There are as many ways to adjust an iron condor – many of which involve moving strikes of the options up or down on the same expiration date.

Today, we will look at an interesting adjustment that involves adding a time spread with two different expirations to the condor.

We will add a calendar at the short strike of the spread that is being threatened.

For ease of modeling the expiration graph, it is best to have the calendar’s near-term expiration be the same as the iron condor’s.

The calendar’s far-term expiration can be some time after that.

Contents

It will make more sense when we look at an example.

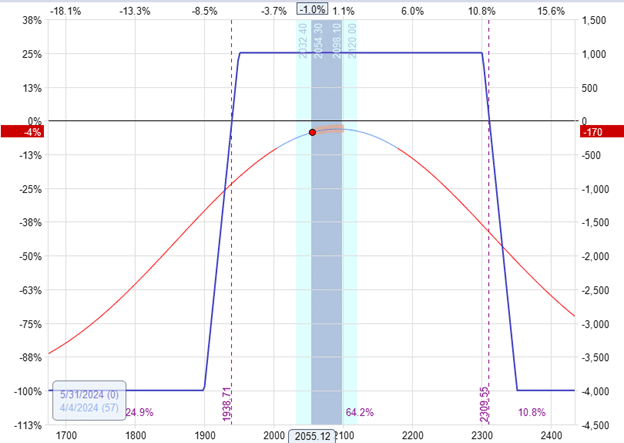

Suppose a trader has the following iron condor trade in RUT already in progress:

Date: April 4, 2024

Price: RUT @ 2055

One long May 31 RUT 2350 call

One short May 31 RUT 2300 call

One short May 31 RUT 1950 put

One long May 31 RUT 1900 put

The put spread is being threatened, with the price of RUT going down, causing the short put to be at the 24 delta on the option chain.

The current Greeks are:

Delta: 2.82

Theta: 14.03

Vega: -93.85

The trader would like to reduce the delta to be a bit closer to zero by adding a calendar with strikes at 1950, the same as the short-put strike.

Sell one May 31 RUT 1950 put

Buy one June 21 RUT 1950 put

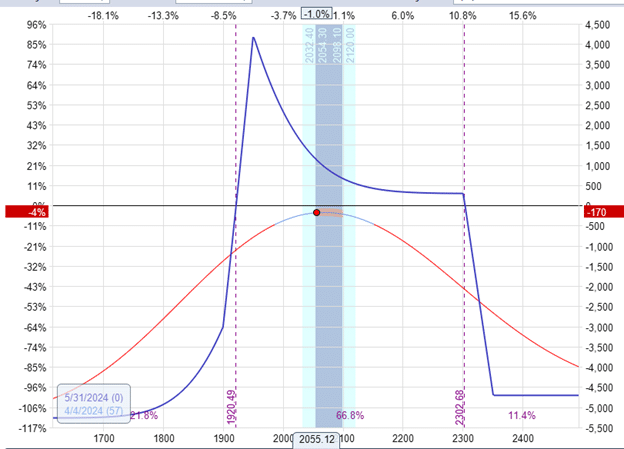

This will cost a debit of about $710 and will change the expiration graph to the following:

When working with trades that involve two different expirations, the graph always shows the expected P&L at the closest expiration.

You will notice that after the adjustment, the price dot is sitting more stable on top of the curved T+0 line than before.

This is also reflected by the improvement of the Greeks.

Delta: 1.21

Theta: 21.22

Vega: -40.68

The adjustment decreased the delta by about half.

The calendar increases the theta.

The amount of negative vega also decreased.

Because the condor trader is a non-directional premium seller, the risks are the directional risk and volatility risk.

Therefore, getting delta and vega closer to zero is a benefit. Increasing theta is the main income generation method in the trade.

The iron condor needed adjustment in this example because the RUT index was going down. When the market goes down, volatility typically increases.

Because the condor is negative vega, it doesn’t like it when volatility increases.

Adding the calendar decreases the overall vega, making the trade less sensitive to volatility changes.

The calendar is positive vega and is not bothered by increases in volatility.

If RUT continues down, the calendar will profit from its directional movement and the accompanying volatility increase.

The idea is that the calendar can provide some gains to offset some of the losses in the condor.

Calendar On The Upside

While the calendar does have benefits when placed below the underlying price, this is not to say that it cannot be used above the price.

The calendar adjustment can be added if the call spread is threatened as the price of the underlying moves up.

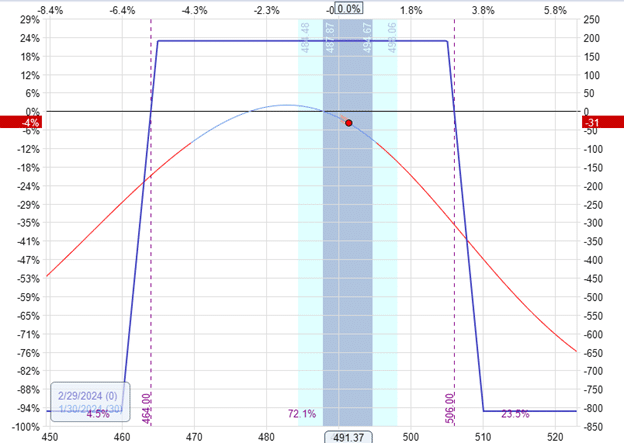

For example, suppose a trader has the following iron condor trade in progress on SPY:

Date: January 30, 2024

Price: SPY @ $491.37

Long two February 29 SPY $510 calls

Short two February 29 SPY $505 calls

Short two February 29 SPY $465 puts

Long two February 29 SPY $460 puts

The price is getting too close to the short call, which is now the 23 delta on the option chain.

The current Greeks are:

Delta: -11.45

Theta: 5.96

Vega: -29.14

The trader adds a calendar centered at $505 (the same strike as the short call):

Sell one February 29 SPY 505 call

Buy one March 8 SPY 505 call

This cost a debit of $82.

The Greeks improved to be:

Delta: -7.30

Theta: 5.73

Vega: -19.14

It decreased the amount of negative delta and the amount of negative vega.

The theta did not change much in this instance.

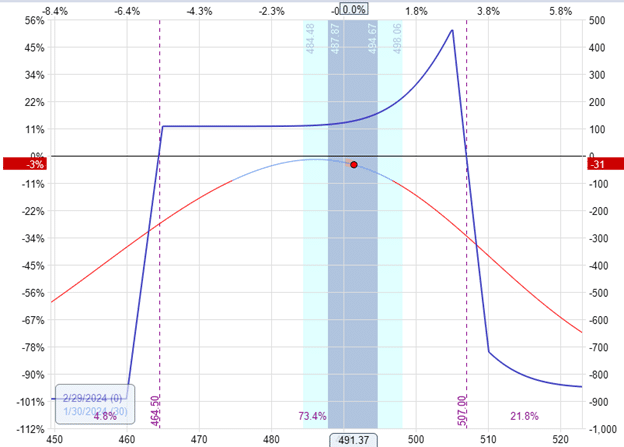

The new expiration graph looks like this:

The calendar decreased the overall position delta from -11.45 to -7.30, meaning it had 4.15 units of positive delta.

If the trader feels this is insufficient to get the delta close enough to zero, the trader can add two contracts to the calendar (matching the number of condor contracts).

Two calendars would provide an 8.30 positive delta and reduce the trade’s net position delta from -11.45 to -3.50.

If the trader’s position size allows for it, starting the condor with two contracts is advantageous.

The trader can better fine-tune the adjustment, choosing to add either one or two calendars as deemed necessary.

Conclusion

It would help if you practiced the adjustment for a while to figure out the nuances of this technique.

For example, the calendar did not increase theta much in the second example because it was too far away from the underlying price.

Try to experiment by moving the calendar closer to the money.

Our examples placed the calendar on the short strike of the spread because that is generally a good starting point to fine-tune the adjustment further.

But no rule says you have to place the calendar there.

Moving the placement of the calendar also changes the amount of delta it contributes to the position.

Another variable to experiment with is the time difference between the near and far-term expiration.

Increasing the time spread difference between the two expirations will cost more but will give your calendars more power.

Once you figure out all the intricacies, using the calendar to defend the iron condor is a good technique to add as a non-directional delta-neutral trader.

We hope you enjoyed this article on calendarizing an iron condor.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.