Contents

If you know about the collar option strategy, then you might wonder, can shorting volatility be done via a collar?

Going short means that we expect the asset to go down.

But the collar is a bullish strategy.

If you don’t know about the collar strategy, don’t worry.

We will go over it in this article.

Shorting Volatility

Many options traders believe that the correct side to be on is the short side of volatility.

That is, we trade with the expectation that volatility drops.

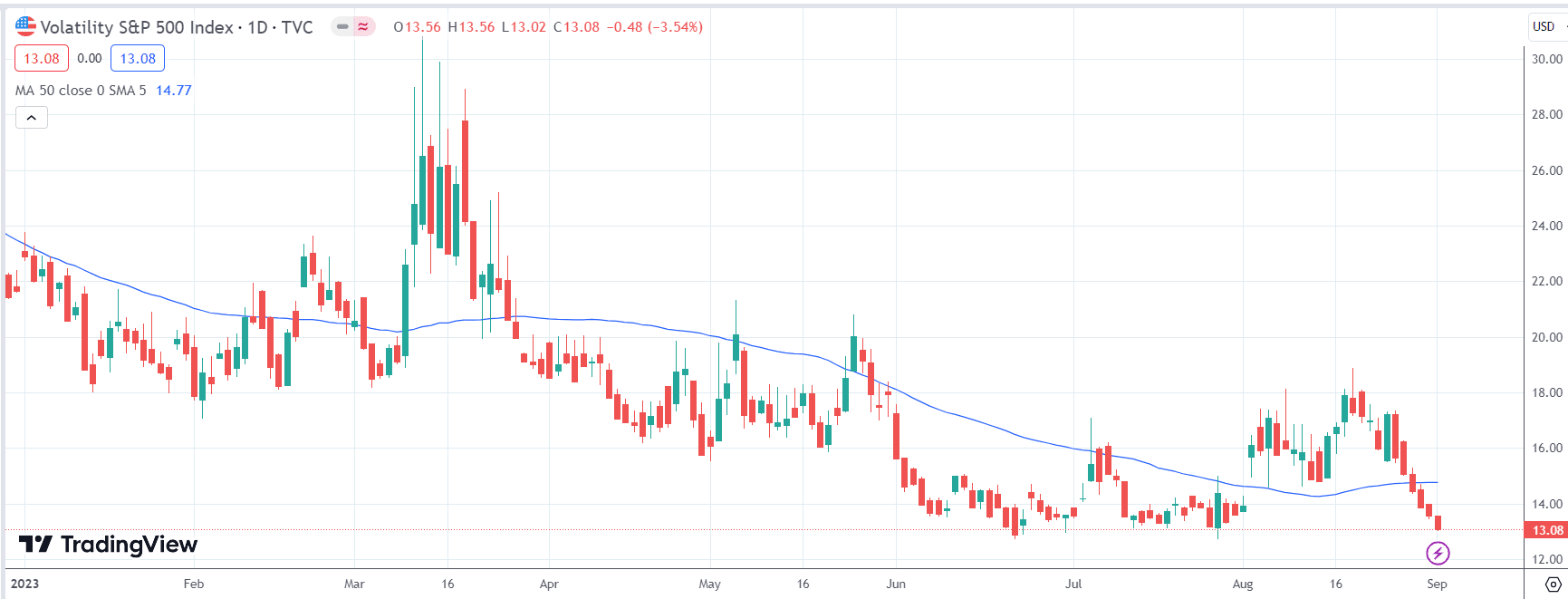

A common measure of volatility is the VIX index.

When volatility is high, the VIX is high. When volatility is low, the VIX value is low.

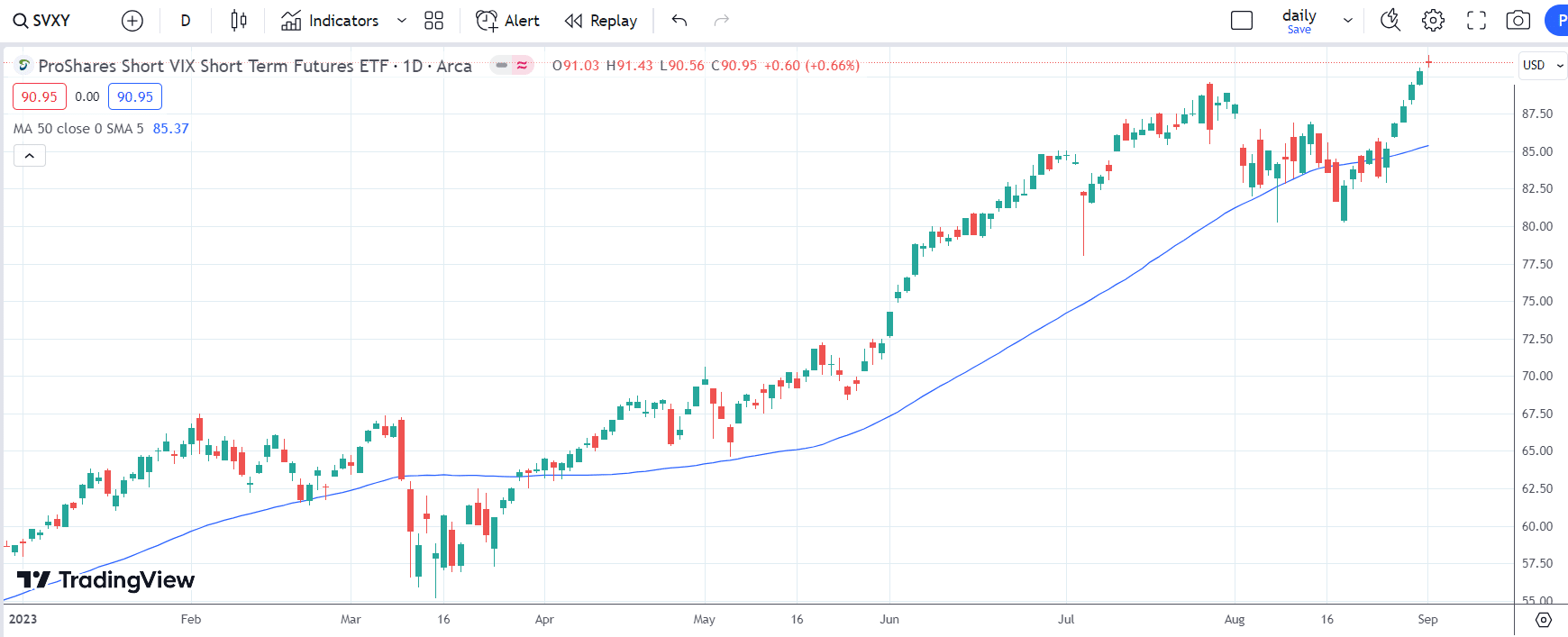

In fact, shorting volatility is so common that there is an ETF (exchange-traded fund) with the ticker symbol SVXY called the “ProShares Short VIX Short Term Futures ETF.”

That is a mouthful. But think of it as an “inverse ETF” to the VIX.

When VIX goes down (what we expect), SVXY goes up.

Therefore, to short the VIX means to be bullish on SVXY.

Here is the chart of the VIX:

Here is the chart of SVXY…

See the inverse relationship?

While it is not an exact mirror image, it is close enough for our purposes.

Therefore, a trader who trades on the dropping of volatility will want to buy SVXY and trade it as SVXY goes up.

The Danger Of Shorting Volatility

Shorting volatility may be profitable in the long run; however, it can also be a danger of large loss if not done correctly.

Volatility can sometimes spike upwards unexpectedly.

See the large move-up on the VIX and the sharp drop of the SVXY on March 9, 2023, in the above charts.

If a trader is trading an undefined-risk position (such as just buying straight SVXY or leveraged undefined-risk options strategy), then they can lose months of gains in just a few days of heightened volatility.

That is why we like to trade defined-risk strategies when shorting volatility.

Many defined-risk strategies can be employed.

For today, let’s use the collar strategy as an example.

Perhaps it is one that you might not have thought of before.

Essentially, a collar is used to protect an asset, such as the ownership of shares of SVXY, from large drops.

Let’s say that an investor buys 100 shares of SVXY for a total cost of $8621.

The investor then buys a put option to protect the value of that investment.

If the investor buys the put option with the $85 strike price, that means that no matter what happens, the investor can sell back the 100 shares of SVXY for $85 per share (as long as it is before the expiration of the option).

That means the most the investor can lose from the drop of SVXY is $121.

He also loses the cost of the put option (which says it costs $196); this is why this protective put option makes the trade a defined-risk trade.

The collar strategy has a further enhancement whereby the investor also sells a covered call on the asset to bring in a small credit.

If the investor sells the call with the $90 strike, the investor receives $84.

So the maximum possible dollar risk on this collar strategy (which includes the shares of SVXY, the protective put, and the covered call) is…

$121 + $196 – $84 = $233 max possible loss

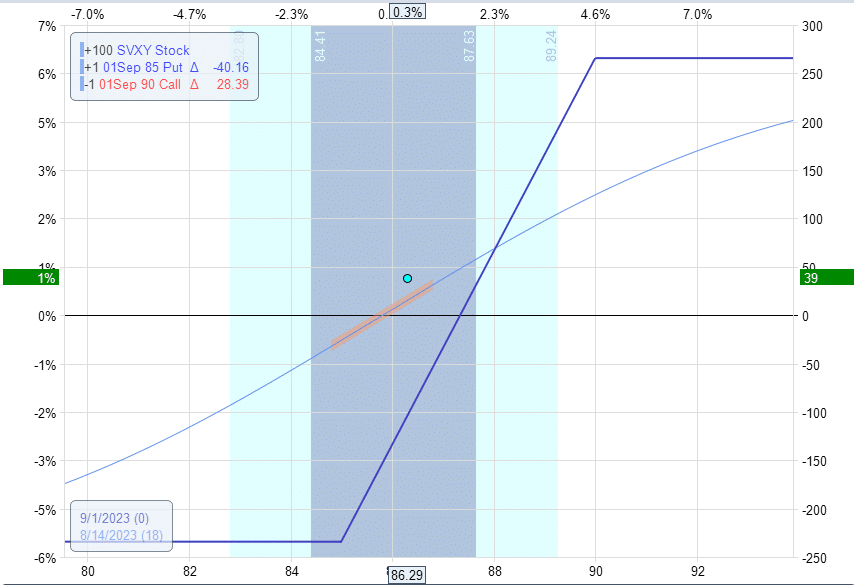

This collar strategy is summarized in this example:

Date: August 14, 2023

Price: SVXY @ $86.21

Sell one Sept 1st SVXY $90 call at $0.84

Buy 100 shares of SVXY at $86.21

Buy one Sept 1st SVXY $85 put at $1.96

Net initial debit: -$8621 – $196 + $84 = -$8733

This is not all done in one order.

You need to purchase the 100 shares of stock first.

This allows you to sell a covered call on it.

And it is after the stock purchase you will need the protective put.

It is not critical to sell the call and purchase the put immediately.

It is fine as long as you take the time to get a good price on the options and fill it within the day.

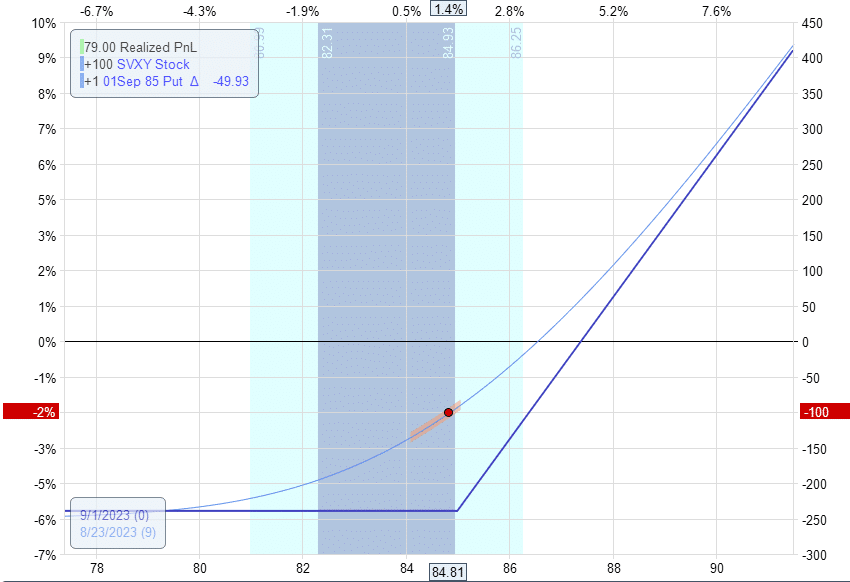

The end result is an expiration graph that looks like this.

Remember that we are trading SVXY, and we have options on SVXY.

Therefore, we are graphing the payoff graph of SVXY. This is not the expiration graph of the VIX.

We are not trading the VIX directly.

We are shorting the VIX indirectly via SVXY.

Look at the lowest point on the payoff graph.

It is at $233, the maximum possible loss calculated previously.

Because the investor sold the covered call, it caps the profits on this trade.

The maximum potential profit is achieved if SVXY is above the strike price of $90 at expiration.

In that case, SVXY is sold back to the market at $90 per share, giving the investor $9000.

Subtract from that the initial cost of the collar ($8733), and you get a maximum potential reward of $267.

The upper point of the graph confirms that our calculations are correct.

Now you understand how the collar strategy works. Would it be interesting to see how this trade plays out?

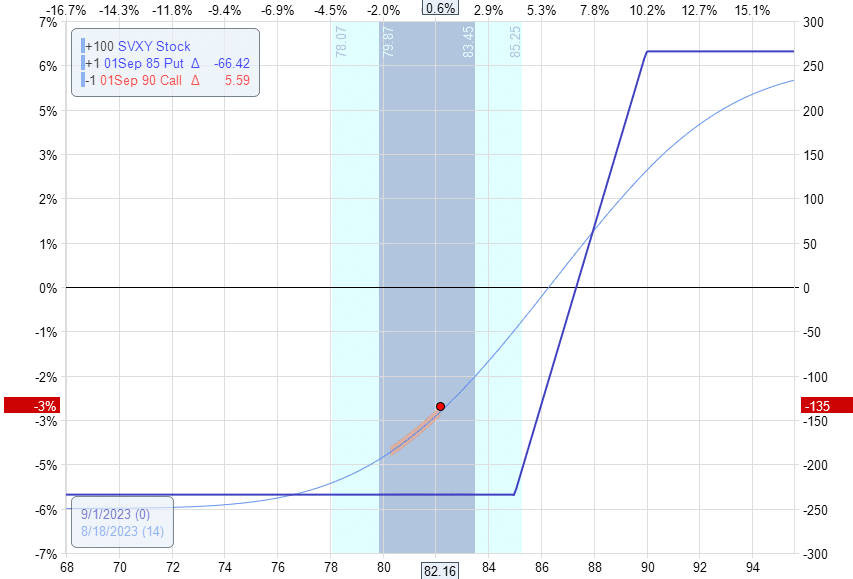

August 18

Well, the trade is not going so well.

Four days later in the trade, VIX rose, and SVXY dropped from $86.21 to $82.16.

This is bad for our trade.

We are at a loss of -$135, as can be seen from the below graph.

No need to panic.

This is a defined risk trade.

We wait to see if volatility drops and see if the trade becomes positive again to get out.

That is why we had set our expiration two weeks out from the start of the trade to give time for volatility to drop just in case we had the bad luck of volatility spiking just right after entering the trade.

August 23

It is because SVXY is falling that the value of the call option is dropping.

The value of the call option dropping is good for us because we had sold the option for a premium of $84.

And if we can buy it back for $5, we would keep the $79.

At the start of the trade, we set an automatic GTC (good-till-cancel) limit order to buy it back at $5 or at the per-share option price of $0.05.

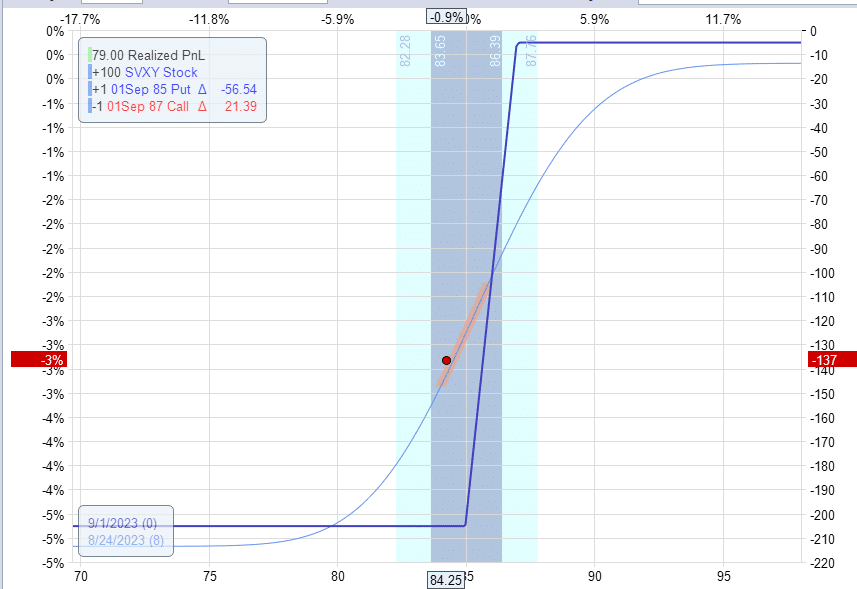

This limit order was triggered on August 23. And we paid $5 to close the short call. And now the graph looks like this:

August 24 – Selling Another Call

We can then sell another call if we want to.

If we sell the $87 call to collect $34 of premium with the Sept 1st expiration, then we get a graph like this:

It reduced our downside risk by 34 dollars.

However, it caps our upside reward so that the best we can do is exit, close to breakeven if SVXY closes above $87 at expiration.

That does not sound like a good reward-to-risk.

So we would rather do nothing and not sell another call option.

August 30

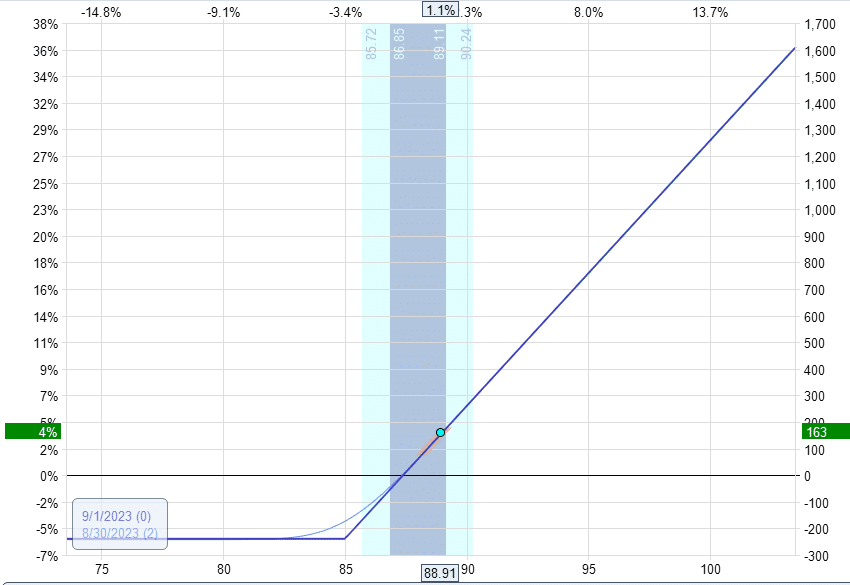

By not selling the call option, we leave the upside uncapped while still limiting our downside risk.

As can be seen by the shape of the expiration graph shown:

The price dot on this graph is what occurred on August 30.

As the VIX dropped and SVXY returned to $88.91, we are back into profitability.

We can sell the 100 shares of SVXY for $8883 and sell the put option for $25.

Computing net profit as follows:

Initial cost of trade: -$8733

Debit to close the call: -5

Sale of 100 shares: $8883

Sale of put: $20

Net profit: $165

FAQs

Is it necessary to buy the put option?

I would say it is necessary.

The put option is what makes the trade a defined-risk trade.

Without the put option, the SVXY can drop a lot unexpectedly.

And we don’t want that.

The put option is part of the risk management plan of the strategy.

Is it necessary to sell the call option?

No, it is not necessary to sell the covered call.

That is to bring in some extra premium.

Whether it is worth it or not is up to you.

Sometimes it is, and sometimes it is not.

If you choose not to sell the covered call, technically, the strategy is not called a collar.

It would be a married put strategy.

But that is still fine as it is still a defined-risk strategy.

Conclusion

A collar on the SVXY is a bullish strategy that profits if the VIX drops.

This strategy might not be able to give you much profit if volatility is at its lowest and is not expected to go any lower.

It may be more advantageous to employ this strategy opportunistically when volatility is high and you think it is about to drop because the “volatility event” has resolved or is about to dissipate.

And if you are wrong, that is what the defined-risk aspect of the trade is for.

We hope you enjoyed this article on shorting volatility with a collar.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

A variation on the collar strategy is buy the Put for a month and sell the Calls on a weekly basis. The key is to set them up with different durations. I buy the collar for half of the credit I got for selling the Call on the long stock. So I get a credit from week one. You have maximum flexibility with the Calls because they are weekly.The secret sauce is the adjustments. It is easy to adjust up or down due to this structure. I’m averaging 40 to 80 percent for underlying with an IV around 30.

Nice work Brendan. Thanks for sharing your process with us.