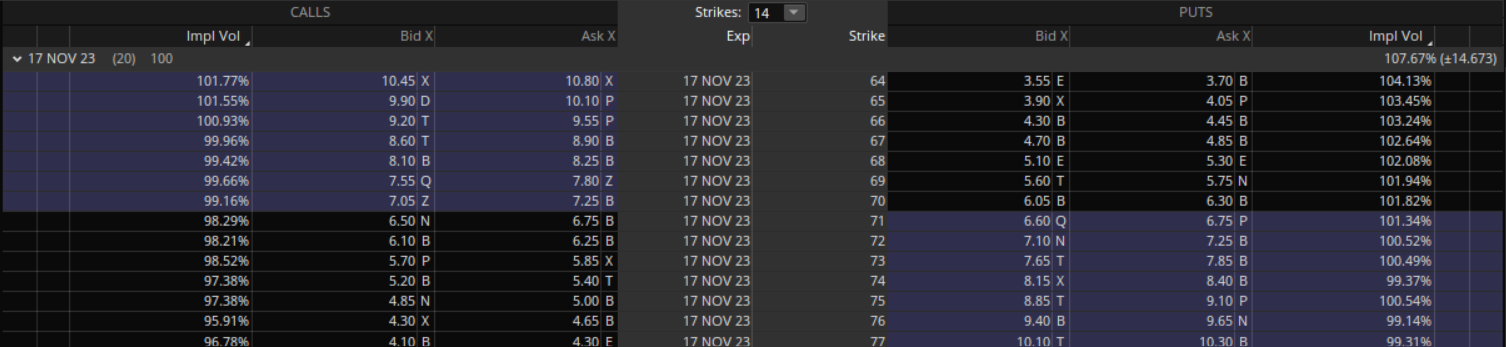

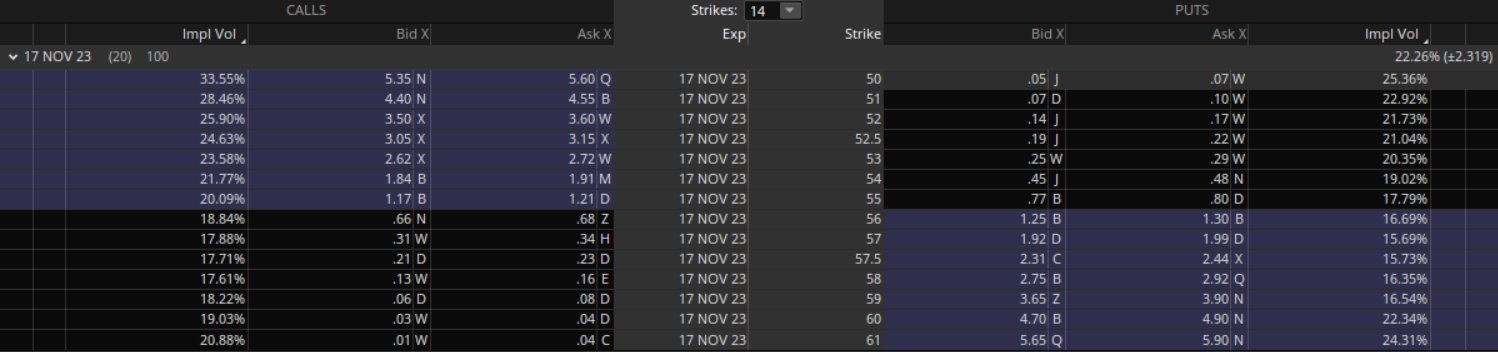

Please take a look at Coinbase (COIN) options for a moment; as you can see by the screenshot below, the monthly options have an implied volatility of roughly 100%, which is right on par with their average (upper right and corner of the screenshot).

Now let’s compare the same expiration and number of strikes on Coca-Cola (KO), which have an implied volatility of around 20% and are trading around their average.

A savvy trader could look at this information and say they would need to take a smaller position on COIN than on KO to keep their risk parameters in check.

Analyzing Market Sentiment with Implied Volatility

Volatility Skew and Implied Volatility Ranks

Skew

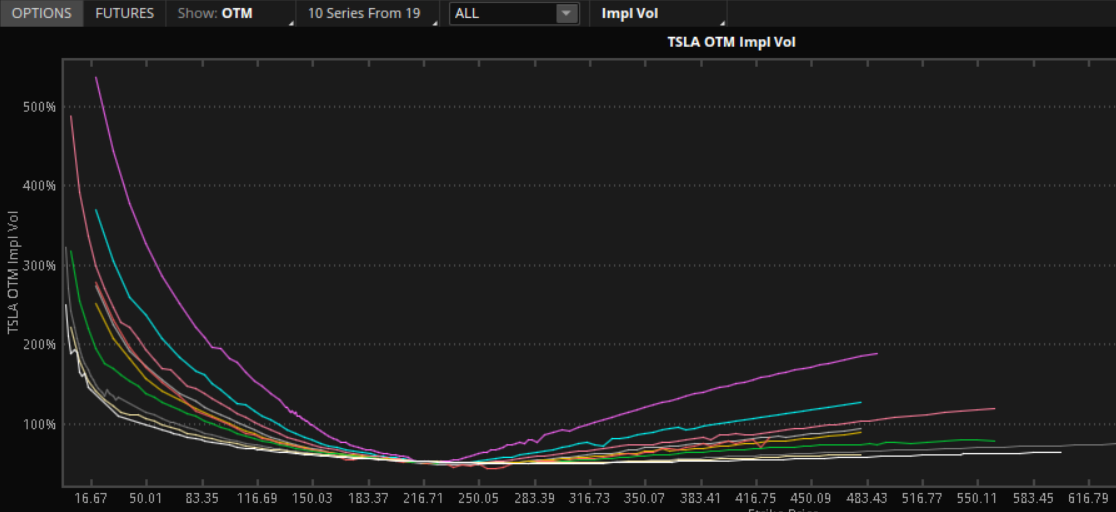

There are a few other ways to use implied volatility to try and gain a market edge; the first is to look at the skew of the options expirations.

Volatility skew is where options of the same expiration but different strike prices have different implied volatilities.

This skew provides potential insights into the market’s expectations of the likelihood of an extreme price move.

A steep skew might suggest that the market anticipates a significant event or a price move in the short term.

This can be a potential signal to prepare for some volatility.

Additionally, the shape of the skew can provide some insights into the collective market bias.

A skew that reflects higher implied volatility at lower strike prices (put options) may indicate a market concern about the potential to trade lower.

Conversely, if the higher prices have an elevated skew, it could signal that the overall market bias is toward higher prices.

Like everything in trading, this is far from a guarantee; it’s more of a window into other market participants’ positioning.

Based on the above, what is the volatility skew of TSLA options below potentially telling us?

Is the market biased towards the upside or the downside?

Implied Volatility Rank

Implied volatility rank provide a relative measure of the current IV compared to its historical range.

This can help the trader to determine a few things.

First, are options pricing in a lot of price movement on the underlying?

Second, are the options premiums displaying a lot of extrinsic value?

Finally, would buying or selling an option at the current implied volatility levels be better?

A higher rank than the historical implied volatility indicates that the current market uncertainty exists and higher price fluctuations are expected.

Conversely, a low rank denotes that the current implied volatility is near the bottom of its historical range and that the options are pricing in market stability and more methodical price movements.

Similar to skew, implied volatility ranks are just a guide to help a trader understand how the options are priced and potentially what the market expects in the underlying.

Closing Thoughts

Implied volatility can be intimidating, but it is vital to options trading.

It can control how an option is priced, show if the market thinks the price will be volatile, and show whether a stock is currently volatile compared to its historical average.

All of this is extremely important to a trader trying to determine which strikes and strategies to employ.

However you end up using it, implied volatility should be an important part of your options toolbox.

In the same way, you wouldn’t drive without knowing the speed limit; you shouldn’t trade without knowing what the implied volatility is saying about your contracts and the underlying stock.

We hope you enjoyed this article on implied volatility in options trading.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.