Contents

What Is A Broken Wing Iron Condor

A Broken Wing Iron Condor is an advanced options strategy that involves the simultaneous purchase and sale of a call spread and puts spread on the same underlying security with the same expiration date but at different strike prices.

One of the spread wings is wider than the other, hence the name “broken wing.”

This strategy is primarily profitable in a market with range bound or spikes and quickly returns to the range.

Due to the wider spread, there’s an imbalance, or a “skew,” creating a larger potential loss on one side and a larger potential gain on the other.

This increased profit potential is one of the driving factors for selecting this over a standard iron condor.

Why Trade A Broken Wing Iron Condor

- Larger potential gain but directionally dependent losses

- The credit received from selling the spreads can offset the cost of the purchased spreads

- A useful strategy to profit from range-bound markets

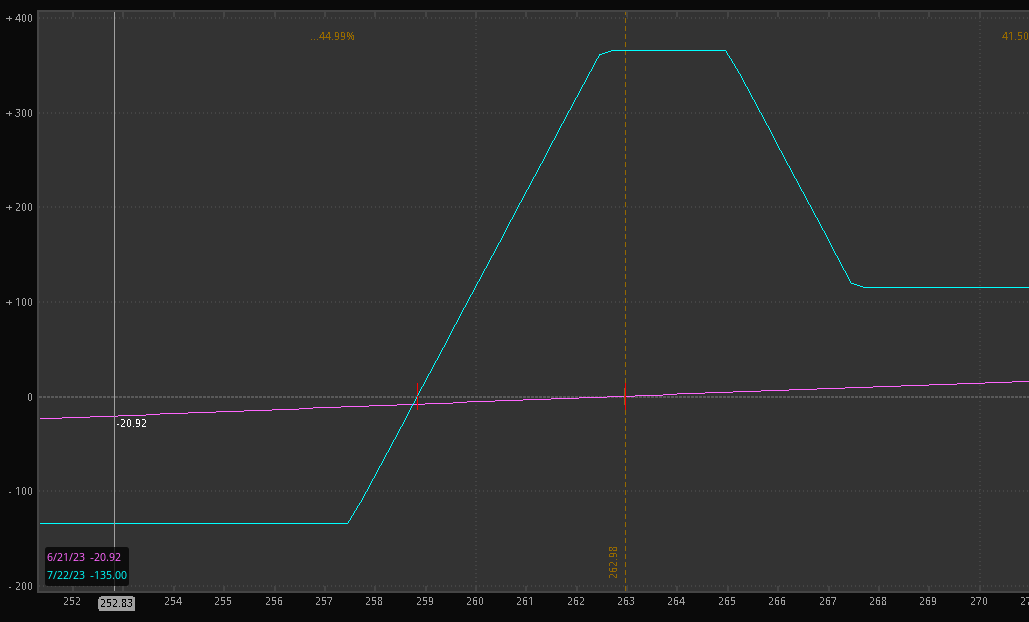

Broken Wing Iron Condor Risk Profile

A Broken Wing Iron Condor is an excellent strategy for a trader looking to potentially increase the profit potential compared to a traditional Iron Condor while accepting a larger potential loss on one side.

As with all Iron condors, the risk and payoff are predetermined when you execute the trade. This payoff simplifies the trader’s money management.

The strategy profits from minimal moves in the underlying price and the time decay of options. The larger wing creates a risk profile with a skewed risk/reward ratio.

Risks and Benefits of a Broken Wing Iron Condor

Benefits

- The Potential Max Risk is defined

- The net credit received from the initial trade

- Effective in range-bound markets

- Allows for the potential of a larger credit due to the larger wing

Risks

- The position has a capped profit.

- Expiration Risk (Only one of the contracts is exercised at expiration)

- Larger potential loss on the “Broken Wing.”

How To Choose Optimal Strikes

The strike selection for a Broken Wing Iron Condor usually involves identifying strikes that offer a good risk/reward ratio.

Choosing strike prices that are a certain percentage out-of-the-money can help manage the risk and potential return.

Here are some things to consider:

- Consider the time until expiration – Longer-term options, while more expensive, might offer better trades. This is potentially beneficial, given it is a credit spread

- Consider the effects of time decay – Longer-term options will be affected by time decay at a slower rate.

- Choose the higher probability direction for the smaller wing to minimize potential losses.

- For the Broken wing, choose strikes that are an additional 1 to 3 prices wide to help add to the premium but keep losses in check.

Trading A Broken Wing Trade Iron Condor

There are a few ways to execute the Broken Wing.

If your broker does not allow you to select spreads, you must buy and sell each contract individually.

Always use the long contracts first to protect your account from unlimited risk.

But since most brokers now allow you to place the entire spread at once:

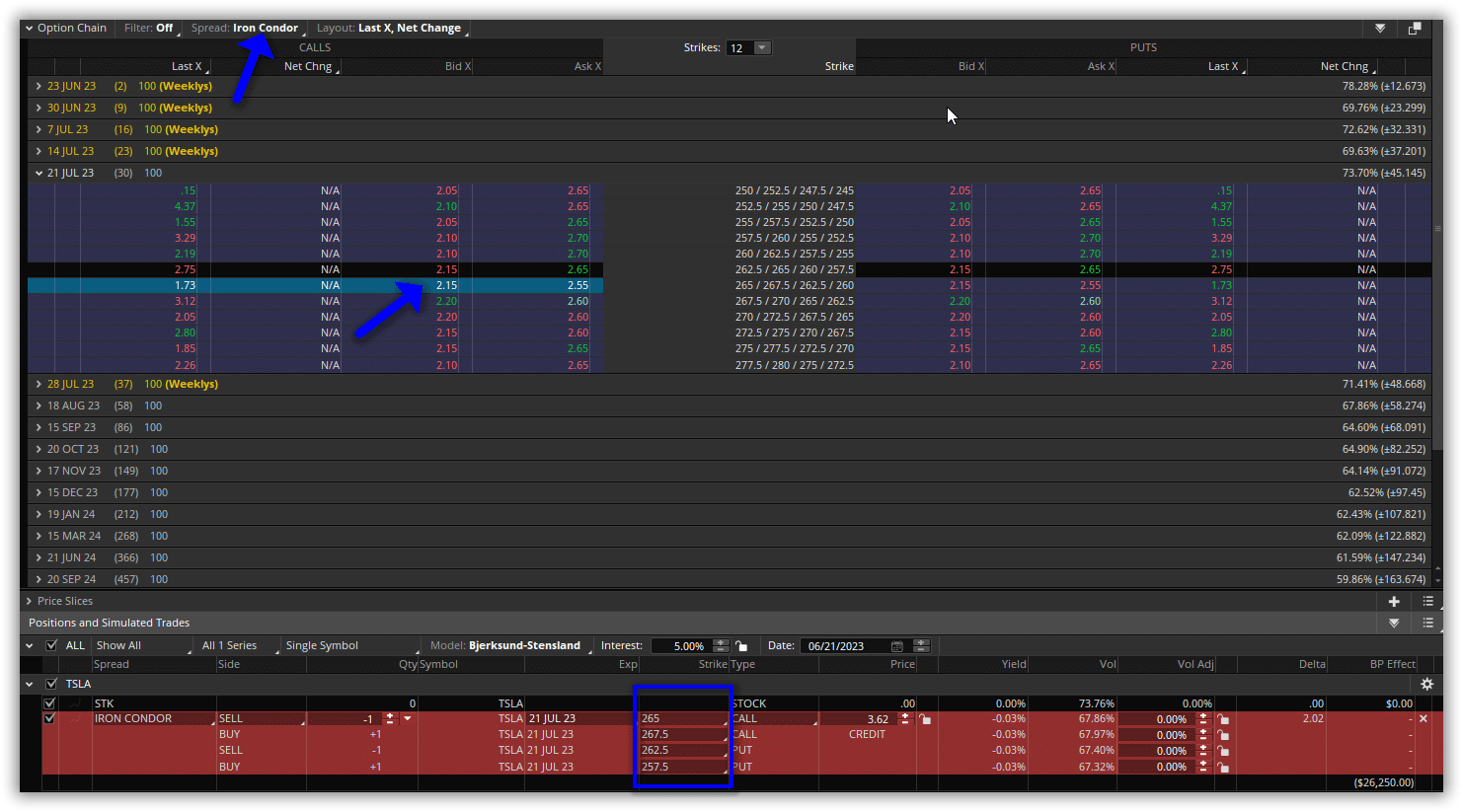

- Go to the option chain on the platform you are using

- Select the expiration

- On most retail platforms, you can select “Iron Condor” from the type of trade.

- Once you click on the spread, you will be able to look at/adjust the strikes.

- Adjust the strikes on one of the wings on the side you feel has a lower probability of hitting.

- Click the “Send” or “Execute” or whatever button your broker has to send the orders to market.

Closing The Trade

Many traders close the spread early to collect most of the credit they receive to limit expiration risk.

There are a few ways to do this:

- You can close one part of the position at a time, also known as legging out

- Legging out will work depending on if only part of the spread is “in the Money.” It will avoid assignment risk.

- Some platforms will allow you to close the position all at once, just click on the position and select “close” or “buy to close.”

- If you need to close manually, then purchase back the short option first to avoid being in an uncovered short position

- Next, sell back the long put to completely close the position.

Review

- A Broken Wing Iron Condor is what kind of strategy?

- Bullish

- Bearish

- Volatile

- Neutral

2. With a Broken Wing Iron Condor, you need the underlying price to:

- Increase A lot

- Increase A little

- Decrease a lot

- Decrease a little

- Stay roughly the same

3. The Max loss on a Broken Wing Iron Condor is:

- Theoretically infinite

- Capped at premium received

- Capped at the cost paid

- Undefined

- Capped at the width of the wider spread minus the initial credit

4. When managing a Broken Wing Iron Condor, what strategy is often used to avoid assignment risk?

- Waiting until expiration

- Letting it be assigned and buying the stock

- Legging out or closing one leg of the trade at a time

- Doubling down on the losing side

We hope you enjoyed this article on the broken wing iron condor.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.