Menthor Q is one of the latest trading research, education, and community platforms on the market.

It offers daily research delivered to your inbox, trading models based on GEX and other market data, and a community accessible through Discord.

In addition, it provides education through its website.

Let’s look at Menthor Q, what it offers, and whether it is worth joining.

Contents

What Are They, And How Do You Join?

Before we dive into all of the tools, guides, and analytics that Menthor Q has to offer, let’s start with the basics:

What they are, what they offer, and how to join up.

Menthor Q bills itself as a quantitative (quant) platform that uses options and stock data to create proprietary trading models for active investors.

They leverage large datasets (known as “Big Data”) and Artificial intelligence to help investors find an edge in the markets.

These tools are neatly packaged into easily readable charts, graphs, and morning reports.

Joining can be done for free from their website at https://www.menthorq.com/.

The free plan will give you access to their Tradingview indicator, free Discord channels, daily research in your inbox, and GEX and proprietary levels for the SPX, QQQ, and VIX.

The free membership also gives you access to their website, which has guides on how to use their tools, various options, stock strategies, and information, as well as guides on how to trade the information they provide.

In addition, they have a paid plan that gives you all of the access mentioned above, plus access to single stock models on names like Apple, Tesla, Nvidia, and other popular names.

The paid plan also gives you access to Discord bots, options screeners that use their models to find trades, and upgraded trade rooms with other premium traders.

The price for the premium membership is $69/Month or $588/Year.

Now that you know what they are and how to join, let’s look at each tool more deeply.

TradingView Integration

One of the more exciting and useful tools available from Menthor Q is their Tradingview indicator.

This tool lets you plot their model levels directly on your trading charts and displays all the critical information in an easy-to-use table right on the chart.

The indicator is free for everyone on Tradingivew, but to use the levels, you must subscribe to at least the free Menthor Q subscription.

You paste the text into the indicator settings tab and let it go to work, plotting everything on the chart.

Below is an example of the levels on the SPX with the table disabled from view.

One thing to mention on the indicator is that it can take some time to load up, given the quantity of the data.

Tools and Discord

Their data tools are the main focus of their service; everything is just an offshoot from there.

The indicator above is a great example of this, given that you would need to paste in their daily levels to get them to populate.

Let’s look at some of the tools they have available to you.

Levels

Menthor Q has several different levels.

The first is the 1 DTE expected move.

These levels are based on gamma and several other factors.

You can trade Menthor in several ways based on your particular trading style.

In addition to the Expected Move levels, there are also put and call support and resistance levels, 0DTE options levels, liquidity, and gamma levels to watch for the day.

Their documentation is excellent, and they have several examples of using and trading the data.

All this information is available for the indexes and individual names (depending on your subscription level), so you can have the data at your disposal for whatever you trade.

All of these levels are available on their Discord server.

Discord

Unlike some other sites, Discord is Menthor Q’s main repository of information.

As we said above, they have channels for free and paid members, the most significant difference being the number of instruments available.

The information provided by the free tier is just as good as the paid tier; the only difference is the number of tickers.

The free Discord is broken down into several channels:

Daily Note – This is a morning report from Menthor. This includes things like levels, macro events, news, and research that their team has done that they view as important to the day.

Free Chat – This is the chat room for free members.

SPX, QQQ, and VIX are separate channels but focus on the same information. The data is deposited in these channels, including things like GEX levels, bid/ask spread on options, open interest, implied volatility levels, volume, and support and resistance levels. These are the channels where a lot of the main information is located.

Premium Rooms – The premium rooms largely mirror the setup of the free rooms but also include chatrooms to discuss trade management, structuring trades, swing trading, scalp trading, and a longer list of tickers, including individual names like Telsa, Nividia, and Apple. Premium membership also grants you access to their propriety models that look at CTA (Commodity Trading Advisors) and volatility for signals. If this type of data is useful to you and you are trading, the premium subscription is well worth it for access.

Education and Documentation

All the tools and information discussed are amazing, but they mean nothing if you can’t use them to your advantage.

Menthor Q does a great job documenting their processes, educating users on their platform, and showing how to utilize the data to your advantage.

Their documentation area is broken down into many sections, but it flows well and is easy to use and understand.

Once you sign up, you get access to all of it, but if it is overwhelming, just follow the Getting Started” section, as it should answer most of your questions.

There are a couple of other key areas worth paying extra attention to, and the first is the “Menthor Q Data” section.

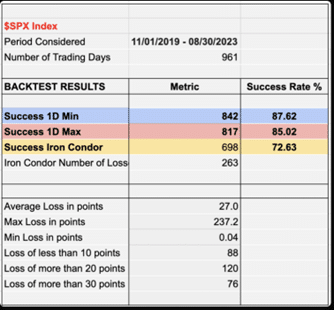

This area goes over all of their data, backtesting, and charts.

It shows historical accuracy and bactested trading accuracy on some larger datasets.

The image here comes from their 1D Expected Move levels and how it would have worked if you had traded an Iron Condor using those strikes as the wings.

Another area to look at is the “Case Studies” section.

Here, they have several guides on how to trade options more effectively.

They go over things like Delta Hedging, Technical analysis and Options, managing risk, and utilizing their Call/Put Levels.

They also have a section for futures trading if that is more your style.

Also worth mentioning is the “Models” section, where you can read about how each more complex model works.

This will not be a major read for most people, but if data and technical specifications interest you, this is the place to look.

The last section of the documentation that everyone should read is the “Trading Strategies” section.

This section has 20+ guides on different trading strategies depending on your goal, market outlook, or trading style.

This section will be especially useful to new traders looking to understand options strategies better.

This is not even close to an exhaustive list of the available documentation, but just some areas that deserve some extra focus.

They have dozens of other articles on options, market making, and their tools, and all of this is available regardless of whether you are a free member or a paid.

The Academy

The Academy is Menthor Q’s options masterclass and is offered outside their typical monthly subscription.

In the Academy, traders can learn all the ins and outs of options trading from one of Menthor’s experienced founders.

More specifically, you will learn how to read options chains, the Greeks, liquidity, skew, term structure, and how to spot potential market positioning.

Once you advance through these basic levels, you will learn advanced position-building, strategy refinement, and how to use big data, AI, and Menthor Q’s tools to enhance your trading.

This program also gives you access to a more extensive Question and Answers section.

The Academy is available for a one-time fee of $399.

Is It Worth It?

Menthor Q has many features, tools, and education available to new and experienced options traders.

Whether you are new to options trading or are an experienced professional, their unique view of the data can benefit your trading.

If you are a complete novice, the Academy is a great and fairly inexpensive place to start your options journey while having access to the Menthor Q suite of tools and research.

So, with all of these positives, is it worth it?

The short answer is yes, especially given that you can sign up for free and try out the SPX, VIX, and QQQ.

The free membership also gives you access to much of their documentation that can help you learn and use the tools more effectively.

After that, you can always upgrade to the premium subscription for additional access to the individual tickers.

We hope you enjoyed this Menthor Q review.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.