After seeing an example, you will understand why this trade is sometimes called the Batman trade.

Without further ado, let’s get into the example.

Contents

This trade consists of one out-of-the-money put broken-wing butterfly and one out-of-the-money called broken-wing butterfly, as follows.

Here is an example placed as two separate orders.

Date: March 1, 2024

Price: SPX @ 5137

Buy one April 30 SPX 4750 put @ $14.60

Sell two April 30 SPX 4825 put @ $18.90

Buy one April 30 SPX 4870 put @ $22.35

Credit: $85

Buy one April 30 SPX 5330 call @ $32.30

Sell two April 30 SPX 5375 call @ $22.10

Buy one April 30 SPX 5450 call @ $11.05

Credit: $85

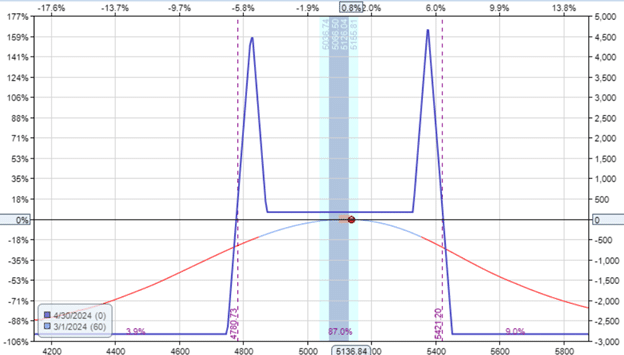

The combined expiration graph is as follows:

The expiration looks like the hood of Batman, the fictional superhero in DC Comics.

But most people likely know Batman from the American movies based on the same.

Here are the Greeks of the trade:

Delta: -0.2

Theta: 7.28

Vega: -73.06

Gamma: -0.03

It is a non-directional short-vega premium collection trade based on positive theta time decay.

It has a relatively low Gamma because this particular example has it at 60 days till expiration.

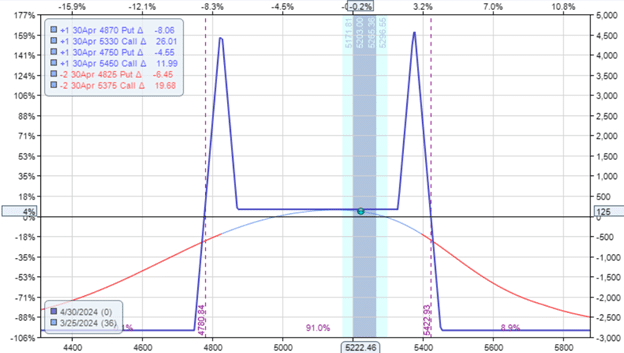

On March 25, twenty-four days into the trade, the trade showed a $125 profit or 4.4% return on the capital at risk:

Further Explorations

The short strikes are at about 15 delta on the option chain in this example.

Here, the broken-wing butterflies have a base wing (the larger, wider wing) that is 75 points on the SPX index.

You can experiment (in backtests or paper trades) with different wing widths and change the flies’ distance to the current price.

In this example, we collected the same amount ($85) on both the put and the call butterfly. But often, this will not be the case, and it need not be.

In addition, you can even make one of the butterflies smaller than the other.

Typically, one would make the call butterfly smaller (and therefore less powerful) since the market tends to move up.

The put butterfly is the one that gives the trade the positive delta.

The call butterflies are the ones that give the trade a negative delta.

However, by adjusting the size of the put or call butterflies, we can apply a directional bias to the trade.

Trade adjustments are very individualized.

You have to find what works for you.

If one follows the iron condor adjustment rules, one might start to adjust when one of the short strikes reaches 25 delta on the option chain.

A typical adjustment might be removing one of the broken wing butterflies and placing a new one away from the money.

However, alternative adjustments can involve selling credit spreads, buying a debit spread on the broken-wing butterfly, or adjusting the widths of any of the four wings of the Batman trade.

Because this trade has six legs (or six different strikes), there can be a multitude of adjustments that traders can come up with.

Conclusion

If this trade is interesting to you (other than the fact that the risk graph looks like the caricature of a superhero), then it is suggested that you back-trade or forward-trade it a few times.

You might find that it behaves somewhat similar to that of an iron condor because the iron condor is also a non-directional short-vega premium collection trade based on positive theta time decay.

The reason for the “ears” in the Batman trade is that it makes the T+0 line flatter than the iron condor.

However, the drawback is that this trade has many more legs, making it very difficult to adjust.

We hope you enjoyed this article on the Batman trade in action.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.