Have you ever wondered about how to do a leveraged trade?

Today, we will discuss using financial leverage in trading with this detailed guide.

Enjoy!

Contents

- Introduction

- What is Leverage?

- Is Financial Leverage Dangerous?

- How To Get Leverage In The Financial World

- How Can Leverage Power Your Portfolio

- What Is The Downside Of Leverage?

- Leverage as Firewood

- So How Much Leverage Should I Use?

- Available Products to Leverage Your Portfolio

- Concluding Remarks

Introduction

A lot of the world’s most wealthy people had one thing in common.

They used leverage to obtain their wealth. As the saying goes, you do not get rich rubbing pennies together.

Leverage, when applied correctly, can lead to large amounts of growth in capital and resources.

Despite this, used incorrectly, leverage can be the fastest way to financial ruin.

This article will give an overview of leverage in the financial space.

We will then discuss some different ways to use leverage and maximize returns while also focusing on minimizing risk.

So, what is leverage?

What is Leverage?

In the financial world, leverage is the use of borrowed funds, either through capital or financial instruments, to amplify exposure to an asset.

A leverage ratio of 1 implies that an investor is not using any leverage, while a ratio of 2 would mean they are investing with 2 times their capital.

A ratio of 0.5 would imply half of their capital is invested.

Is Financial Leverage Dangerous?

Many people will scoff at using leverage in the stock market.

“Using leverage in your portfolio, are you crazy!?” – Is an all too common remark.

Yet, these comments are often from the same people who are highly leveraged themselves through large mortgages and loans.

Ironically they are probably even more leveraged than you in your investment portfolio.

Not only that, while claiming to be risk averse, they are probably taking on far more risk than a diversified portfolio is.

After all, they have all their chips in one basket/house.

Many of these same individuals will retort back that real estate is safer than stocks.

Clearly, they have not yet visited Detroit!

Even if this was true, an investor could simply leverage up on various REITS (made up of various properties) instead of buying only one home.

This would leave an investor exposed to different properties both in type and location, which would provide some diversification.

Nevertheless, using too much leverage in the financial space is not only dangerous.

It can become suicidal. Leverage, when used correctly, always needs to be applied in moderation.

How To Get Leverage In The Financial World

There is no easier place to get leverage and access to capital than in the financial world.

This can easily be achieved by using derivatives such as futures and options, which can allow access to a large amount of leverage with very little capital required.

Not only that, but the leverage is extremely cheap.

Loans from Credit Cards can top 20% in interest annually, while even personal loans and mortgages for creditworthy investors can be in the 3-10% range.

In contrast, buying a futures contract or option allows investors to borrow capital at a rate approximate to LIBOR, or the rate that banks can borrow from the government.

This currently sits at 0.5% annually or less.

Even better, getting access to leverage is extremely easy and only requires some capital to start and some disclaimers beforehand.

How Can Leverage Power Your Portfolio

To see the power of leverage, let’s look at the below example.

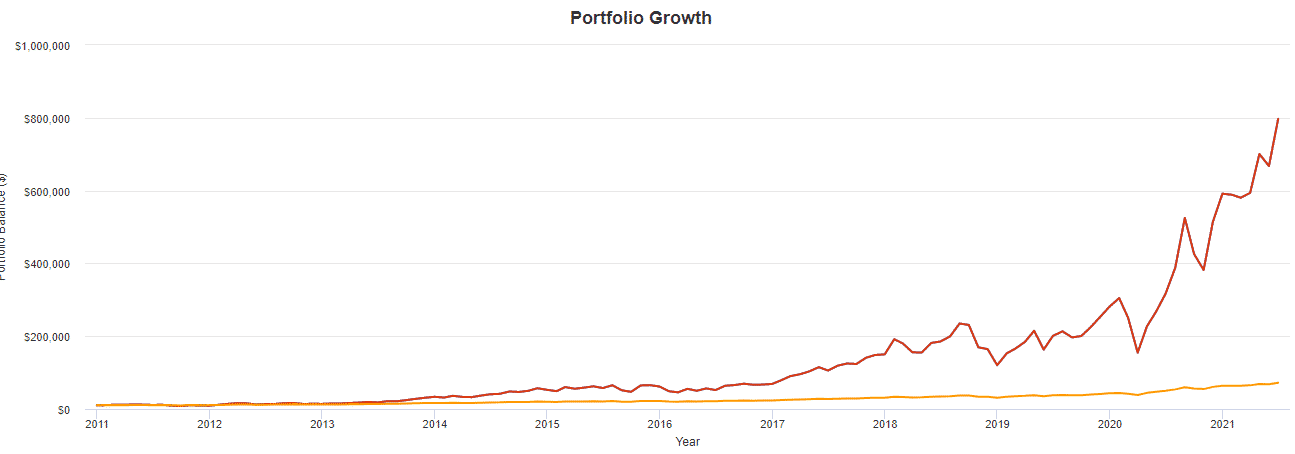

Here we have the Nasdaq 100 shown in yellow. Starting with $10,000 in 2011, you would have a very impressive $72,000 today.

Yet what about the red line?

What stock is that?

What on earth could have changed $10,000 into $800,000?

Source: Portfolio Optimizer

If you think of the hottest Wall Street stock, such as Tesla you would have had comparable returns, but it is actually the 3x leveraged Nasdaq, TQQQ.

The reality is that the average retail stock picker will most likely not find the next Tesla.

In fact, if you are an average retail stock picker, you most likely underperformed the index over this same period.

Furthermore, even if you do get lucky, are you going to invest 100% of their portfolio in Tesla and not sell when it is already up 1000%?

In contrast, simply buying the leveraged index requires no stock picking, and as the stock market usually goes up over time, leveraging can lead to drastic returns.

This is highlighted by the effect of compounding, which we can see on the steep right hand side of the graph.

While this growth acceleration may seem unsustainable, it can go on for a lot longer than you would think because of this compounding.

These gains are astronomical and completely true – no messing with the data or secret signals.

Now before you go out and put your whole portfolio in TQQQ, of course, there is a catch.

What Is The Downside Of Leverage?

Increasing leverage not only increases returns it also increases losses.

For investors of TQQQ, this coincides with three times the volatility of the Nasdaq 100.

Over the last five years, the Nasdaq 100 has had an annualized volatility of around 17%.

That means over 51% for TQQQ (it is actually 54% due to compounding).

That is a lot of volatility.

Seeing drawdowns of 70, 80, or even 90% are not only entirely possible but will happen at some point holding this product.

If you can stomach losing 90% of your portfolio in the span of a few weeks to obtain the riches of leverage, you are a brave person, but even then, you may end up with your house burning down.

To illustrate this, let’s dive into TQQQ’s prospectus.

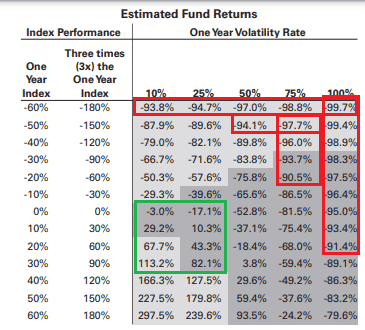

Source: Proshares TQQQ Prospectus

Here we have the estimated annual returns given the index (QQQ) returns and our one-year volatility rate.

We can see that bad QQQ performance and high volatility do not bode well.

The red boxes show all the times when the portfolio would have lost over 90% in value.

Some instances have greater than 99% losses!

An issue is that even if you manage to avoid completely blowing up, at this point, the fund will most likely be delisted, and you will be left holding the bag.

So despite us having a relatively high level of returns and low volatility since TQQQ’s inception (putting returns in the green box) it is not without immense risk.

In the event of an extreme stock market crash or major tech meltdown like the tech bubble seen in 2000, havoc will ensue in this product.

Leverage As Firewood

My favorite analogy of leverage is like firewood.

We can use firewood to generate warmth and keep a fire burning merrily and happily.

Adding more wood fuels the flames, allowing for even more warmth and enjoyment – up to a certain point.

If we add too much wood, we risk the fire getting out of control.

If it does, you can start to lose control and burn down your house.

All out of something that provided so much warmth and happiness.

Welcome to the world of leverage.

So How Much Leverage Should I Use?

There is no set amount of leverage an investor should use.

It depends a lot on a person’s circumstances and goals in life.

For a person who already has a comfortable retirement in order, there is no need to use leverage.

This investor should most likely use far less leverage than their own capital.

Instead, the focus should be on capital preservation.

In contrast, a young investor with a few thousand dollars in the bank can afford to risk more.

After all, even if they lose their money, they can still get a job flipping burgers at Mcdonald’s.

Despite this, at a certain point, increasing leverage is detrimental to all investors, independent of risk tolerances.

This is because too much volatility becomes a self-fulfilling prophecy that is destined to go to zero. So how much leverage is optimal for maximizing returns?

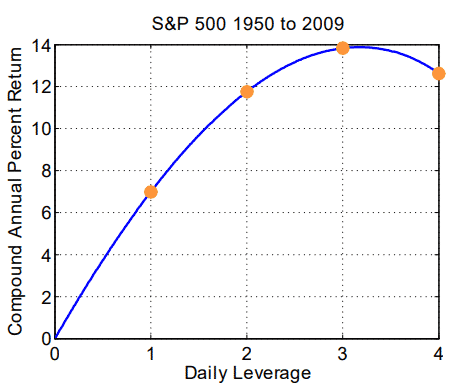

Souce: SSRN Alpha Generation and Risk Smoothing using Managed Volatility

Here we have the compound annual percentage return of the S&P from 1950-2009 depending on the level of leverage.

We can see that more leverage equates to higher returns, up to a certain point.

After 3X leverage, annual returns start to go down. So is 3X ideal? Let’s look at another graph of the FTSE 100.

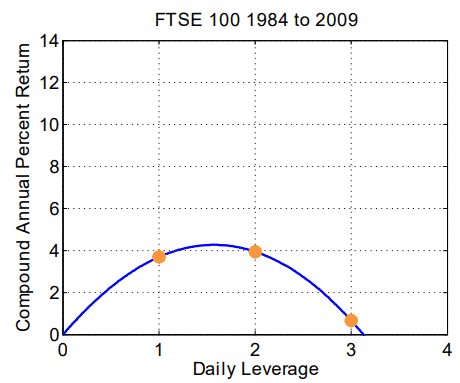

Souce: SSRN Alpha Generation and Risk Smoothing using Managed Volatility

Over this period on the FTSE, it seems like the ideal amount of leverage was 1.6X.

A far cry from the 3X in the graph above.

Leveraging up to 3X over this period would have led to negligible returns.

All with even more unwanted volatility.

So, what amount of leverage is ideal for maximizing returns?

As we cannot predict future returns, it is tough to know exactly but somewhere between 1-2X is probably ideal for maximizing returns without taking too much risk.

But again, it depends on personal circumstances.

There are some advanced techniques that hedge funds use to allocate leverage.

One such method is Volatility Targeting, where a portfolio has a leverage ratio based on the implied volatility of the underlying.

By doing this, an investor can take advantage of leveraging up in low volatility periods while cutting down exposure when the market becomes more unstable (thus lowering blow-up risk).

This can be a great strategy but will underperform in markets that do not trend as you will be constantly be selling low and buying high.

Available Products To Leverage Your Portfolio

There are numerous products available for traders to leverage your portfolio. Here are a few.

Futures

Probably the most clean-cut way to get leverage is access to index futures.

They are cheap and liquid and require minimal margin.

For example, to obtain 2X leverage, an investor buys twice the notional value in futures as the account value.

The benefits are the low costs and margin.

The downside is that an investor will have to rebalance.

For example, an investor buys $200,000 of S&P 500 futures with a $100,000 account.

If the S&P drops 20%, an investor will only have $60,000 in the account but still have $160,000 in notional futures exposures.

They will need to sell $40,000 in futures to realign their 2X ratio; otherwise, they risk blowing up from now being overleveraged.

Options

Call options offer a cheap way to obtain leverage on the movement of an underlying.

An advantage of options is that you can leverage single stocks if you want.

The issue, unfortunately, is that when an investor buys a call option, they also take an opinion on the volatility of the underlying.

If an investor has no view on the volatility, it may not make sense to trade it.

This is especially true as they are buying variance risk premia which tends to be damaging over time.

Some investors buy LEAPS thinking they avoid this, but they are just trading theta for vega.

One way to negate this is to buy deep in-the-money calls which, will have more of a delta component and less of a volatility one.

Margin

Brokers offer margin for investors who want to borrow funds.

This can allow leverage, and better yet, an investor can choose a mix of securities they like instead of having to buy index futures.

Interactive Brokers offers very competitive borrowing rates of a few percent.

Despite this, some other popular brokers lend from 5% and upwards.

These should be avoided as the costs of borrowing start to negate the returns from investing.

Leveraged ETN’s

Leveraged ETN’s offer investors the ability to obtain leverage from futures without rebalancing themselves.

This is a straightforward hassle-free way to obtain leverage and can be suitable for casual investors.

It has the added benefit of separating the leveraged part of a portfolio from a more conservative one.

Despite this, these products have some issues such as a 1% management fee and performance drag which tends to be worse in high volatility periods.

This may lead to you not exactly getting the long-term returns you were looking for.

Concluding Remarks

Leverage can offer investors the opportunity for outsized gains in a portfolio.

Over long periods this can offer monumental returns over and above unleveraged portfolios.

That being said, using too much leverage can lead to lower returns, higher volatility, and subpar performance.

For risk-seeking investors with longer time horizons, considering implementing some small amount of leverage in their portfolio can be smart.

This is assuming one can stay level headed during large drawdowns.

Regardless, even if an investor uses no leverage, understanding it and how it affects the financial system can be valuable in trading and investing in general.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.