The question of when to exit a winning options trade is not easy to answer, as many factors need to be considered.

One must strike a balance between letting profits run and protecting gains.

The exact balance will depend on the strategy, the time frame, and the trading style.

Hence, there is no one-size-fits-all answer.

Nevertheless, there are some general principles that many traders tend to adopt.

Contents

Managing Winning Trades In Credit Spreads

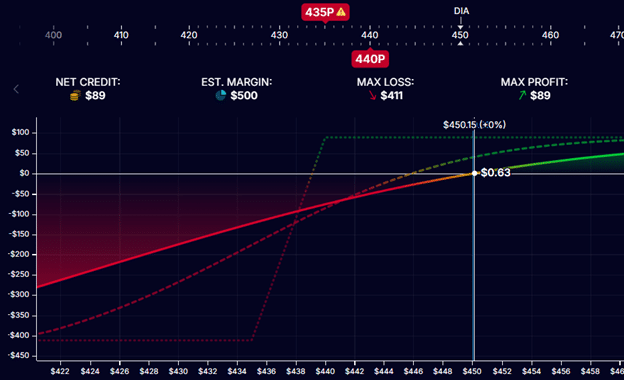

Here is an example of the P&L graph of a credit spread at the start of the trade…

It received a credit of $89, which is its maximum potential profit. Its max loss is $411.

This gives it a risk-to-reward ratio of $411 / $89 = 4.6.

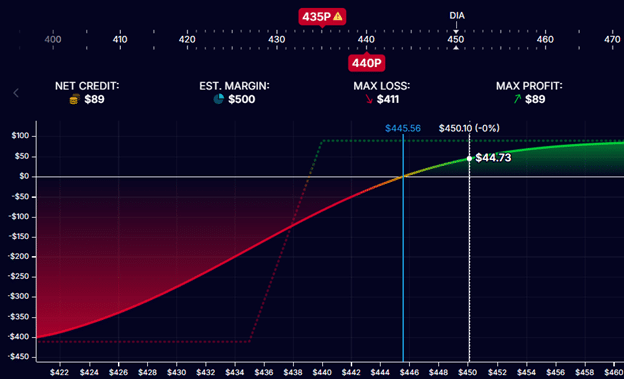

Suppose that time passes, and now the spread has already accrued $44.73 of profits, as shown below.

It has made half of its maximum potential profit. Is now a good time to take profit?

There is only $44 of profit left in the trade.

However, to capture that profit, the trader still has to hold a trade with a risk of $411.

The risk-to-reward ratio has increased to $411 / $44 = 9.3.

At what point does the trader decide that the reward is too little left for the risk they need to hold?

If the trader was not already in this trade, would this be a trade that they would be willing to initiate?

A general principle for taking profits in a credit spread is to take profit at a percentage of the maximum potential profit of the trade.

This take-profit percentage of many traders ranges from 50% to 80% of max profit.

Managing Winning Trades In Iron Condors

This principle of taking a percentage of the maximum profit applies not only to credit spreads but also to many other options and strategies where one receives a credit upon entry.

This is true of iron condors, which are just two credit spreads.

Some traders will also take the profit accrual rate into account as well.

After doing many trades using the same strategy, the trader will know when profit comes particularly fast for a trade (much faster than normal).

In that case, they may take profit quicker and recycle capital.

For example, take a trader who typically trades iron condors that expire 45 days later.

They may enact a take profit rule that says take profit if it has captured 50% of the max potential profit in less than half the time in the trade.

If this profit target is not reached, continue the trade and exit with 21 days left until expiration.

Here, they have incorporated the element of time into how they manage trades.

As iron condors accrue profits, their risk-to-reward becomes less favorable because a smaller reward is left, and the trader has more to lose.

However, their probability of profit increases.

As iron condors get closer to expiration with fixed wings, their wings get further and further out of the money at more and more decreasing deltas on the option chain.

Therefore, there is a smaller likelihood that the wings will be breached.

On the other hand, if they get too close to expiration, the gamma risk increases, and they see a greater fluctuation in their P&L with small price moves in the underlying asset.

These are all the elements a trader considers when managing trades.

Managing Winning Trades In Short Puts

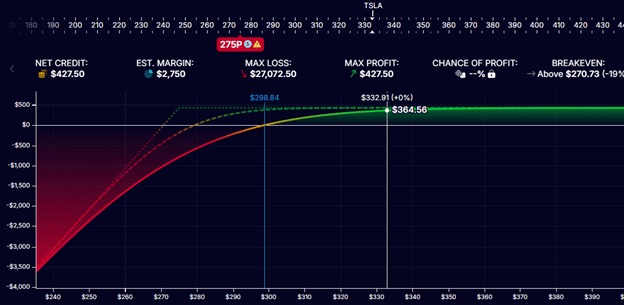

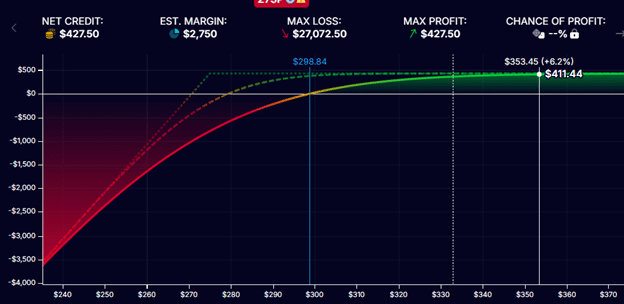

Here is an example of a short put on Tesla (TSLA) where the trader had sold a put option with the $275 strike for a credit of $427.50.

Source: OptionNet Explorer

The max profit on this trade is $427.50.

The white vertical line at $332 is where the current price of TSLA is.

The trade is already showing a profit of $364.56.

It can only make an additional $63.

Is this a good time to take profit?

Most traders trading the short put as a stand-alone strategy would say yes because this trade has already captured over 80% of the maximum potential profit that it can capture.

Taking $364.56 divided by $427.50, this trade has captured 85% of its max profit.

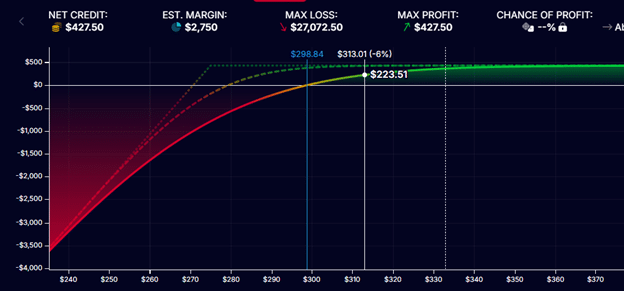

Using modeling software, say that TSLA goes down 20 points to $313.

The profit would be $223.51 – a loss of $141 of profits.

And If TSLA were to go up by 20 points…

We would only gain $46.88 of additional profit, with P&L going from $364.56 to $411.44.

With an equidistant move up or down, we can increase our P&L by $46.88 or decrease it by $141.

This is a risk-to-reward ratio of 3 at this current time.

As more and more profits are accrued and less and less of it is left, the risk-to-reward ratio increases (just as we saw in the credit spread).

Managing Winning Trades In Covered Calls

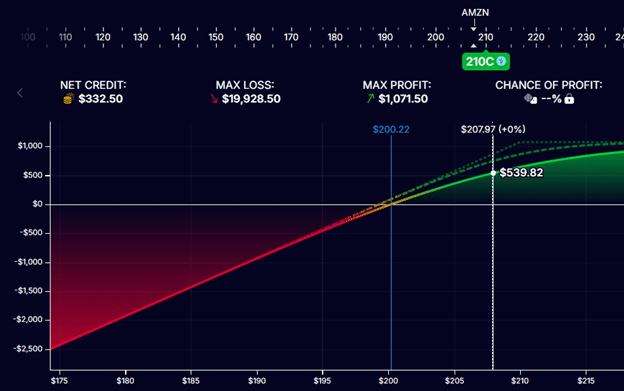

The P&L graph of a covered call is very similar to that of a short put…

This shows that an Amazon (AMZN) covered call trade had made $540 as the price of AMZN had gone up to $208 per share.

The covered call had just hit 50% of its max potential profit of $1071.50, and are 13 days left in the trade.

Some traders may take the win here. Others may hold out for 80% of potential profit.

And yet others may hold until expiration or the last few days of expiration to squeeze out as much profit as possible.

With all other things being equal, the closer to expiration, the greater the chance the stock will be called away.

However, some traders do not mind that the stock gets called away.

Therefore, they can hold out for a larger profit or hold to expiration.

Especially if the covered call and the short put are part of the wheel strategy, they may even want the stock to get called away or the stock to be assigned to them.

The take-profit level depends on the intent of the trade and whether it is part of a larger strategy.

Managing Winning Trades In Ratio Spreads

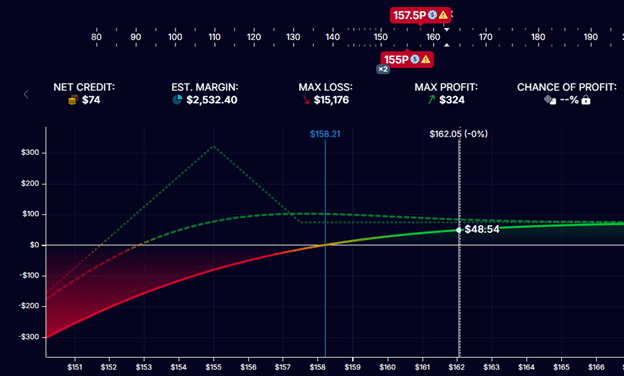

Here is a more complex exercise to test your decision-making ability.

Consider this put ratio credit spread on Chevron (CVX), in which two puts were sold at the $155 strike and one purchased at the $157.50 strike.

The trade had received a net credit of $74 at the start.

In this strategy, the max profit is $324 at the peak of the expiration graph.

If the trader only targets to capture the tail profit, then it would be $74 of the tail profit at expiration.

However, before expiration, it is possible for the tail profit to exceed $74, but not by much.

The trade had already received $48.54 of profit in 8 days, and there are still 29 days remaining in the trade.

This is more than half the potential tail profit in less than half the trade duration.

Would you take profits at this point?

Trading Style

When to take profit will also depend on the individual trading style.

A conservative-style trader will take smaller profits, prioritizing capital preservation by reducing exposure to market risk once a trade becomes profitable.

They may prefer locking in small, consistent profits and frequently reallocating capital to new opportunities.

An aggressive style trader who values potentially higher returns and is willing to tolerate more uncertainty will set higher profit targets and stay in the trade longer.

They emphasize maximizing returns even if it means accepting higher volatility and the potential for larger drawdowns.

Conclusion

We saw the many factors that are taken into consideration when managing winning trades.

Traders take into account the current profit in relation to the max profit, the speed at which profit comes, the risk-to-reward, technical analysis of chart patterns, and other factors.

With experience, many traders would be able to look at the P&L graph and know whether it is right to take profit for them.

We hope you enjoyed this article on how to manage winning trades.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.