Day trading options means initiating an options position and exiting it on the same day, avoiding overnight risk.

Zero-DTE refers to options that expire on the same day they are purchased or sold. In other words, these options have zero “days till expiration” (DTE).

People who trade zero-DTE are, by necessity, day trading options because they can not carry their options to the next day.

However, day trading options do not necessarily require the use of zero-DTE options – as we shall see.

Contents

Example Of Day Trading Options

By way of example, let’s start with the following example of a trader day-trading option without using zero-DTE options.

As an aside, we use the term “trader” and “trading” to refer to people who enter and exit the position in short time frames to capture the short-term price moves of an asset as it fluctuates up and down.

We use the term “investor” or “investing” for people who hold a position for a longer term in hopes that the asset will increase or decrease in value.

Investors hold positions for months to years and are less concerned with day-to-day price fluctuations.

What is considered long-term and short-term is a bit subjective, depending on who you ask, as well as the intention of the investor/trader.

Typically, the 90-day time frame is where the gray area boundary between investor and trader lies.

There is no question when we are talking about day trading and zero-DTEs.

These are trades rather than investments.

Here we see the 5-minute chart on SPY (S&P 500 ETF) on July 17 and a part of the morning session of July 18, 2024:

SPY Chart

A trader sees that the price at $555 has dropped below yesterday’s low (which could be interpreted as support).

And it bounced, putting in two candles with bottom wicks.

But then the price dropped below the two wicks.

The traders may also look at other market indications and decide that the market is trending down for the day.

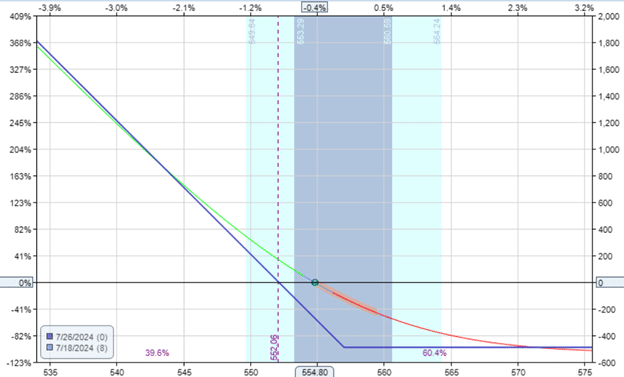

The trader buys the 557-strike put option with the July 26 expiration for a debit of $490.

Source: OptionNet Explorer

This is not a zero-DTE option because the put option does not expire until eight days later.

The trader has no intention of holding the option till expiration, nor even any intention to hold it till the next day because he has no idea what the stock will do tomorrow.

He only sees that the asset is bearish today.

One hour before the market closes in the same session, he closes the position with a $156 profit or a 32% gain on the capital at risk.

In a long put option, the capital at risk is the capital paid to purchase the put option.

Indeed, the price had gone as the trader had predicted:

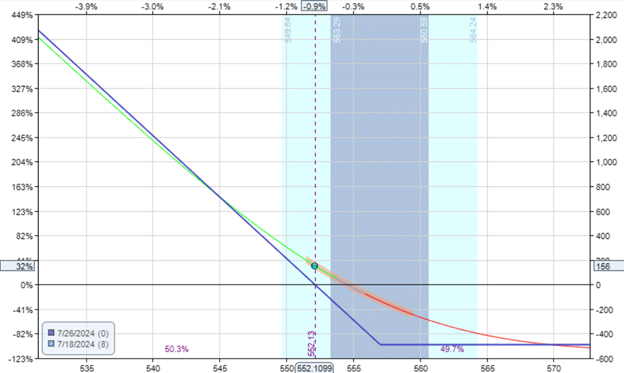

If another trader had purchased four out-of-the-money puts with a similar capital allocation of $472, he would have made about the same at $176 profit.

Day Trading Complex Option Structures

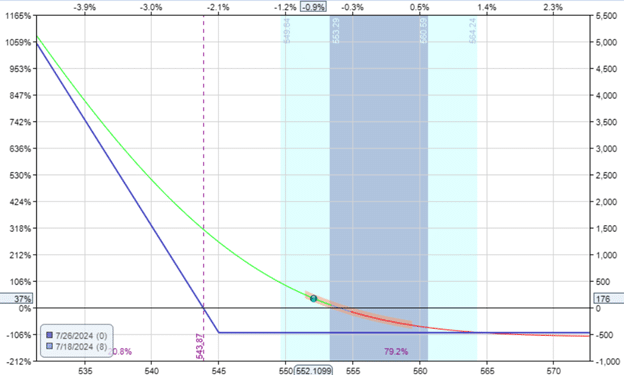

Yet another trader could decide to work on the larger SPX index (which is ten times the size of SPY).

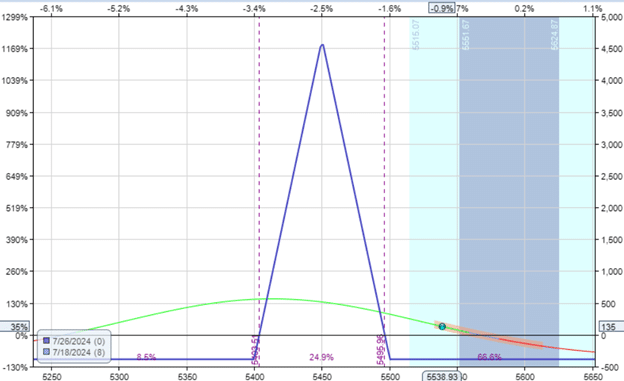

By using an option structure such as a symmetrical butterfly that has a lower capital outlay, he can still limit the risk to the debit paid of $385 for this butterfly:

This all-put butterfly has an expiration eight days away.

The center short strikes are out-of-the-money at 5450.

The upper long strike at 5500.

The lower long strike at 5400, making the butterfly wings 50 points wide on both sides.

But by exiting the butterfly one hour before market close in the same trading session and pocketing the $135 profit:

The trader does not risk overnight moves that might take away that profit.

Unlike the long put option, which has a negative theta, this butterfly has a positive theta.

This means that if the price did not move and stayed at 5540 all day, the trader could possibly still exit the trade at near break-even or slight profit on the same day.

Zero-DTE Options

Speaking of theta: What some traders like about zero-DTE options is that they decay very fast.

So when selling premiums such as selling credit spreads, they can have a large positive theta.

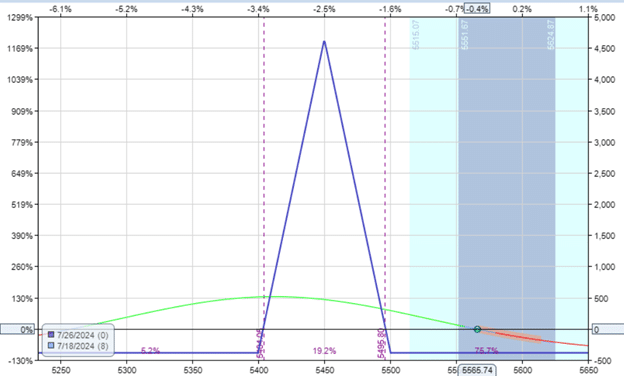

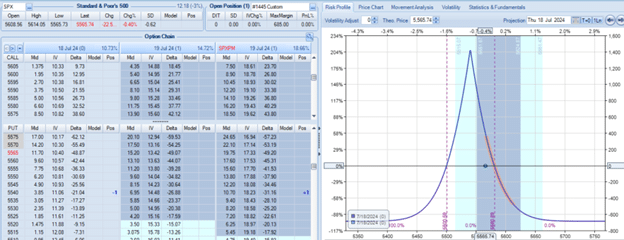

For example, here we are modeling a 5595/5600 bear-call credit spread on SPX expiring the same day (zero-DTE trade):

The short option of the bear-call spread is at around the 15-delta on the option chain.

The max risk is $425, with the potential max reward of the $75 credit initially received.

If held to expiration, both the call options in our example would expire worthless at the close on July 18, and the max profit of $75 would be achieved.

If the trader had set a GTC (good-till-cancel) order to take profit at 80% of the credit received, a $60 profit would have been achieved 3 hours later.

Mixed Expiration Spreads

For the last example, we will look at a calendar with a zero-DTE short option expiring the same day.

And the long option expires a day later.

The cost of $685 is the max risk on this put-calendar.

Setting a GTC order to sell the calendar at $890 would reap a profit of about 30%.

According to the model, this order would have been filled three hours after opening the trade.

Because calendars should be closed prior to the short strike expiring, this is a day trade.

The short put option is a zero-DTE option, and the long put option is a one-DTE option.

Conclusion

For illustrative purposes, we have chosen examples that would have worked based on modeling with historical data.

So, day-trade options may seem deceptively simple.

In reality, this is not the case.

Without knowing in advance what the price would do, all these trades could have easily resulted in a maximum loss.

Price could have gone in one direction and then reversed.

The timing could be off.

The fills might not be able to execute in a fast-moving market.

And so on.

In addition, we picked a day on which the price was trending well.

The price will not trend in many days, and traders attempting to trade in the price chop would be whipsawed back and forth.

Certainly, paper trade first before putting real capital at risk when attempting to day-trade or use zero-DTE options.

We hope you enjoyed this article on day trading options versus zero DTE options.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.