Today, we will look at the option Greek gamma with regard to credit spreads.

While many traders are familiar with Delta, Gamma is often overlooked, yet it plays a vital role, particularly in the behavior of credit spreads.

Contents

The first few Greeks an option trader might learn are delta, vega, and theta.

They indicate how an option position’s profit and loss (P&L) might change if the underlying price, volatility, and passage of time change.

Gamma is different because it indicates how delta changes as the underlying price changes.

Gamma definitely affects the position’s P&L.

But it does not affect it directly.

Gamma affects delta, which in turn affects the P&L.

As such, it is more complicated to understand and is understandable after you have a good grasp of delta.

An example always helps.

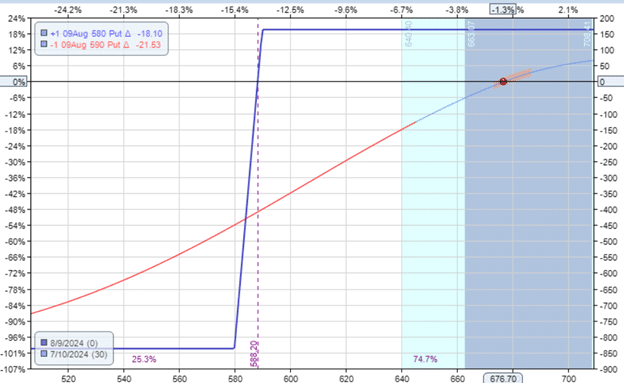

Suppose a trader has the following credit spread on Netflix (NFLX) on July 10th, 2024:

A short put option with a strike at $590 and a long put option with a strike at $580.

Both with the August 9th expiration, which is 30 days away.

The current Greeks are:

Delta: 3.37

Theta: 4.30

Vega: -5.65

Gamma: -0.07

This is a bull put credit spread with a positive delta of 3.37, where the trader expects the price of Netflix to go up.

A 3.37 delta in an option position has a market exposure similar to having 3.37 shares of Netflix stock at $676.70 per share (the price of NFLX at the time).

In other words, the bull put spread has $2280 Delta Dollars of exposure.

That’s 3.37 x $676.70.

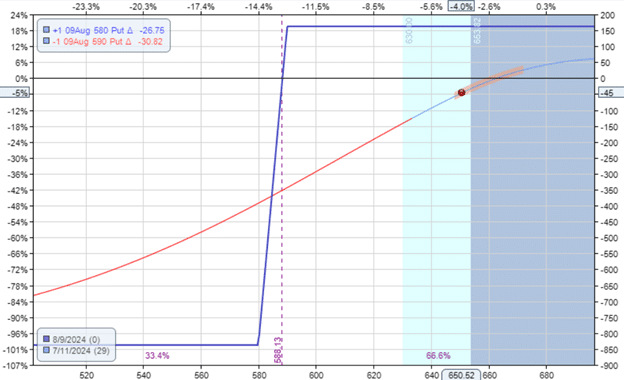

Now, 24 hours later, on July 11th, the position looks like this due to a fall in NFLX stock price…

And the Greeks are now:

Delta: 4.38

Theta: 4.29

Vega: -5.39

Gamma: -0.06

The P&L (profit and loss) decreased by $45 because the stock price went in the wrong direction.

The delta has increased from 3.37 to 4.38 due mainly to gamma’s effect.

(We use the term “primarily” because it is also affected by other factors.

But let’s not over-complicate things.)

This increases the Delta Dollars exposure to 4.38 x $650.52 = $2849.

While the trader might be fine with an initial $2280 position on NFLX, to begin with, he may no longer be fine with a $2849 position.

While he may be fine being bullish at 3.37 delta, he may no longer be fine with a 4.38 delta.

A 4.38 position is more bullish than he had started with.

The worst is that the position becomes bullish when the stock becomes more bearish.

The increase in delta made his position worse.

That is what negative gamma does.

It makes it so that if the trade goes against the trader, the trader becomes worse for the trader.

The larger the magnitude of this gamma value, the larger this effect is.

When we talk about the magnitude of gamma, we refer to the size of the number without regard to the sign.

So, a -0.14 gamma has a larger magnitude than -0.07 and would have a larger effect.

The effect that gamma has is that it changes delta.

The larger the gamma value, the more it changes delta when the price moves.

A -0.14 gamma will change the delta more than a -0.07 gamma for a given one-point move in the stock price.

In technical terms, we say that gamma is the rate of change of delta with respect to the price.

Is Gamma Always Negative For Credit Spreads?

No.

Gamma can be negative or positive for credit spreads depending on how near or far the spread is from the current price.

For far out-of-the-money credit spread (as in our example where the put spreads are far out of the money at around 20-delta in the option chain), gamma is negative.

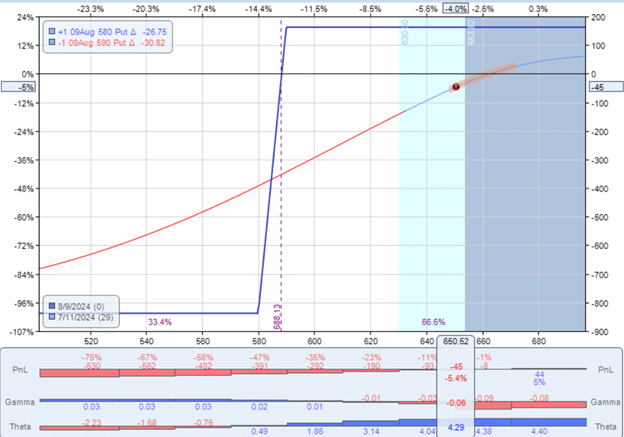

If I turn on the gamma histogram in OptionNet Explorer:

You can see that at some point, when the price of NFLX drops far enough such that the credit spread becomes in the money, gamma becomes positive (as indicated by the blue histogram).

What Does a Positive Gamma Mean?

Positive gamma means that the delta will increase as the stock price increases.

If the stock price goes down, then delta will decrease.

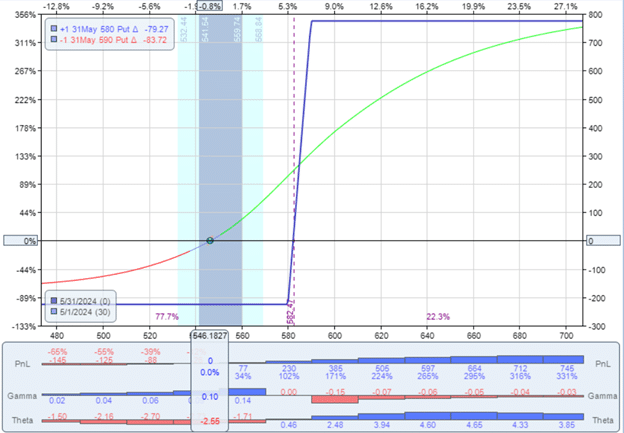

Let’s say we have an in-the-money $590/$580 bull put credit spread as in the following when the NFLX price is at $546:

We see that we have a positive 0.10 gamma.

If NFLX goes up (which is favorable), then the delta will increase (which is also favorable for the position).

If NFLX goes down (which is bearish), then gamma will cause delta to decrease to make the position less bullish.

So, in effect, a positive gamma tends to help a position as the price moves.

A negative gamma tends to hurt a position as the price moves.

Why We Might Want To Decrease The Magnitude Of Negative Gamma

Most traders are selling out-of-the-money credit spreads with negative gamma.

A large magnitude of gamma causes the delta to change a lot.

When the delta changes a lot, the P&L of the position can change a lot as the price moves (even if the price moves by just a little).

This is what is referred to as gamma risk.

Gamma gets larger closer to expiration.

Some traders do not want their delta to change, especially not change in a way that makes their position go against them more (assuming that their position has a negative gamma).

Therefore, they would like to reduce the amount of negative gamma.

What Is The Disadvantage Of Reducing Negative Gamma?

There is always a trade-off.

By reducing the magnitude of gamma, they also reduce theta, which they might not want if their position relies partly on positive theta to generate income (as in the case of credit spreads).

Study the above gamma and theta histograms.

For the most part, with some small minor exceptions, whenever gamma is negative, then theta is positive.

Whenever theta is positive, then gamma is negative.

The bigger the magnitude of theta, the bigger the magnitude of gamma.

When you try to decrease negative gamma, you will decrease theta as a side effect.

When you try to increase theta, you will increase the amount of negative gamma.

Conclusion

Positive theta traders (who make their money from time decay) and credit spread traders (who partially make their money from time decay) will have to live with negative gamma.

Negative gamma is a negative for their position.

It makes things worse if the trade goes against them.

And if the trade goes in their favor, it makes their credit spreads less powerful.

What about delta-neutral traders?

They are the same as positive theta traders.

Large gamma is also a negative for them because the gamma changes their delta when they prefer their delta to be as close to zero as possible.

What about long gamma traders?

Yes, some traders love large positive gamma.

But that is a different story, and they are not trading the out-of-the-money credit spreads we are discussing today.

We hope you enjoyed this article on how gamma affects credit spreads.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.