Contents

When selling premiums in non-directional strategies (such as iron condors) on the indices such as SPX (or on individual stocks, for that matter), a sharp market downturn will cause both price and volatility to go against the strategy. Let’s look at a VIX hedge strategy.

When the market goes down, the implied volatility goes up, and the strategy loses money because these non-directional positive-theta strategies have negative vega.

A gauge of this volatility is the VIX, which is the market’s expectation of 30-day future volatility of the S&P 500 and is constructed based on the option prices of the SPX.

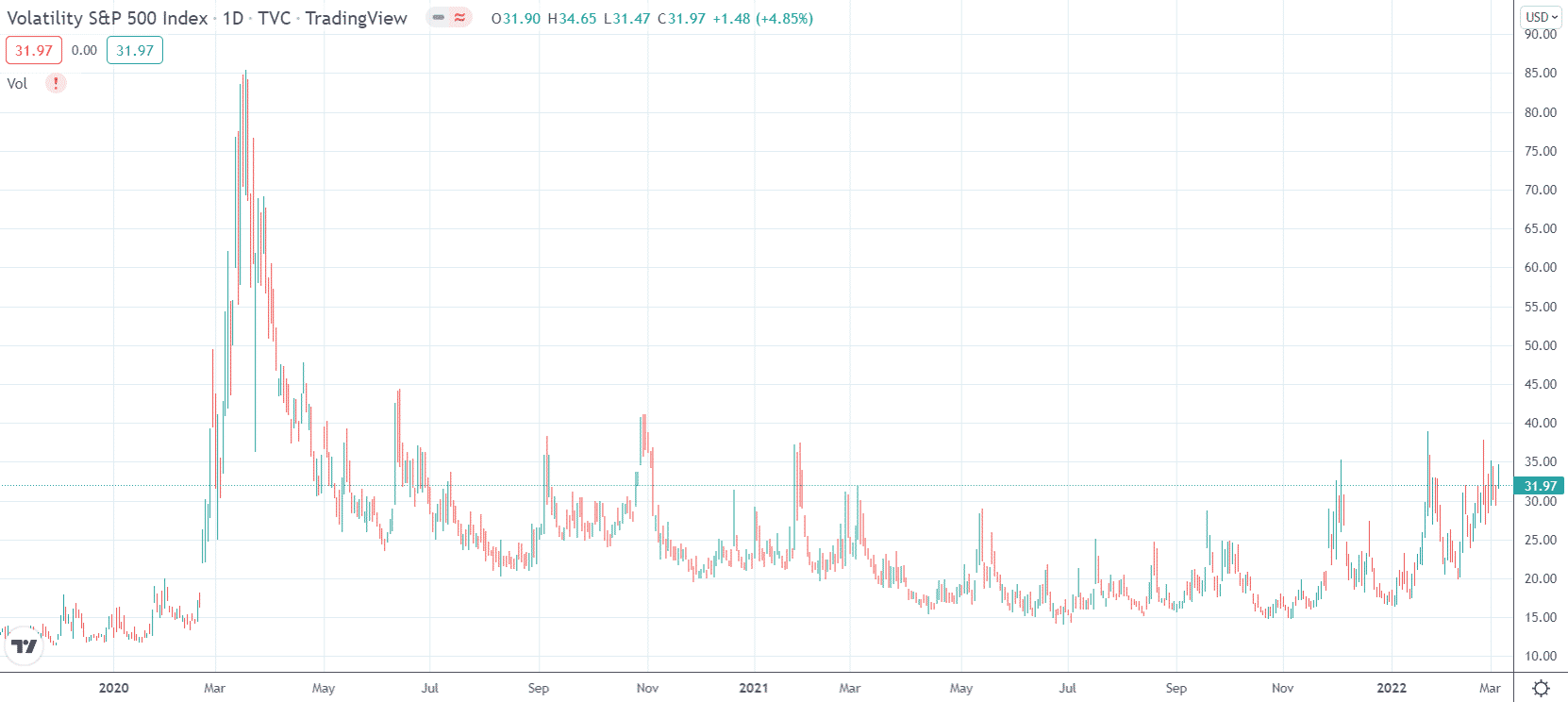

Here is the graph of the VIX as March 2022 while I’m writing this.

The VIX is currently high at 32.

Typically, but not always, when SPX goes down, VIX goes up.

VIX is a cash-settled index, just like SPX.

You can not buy shares of VIX, but you can buy and sell options on VIX.

A VIX hedge is an options structure that aims to profit when VIX goes up.

This profit is meant to help partially pay for the other positions’ losses.

There are many options structures that can do this. In this article, we will talk about the two popular ones.

The Bull Call Spread

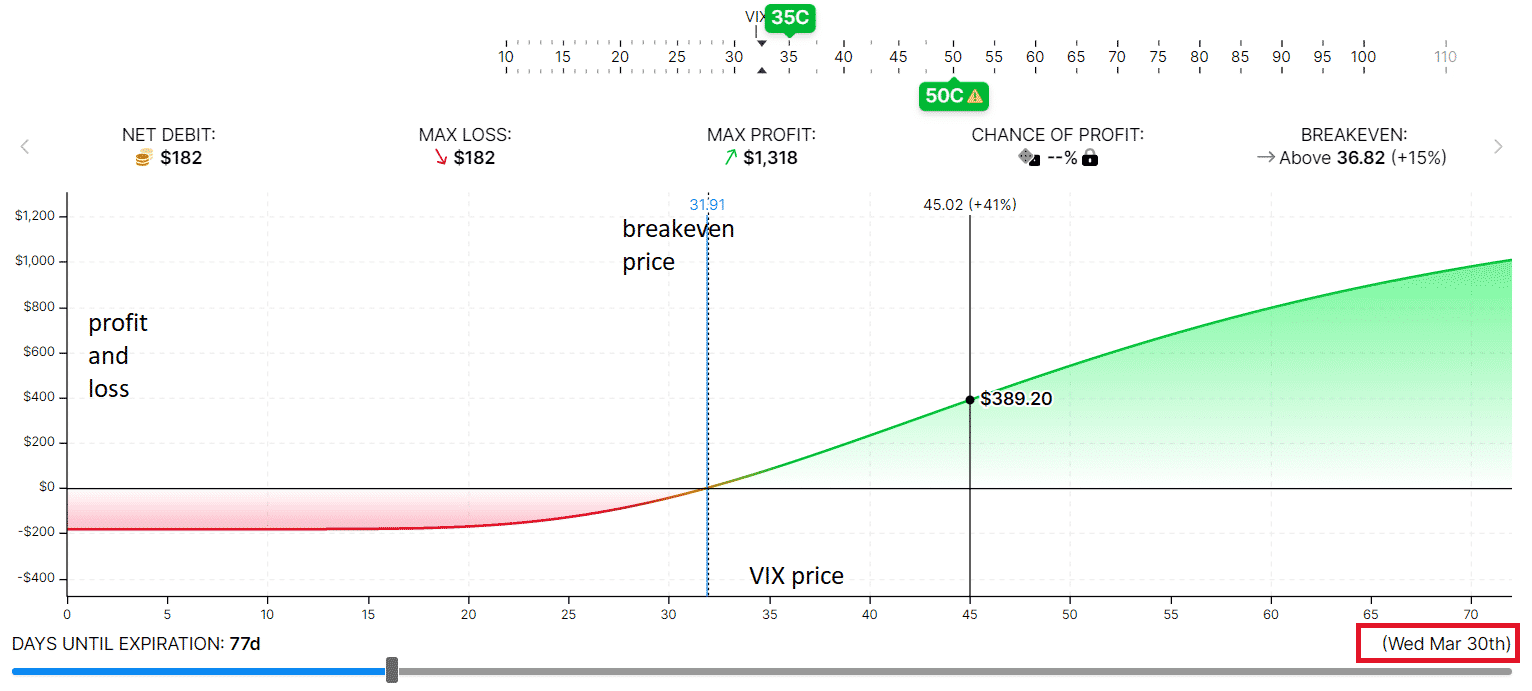

Suppose we buy one bull call spread on March 4, 2022.

Buy one Jun 15, 2022 VIX 35 call @ $4.10

Sell one Jun 15, 2022 VIX 50 call @ $2.28

Debit: $182

The call option that we are buying is just out-of-the-money.

This option will increase in value if VIX goes up.

This is our money-making leg.

This option costs $410.

To help pay for this option, we sell another call option further out of the money and receive $228.

By doing so, it will cap our profits in the event that VIX goes above 50.

But that’s okay. Looking at the above VIX chart, there are not that many occurrences where VIX goes above 50 anyways.

In net, we paid $182 for the one spread that expires 103 days from now on June 15, 2022.

We like to buy these spread with enough time for them to work — maybe 3 to 4 months out.

If VIX does not spike up during that time, the most that we would lose is $182 per spread.

How much this hedge will make will depend on how high VIX goes and when it gets there.

Let’s say that VIX gets to 45 at the end of the month on March 30.

Then the payoff diagram shows that we can sell the spread for $389 — about three times what we paid for it.

source: optionstrat.com

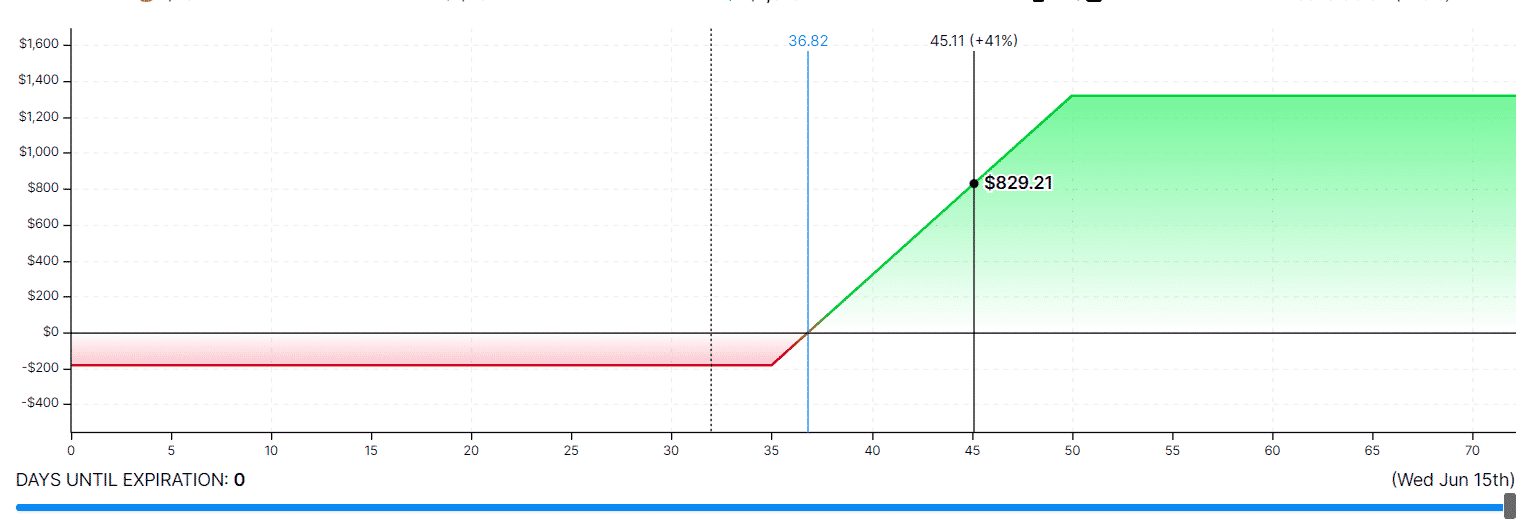

If VIX is at 45 on June 15 expiration day, the spread will be worth $829.

source: optionstrat.com

The value of the spread would have expanded six and a half times.

Many investors will put in a good-to-cancel order to sell the spread at the desired profit target.

This order enables the investor to take profits as VIX spikes when we are not watching, even when it is a brief spike (such as in a flash crash).

Taking Money Out

If the investor does see the VIX going up, the investor can take some money off the table while letting the options structure continue to make money if VIX continues up.

I’ll illustrate with a different example.

Suppose the following bull call spread was purchased for $355 on November 17, 2021.

Date: November 17, 2021

Price: VIX at 16.70

Buy one Mar 15 VIX 20 call @ $5.95

Sell one Mar 15 VIX 35 call @ $2.40

Debit: $355

On December 1, VIX went up to 22.7, and the spread value increased to $415.

Selling the spread now would only give you a 17% return.

However, it is enough to take some profits by selling a bear call spread further out-of-the-money with the same width:

Sell one Mar 15 VIX 50 call @ $1.70

Buy one Mar 15 VIX 65 call @ $1.00

Credit: $70

This takes $70 out of the structure and puts it into our pocket.

Our max risk has been reduced by $70 from $355 to $285.

The resulting iron-condor-like structure can still profit more if VIX goes higher.

On December 20, the VIX got a little bit higher to 26.

We will not know if it will go higher later on or not.

We need to decide if we will close out the entire options structure or take more money out of it again.

If we were to close out the condor structure (worth $357.50), our net profit on the hedge would be $72.50.

For this example, let’s continue with the trade and take money out by rolling our existing bear call credit spread down closer to our bull call debit spread.

We’ll roll it until the two spread touches, forming a butterfly.

Buy to close one Mar 15 VIX 50 call @ $2.35

Sell to close one Mar 15 VIX 65 call @ $1.52

Sell to open one Mar 15 VIX 35 call @ $4.00

Buy to open one Mar 15 VIX 50 call @ $2.35

Credit: $82.50

This puts another $82.50 into our pockets, reducing our max risk to $202.50.

On January 12, the VIX dropped back down to 18.

Our existing butterfly structure is worth $190.

If we sell that to close out our hedge now, we would be at a net loss of $12.50.

Oops.

Maybe the other choice of closing the entire hedge on December 20 might have been better.

This goes to show that for VIX hedges, you need to take the hedge off when they are in profit when you get the chance.

The VIX is not like stocks that goes up and stays up. VIX is mean-reverting; it goes up and then it comes back down.

We still have 62 days till expiration.

Let’s wait. Maybe VIX will spike again.

On January 24, it did. The VIX is up to 35.

The butterfly structure is now showing a value of $360.

Closing out the hedge this time, our net profit from the hedge is $157.50.

The initial debit for the bull call spread: –$355.

Selling a bear call spread: $70

Rolling down the bear call spread: $82.50

Selling the butterfly structure to close hedge: $360

Net P&L: $157.50 (equals 44% return on initial investment)

What if we had not made any adjustment and had not taken those intermediary profits?

In that case, our original bull call spread will be worth $560 on January 24, and selling that spread would net us a total profit of $205.

The initial purchase of bull call spread: –$355

Exit sale of bull call spread: $560

Net P&L: $205 (equals 58%)

By taking money out of the bull call spread, you weaken the power of the spread to make money for you in the future.

In either case, $157 or $205 is not enough to protect an entire portfolio.

We used only one contract to keep the math in the example simple.

Each investor will need to scale up the number of contracts based on the size of their portfolio and what percentage of the portfolio they want to hedge.

There are no free hedges.

Even ones that give us a credit to put it on are not “free” — as we shall see in the next example.

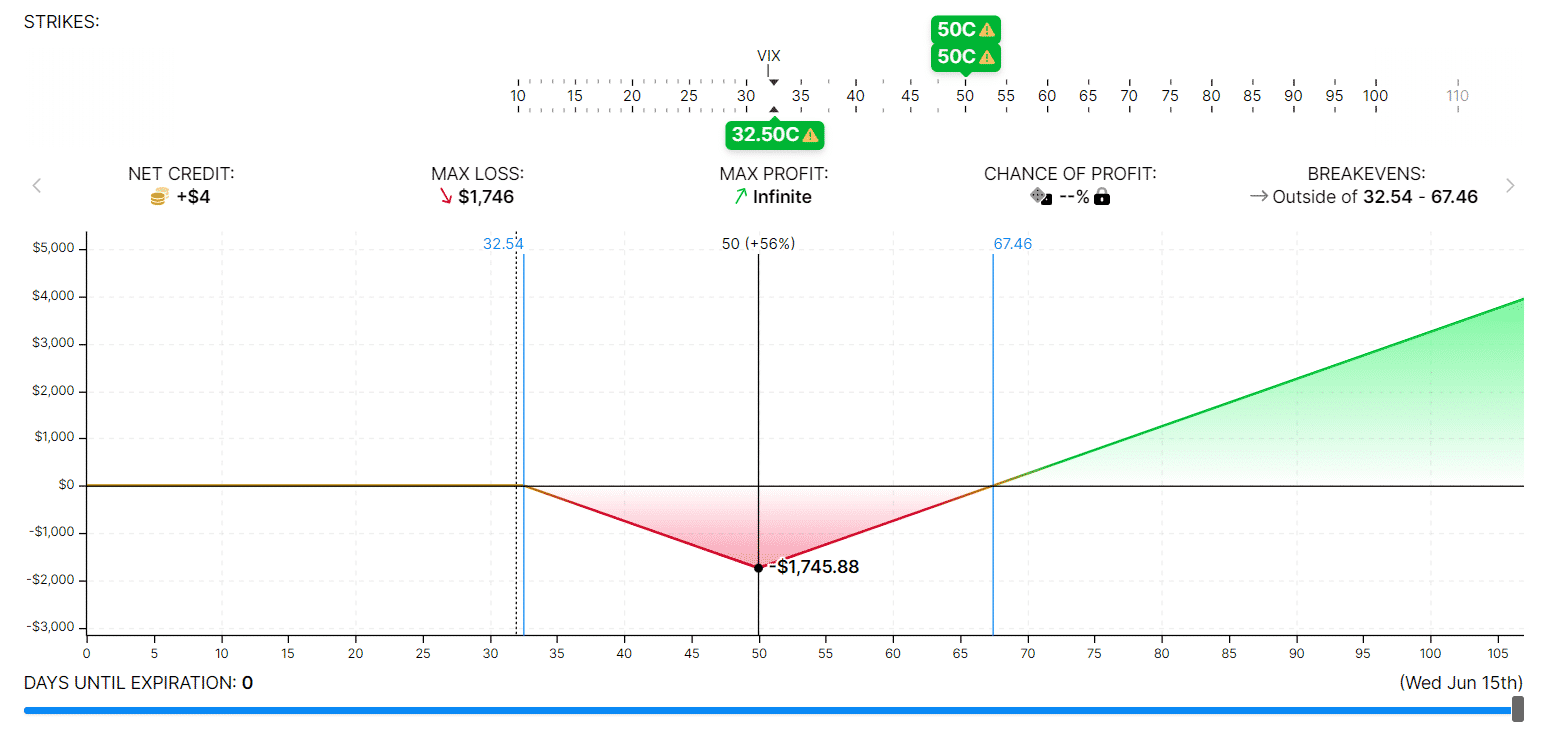

Call Ratio Backspread

A more sophisticated structure is the call ratio backspread.

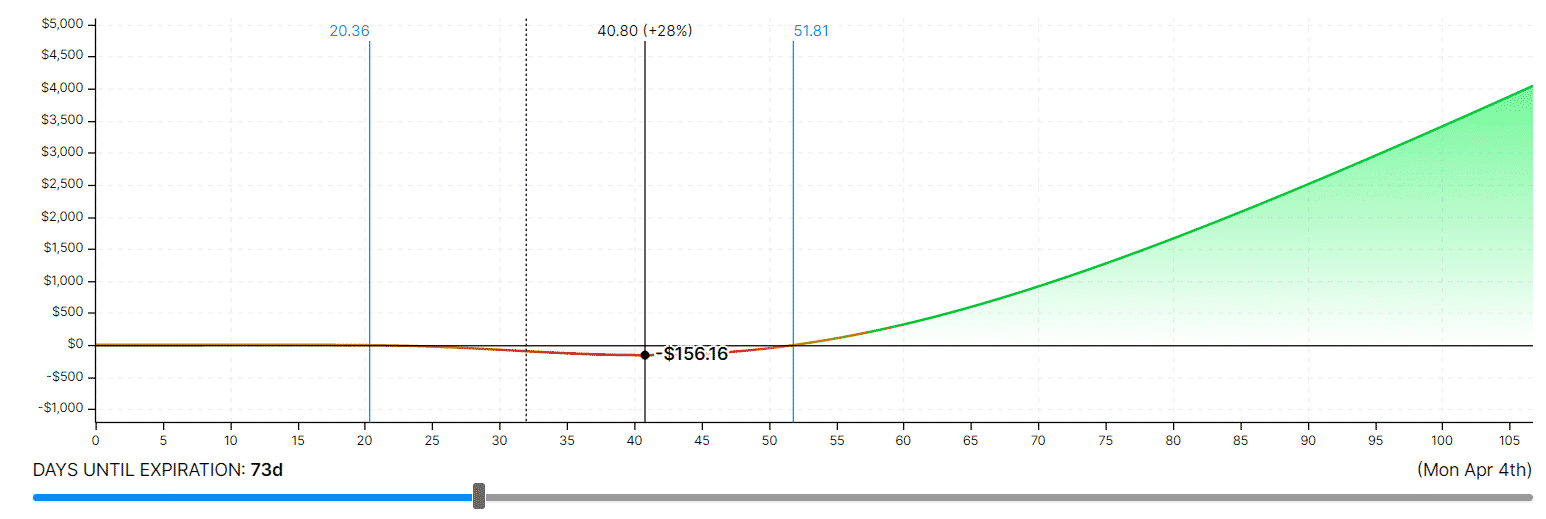

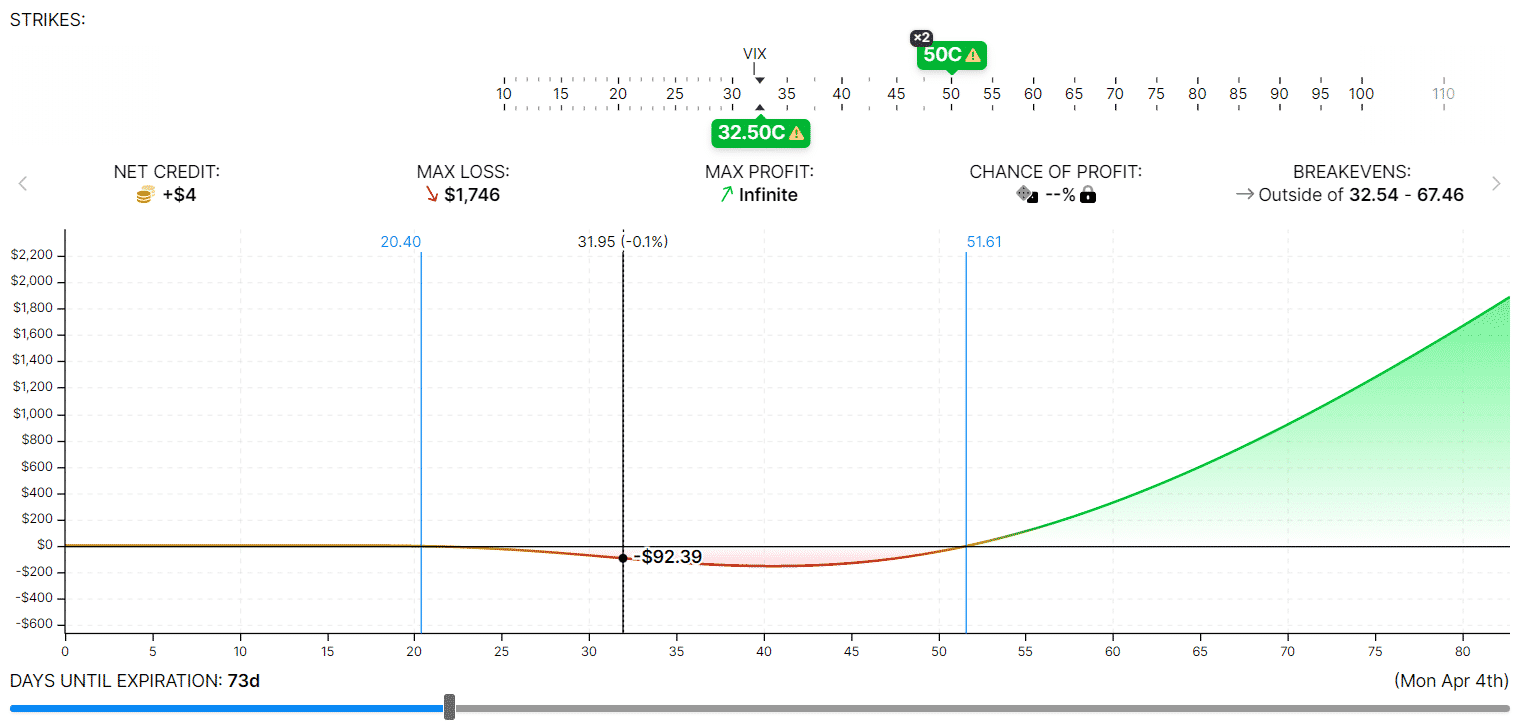

Date: March 4, 2022

Price: VIX at $31.97

Sell one June 15 VIX 32.50 call @ $4.60

Buy two June 15 VIX 50 calls @ $2.28

Credit: $4

We buy two out-of-the-money calls, which make money for us when VIX goes up.

We finance these calls by selling an at-the-money call.

In this case, the call we sold more than pays for the two calls by $4.

We like either a small credit or a small debit.

The strikes can be adjusted to make this be the case.

The two long calls need not be on the same strikes.

While this hedge is free in monetary terms, it is not risk-free.

The expiration payoff diagram shows that we will have to pay money at expiration if VIX falls between the range of 32.54 and 67.46.

source: optionstrat.com

And if on rare chance VIX falls on 50 at expiration, we need to pay the maximum amount of –$1746. If held to expiration, this hedge will only return money if VIX is above $67.46 on the expiration day.

Prior to expiration, however, VIX does not need to go this high for the spread to profit.

The nice thing with this backspread is that if VIX stays the same or is lower at expiration, we lose nothing. This is only true if you hold the trade to expiration.

To avoid the red “Valley of Death,” some investors will not hold this trade to expiration to avoid the red “Valley of Death.”

This valley grows with time.

They would rather exit after, say, one month before the valley grows too big.

One month into the trade on April 4, the maximum depth of the valley is only –$156.

source: optionstrat.com

And VIX needs only to go up to $52 for the backspread to be profitable at this time.

If VIX remains at where it is at 32 on April 4, the backspread is at a net loss of –$95. Free to enter, but not free to exit.

Summary

We first introduced the bull call VIX hedging strategy because people are probably more familiar with vertical spreads.

It also provides an easy mechanism for money to be taken off the table at opportunistic times.

As constructed, the bull call spread has a decent reward-to-risk ratio of about 7 to 1.

But you also have to weigh the chances of the hedge paying off.

In other words, what is the likelihood of a market crash, and is it worth the small added cost of continually buying the bull call spread as a hedge as soon as one of them expires?

While some investors find comfort in having a continual hedge to protect their short vega position from volatility spikes, other investors may find the cost to be too expensive.

Others in between will put on the hedge opportunistically, say when the VIX futures term structure is in backwardation, etc.

Some investors may not VIX hedge at all because they rather hedge each individual position (such as with defined risks structures, or protective puts on long stocks, or balance short vega trades with long vega trades or with negative delta trades, and so on).

No one can tell who is correct because it depends on how often and how violently the market will crash in the future, which no one can predict with any kind of accuracy.

More experienced options investors may prefer using the call ratio backspread since the initial outlay of capital is near zero.

Unlike the bull call spread, the upside potential reward is uncapped. Hence the reward-to-risk ratio is in theory infinite.

This gives the call ratio backspread a greater leverage factor than the bull call spread.

Take your pick — one or the other, something else, or nothing at all.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks mate, this was really helpful . What about Bearish BWB with Debit , does that help?

Yes it could work.