When volatility is high, traders often use strategies like selling premium or adjusting position sizing to manage risk.

At times, when the VIX spikes up, some traders may want to do a mean-reversion trade to make a profit for when the VIX drops back down to normal.

In other words, the trader expects VIX to drop back to its normal average value (revert back to its mean).

Contents

VIX is the volatility of the SPX index.

It is commonly said that price does not need to mean-revert.

But volatility almost always does.

The only question is timing.

When VIX goes up, that likely means SPX has dropped.

We have all seen stocks where prices dropped but never returned back up.

One can argue that for an index, the price would eventually come back up.

But even still, it could be a very, very long time.

When SPX dropped from the 4800 level at the end of 2021, it took nearly two years for it to come back up to that level.

That is why waiting for a high VIX to return to normal may be easier than waiting for the price to return to its prior level.

Not to anthropomorphize the market too much (a good Scrabble word), but it is like an angry person when VIX is high.

With time, they will calm down.

No one stays angry forever (hopefully not).

Vertical Spread On The VIX

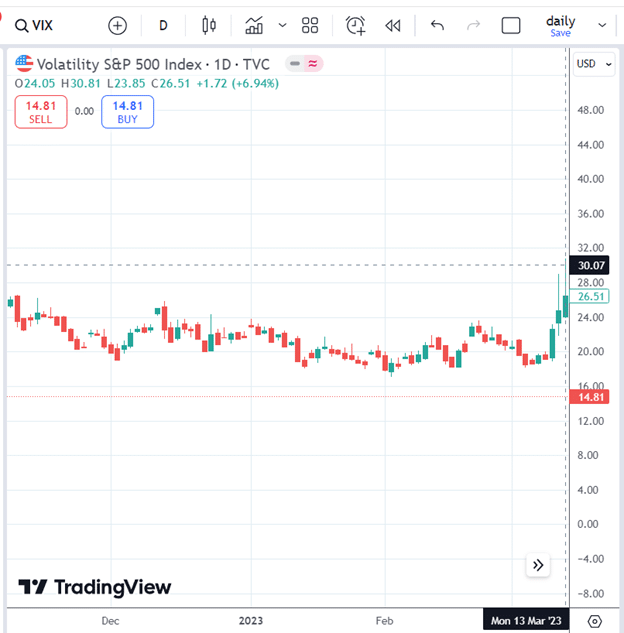

On Monday, March 13, 2023, the VIX went above 30:

A trader might put on a bear put spread on the VIX that has 37 days till expiration.

Date: March 13, 2023

Price: VIX @ 30

Sell one April 19 VIX 20 put @ $0.34

Buy one April 19 VIX 25 put @ $2.58

Net debit: -$224

The nice thing about these debit spreads is that the maximum risk in the trade is the debit paid, which, in this case, is $224.

The next day, VIX dropped to 23, and the trader was happy to take the profit by closing the trade:

Buy to close one April 19 VIX 20 put @ 0.69

Sell to close one April 19 VIX 25 put @ 3.85

Credit: $316

Net profit in trade: $316 – $224 = $92, or 41% return on capital at risk.

Long SVXY

Another trader might buy shares of SVXY.

The SVXY ETF is a short VIX ETF. In other words, SVXY goes up when VIX goes down.

And it goes down when VIX goes up.

Since the trader is expecting VIX to go down, they want to buy 20 shares of SVXY at $57.05 per share, expecting it to go up.

The total cost is 20 x $57.05 = $1141.

The next day, the price of SVXY indeed went up to $61.24 per share.

Selling the 20 shares to collect $1224.80 results in a profit of $83.80.

In percentage of capital usage, it is 14.7% return.

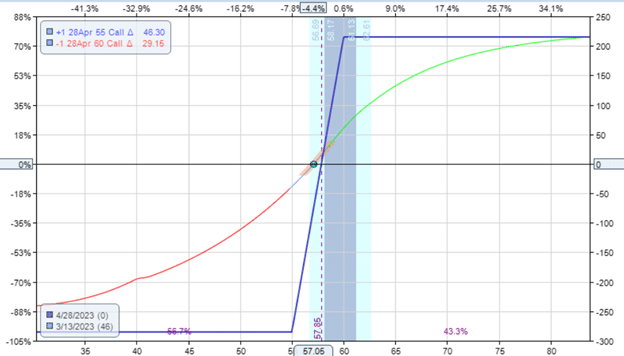

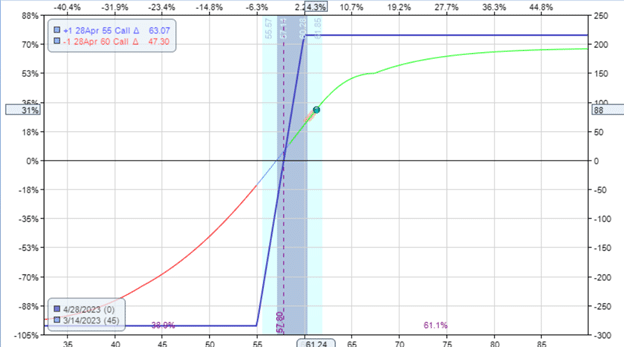

Vertical On SVXY

A trader who might not want to outlay $1141 might take advantage of the leverage of options and buy a bull call spread on SVXY instead.

Date: March 13, 2023

Price: SVXY @ $57.05

Buy one April 28 SVXY 55 call @ $5.15

Sell one April 28 SVXY 60 call @ $2.30

Net debit: -$285

Like the bear put spread on the VIX, this bull call spread on the SVXY has a max loss of the debit paid, in this case, $285.

The next day, the trader closes the trade for a profit of $87, a 30% return on capital usage:

Sell to close April 28 SVXY 55 call @ $7.65

Buy to close April 28 SVXY 60 call @ $3.93

Credit: $372

Conclusion

When the VIX spikes up, traders have a variety of trades to capture the mean-reversion move back down.

They can buy shares of the SVXY directly, which moves inversely to the VIX.

Or they can buy a bull call spread with a lower capital usage.

Because VIX is an index, they can not buy shares of the VIX.

However, using a bear put spread can be used to capture a directional move down.

We hope you enjoyed this article on how to trade when volatility is high.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gavin,

Thank you for this very interesting article.

Instead of a vertical spread using puts on VIX and be in debit, wouldn’t an opposite vertical Call spread that comes with a credit be equally tradable with similar risk profile?

So with Calls

Sell 20 Call

Buy 25 Call

Net Credit?

Have I missed something here?

Yes it would be a very similar trade with a similar risk graph.