The California Condor is a North American bird with a large wingspan reaching up to 3 meters (nearly 10 feet).

The Iron Condor is an option strategy designed for non-directional traders to capitalize on selling premiums and taking profit from time decay.

As the California Condor flies, it can adjust the width of the left and right wings independently to navigate the air currents.

Contents

Narrowing the Wings

The Iron Condor wing widths are defined by the width of the put credit spread below the market and the width of the call credit spread above the market.

While many traders like to set the wing widths to be equal initially, they need not be, and they can also be adjusted independently mid-trade.

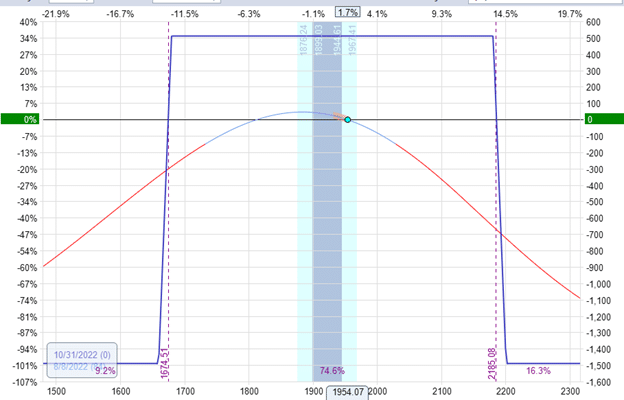

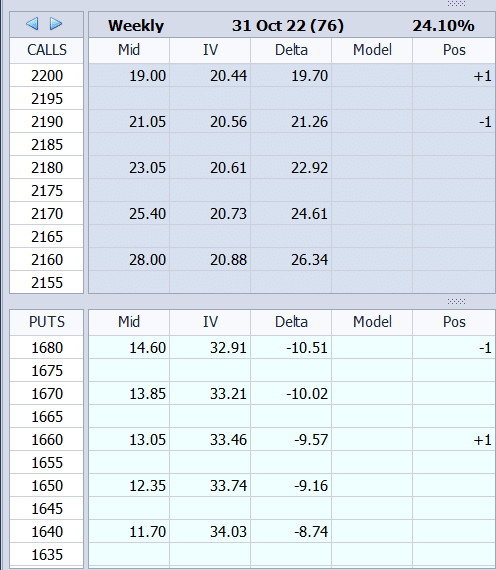

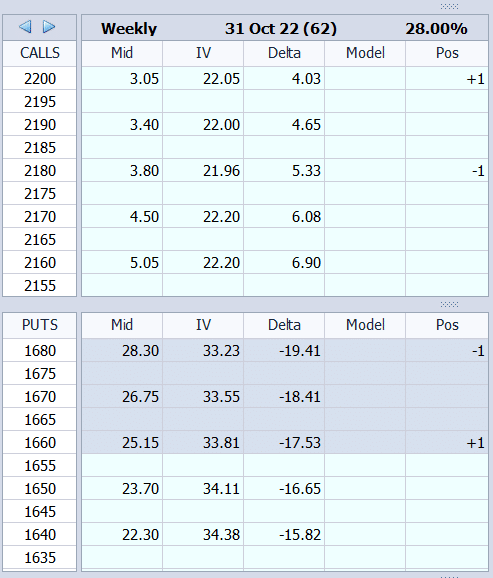

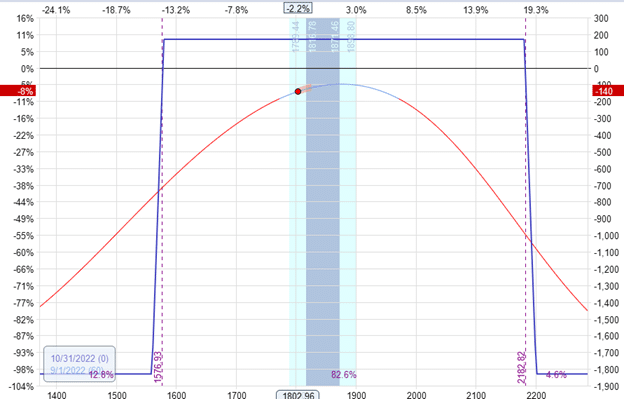

Suppose we start off with an Iron Condor on the RUT with 20-point wings on both sides:

The condor was started on August 8, 2022, with the following strikes on the option chain:

The short put at 1680 is at the 15 delta.

The short call at 2180 is roughly at the 15 delta, or 15.98, to be exact (if you are looking for the number in the above grid).

This condor has an expiration date of October 31, which is 84 days from the start.

The credit received from initiating this condor is $510, but the investor aims to keep half of that – taking home a profit of $255 if possible.

Whether that is possible or not is partly up to the market and partly up to the investor to adjust the wings of the condor to navigate the markets.

Let’s see.

Narrowing the Wings

On August 16, the market moved up.

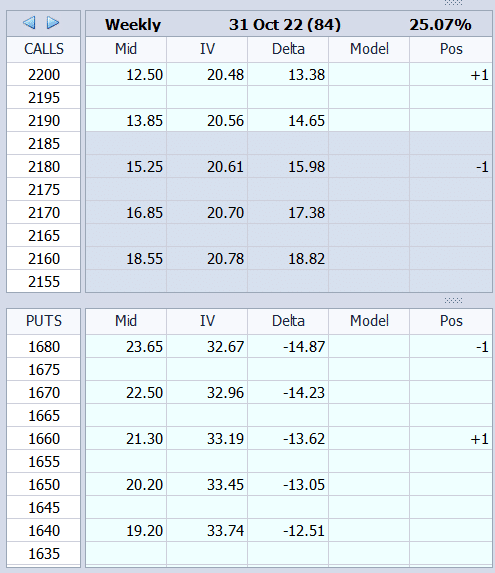

The short call is being threatened with the short strike reaching up to 23 delta on the option chain:

Delta: -2.26

Theta: 5.95

Vega: -35.24

The investor can narrow the call spread by buying to close the 2180 call and selling to open the 2190 call.

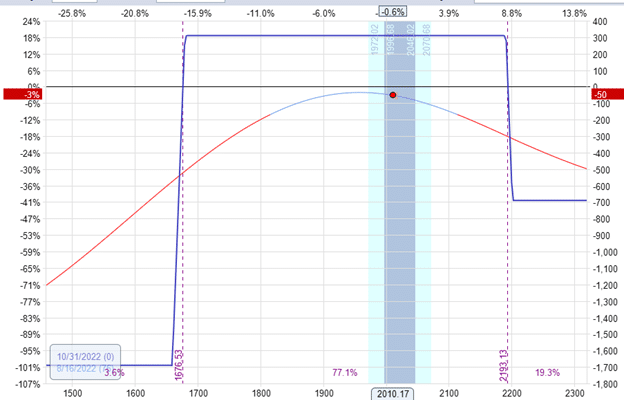

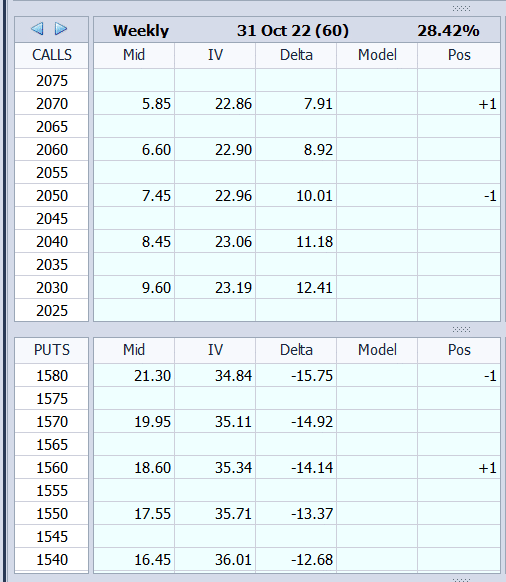

Then, the width of the 2190/2200 call spread has decreased to 10 points wide:

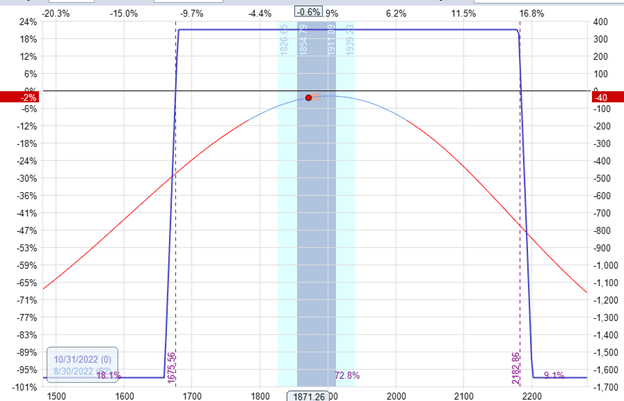

The resulting expiration graph would be asymmetric, as shown here:

The Greeks have improved – primarily, the delta decreased to delta neutral.

Delta: -0.68

Theta: 3.87

Vega: -23.56

Like the California Condor, a small wing width means a less powerful wing.

The smaller call credit spread is not going to provide as much theta.

Hence, you see that the overall theta has decreased.

At some point, when the opportunity arises, we can expand this wing.

Expanding Back the Wing

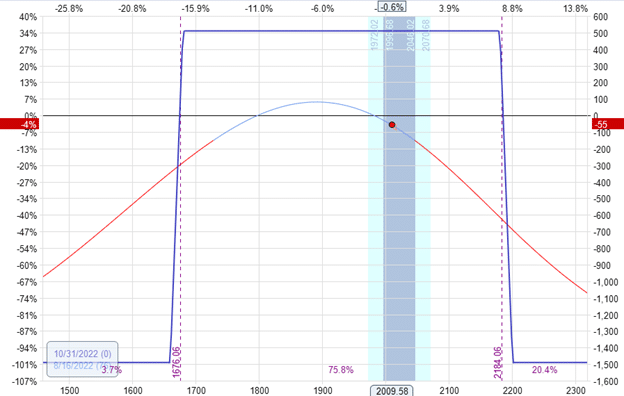

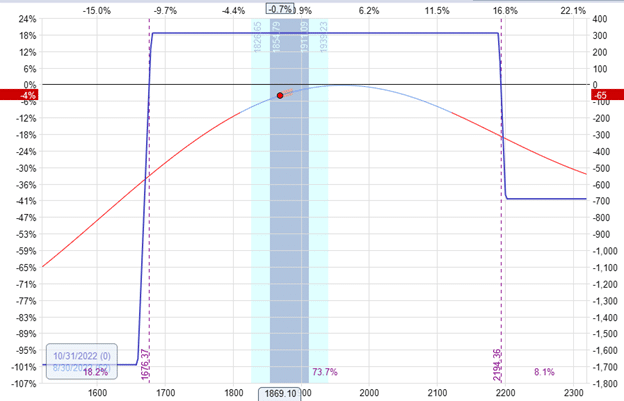

That opportunity came on August 30, when the price of RUT moved back down.

There is no longer a thread on the side of the call spread.

Looking at the delta of the short strikes on the option chain:

The short put at 19.58 delta is not quite in danger yet.

But the short call at 4.29 delta is very far out of the money.

It generates only 1.4 units of theta.

Would it be possible to move the short call from 2190 back to its original 2180 strike?

The short strike would still be far enough out-of-the-money at the 5 delta.

Yes, it is possible.

Some might even expand the wing larger by moving it to 2170 strike.

That is the trader’s choice.

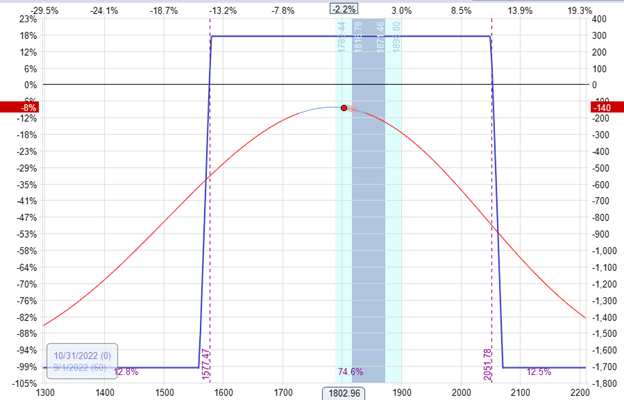

Trying not to over-adjust, let’s move it to 2180 by buying to close the 2190 and selling to open the 2180, so we now have:

Our expiration graph is back to having symmetrical risk on both sides:

The net result is an improvement in the Greeks.

The overall position delta dropped from 1.3 to 0.6 (cutting the delta by about half).

Because we increased the wing width of the call spread, theta increased from 4 to 5.6 overall.

The call spread itself is now generating 3.2 units of theta.

Moving the Wings

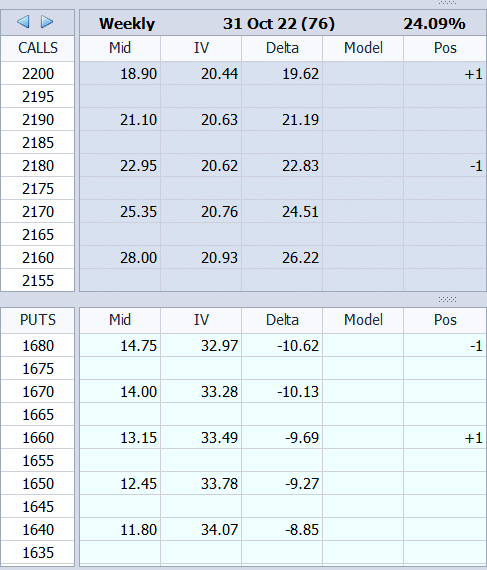

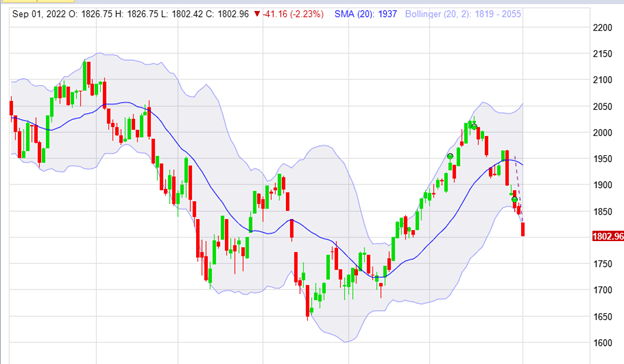

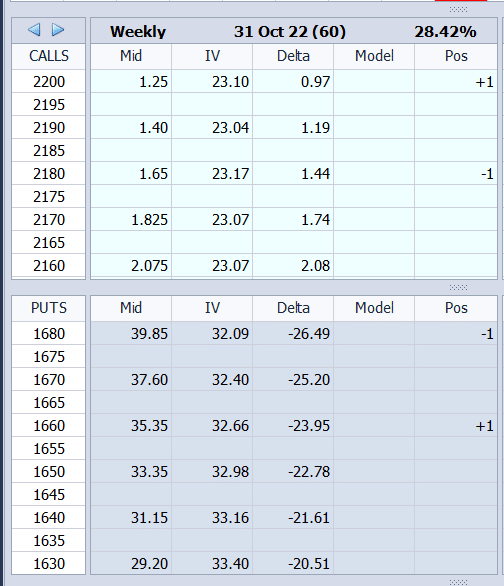

On September 1, the RUT is moving down rapidly.

The put spread is being threatened with the short strike with a 26 delta:

Narrowing the wings of the put spread is not going to help.

We will need to move the entire spread down.

Closing the original spread:

Buy to close the 1680 put

Sell to close the 1660 put

And opening a new spread (with the same width) further away from the money:

Sell to open the 1580 put

Buy to open the 1560 put

The result:

This improved the overall position delta from 2.17 to 1.2.

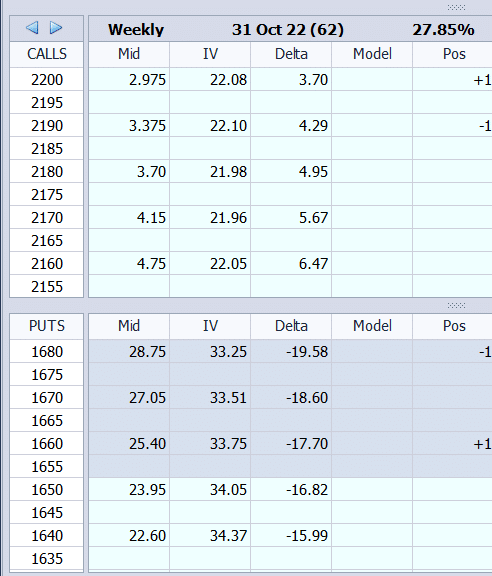

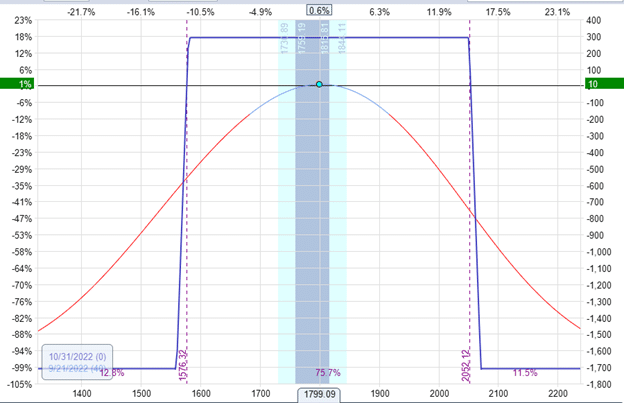

Moving Call Spread Closer

We also noticed that the call spread is too far away from the money.

Let’s relocate it with the short strike to the 10 delta in the option chain:

The condor looks like this:

And the Greeks are:

Delta: -0.43

Theta: 7.12

Vega: -33.3

Back to Break-Even

On September 21st, the condor is back into profitability with a P&L of $10.

The investor is looking to exit after 44 days into the trade, which is already half the trade duration.

Conclusion

Also known as vultures, condors are scavenging birds.

While it is barely satisfied with the morsel it found in a tough market, this condor folds up its wings for the night and prepares to go out and hunt again tomorrow.

We hope you enjoyed this article on adjusting the wings of an iron condor.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.