A poor man’s covered put is a bearish strategy that is the opposite of the poor man’s covered call.

We buy a long-term, in-the-money put and sell a short-term out-of-the-money put against it.

Contents

- What Is A Poor Man’s Covered Put?

- Maximum Loss

- Maximum Gain & Breakeven Price

- Risks

- How Delta & Vega Impact the PMCP

- How Theta Impacts the PMCP

- How to Select Stocks for the PMCP

- How to Select Stocks for the PMCP

- Summary

What Is A Poor Man’s Covered Put?

When just getting started with options, your brokerage firm probably started you off with the covered call strategy.

It’s easy to learn and only has long stock and short call options.

fter you gain some experience, you pick up the poor man’s covered call and replace the stock in the covered call with a long-dated ITM long call option.

Then you heard about the covered put with short stock and short put options, wait, what?

Honestly, when I first started trading options this strategy really confused me.

I encourage you to read through the covered put strategy to make certain you really understand the mechanics.

Now, with the poor man’s covered put, we are going to replace the short stock with long-dated ITM long put options.

We are going to move rapidly through the points below and then with a few examples, all should become clear.

Poor Man’s Covered Put Example

Let’s look at a quick example:

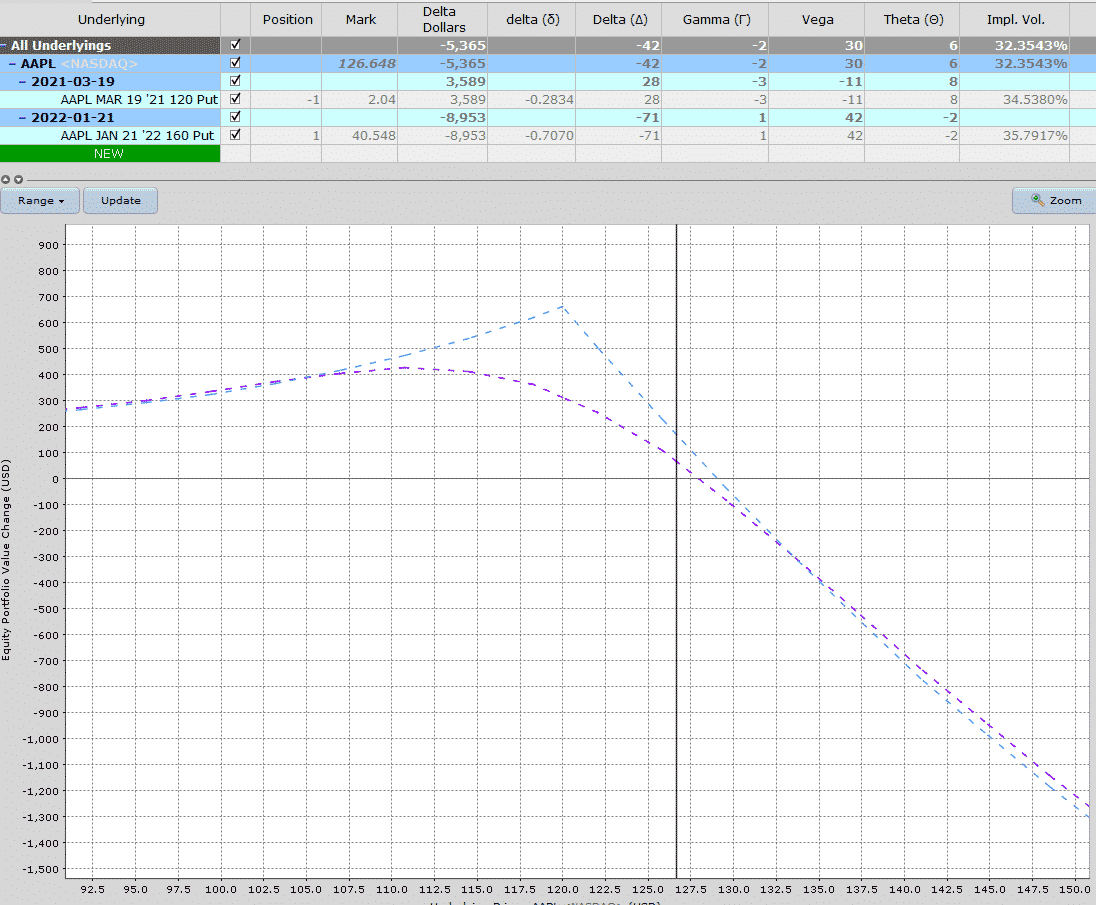

Date: February 22nd, 2021

Current Price: $126.64

Trade Set Up:

Buy 1 AAPL Jan 21st, 2022, 160 put @ $40.55

Sell 1 AAPL March 19th, 120 put @ 2.04

Premium: $3,851 Net Debit.

Breakeven Price: Approximately $129

Maximum Loss: $3,851

Maximum Loss

The covered put uses 100 shares of short stock and a short OTM put option.

The maximum loss for the covered put is undefined because the price of the stock can theoretically rise without limit.

The poor man’s covered put (PMCP), on the other hand, consists of a long ITM put option and a short OTM put option.

Taken together, these options make a diagonal spread. Specifically, a PMCP is also referred to as a long put diagonal spread.

Like most long spreads, our maximum loss is equal to the debit paid to open the spread.

In the case of our AAPL example above, both the premium paid and the maximum loss are the same at $3,851.

Maximum Gain & Breakeven Price

As mentioned above, the PMCP is a long put diagonal spread.

Diagonal spreads are really a combination of vertical spreads (different strikes with the same expiration) and calendar spreads (same strikes with different expirations).

Since we have differing expiration periods, we can not know for sure the maximum gain or a breakeven price for the spread because we can not possibly know the implied volatility of the options at the first expiration period.

This is really not a problem since we can just base our target exit price on a 20-30% gain on the debit paid.

Risks

Assignment risk is normally only an issue if the stock price falls below your short put strike and expiration is nearing.

Honestly, by the time this situation develops, we should have closed the position for a nice profit.

If assignment does happen, simply close out the assigned shares and the long put if that’s part of your game plan.

We’ll discuss different time horizon strategies soon.

The PMCP does not suffer from dividend payment risk unless you get assigned short shares before the Ex-Dividend date and the stock is paying a dividend.

This is a big risk with covered puts since they use short stock by design.

Gamma risk is ever present as options near expiration.

It creates large fluctuations in option prices that we can do without.

It’s a good idea to close the short put at least one week prior to expiration.

Overpayment risk is a risk that can be avoided by never paying more than the spread width of a PMCP.

Think about it for a moment, if you pay $10.02 for a $10-wide spread and both puts wind up ITM, how much will the spread sell for at expiration?

Yup, $10 max. That’s a guaranteed loser!

How Delta & Vega Impact the PMCP

Both the PMCP and the covered put are delta negative trades, meaning that they profit from the stock price falling.

Vega, on the other hand, is not as straightforward.

The covered put is a short vega trade since we have short stock and a short put. We see this all the time when we sell options with high implied volatility then buy them back when implied volatility falls.

The PMCP is considered a long vega trade since we have an overall debit spread.

With debit spreads, we buy them when implied volatility is low and want it to rise.

The fly in the ointment has to do with how far out we place our long put.

One consideration is that short-dated options are more affected by changes in volatility than long-dated options.

This means that our short puts are more sensitive to implied volatility and will show greater price variations than the longer-dated bought puts.

Our AAPL example above had vega of positive 30.

How Theta Impacts the PMCP

The passage of time affects the different expiration periods by different amounts. Longer-term options by definition have more extrinsic value and a larger number of days to decay over.

This has the effect of longer-term options having a lower theta decay value than near-term options.

Long options have negative theta decay while short options have positive theta decay.

This means that our PMCP position has an overall positive theta decay (we are gaining value as time passes) since we hold a long-dated long put (smaller negative value) and a near-dated short put (larger positive value).

This concept assumes all other variables like price and volatility do not change.

Our AAPL example above had Theta of plus 6, meaning the position should make roughly $6 per day through time decay.

How to Select Stocks for the PMCP

Quality ingredients are the secret to most recipes and the PMCP is no exception.

I think the same list and criteria used for the covered call is appropriate for the PMCP as well.

The PMCP is a neutral to slightly bearish strategy, so we want to grab a stock that may trend sideways for a while or decline a bit.

Poor Man’s Covered Put Example – KO

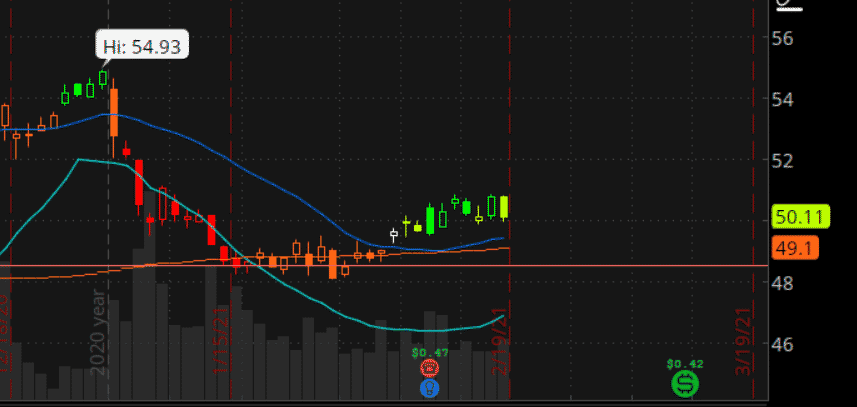

On 02/21/21, I found a ticker that looks like it may work for a PMCP, Coca Cola (KO). RSI, CCI and Stochastic Oscillator all showed middle range kind of values.

IV percentile is 20% and there are no earnings on the radar. The current stock price is $50.11 and the 52-week high is just shy of $55. This gave me my target for the long put.

The next step is to find the expirations and the strike prices. Personally, I like to stick to monthly expirations for the liquidity.

I looked at April and May expiration cycles and both had less than 500 open interest.

June had 550 open interest for the $55 strike. Perfect! That’s one side.

Now, I want a close expiration with at least 25 days to expiry (DTE) for my short put.

The March expiry is 26 DTE.

There are 2 strikes with at least 500 open interest, $50 and $47.5. I think $50 is a little too close to the current price of $50.11, so $47.5 it is.

![]()

Constructing the PMCP spread:

What if the closer in expirations were good for the long put?

I still would choose the June expiration because after the March contract expires, I can sell another short put OTM expiring in April to take in more premium then again in May and then sell another short put in June, which turns the PMCP into a vertical put spread.

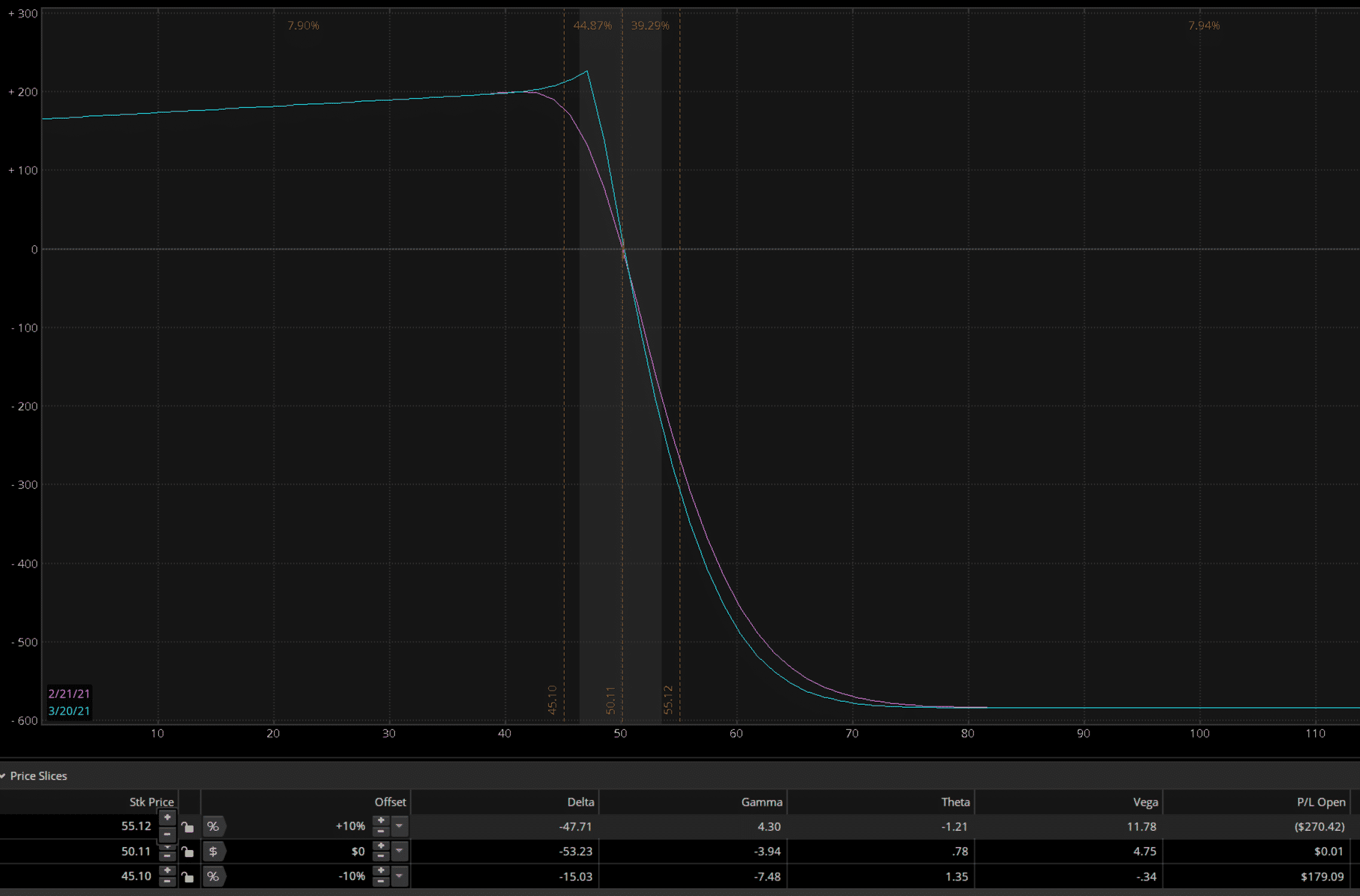

Let analyze the trade a bit. Our position delta is -53.23, theta is 0.78 and vega is 4.75.

These numbers are in keeping with our discussion above. Our cost is $585 to open the trade and max profit is roughly $225.

Volatility is sitting at 26.16% at the time of purchase.

Now, let’s examine what happens if the price changes.

Price declines 10% to $45.10

This is the best case for us. As you can see our profit is about $180 not taking volatility changes and time passage into account.

Let’s add a bit of both and use the date 03/05/21 and since price fell, let’s increase volatility 10%.

Now, we’re looking at a profit of $213. That is a 36.4% profit ($213 / $585) if we close out the trade.

Price is unchanged at $50.11

This is ok for us and since we have positive theta decay then we make a little profit of $12.60 at 03/19/21.

That’s ok because we close this short put and open a new one expiring in April.

The small profit reduces our cost basis from $585 to $572.40.

Price increases 10% to $55.12

This is not good for us since our contracts lost value, implied volatility moved against us and our puts are now both OTM.

Let’s use the same date as the price decline scenario of 03/05/21 and since price increased, let’s reduce volatility by 10%.

We are looking at an overall loss of $403 if we close out of the position.

We have lots of time left on the long put, so we can roll the short put up and out to a strike of $50 and an April expiration.

We are already at max loss, so rolling the short put up and out only gives us more premium and time for our trade to come back into our profit zone.

Be cautious about rolling too close to the long put strike as you could severely limit your profit potential.

Summary

The poor man’s covered put is a bearish option strategy that involves buying a long-term, in-the-money put and selling a short-term put against it.

Delta is the main driver of the trade, so we want to pick a stock that we believe will decline slightly in the future.

Poor man’s covered puts are positive vega and positive theta.

Risk is limited to the premium paid.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.