Have you ever looked for a bull put spread screener but been unable to find one? Well, today you are in luck because we will share with you a great screener that will help your trading.

Contents

- Key Elements of Profitable Bull Put Spreads

- How To Use The Bull Put Spread Screener To Find Bottom Out Bullish Trades

- What Is The Safest Bull Put Spread To Enter Right Now?

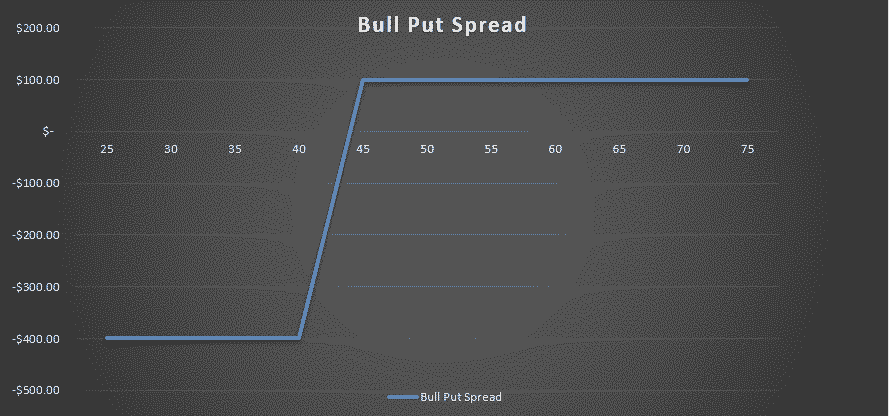

A Bull Put Spread is a bullish option strategy that is profitable from an upward price movement.

It is a high leverage bullish trade as you can easily make 30% or more return on capital in a short time.

A Bull Put Spread works by selling a Put option and buying another Put option at a lower strike price that expires at the same time.

Let’s review the profit analysis of a Bullish Put Credit Spread.

A Bull Put Spread is profitable when the underlying price goes up.

The Bull Put Spread is profitable when the underlying stock does anything but go down.

As long as the underlying stock price stays stable or moves up, the Bull Put Spread is profitable.

Key Elements Of Profitable Bull Put Spreads

When selling Bull Put Spreads, we have a positive delta in our position, so we want the stock price to go up to decay the option value, then we can buy to close the trade for a profit.

A positive delta trade is profitable when the stock goes up, and the trade loses when the stock price drops.

If the stock price stays above the short Put strike, we can wait for the options to expire worthless for a profit.

The maximum loss of a Bull Put Spread is the width of the Put strikes x 100 minus premium collected.

The Buying Power used is the potential maximum loss.

Since the greater the delta is, the higher the premium, if the Put strike width stays the same, a higher delta Bull Put Spread lowers maximum loss and lead to higher returns.

How To Use the Bull Put Spread Screener To Find Bottom Out Bullish Trades

Now we know how a Bull Put Spread works, we want to find high probability bullish underlying to trade.

A common perception is looking for bottom-out stocks that have been trending down for so long, that have a high chance of bouncing back in a bullish manner.

SlashTraders’ Bull Put Spread Screener uses historical chart analysis to find bottom out stocks that have a high probability of an upward correction that we can sell Bull Put Spreads to open.

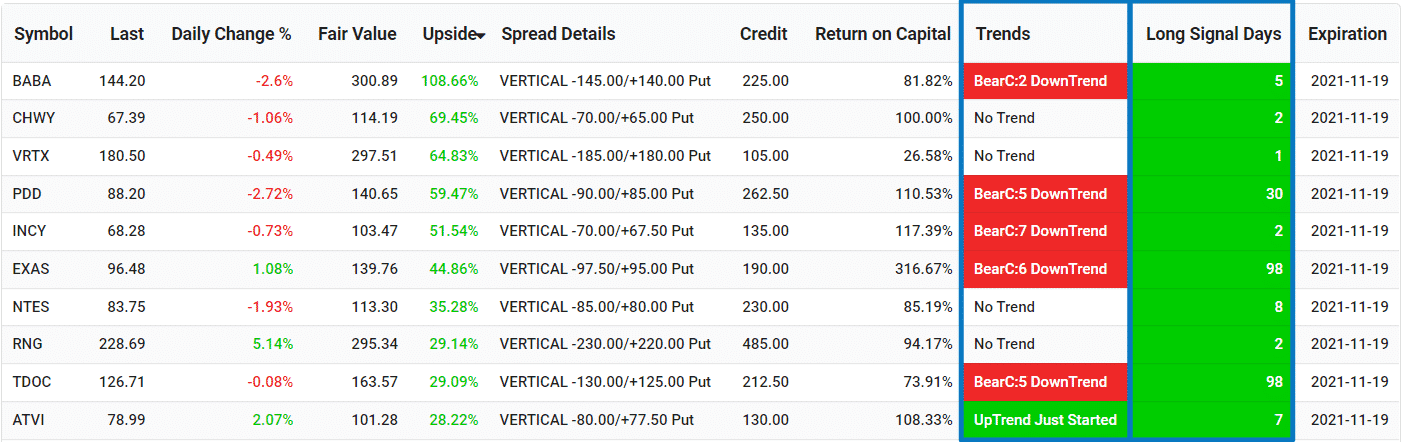

There are three key metrics on the Bull Put Spread Screener that helps us find heavily undervalued and bottomed out stocks:

- The options screener uses fundamental analysis to calculate a Fair Value and derive a potential Upside of the stock. When the Upside is greater than 30%, we have high confidence in a bullish outlook.

- Chart analysis is used to see the short term movement of the stock, whether the underlying is in an uptrend or a downtrend, so we can time the market accordingly. When the Trends column turns green and shows BullC UpTrend with a number, we know the stock price has been bullish several days in a row.

- The screener’s unique Long Signal Days uses chart analysis again to find the long term trends of the underlying. When the Long Signal Days column turns green and showing the number of days that have passed since the last bottom out signal, we can be confident the stock has hit bottom, and is ready to correct in an upward direction.

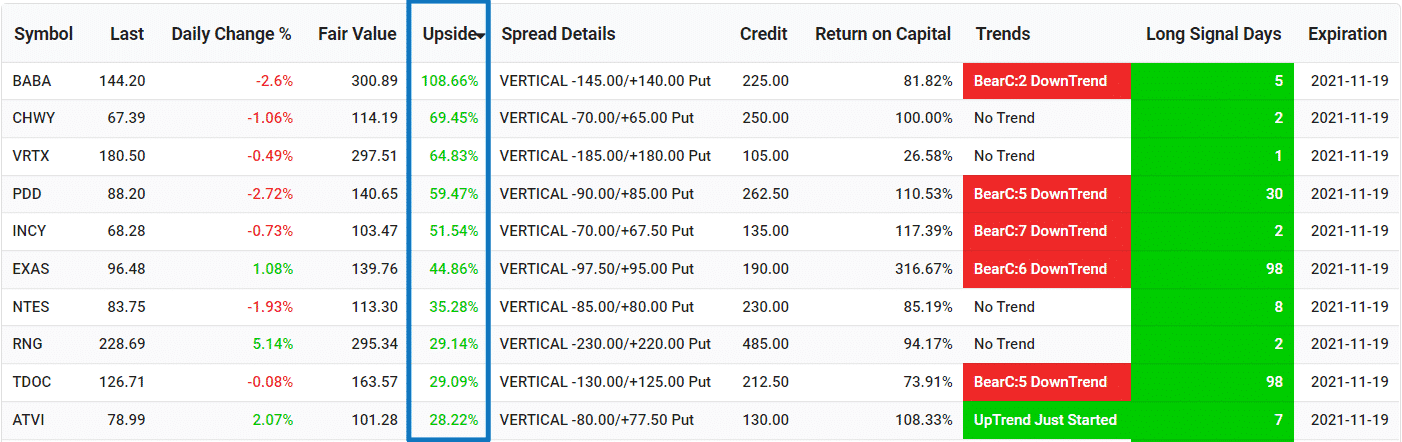

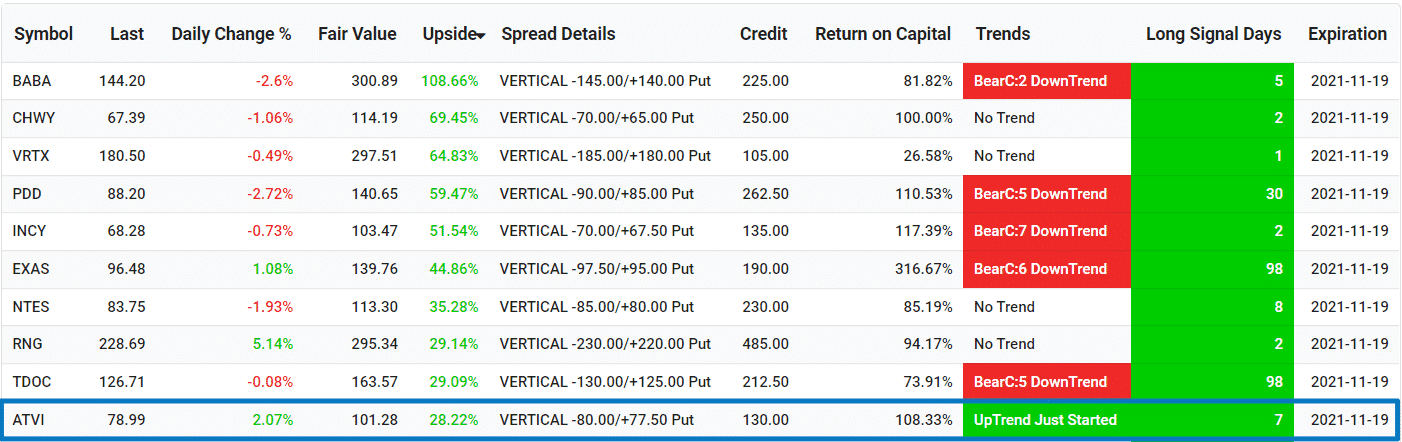

Let’s start by sorting the Bull Put Spread Screener with the Upside column, to find the most undervalued stocks in the list of overstretched underlying.

The Bull Put Spread Screener finds overstretched stocks and sorts them by the Upside.

Then we want to use Trends and Long Signal Days to find stocks that are trending up in both the short term and long term.

Use Trends and Long Signal Days to find upward trending underlying.

When an undervalued stock has both Trends and Long Signal Days turn green, we can be confident of entering a bullish trade.

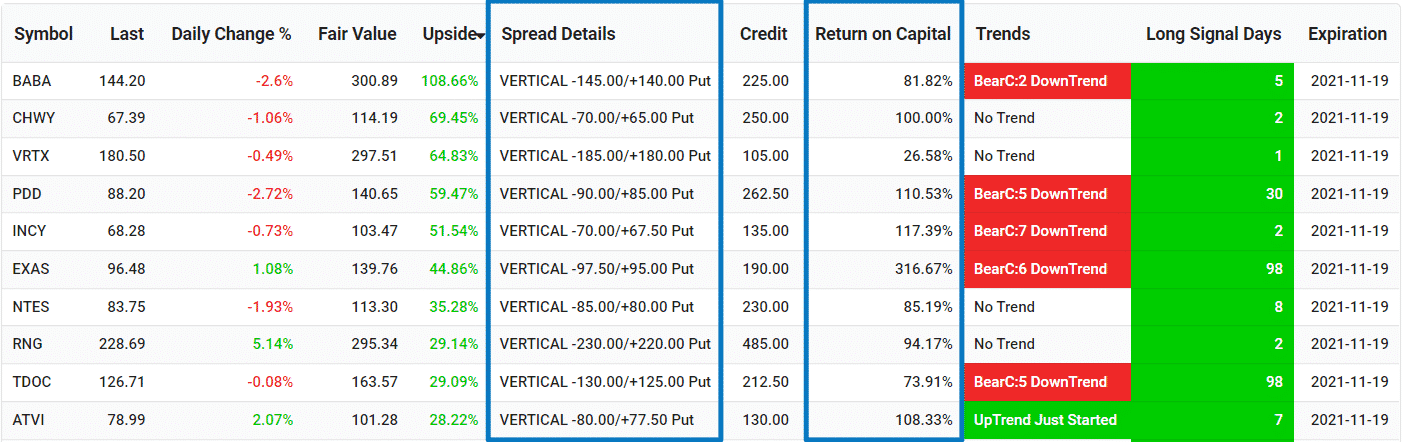

Then we can use the screener to find high Return on Capital 0.50 delta ATM Bull Put Spreads, so you get the highest return, with the least maximum loss if we are wrong about the trade.

The screener calculates ATM Bull Put Spread strike prices and the Return on Capital.

What Is the Safest Bull Put Spread To Enter Right Now?

Looking at the SlashTraders’ Bull Put Spread Screener, the stock that meets all 3 criteria of a bottom-out stock is ATVI:

- It is heavily undervalued with almost 30% Upside potential.

- An UpTrend Just Started signal indicates a bullish trend just started.

- Long Signal Days signal shows the stock bottomed out 7 days ago.

ATVI is an undervalued stock that has bottomed out and trending upwards.

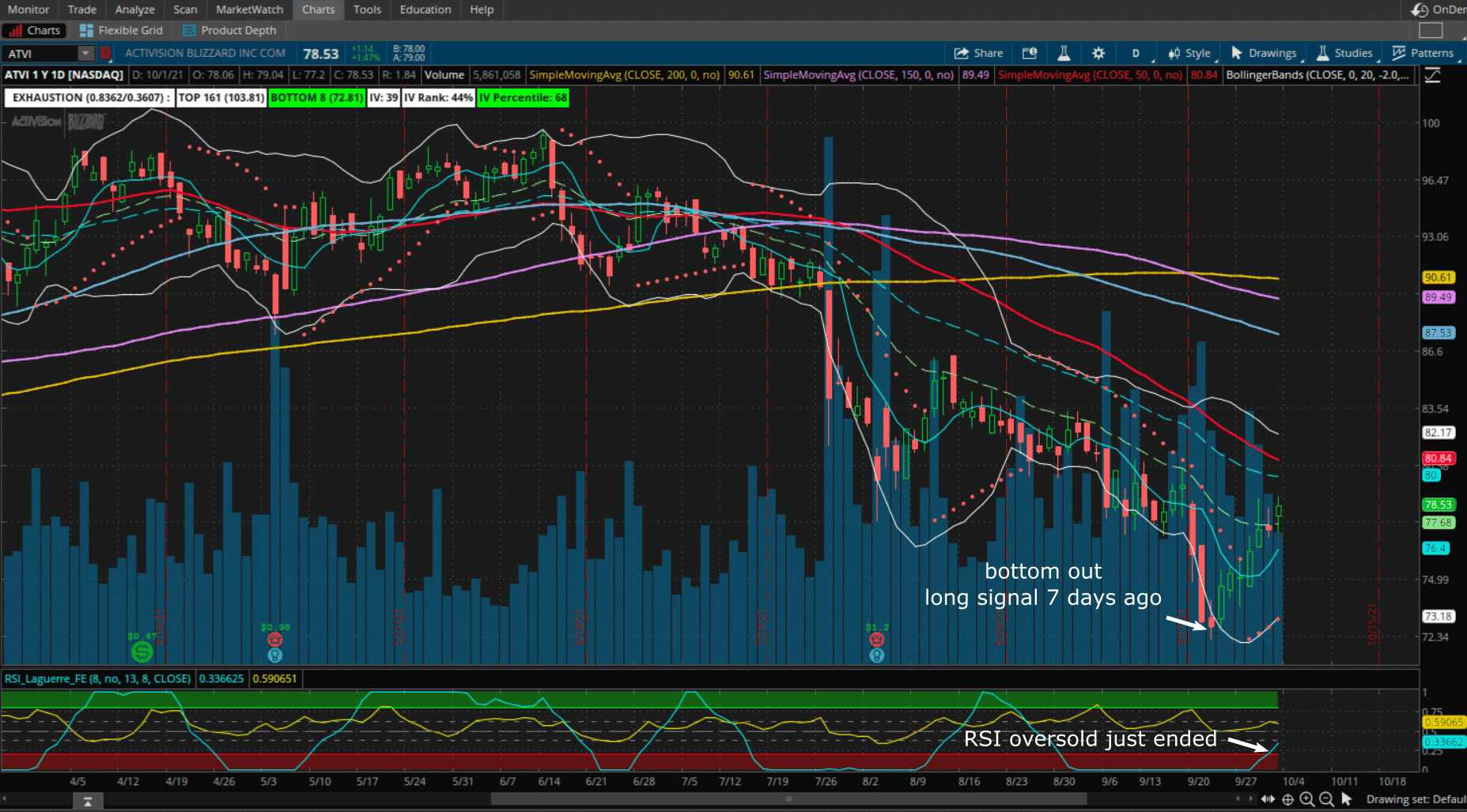

We can double-check the ATVI price charts to confirm the bottomed-outness of the trend.

ATVI’s price chart shows it has bottomed out 7 days ago, with RSI oversold ended yesterday.

The ATVI’s price chart shows it reached the bottom 7 days ago and has been on a bullish trend ever since.

The RSI oversold condition just ended yesterday, so there is a high probability that ATVI will continue to trend upwards.

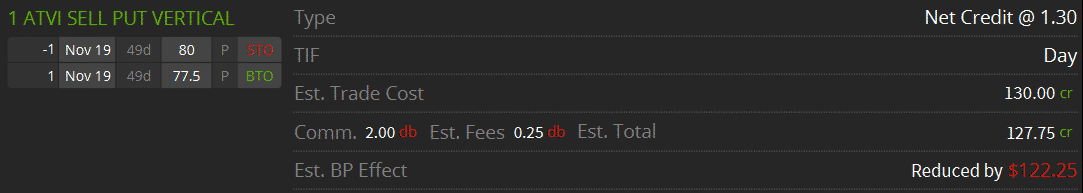

So we can enter the trade in the platform of our choice, and execute a high probability ATM Bull Put Spread for ATVI that expires next month.

We see the ATVI Bull Put Vertical Spread fits all our criteria as the safest and most profitable opportunity at this time.

After taking into account of commissions, this trade has a maximum Return on Capital of 104% if the options expire worthless next month.

The SlashTraders’ Bull Put Spread Screener is updated every day so visit often to find high probability bullish trends.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks for sharing that.

You’re welcome