Today, we’re looking at how to reduce gamma on an iron condor.

Mastering this technique could be the difference between a solid profit and a significant loss.

Contents

Introduction

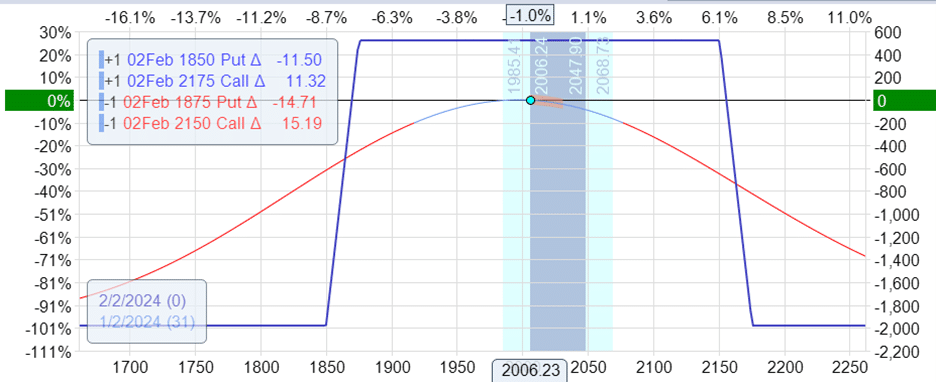

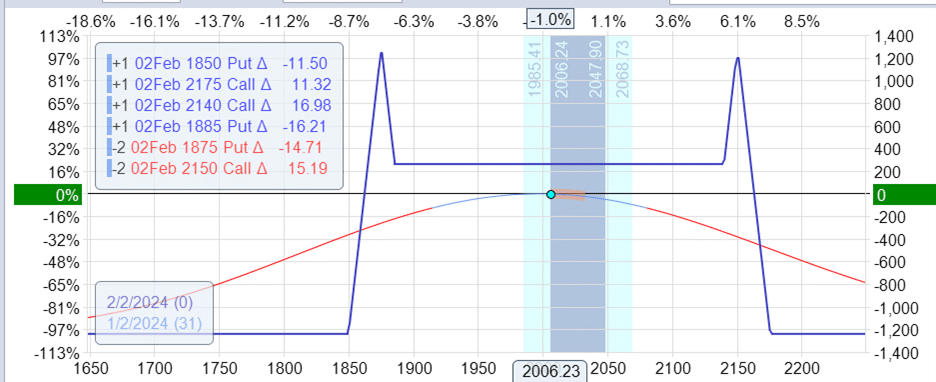

Let’s say that a trader has an iron condor that has progressed into the following position.

Date: Jan 2, 2024

Price: RUT @ 2006

Long one Feb 2nd RUT 1850 put

Short one Feb 2nd RUT 1875 put

Short one Feb 2nd RUT 2150 call

Long one Feb 2nd RUT 2175 call

Delta: -0.63

Gamma: -0.08

Theta: 15.30

Vega: -46.48

The trade now has 30 days till expiration, but it might have started with many more days to expiration before now.

Gamma right now is at -0.08.

Gamma is the rate of change of delta.

The higher the magnitude of gamma, the more delta will fluctuate as the price of the underlying moves.

As the trade progresses closer to expiration, its gamma naturally grows.

The trade becomes more sensitive to price movements of the underlying asset.

This means the trade’s P&L number will fluctuate more (for better or worse).

The only problem with iron condor range-bound traders is that if the P&L changes for the worst, there may not be enough time left in the trade to recover that loss.

Right now, a delta of -0.63 is good and fairly neutral, as iron condor traders would like it to be.

However, this can quickly change, throwing delta beyond acceptable ranges if the market moves a large price.

Gamma tells us how quickly this delta can change.

Therefore, they prefer that the delta does not change so much. (Ideally, they would like the delta not to change at all, but that won’t happen.)

That’s why they are called delta-neutral traders, as they don’t allow their trade to become too directional.

How can we reduce the magnitude of gamma (get it closer to zero) so that the delta does not change so much?

Reducing The Width Of The Spreads

One way to reduce gamma is to reduce the width of the spreads.

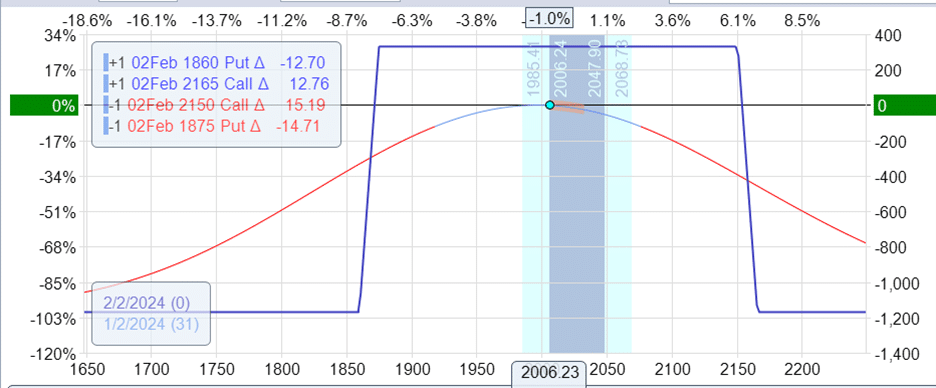

Rolling the 1850 put up to 1860:

Sell to close one 1850 put

Buy to open one 1860 put

And by rolling the 2175 call down to 2165:

Sell to close one 2175 call

Buy to open one 2165 call

The net effect is:

Delta: -0.39

Gamma: -0.05

Theta: 9.27

Vega: -28.33

The gamma has decreased from -0.08 to -0.05.

You may say that 0.03 is hardly any difference.

And that a gamma of -0.08 is already so small.

You compare them with much larger numbers, such as vega of -27, theta of 9, etc.

You can not compare the value of gamma with the other Greeks.

Gamma is a second-order Greek.

Theta, Delta, and Vega are first-order Greeks.

Their value range scales are completely different.

You will better understand what gamma values you will be comfortable with as you manually backtest many different trades over many market conditions.

The downside to reducing gamma is that theta decreased from 15 to 9.

Gamma and theta go hand-in-hand.

Rolling The Short Strikes Out

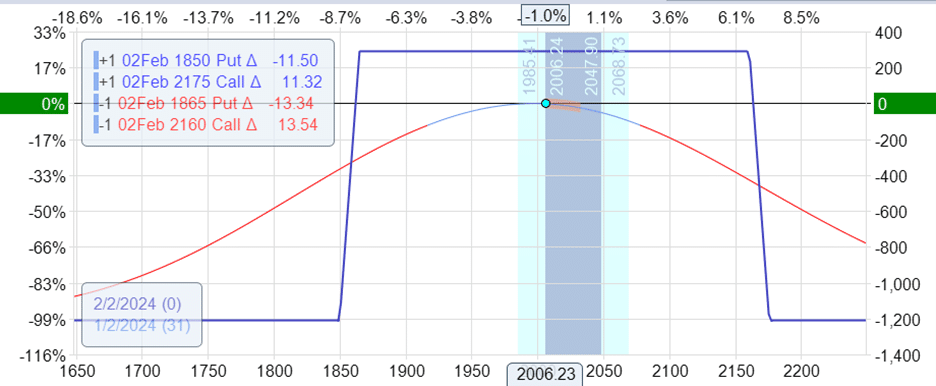

Could we have rolled the short strikes out instead of rolling the long strikes in?

Sure, we could have.

Buy to close the 2150 call

Sell to open the 2160 call

And

Buy to close the 1875 put

Sell to open the 1865 put

Delta: -0.37

Gamma: -0.05

Theta: 9.09

Vega: -27.46

The results are very similar.

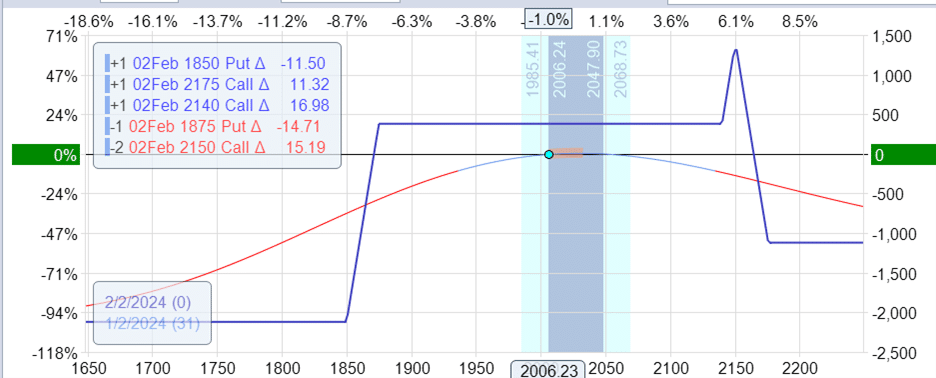

Adding Cat Ears

Another way to reduce gamma is adding “cat ears” to both spreads.

For the bear call spread, we add a call debit spread with a width smaller than our bear call spread:

Sell one Feb 2nd RUT 2150 call

Buy one Feb 2nd RUT 2140 call

Note that the call debit spread has the same short 2150 strike as the existing bear call spread.

We end up with the following:

Instead of a bear call spread, we now have a call broken wing butterfly.

This made the trade more bullish.

Suppose we want to keep the trade balanced. Do the same on the bull put credit spread:

Sell one Feb 2 RUT 1875 put

Buy one Feb 2 RUT 1885 put

And the result is an expiration graph that looks like a cat or perhaps Batman.

Delta: -0.35

Gamma: -0.05

Theta: 9.05

Vega: -27

The gamma has decreased from -0.08 to -0.05.

Conclusion

As an iron condor gets closer to expiration, theta increases, and correspondingly, the magnitude of gamma increases, making the trade more sensitive to price movements.

If a trader finds that gamma is causing the delta to change too much, having to make too many adjustments, they may prefer to alter the trade to decrease gamma – either by narrowing the widths of the spreads or turning it into the Batman trade.

We hope you enjoyed this article on how to reduce gamma on an iron condor.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Adding CatEars to the untested side? Is this Gamma Scalping?

It reduce the risk on the untested side of the condor.

It’s not really Gamma Scalping, but yes it can reduce risk on the untested side.