If a trader wants to initiate an at-the-money non-directional butterfly, what difference would it make if the fly had wider or narrower wings?

Contents

Well, let’s take a look at both on the SPX index.

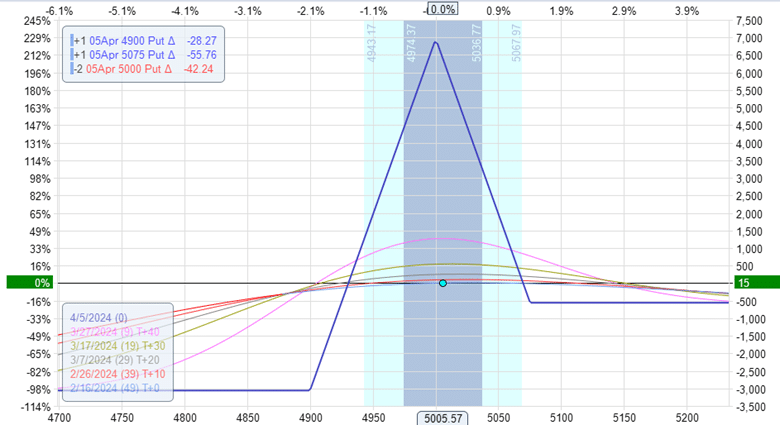

The Wider Fly

First, consider a wider fly with an upper wing width of 75 points and a lower wing width of 100 points.

Date: February 16, 2024

Price: SPX @ 5005

Buy one April 5 SPX 4900 put

Sell two April 5 SPX 5000 put

Buy one April 5 SPX 5075 put

Debit: -$560

The max risk is $3060, and the theoretical max profit is about $7000, as shown in the payoff graph below.

This gives a reward-to-risk of 2.3.

The Greeks are:

Delta: 0.52

Gamma: -0.03

Theta: 7.35

Vega: -93.42

Theta/Delta: 14.2

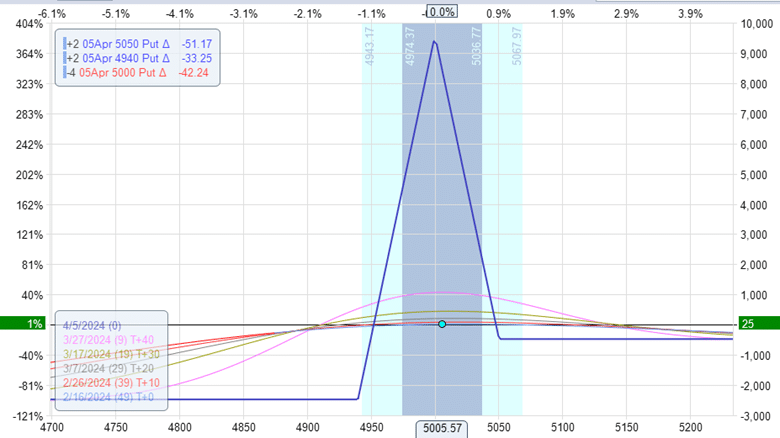

The Narrower Fly

Now consider a narrower fly with 50/60 upper and lower wing widths.

Date: February 16, 2024

Price: SPX @ $5005

Buy two April 5 SPX 4940 put

Sell four April 5 SPX 5000 put

Buy two April 5 SPX 5050 put

Debit: -$480

We are using two contracts here to get the capital usage of the narrow fly to be almost comparable to the capital usage of the wide fly.

While the reward-to-risk ratio and the ratio between the Greeks will not change based on the number of contracts, the absolute value of the Greeks is cumulative depending on the number of contracts.

This will make it a fairer comparison.

With two contracts, the max risk of the narrow fly is $2475, and the max reward is $9400 – about a 3.8 reward-to-risk:

Delta: 0.46

Gamma: -0.02

Theta: 5.51

Vega: -77.86

Theta/Delta: 12

The Comparison

The narrower fly has a better reward-to-risk ratio.

The wider fly has a higher theta, resulting in a bigger theta-to-delta ratio – both of which we want.

With greater theta, we also get larger gamma (which we don’t want).

The expiration break-even points are closer (or narrower) in the narrow fly.

The graph of the narrow fly shows that they are at $4950 and $5050.

These are the prices at which the expiration graph crosses the zero-profit horizontal axis.

That means the trade should be profitable if SPX is between $4950 and $5050 at expiration.

Narrower break-even points mean a narrower range of profitability.

The break-even points for the wide fly are roughly $4930 and $5070.

This range is wider by 40 points, giving a wider range of profitability.

Frequently Asked Question

The Narrower Fly Has Less Capital At Risk. Is This The Reason Why It Has Less Theta?

No.

In this example, two contracts for the narrow fly are still less capital than those for the single large fly.

Rightly so, the more capital that is in the trade will provide more theta (with other things being equal).

However, that is not why the narrow fly has less theta.

Looking at the narrow fly, we got 5.51 theta from $2475 capital of risk; this implies that if we have $3060 of risk as in the wide fly, then math would say that we should get 6.8 theta:

$3060 x 5.51 / $2475 = 6.8

However, the empirical evidence shows that the large fly got 7.35 of theta – more than what the narrow fly would get even if we bump up the capital usage of the narrow fly to $3060.

There is something inherent about the wider fly that gives it more theta.

Why Do Narrow Flies Have Less Theta Than Wider Flies?

The narrow flies have the long options closer to the short options.

It is the short options that are giving us positive theta.

The long options have negative theta.

The closer the long options are to the short options, the more the long options negate the positive theta effects of the short options.

If we didn’t have the long options, we would have a straddle that would give us more theta than a butterfly at the same strike and expiration.

Conclusion

On a per-contract basis, wider flies use more capital at risk than narrow flies.

One can think of straddles as infinitely wide butterflies.

They have unlimited risk.

Because straddles are only short options unhedged by any long options, they can generate large amounts of theta.

This is also why wider flies can generate more theta than narrower flies because their long options don’t hedge their short options as much as the narrow flies.

Narrow flies look skinnier in the graphs and have a higher reward-to-risk ratio. But that also means they have a lower probability of profit due to narrower expiration break-even points.

There are pros and cons to wide and narrow flies. Hope this article gives you a sense of the characteristics of the two so you can pick something in between.

We hope you enjoyed this article on the difference between wide vs narrow butterflies.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.