Contents

Today we’re going to look at an example of a bullish risk reversal.

Unlike the synthetic long stock which has same strike price for both the call and put, the bullish risk reversal trade has the strikes of the call and put at different prices.

For this example, we use the emerging markets ETF (ticker EEM) to avoid individual stock risk and earnings risk.

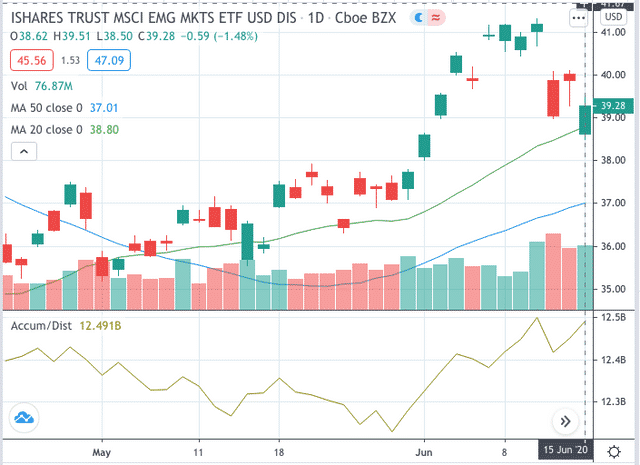

On June 15, 2020, EEM closed on a green candle that was bouncing off the 20-day simple moving average (green line) after a pullback from an uptrend.

Bullish strength is indicated with the 20 simple moving average above the 50 simple moving average (blue line), and with both sloping upwards.

In addition, we see the stock is being accumulated via the accumulation/distribution indicator.

Trade Details:

Date: June 15, 2020

Price: $39.28

Sell one July 17th EEM 37 put @ $0.76

Buy one July 17th EEM 41 call @ $0.71

Credit Received: $0.05

We pick the short put strike around the 25 delta which provided us with a credit of $76 per contract.

We use this credit to buy the 41 call at $71.50, leaving us with a net credit of $5.

The goal of this strategy is not to collect the credit, but for the price to move above our long call strike to become in-the-money.

We want to set this up so that we end up with a slight net credit, or at zero-cost, but not at a debit.

This ensures that if price doesn’t move and ends up between $37 and $41 at expiration, we don’t lose anything and hopefully cover the commissions.

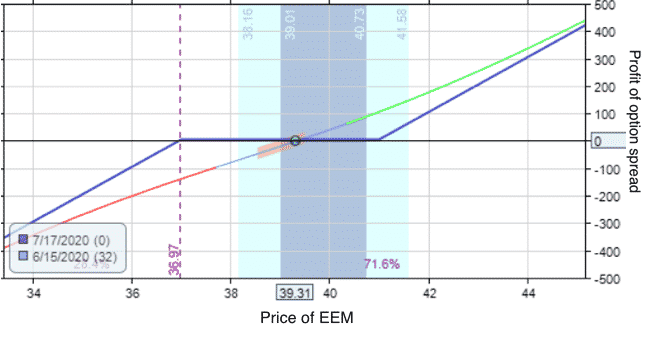

The profit and loss graph looks like this with the dark blue line the profit-and-loss at expiration.

The Greeks

Delta: 60.28 Theta: 0.27 Vega: 0.36

Similar to a stock synthetic, theta and vega will not have much effect. This option spread is clearly a directional price movement play, equivalent to owning 60 shares of EEM.

Get the direction correct and we will make money on this strategy.

Get the direction wrong and we will lose money.

Put Call Skew

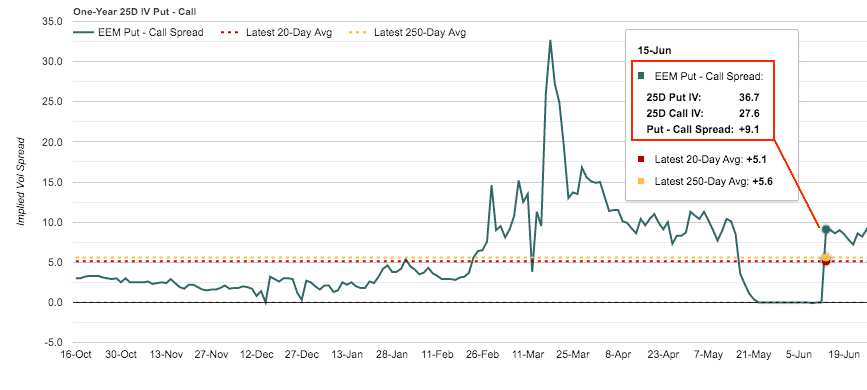

Since we are selling the put and buying the call, we want the put to be expensive relative to the call.

Sell high. Buy low.

Expensive is synonymous to having high implied volatility (IV).

The IV difference between the put and call of the same delta is the put call skew, or put-call spread.

Looking at marketchameleon.com, we see that on June 15, the IV of the 25-delta put is 36.7.

The IV of the call of the same delta is only 27.6.

The put-call spread is 9.1. The bigger the difference, the better.

This will provide us with a slight additional edge.

Puts are general more expensive than calls because they are more in demand used for hedging stock portfolios and as insurance against a market crash.

Fear is a stronger emotion than greed.

When there is fear, people but puts.

When there is greed, they buy calls.

The Results

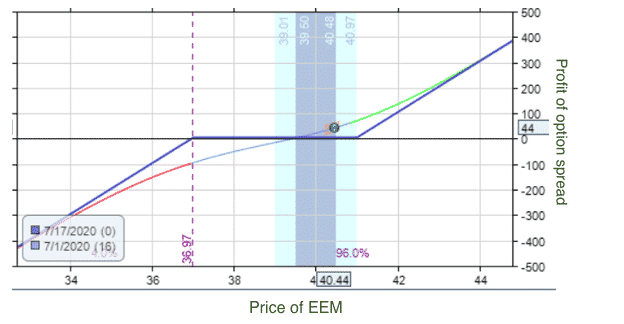

Two weeks later, EEM moved up slightly to $40.44

While our long call is still not in-the-money, our options spread is showing a profit of $44.

Even though the expiration graph is flat when price is between $37 and $41, this is only true at expiration day.

Prior to that, we are tracking the curve line, which is sloping upwards.

We stay with the trade for another week.

On July 9th, our long call is in-the-money with EEM price at $43.52

Our spread is showing a profit of $262.50 — at which point we can take profit and close the trade.

We got paid $5 to initiate the trade.

Three weeks later, we got paid $258 by closing the trade:

Buy back our EEM 37 put @ $0.01

Sell out EEM 41 call @ $2.59

Resulting in a total profit of $262.50 (excluding commissions).

For the purpose of illustrating the concepts, this is a cherry-picked example using historic options data from OptionNet Explorer.

Not all live trades turn out this nicely.

Bearish Risk Reversal

We just saw an example of a bullish risk reversal, where we sell a put to finance the purchase of a call.

The bearish risk reversal is when we sell a call to finance the purchase of a put.

This is less frequently used because the put-call skew is not in our favor (rare that a call has higher IV than a put of the same delta).

Some traders, rightfully so, may be nervous at holding a short call, unless it is secured by owning the underlying stock.

When a bearish risk reversal is used in conjunction with a stock position of the same underlying, it is called a collar.

Another alternative is to use a short call spread and a long put spread instead of having a naked short call and long put.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.