Contents

The diagonal options spread consists of two options expiring at different expirations and at different strikes.

This will become more clear when we look at an example.

Let’s initiate a diagonal spread on May 28, 2024, for the stock Lululemon Athletica (LULU), a Canadian athletic apparel retailer known for its high-quality yoga fitness wear.

Date: May 28

Price: LULU @ $295.32

Sell one contract June 7 LULU $260 put @ $2.58

Buy one contract June 21 LULU $250 put @ $2.23

Credit: $35

We received a credit of $35 because the option we sold was 35 cents more than we bought.

Keeping things simple, we are trading one option contract representing 100 shares of the underlying stock.

So, we have a 100 multiplier on the option price that is quoted in price per share.

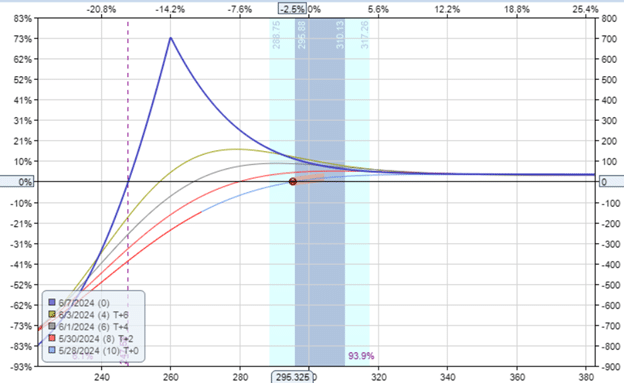

Drawing the payoff diagram in OptionNet Explorer, we have the following:

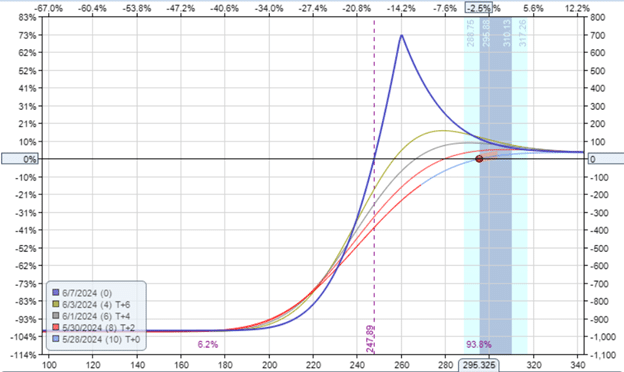

The put diagonal would look like:

The solid blue line is the payoff graph at the expiration of the short option (June 7).

The other colored curved lines are payoff graphs at different times in the trade.

If Lululemon’s stock price increases, there is no upside risk since the blue line is above the zero-profit horizontal.

If the price goes down, below around $250 at expiration, the blue line is below the zero-profit line, and we would be at a loss.

The further down the stock price goes, the greater the loss.

It is not clear from the diagram if the loss would ever stop if the stock price goes to zero.

By zooming in on the chart, we can better see that the loss stops at some point at about $950 loss.

The blue line does not appear to go much below -$950 – as a rough approximation.

The diagonal is a defined risk options strategy.

The max loss is defined and cannot result in an unlimited loss.

How Do We Find The Max Loss In A Diagonal?

In the case of a put diagonal constructed as we have it, consider what would happen on June 7 at the near-term option expiration if the price of Lululemon goes way down to, say, $140.

In that case, the price would be below the strike of the short put option, with a strike price of $260.

With one short put contract, we are obligated to buy 100 shares of LULU stock at $260 per share.

That would be a loss of $120 per share.

However, we have a long-put option enabling us to sell 100 shares of LULU at $250 per share.

If we exercise this right, our loss would only be $10 per share because we are selling at $250 and buying at $260 per share.

A loss of $10 per share is a loss of $1000 because one contract represents 100 shares.

Since we received a credit of $35 for initiating this trade, our net max loss for this diagonal is $965 at the near-term expiration.

This calculation is more precise than eye-balling the expiration graph.

What About A Call Diagonal?

Using Lululemon again, suppose we have the following call diagonal consisting of a short and long call.

Date: May 28

Price: LULU @ $295.32

Sell one contract June 7 LULU $330 call @ $3.75

Buy one contract June 21 LULU $340 call @ $3.65

Credit: $10

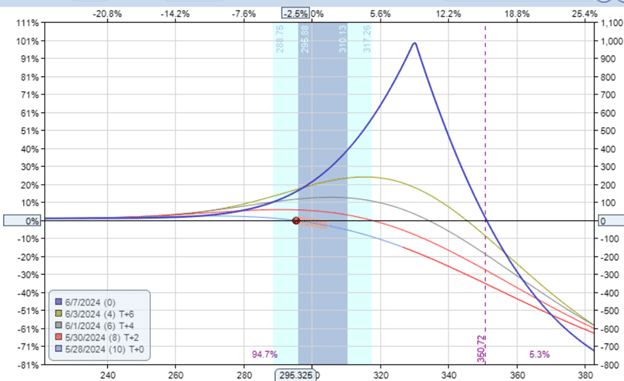

This time, we received a credit of $10 and have no loss if the stock price goes down, as indicated by the payoff diagram:

However, there would be a loss if the price of Lululemon goes up past the expiration breakeven point.

If that were to happen, we would be obligated to sell at $330 with the ability to buy at $340, incurring a loss of $10, which is the width of the strikes.

Multiplying by 100 and accounting for the $10 initial credit, the max loss on this call diagonal is $990 at the near-term expiration of June 7.

If that were to happen, the trade would end with the trader no longer holding any contracts.

The short call has expired, and the long call has been exercised to limit the loss.

Pop Quiz

What is the max loss of a double diagonal?

Let’s look at the following double diagonal initiated on May 28.

Date: May 28

Price: LULU @ $295.32

Sell one contract June 7 LULU $330 call @ $3.75

Buy one contract June 21 LULU $340 call @ $3.65

Sell one contract June 7 LULU $260 put @ $2.58

Buy one contract June 21 LULU $250 put @ $2.23

Credit: $45

Correct Answer:

Take the width of the wider spread.

In our case, the strikes of the put spread and the call spread are both $10 wide.

Multiple by 100 and subtract the credit received.

$10 x 100 – $45 = $955

Wrong Answer:

Some may theorize that the max loss on a double diagonal is the larger loss between the two diagonals.

Since the put diagonal has a max loss of $965 and the call diagonal has a max loss of $990, the max loss on the double diagonal is $990.

But this is not correct.

Having two opposing diagonals can reduce the risk of having just one diagonal.

In our case, the max loss of the call diagonal is reduced by having the put diagonal as part of the trade.

This is because when the call diagonal is at a max loss, the put diagonal has some profits that reduce this loss.

The $990 max loss of the call diagonal is reduced by the credit received ($35) from the put diagonal.

So, the max loss on the double diagonal is $955.

In Summary

Diagonals can be put-diagonals where both options are puts.

Or they can be called diagonals, where both options are calls.

We do not mix puts and calls in the same diagonal.

The diagonal spread is a defined risk strategy where we can approximate the maximum loss from modeling the near-term expiration graph.

Or we can calculate the max loss more precisely as we have shown.

The max loss depends on the width of the strikes (the wider, the greater the loss) and the credit received.

The greater the credit, the less the loss is reduced.

We have shown examples of diagonals placed for credit.

Note that diagonals can also be initiated for a debit.

The calculations would be similar.

The initial debit would be in addition to the loss due to the width of the strikes.

We hope you enjoyed this article on the maximum loss in a diagonal options spread.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.