Learning option adjustment strategies is a huge key to success.

As markets evolve and prices rotate, professional traders must be equipped with effective strategies to adjust their positions.

Options can be a valuable tool for managing risk and maximizing profits.

The nature of options can make them a volatile instrument to use.

Option adjustment strategies allow traders to minimize the potential damage of this volatility by manipulating the key variables.

We will explore some option adjustment strategies traders can employ to optimize their positions and achieve more consistent success.

These strategies offer valuable techniques for managing your options trades, from rolling to implementing spreads.

Contents

What Are Option Adjustment Strategies and Why Use Them?

Option adjustment strategies refer to the techniques used to modify existing option positions in response to changing market conditions.

These help traders manage risk, protect profits, or hedge against an adverse move to an open position

Let’s take a deeper dive into why traders may utilize some of these strategies:

Changing Market Conditions

Simply put, changing market conditions may necessitate an adjustment to the position to maintain profitability or minimize a loss.

A trader should be aware of any major data releases or headlines throughout the position’s holding period.

Implied Volatility Shifts

Changes in implied volatility can significantly impact option prices.

If news comes out or an event occurs that dramatically changes the IV of a contract, you may need to adjust a position to take some profit off the table or help minimize a loss.

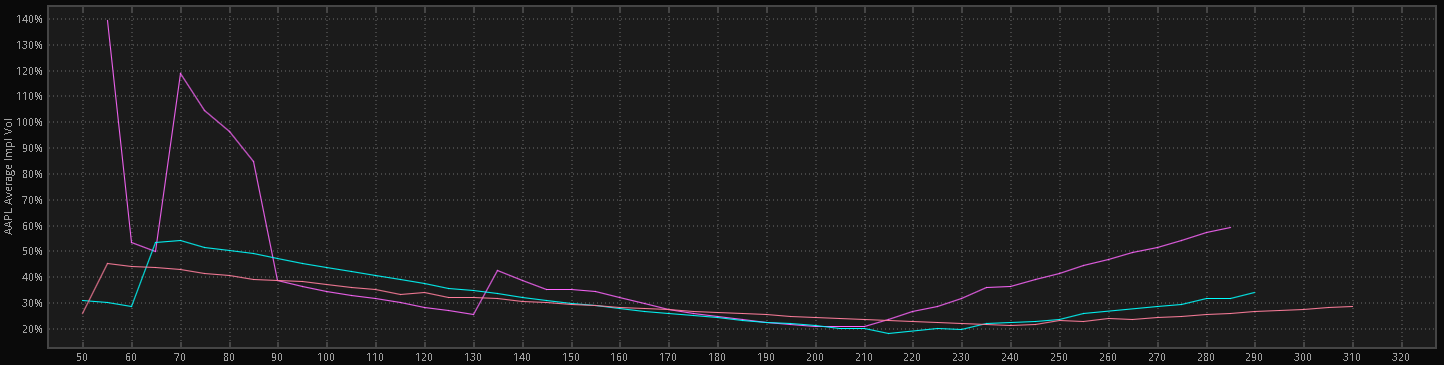

One way to monitor IV shifts is through an options skew chart.

These will show you a line graph of all IVs on an instrument’s options over time.

While they look complicated, they just show you the highest IV strikes.

Here is an example on AAPL of the average IV of the 3 of the more popular monthly expirations.

Price Movements

This is self-explanatory, given that half of the options pricing model is derived from the strike distance relative to the underlying market price.

As this distance ebbs and flows, so do options pricing changes.

Time Decay

Time decay is the other half of the puzzle: the yin to strike price yang, as it were.

Also known as theta decay, the portion of an option’s price derived from time until expiry will erode as that expiration arrives.

The trader may want to adjust to mitigate the impact of time decay and maintain optimal positioning.

Adjustment Strategies

Let’s take a look at some of the more popular adjustment strategies.

Although this article’s main premise involves strategies for adjusting current options positions, we will also cover a few situations that can protect existing stock positions.

Covered Calls and Collars

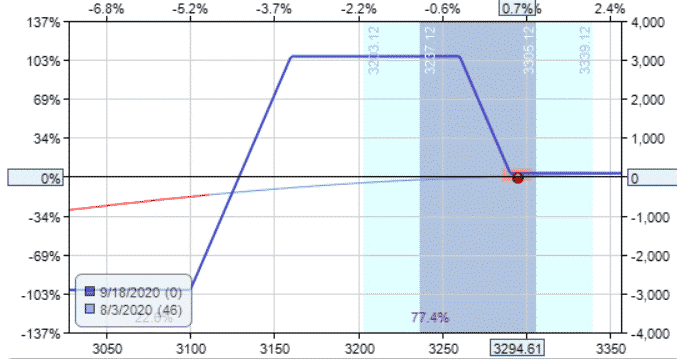

The covered call is a popular option adjustment strategy for traders who own underlying assets.

Traders can sell call options against the underlying to create income from the position.

This is a popular strategy for owners of dividend-paying stocks because it helps to increase the yield and add cash flow. An example of a covered call risk profile is below.

A variation of the covered call is the collar strategy.

It combines selling a call option with buying a protective put option.

The call premium received helps fund the purchase of the put option, limiting the downside risk.

The collar strategy is particularly useful when traders anticipate near-term market volatility but still want to hold onto their underlying position.

Protective Puts

Protective puts are a straightforward option adjustment strategy that provides downside protection for long stock positions.

By purchasing put options, traders can set a predetermined price to sell the stock.

This protects their position against significant losses if the market suddenly collapses.

While the cost of buying the puts reduces potential profits, it offers significant protection for a position with no possibility of the underlying being called away.

Rolling

Rolling is the process of closing an existing option and opening a new one with a different strike price or expiration date.

This is often all done in one transaction.

Traders can roll positions forward (to a later expiration date) or up or down (to different strike prices) based on their market outlook and profit objectives.

Rolling allows traders to extend the duration of the position or adjust the risk/reward profile.

This is particularly useful if your option is at risk for early assignment. Simply put, rolling also allows a trader to keep a position open.

Vertical Roll

A vertical roll entails adjusting the strike price(s) only.

The expiration date will maintain that of the original position.

This strategy is useful when the underlying asset’s price has moved significantly and is expected to continue to move.

This helps a trader stay in a position but adjust an open profit/loss.

Calendar Roll

Similar to a vertical roll that adjusts strike price, a calendar roll adjusts expirations.

One can use this adjustment to extend the position’s duration or just adjust their exposure to implied volatility.

Diagonal Roll (Up and Out/Down and Out)

A diagonal roll combines both a vertical and a calendar roll.

Traders simultaneously adjust both the strike price and expiration date to allow for both more time and price change in the underlying.

These strategies are often called Up/Down and Outs to describe the price direction and time direction of the roll.

Hedging

Hedging involves adding or adjusting positions to offset potential losses or manage risk.

Traders can utilize options to protect themselves from adverse price changes in the underlying assets.

In addition to the stock hedges discussed above, there are also option hedges that can be used.

A popular option hedging strategy is called the “Poor Man’s Covered Call.”

While this is a position type in and of itself, it can also be used as a fantastic hedging technique.

Take, for instance, a trader holding a long call with a significant timeframe.

If the price stagnates, one opportunity would be to sell a shorter-dated call.

If the price continues to rest, the trader has created a quasi-calendar spread that collects some income while awaiting a price increase.

Most experienced traders would say that this strategy works best with In or At-the-Money calls.

Legging In/Out

While not a fancy technique for creating a spread or income for a position, legging into and out of a trade can be a very strong options adjustment technique.

This can allow a trader to add and subtract contracts around a core position to help add and reduce risk as the market changes.

While it’s very popular for larger accounts, small accounts can also utilize it to average into positions of conviction.

Of course, sometimes, the best solution is to let the position expire and take the loss.

It’s important to remember to stay within your risk tolerances.

What to Consider When Adjusting

Now that some of the more popular adjustment methods have been described, let’s consider when a trader may implement them.

Several key factors to consider include:

Market Conditions

Before implementing any option adjustment strategy, evaluating the current market conditions and the factors influencing the underlying asset’s price is crucial.

Traders should consider current volatility levels, upcoming events, and earnings reports.

Do these conditions look like they would work well with an adjustment, or are you better off closing the position or looking for another entry later?

Cost

Traders should consider the cost of an adjustment before they pull the trigger.

Since you will most likely be closing or adding to what you already have, you must consider your current profit or loss.

You will also be opening/closing contracts and incur additional brokerage fees.

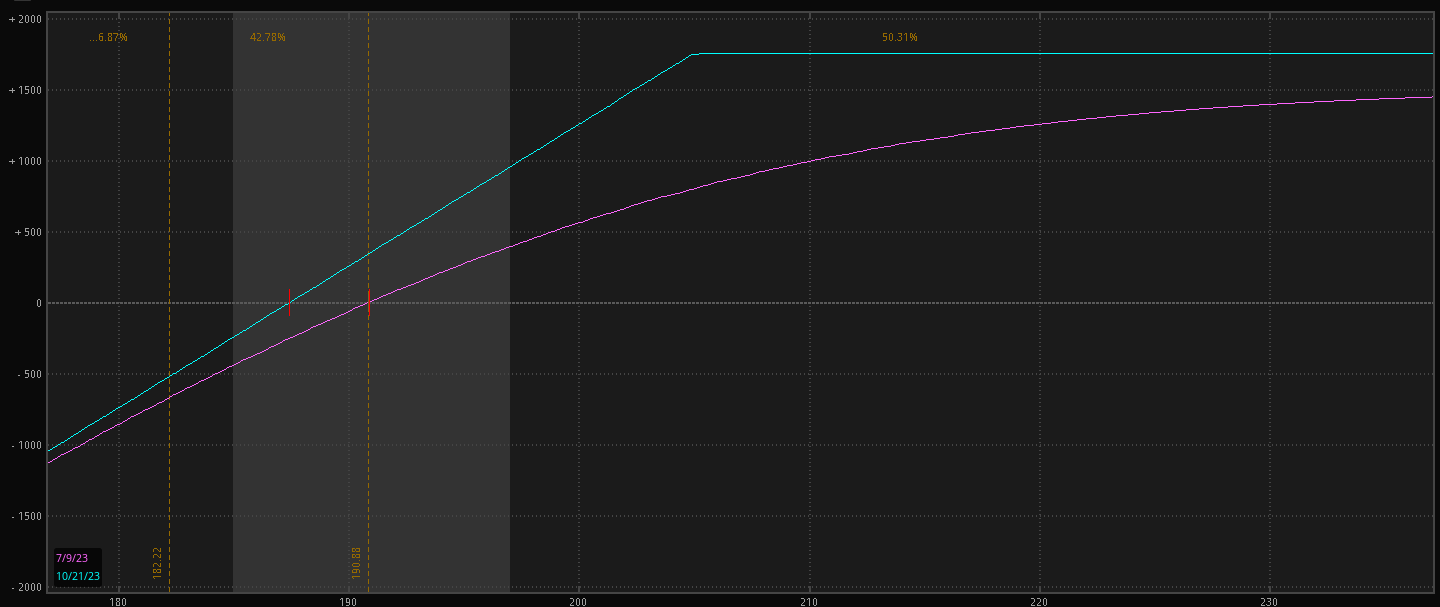

Utilize the power of software.

Many major retail platforms will have a visual representation of the adjustment before it is placed.

It is critical to understand the pricing of the addition/adjustment and how it will affect the profit/loss of the position.

Here is an example of a risk profile from OptionNet Explorer.

Liquidity

This term gets thrown around a lot in recent years, but essentially it’s the volume of the instrument you are trading.

The more volume in an instrument, the tighter the bid/ask spread is.

Tight bid/ask spreads give traders many advantages; some of these include; ease of entry and exit of the position, as well as less slippage of the expected price.

Watching the liquidity of both underlying and associated options chains is vital.

Time Horizon

Time horizon often depends on one’s trading style.

How long does the trader desire to hold a position?

Scalpers have a much different time horizon than swing traders.

Typically, shorter time frames do not require or call for adjustment.

As the time horizon extends, the opportunity presents itself to utilize one or many of these strategies to one’s advantage.

Risk Tolerance

One of the most important factors in any trading action or technique involves the individual’s risk tolerance.

The risk tolerance conversation includes many factors:

- Never leverage money that one isn’t willing to lose. Not many traders truly consider this in the entirety of its meaning.

- Calculate, based on portfolio size, the maximum loss per trade.

- Create and maintain a trade plan that is a living document.

- Be willing to understand where the position went wrong – adjust as necessary, or cut.

- The time horizon is just as important as a profit/loss goal.

A strict trading plan will prevent catastrophe stories such as revenge trading, trading too large, and simply hoping/wishing when the position does not go as expected.

Conclusion

That’s it: A basic guide on options adjustment strategies.

We have summarized how to implement them, what they are when they apply, and what to look for in each adjustment strategy.

Understanding these techniques can drastically improve trading results and assist with confidence in handling whatever the market may bring to the trader.

Utilization of these tools can keep the trader on the right side of the risk curve.

There are more complex strategies, but this article attempted to lay out some of the basic methods.

Working these strategies into a trading plan will certainly assist in becoming a better, more noble trader.

We hope you enjoyed this article on option adjustment strategies.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I am still waiting to know when you will be offering mentor ship programs.

Look forward to hearing from hearing from you.

Thanks !!

The Accelerator Program will be open in mid-late Feb. Will email you when it is open.