Contents

In the previous article, we discussed why some prefer to trade the Rhino broken wing butterfly on the SPX instead of trading it on the RUT as originally designed.

Today, we will show you how the Rhino can be traded on the SPX (with some modifications).

The first modification is wing widths.

The RUT Rhino has a 40-point upper wing and a 50-point lower wing.

We say it has a wing size of 40/50.

Because SPX is roughly twice as large as the RUT, we will double the wing widths so that a typical SPX Rhino is 80/100.

The upper wing, 80 points on SPX, is always the narrower wing for these butterflies.

With SPX around 4200 and RUT around 1800, the ratio is 2.3, close enough to about twice the size.

Having 100 points as a base is a good round number for placing option legs on large round-number liquid strikes (and for easier mental math).

In his presentation, options trader Bruno Voisin trades the SPX with the following wing widths.

During high VIX, he uses larger wing size 100/125

During normal mid-VIX, he uses 75/100

During low VIX, 50/75

Because he trades in large sizes and requires greater liquidity, he uses quarter strikes, which is why his wing widths are constrained to quarters.

But others who are not so constrained can be more flexible in the wing widths.

As Bruno said, you generally don’t want the ratio of your wing width to be too much greater than 1.2.

This way, the two wings of the butterfly act as better hedges to each other.

For example, having a lower wing of 100 points and an upper wing of 80 would be a fine ratio of 1.25.

We can make the fly slightly larger or smaller without issues.

The choice depends a bit on the volatility of the market and the capital you want to use.

Larger flies will use more capital but will be more stable if the market makes large moves.

When constructing the initial butterfly, adjust the upper wing narrower or wider so that the position delta of the butterfly is close to zero or just slightly negative.

For our example, we will use an 80/100 wing width.

First, familiarize yourself with the Rhino strategy with this article, and we will dive right into an example of how to trade the Rhino on SPX.

SPX Rhino Example

Date: September 08, 2023

Price: SPX @ 4457

Buy two November 30 SPX 4460 put @ $80.11

Sell four November 30 SPX 4380 put @ $59.72

Buy two November 30 SPX 4280 put @ $42.18

Net debit: -$570

Like the RUT Rhino, the SPX Rhino is started 10 to 12 weeks before expiration.

In our case, we have 83 days till expiration.

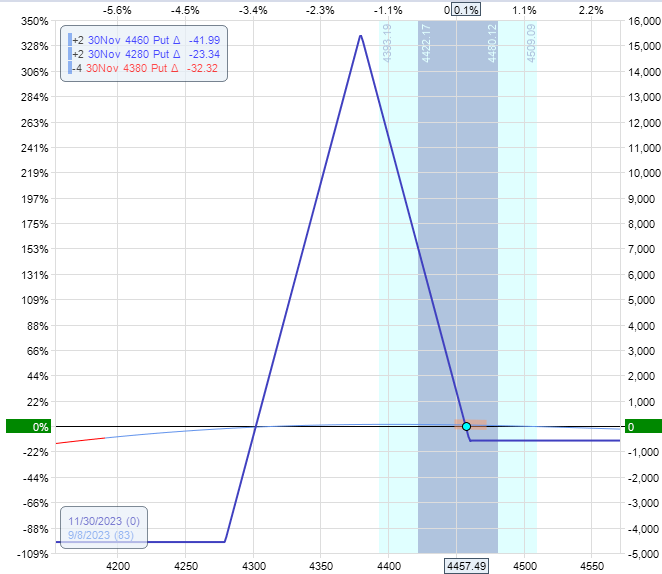

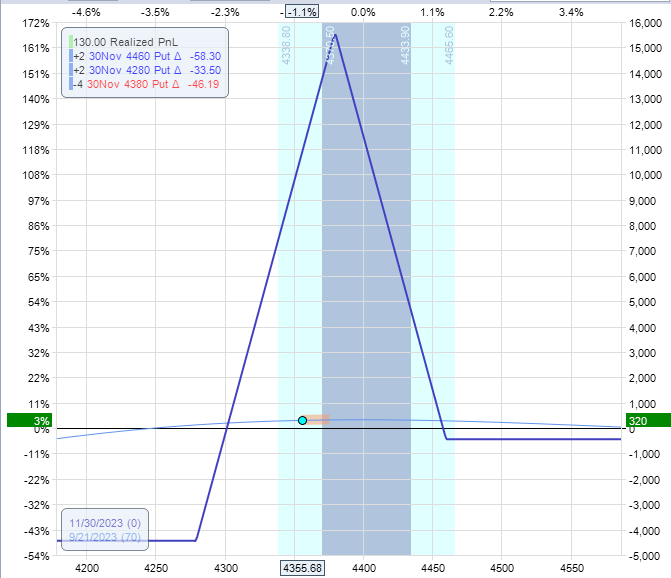

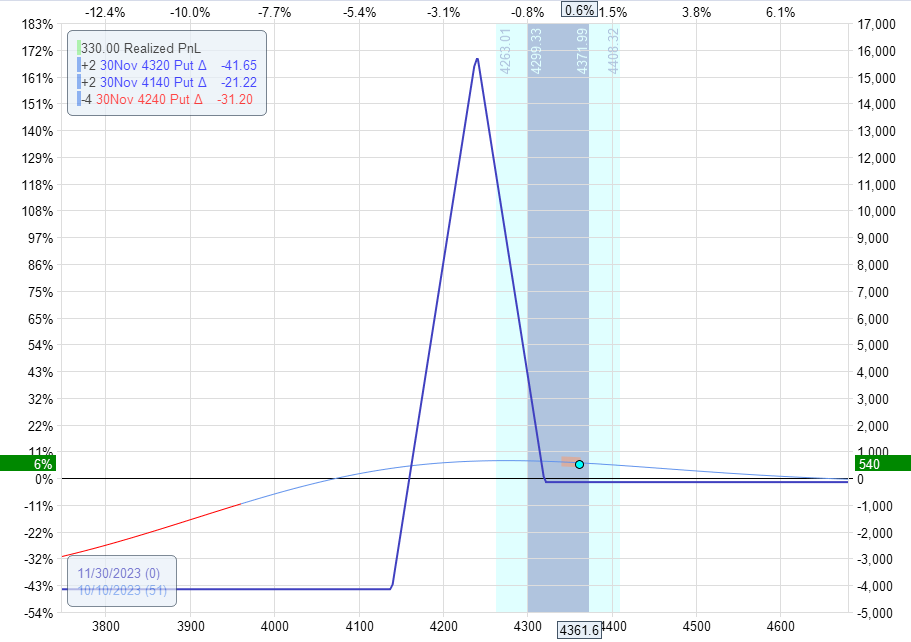

By using an all-put broken-wing-butterfly, the starting configuration looks like this:

We want the price to be in the general area of the upper long put options.

The trader can slide the entire butterfly slightly higher or lower in price, and the position delta will change slightly.

The Greeks for this two-lot butterfly are:

Delta: -1

Theta: 8.7

Vega: -98

Some like to get the position delta to be slightly negative.

That way, if we have the bad luck of a big down move with increased volatility right after starting the trade, our P&L will not get hurt so badly.

This is also why the Rhinos are started far out in time.

So, during the beginning of the trade, the butterfly is very stable and can easily withstand large price moves.

Scaling In:

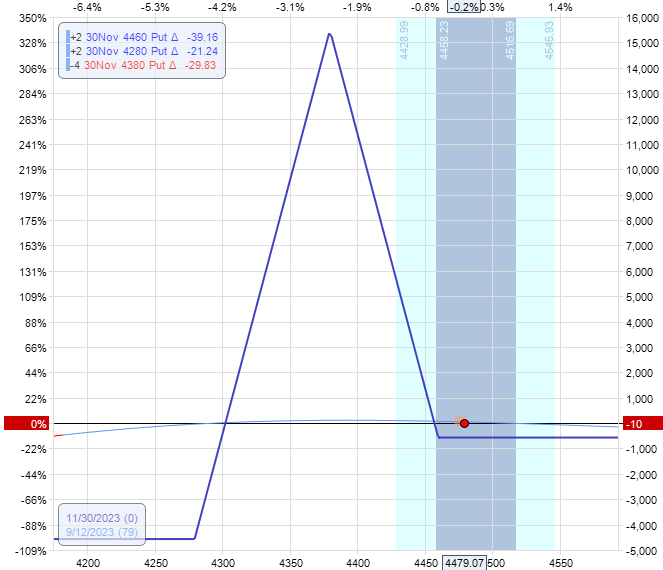

If the price strays up outside the tent, as in the case here on September 12:

We scale in by adding butterflies with the same number of contracts as the original.

Position the butterfly higher with the short options about mid-way between the original butterfly’s short options and the upper leg.

For example:

The upper leg of the original fly: 4460

The short legs of the original fly: 4380

The exact mid-point would be to position the short legs of the new fly at 4420.

But it need not be exact.

We will use the 4425 quarter strike since big players like to use these round numbers and quarter strikes for greater liquidity.

Date: September 12

Price: SPX @ 4479

Buy two November 30 SPX 4505 put @ $96.50

Sell four November 30 SPX 4425 put @ $70.98

Buy two November 30 SPX 4325 put @ $49.11

Net debit: -$730

Typically, you would use the same wing width 80/100 as long as the Greeks were acceptable. If not, traders can alter the wing width by 5 points.

Note how scaling in will get the price back inside the expiration graph tent:

Our Greeks are:

Delta: -2.45

Theta: 18

Vega: -201

A negative -2 delta for a four-lot butterfly trade is fine and not excessive.

Scaling Out

If the market then goes down, such as getting into the lower half of the butterfly, first get rid of any upside calendars (which we don’t have).

And then scale out of the second set of butterflies.

If you have multiple contracts, you can sell one or all of them depending on how it affects the delta.

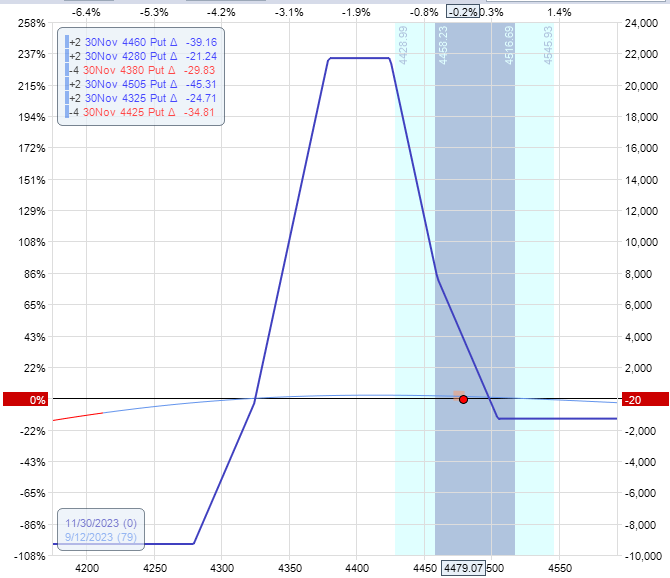

For example, on September 21, the market had dropped, and our position looks like this:

Delta: 4

Theta: 24

Vega: -328

We close the two upper butterflies by:

Date: September 21

Price: SPX @ 4355

Sell two November 30 SPX 4505 put @ $161.91

Buy four November 30 SPX 4425 put @ $119.93

Sell two November 30 SPX 4325 put @ $82.25

Credit: $860

The result improved the position delta from +4 to +1.5:

Delta: 1.5

Theta: 12

Vega: -155

We are okay for now.

Roll down:

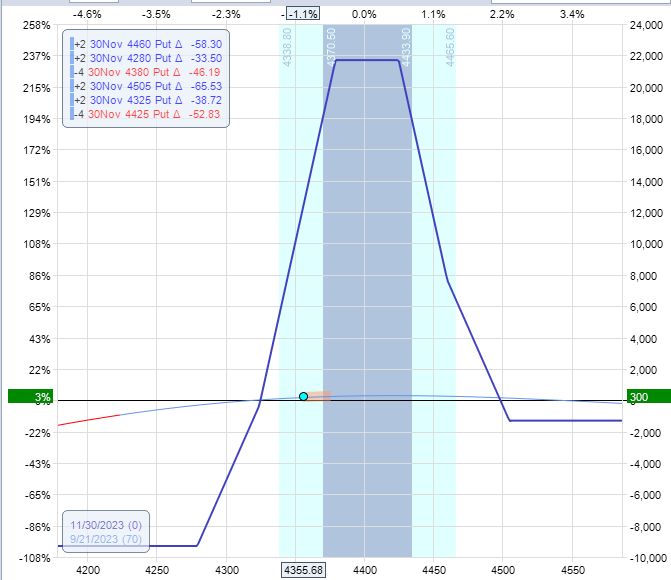

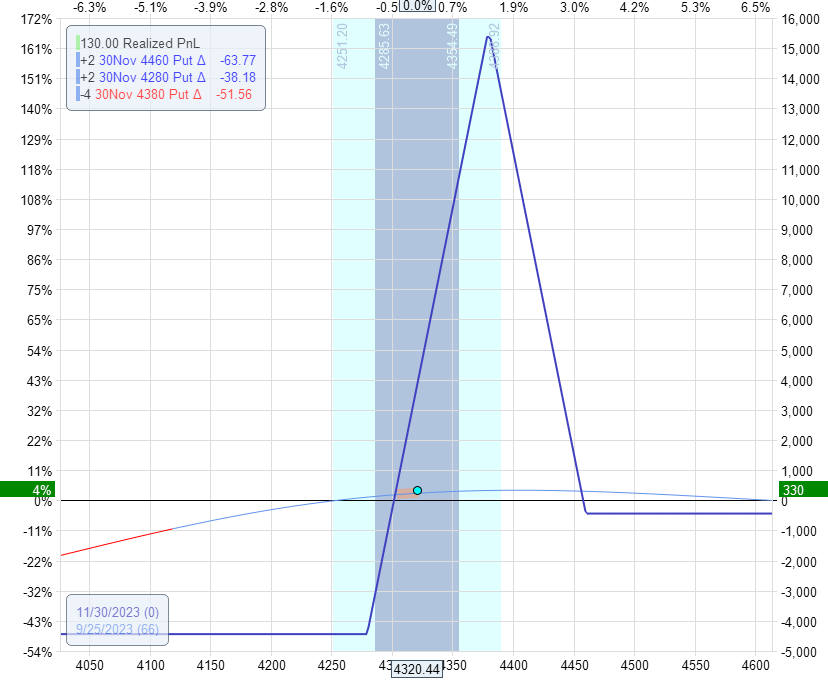

If the price goes further down, as on September 25 towards the right edge of the tent:

Delta: 2.5

Theta: 12

Vega: -158

The adjustment would be to roll the entire butterfly down by closing the existing butterfly:

Sell two November 30 SPX 4460 put @ $154.65

Buy four November 30 SPX 4380 put @ $115.09

Sell two November 30 SPX 4280 put @ $79.53

Credit $800

And opening a new one:

Buy two November 30 SPX 4320 put @ $91.83

Sell four November 30 SPX 4240 put @ $68.26

Buy two November 30 SPX 4140 put @ $47.24

Debit: -$510

We get a net credit of $290 for rolling the position down.

This is good because it means we are taking capital out of the trade.

If you compare the max risk before and after, the max risk has decreased by exactly that amount of credit.

It is not always possible to get a credit by rolling it down.

But it is more likely when the adjustment is made earlier rather than later.

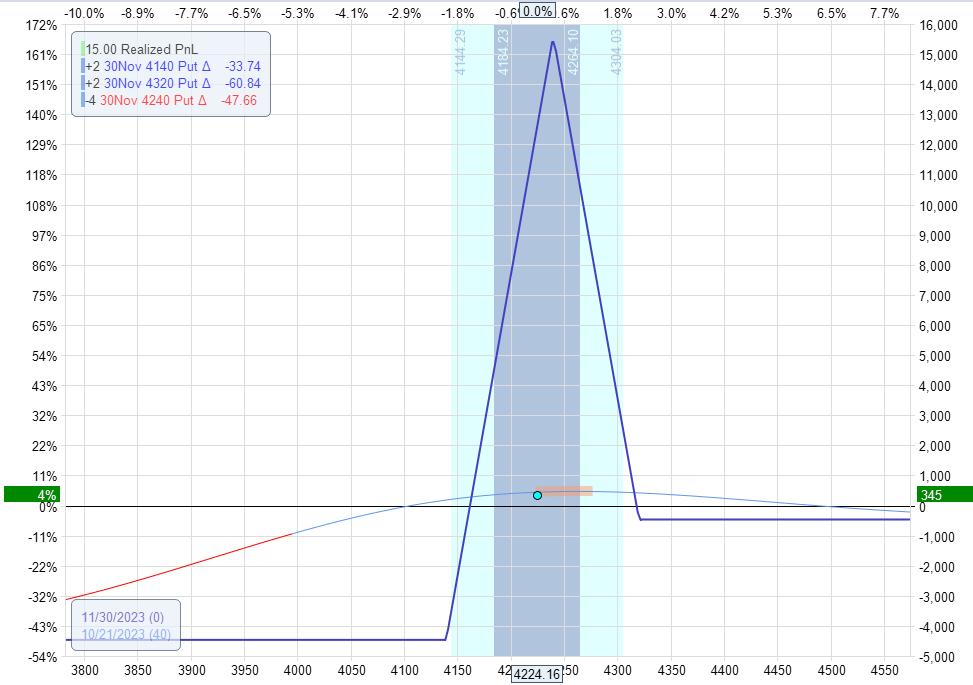

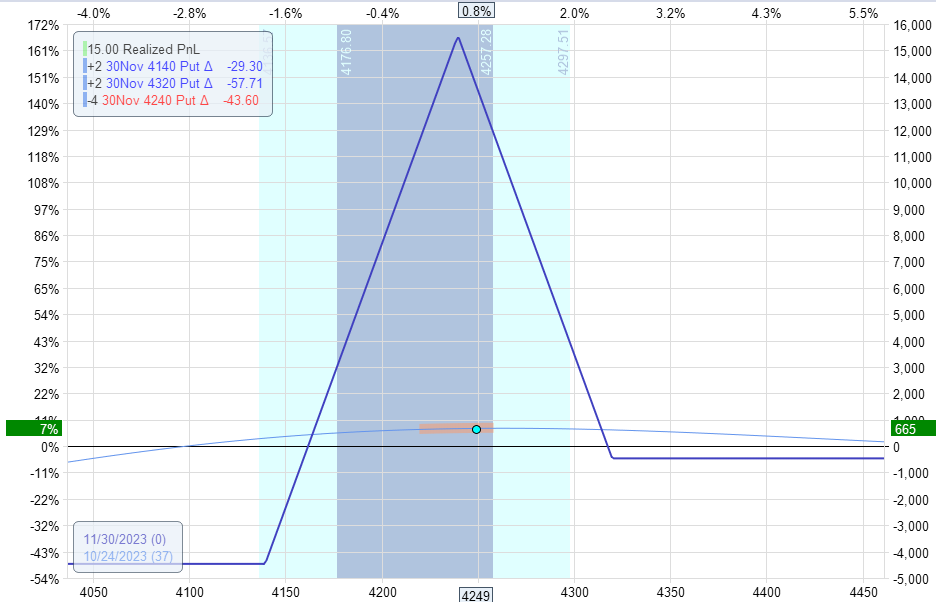

The result after the roll is that the price is in a safer position within the expiration graph:

And the position delta has improved:

Delta: -0.5

Theta: 11

Vega: -90

A bonus is that the delta is slightly negative to give protection on the downside.

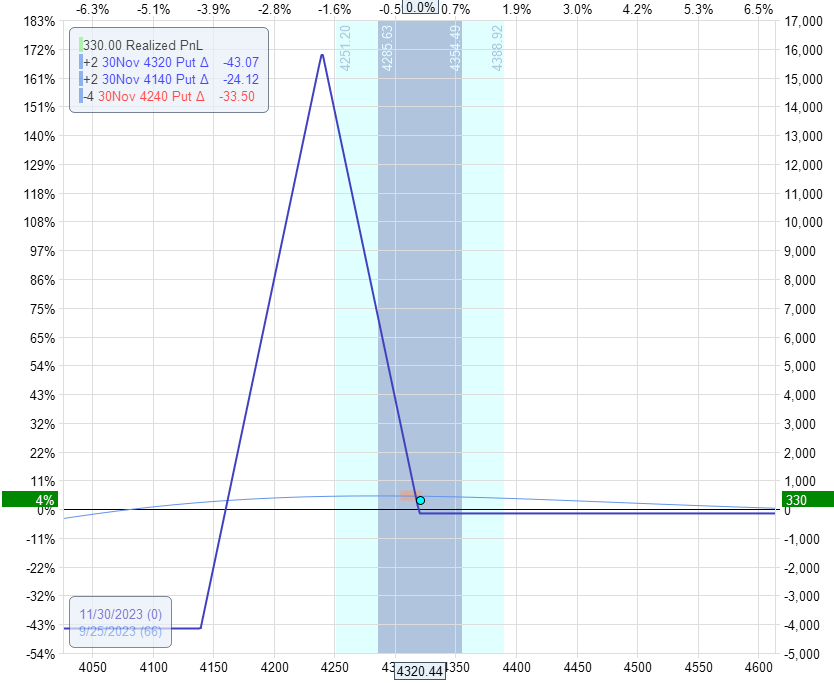

Possible Take Profit

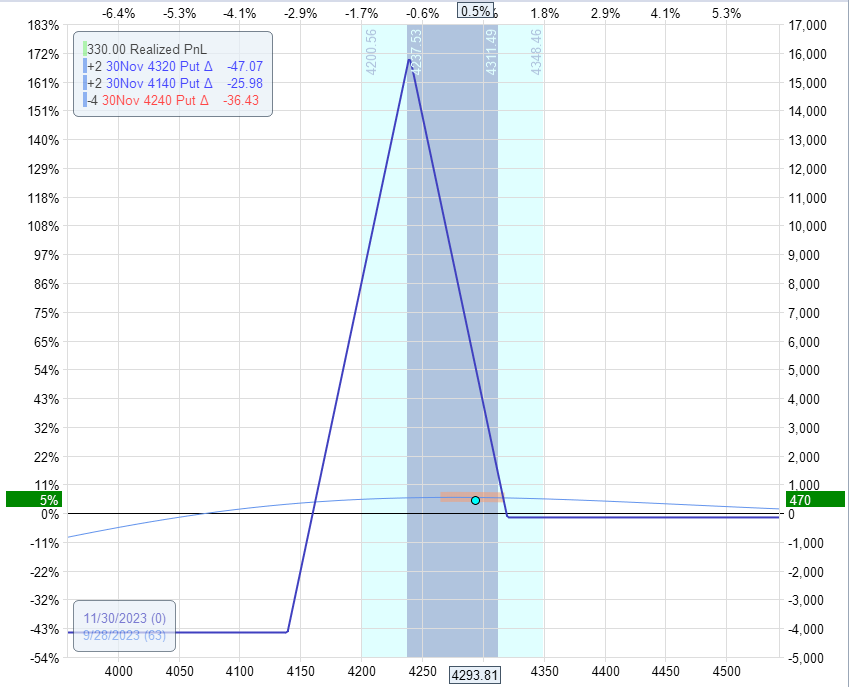

On September 29th with still 62 days till expiration, the P&L is at $470…

Some traders who are early profit-takers may decide to take a profit at this point because the max risk on the current trade is $4150 (as seen on the above expiration graph), and a $470 would represent more than 10% return of the current capital at risk in the trade.

The closing order would be as follows:

Sell two November 30 SPX 4320 put @ $87.83

Buy four November 30 SPX 4240 put @ $63.56

Sell two November 30 SPX 4140 put @ $42.39

Credit: $620

However, it is more commonly accepted that the P&L percentage be based on the max-margin used in the trade.

Recall that we had scaled into a 4-lot butterfly with a max capital usage of $9300 at one time in the trade.

OptionNet Explorer (depending on your settings) uses this methodology, and the percentage return on max margin used would only be 5% = $470 / $9300 – as seen in the above screenshot.

The rules of the Rhino aim for a target profit of 10% of planned capital.

This is yet another way to compute the profit percentage.

Planned capital (as opposed to max margin) is the amount of money set aside for the trade, including any possible adjustments (even if that money turns out to be never used).

For example, a Rhino trade can potentially be scaled in with upside calendars.

Therefore, one may need $15,000 of planned capital for an initial two-lot butterfly (as in our example). Different brokers may calculate the margin on calendars differently.

So, planned capital can differ from individual traders.

Assuming a planned capital of $15,000, the 10% profit we are shooting for is $1,500.

As per the Rhino rules, this profit target is scaled down if the profit target is not reached within a certain amount of time.

Each trader will have to determine where their own take profit point is, which calculation methodology to use, and their profit reduction plan.

For example, a trader may decide if 10% is not reached within the first half duration of the trade, then reduce the profit target to 6%.

Or they may decide if the trade has less than 35 days till expiration, reduce the profit target to 5%.

Stop Out Exit

In addition to the take-profit level, the trader needs to decide on the stop-out level.

A reasonable stop would be if the dollar amount of the loss is more than the dollar of the take-profit target, then exit the trade entirely.

We don’t want our losses to greatly exceed our wins.

Timed Exit

The Rhino is not meant to be held to expiration because as it approaches expiration, gamma risk increases, and price swings in the SPX can more easily take away profits and turn the trade’s P&L negative.

Because one of the primary goals of this conservative Rhino strategy is capital preservation, a reasonable timed exit would be to exit around 21 days to expiration if neither the take profit nor the stop loss has been reached.

But of course, each individual trader would have to decide when this is, depending on risk tolerance and how comfortable the trader is going close to expiration.

Suppose we decided to continue with the trade because we have not yet reached the 10% profit target nor the max margin.

And we still have 62 days till expiration.

Upside Calendars

On October 10, the market had moved up past the upper edge of the graph:

While we only have the original 2-lot butterfly, we do not scale up now because we have already scaled up once and made several adjustments.

We only scale up in the Rhino early in trade when we have many days to expire.

There are now only 50 days to expiration.

We don’t scale in if we have already scaled in once before.

And we don’t scale in after a rollback. In other words, we don’t scale in if we have made any prior adjustments.

To perform an upside adjustment now, we would add a calendar.

The short option of the calendar always has the same expiry as the butterfly.

The long option of the calendar is typically one week later.

Or it can be the next available expiry after the short expiry.

The number of calendars used is typically half the number of butterflies in play.

You have to look at the position delta of the entire trade and adjust the number of calendar contracts to get the position delta close to zero.

Date: October 10

Sell one November 30 SPX 4400 call @ $86.85

Buy one December 15 SPX 4400 call @ $105.65

Debit: -$1880

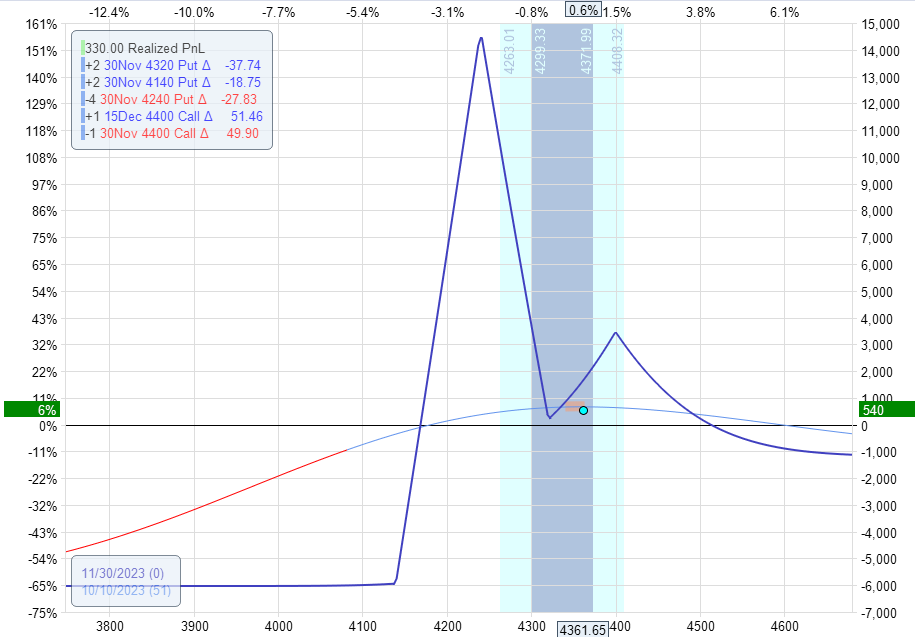

The resulting graph looks beautiful:

The pointed expiration graph tent of the calendar is the characteristic mark that gave the name for this trade, the Rhino.

The Greeks look just as good:

Delta: -0.12

Theta: 23

Vega: 16

We want the price to stay between the peaks of the butterfly and the calendar.

If the price goes above the peak of the calendar, we roll the calendar up.

It is possible to roll the calendar up multiple times.

However, if it gets too far away from the butterfly, the butterfly portion of the trade may become negative theta. It is not good when that happens, and you need to do something.

Exiting the trade is one possibility.

If the price goes below the shorts of the butterfly, we need to exit the calendar.

Removing Calendar

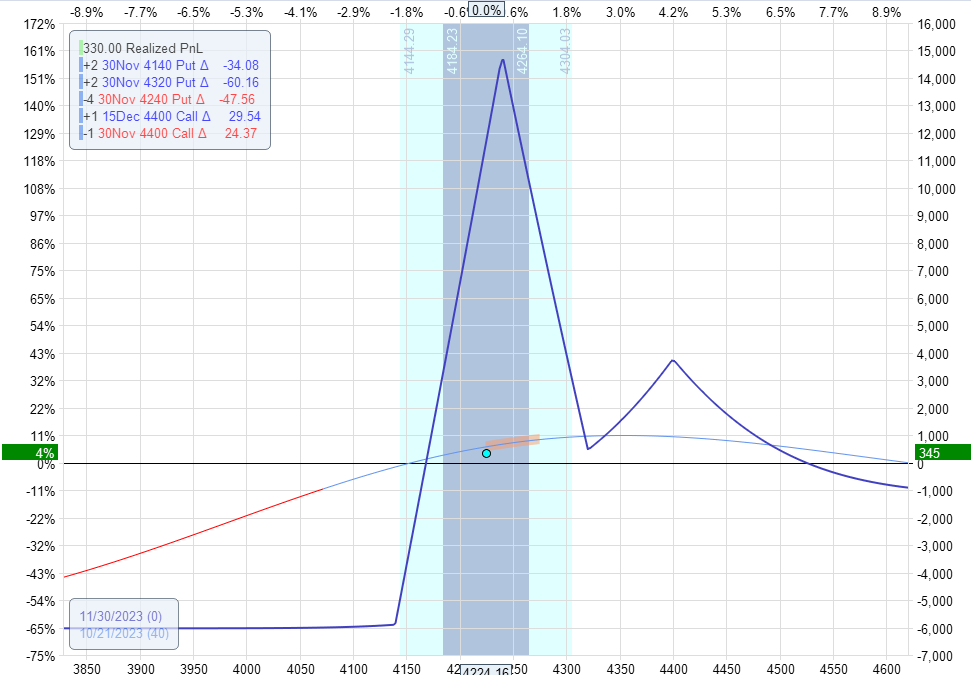

And that was what happened on October 20.

That day was the third consecutive down day in SPX, which brought it down to 4224 near the close.

We see that the price is below the short strikes of the butterfly:

The Greeks are:

Delta: 6.5

Theta: 26

Vega: -7

We have to take off the upper calendar:

Date: October 20

Buy one November 30 SPX 4400 call @ $29.10

Sell one December 15 SPX 4400 call @ $44.75

Credit: $1565

Now, the delta is closer to zero.

Delta: 1.4

Theta: 25

Vega: -134

October 24 – Near Profit Target

On October 24, the price was sitting perfectly on top of the ball with a 7% profit.

Some might want to take the trade-off now and lock in the profit.

Or one can take one of the butterflies off and leave the other half to continue.

With 46 days to expiration, the trade was almost half-way through the duration mark on this original 82 DTE (days to expiration) trade.

But it is not quite to the point where we would normally reduce our profit target yet.

And since it is not quite at the 10% profit target, let’s continue and see what happens.

October 26 – Exit Trade

On October 26, with 35 days left till expiration, the price decided to go outside the tent on the downside.

This is not good, and our profit fell down to only 5%.

We need to do something.

We can not leave the trade like this because the next day can be another down day that might take our entire profits away.

Rolling the entire butterfly down is the standard Rhino adjustment for this situation.

This requires closing all the existing butterflies and re-positioning them lower in price.

We’ve been in this trade for 53 days.

But since we are more than halfway through the current trade, it is reasonable to reduce our profit target and just conclude this Rhino trade with a net profit of $475, or a 5% return on the max margin used in the trade.

We could reuse the capital for a new Rhino at 70 to 90 days out.

Conclusion

The Rhino broken wing butterfly strategy revolves around understanding the various concepts and adjustment techniques.

The exact details are left to the trader to develop.

Two different traders can adapt the strategy to their own style and have planned out different rules, yet both can be profitable.

This is why the Rhino, which was designed on the RUT, can be successfully adapted for the SPX and potentially even other high-price tech stocks.

We hope you enjoyed this article on the rhino broken wing butterfly.

Will you try it on SPX?

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Is there any reason besides upward drift that I don’t see any examples of anyone trading this from the call side? What about having a call bwb and a put bwb running together? Alot to manage but seems like alot of opportunity to profit and might actually end up with less of the hedging shenanigans.

I don’t think it would work as well on the call side. The skew is working for you to some extent on the puts. In theory, maybe it works, but I’ve never tested it.

The calendar spread have the same expiration? Something doesn’t add up…

Typo. Fixed now, thanks for letting me know.