The put-call ratio provides an investor or trader with an indication of an asset’s sentiment—whether bullish or bearish.

The put-call ratio measures the volume of put options traded relative to the volume of call options traded.

It is calculated by dividing the number of traded put options by the number of traded call options.

Put-call ratio = volume of put options / volume of call options

Because it is called the “put-call” ratio (and not the “call-put” ratio), it is the put options divided by the call options and not the other way around.

Contents

Where Can We Get The Volume Of The Options?

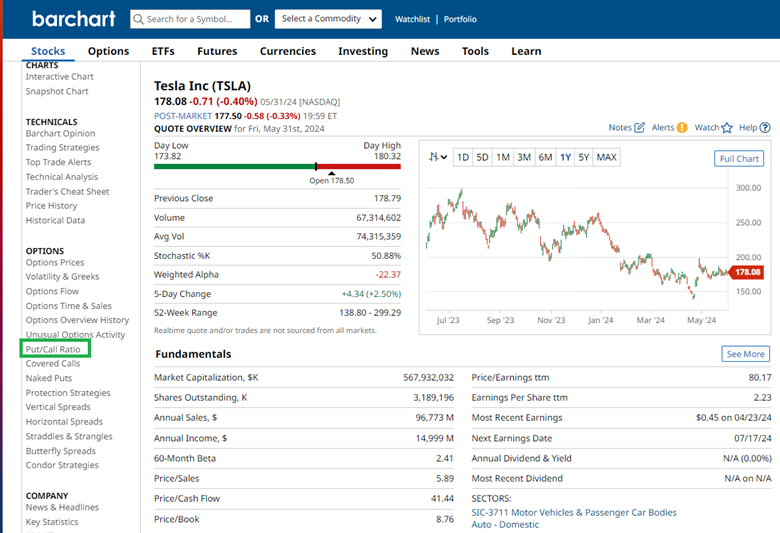

The simplest way is to type the ticker symbol into BarChart.com and bring up the stock overview page.

For obvious reasons, the put-call ratio only applies to equities with options available.

Let’s take a random optionable stock as an example, say Tesla (TSLA).

Then click “Put / Call Ratio” in the left menu:

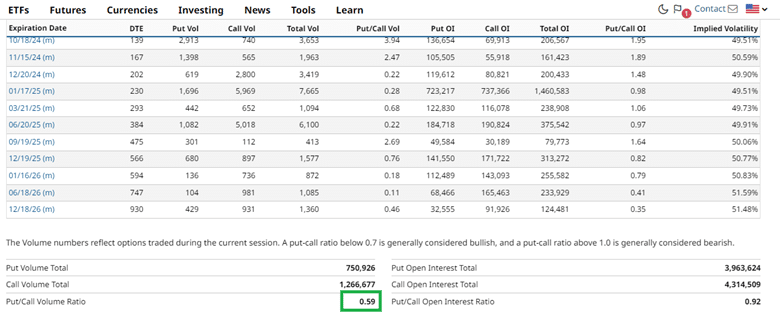

You get a table with put and call volumes of the options for different expiration cycles:

If all these numbers make your eyes glaze over, as mine, then all you need to do is scroll to the bottom, and you will see the summarized put/call volume ratio.

In the case of Tesla, it is showing 0.59.

If you want to confirm this calculation, Tesla has a total put volume of 750,926 and a total call volume of 1,266,677.

Dividing the latter by the former, you get 0.59.

As is mentioned on the Barchart page:

“The volume numbers reflect options traded during the current session. A put-call ratio below 0.7 is generally considered bullish, and a put-call ratio above 1.0 is generally considered bearish.”

Since Tesla’s put/call ratio is below 0.7, it shows a bullish sentiment.

Why Is A Low Put/Call Ratio Bullish?

Investors buy put options for protection in declining assets.

When puts are low compared to calls, investors are not buying that many puts.

Or it could mean that investors are buying many call options for speculation of an up-move.

In both cases, that results in a low put/call ratio.

Just remember that lots of puts are bearish. Lots of calls are bullish.

The put/call ratio tells us how many puts there are in relation to calls.

Equities Put/Call Ratio

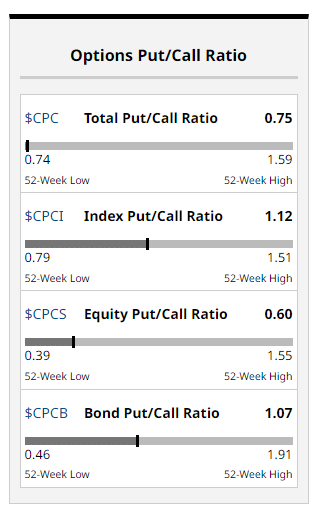

What if you want to see the sentiment of the market rather than just an individual stock?

Simply go to the Options overview page on Barchart, and you will see a panel on the right that looks like this:

The “Equity Put/Call Ratio” currently shows 0.60.

That is the aggregate put/call ratio of all the optionable stocks combined.

The put/call ratio for the index is 1.12.

And the total put/call ratio combining both equities and index is 0.75.

What is nice is that the slider shows this ratio’s current position in relation to the high and low for the last 52 weeks (or year).

The total put/call ratio is close to its 52-week low, which is a very bullish sentiment.

Incidentally, a bullish sentiment is in line with the typical sentiment of the market during an election year, which is 2024.

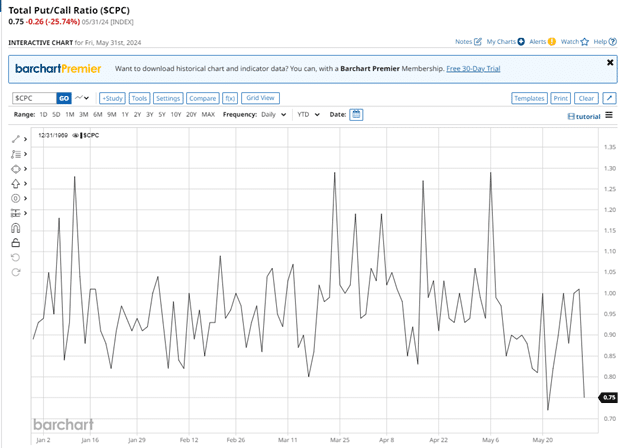

Graph of Put/Call Ratios

If you want to see the put/call ratio over time, simply type in the symbols “$CPC,” “$CPCI,” and “$CPCS” (including the $ sign) into Barchart:

These symbols are specific to Barchart and may not work in other charting platforms.

An easy way to remember these symbols is to think:

$CPC = Cumulative Put Call

$CPCI = Cumulative Put Call for Index

$CPCS = Cumulative Put Call for Stocks

Final Thoughts

The put/call ratio is just one way the investors can gauge the market’s sentiment.

Investors should use it in conjunction with other indicators, such as a breadth indicator, to get an even better picture.

We hope you enjoyed this article on how to determine the put-call ratios.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.