Today, you will learn to unlock the complexities of options trading with a comprehensive guide to understanding option gamma and its crucial role in shaping your trading strategy.

Options trading can be extremely lucrative, but like anything market related, it requires understanding and utilizing some potentially complex topics.

One such topic is the Greeks.

The Greeks are the backbone of many options strategies.

Some of the more common Greeks you have probably heard of are Delta, Theta, Vega, and Gamma. Gamma is what we are focusing on today.

Contents

What Is Options Gamma?

Options Gamma is a second order derivative.

Basically, it is how fast something changes.

In this case, it is the rate at which an option’s Delta changes when there’s a one-unit move in the underlying price.

An easy way to conceptualize Gamma is like the accelerator on your car.

Delta is how fast you drive, and Gamma is how fast you accelerate.

If an option has a Gamma of 0.10, its Delta, or “speed,” will increase by 0.10 for every $1 move in the underlying asset.

Calculating Options Gamma

Calculating Gamma can be a difficult and complex process.

It leans heavily on mathematical models like the Black-Scholes model or Binomial equations.

These models involve numerous variables, such as Delta, Vega, and Theta, as well as the price and volatility of the underlying asset.

It’s a balancing act of inputs.

Thankfully there are some shortcuts to this that work almost as well and can be done with a calculator or Excel.

The quick calculation method is as follows:

Gamma = (Delta1 – Delta2)/(Price1 – Price2)

So in practice, let’s say stock ABC is trading at $100/share, and the $100 call has a Delta of 0.30.

The Stock price rises to $105/share, and the Delta increases on the $100 call to .50.

The formula would be (.30-.50)/($100-$105) = a gamma of .04

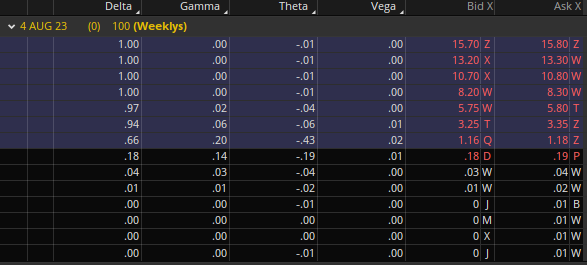

Luckily for us, most brokerages have the ability to view the Greeks in real-time with all market forces considered in their formulas.

This is the route I usually take.

Options Gamma In Trading Strategies

Gamma is a key variable in options trading for some traders.

As a hedging strategy, for example, a positive Gamma can bolster gains and shrink losses as the market rotates around a price level.

This is predictably called gamma hedging.

During periods of expected high volatility, traders might choose to go long on Gamma, anticipating large price swings in the underlying asset.

As discussed above, a higher Gamma means Delta increases faster and can help a trade work for you faster.

Conversely, a short Gamma position might be more favorable during expected low-volatility periods as minor price changes are anticipated, and Delta will change slower.

Gamma And Other Greeks

Gamma can also affect some of the other Greeks as well, just not in the same manner.

While it directly affects Delta, the changes in volatility can also impact the Vega of an option contract, and these changes in volatility can also impact how quickly time decay or Theta affects your position.

So as you can see, while not directly linked, all Greeks are interrelated to some degree.

Gamma Squeeze: A Recent Phenomenon

In recent years, a new form of squeeze has arrived on the trading scene: the Gamma Squeeze.

A normal squeeze occurs when rapid price changes force investors or traders to make changes to their positions that they normally would do gradually.

The most well-known is probably the short squeeze.

A Gamma squeeze has some similar characteristics.

As prices rise, short positions need to be bought to cover, pushing stock prices up.

This, in turn, increases call buying, which now requires market makers and brokers to buy the underlying to hedge the calls they are selling.

This continues to push prices up, which sends this into an upwards spiral.

As you can see, this is very similar to a short squeeze, and just as with a short squeeze, these often only last a few days.

Conclusion

Understanding options Gamma can help you to level up your options trading.

It can help you hedge your positions or look for queues that a position is getting ready to slow or reverse in direction.

Vitally it can also help explain how some of these large price squeezes happen and how you can profit from them (either by participating in them or fading them when they slow.)

Gamma is gaining more exposure in the main streams of financial news, so understanding how it works will become more important for your options trading.

We hope you enjoyed this article on options gamma.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks Gavin for the gamma clarification.

You’re welcome!