Contents

If you answer that credit spreads have positive theta, that is only partially correct.

It depends on whether it is a put credit spread or call credit spread and whether the spread is in the money or out of the money.

Let me explain.

If you are thinking of a typical bull put credit spread that is out of the money, as is typical of one side of an iron condor, then yes, theta is positive.

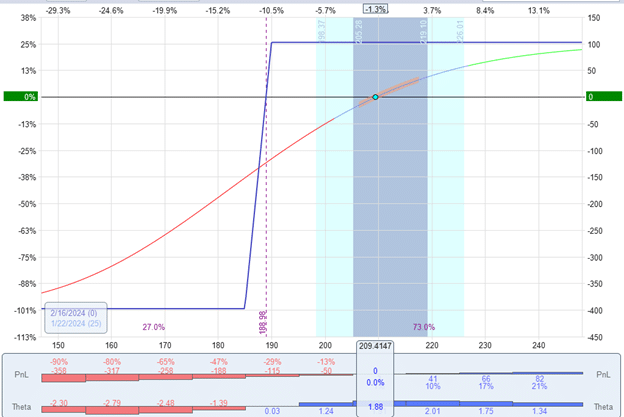

Here is an example of a theta-positive bull put credit spread on Tesla (TSLA):

Date: Jan 22, 2024

Price: TSLA @ $209.41

Sell one Feb 16 TSLA $190 put @ $4.05

Buy one Feb 16 TSLA $185 put @ $3.03

Credit: $103

The Greeks of the trade are:

Delta: 4.62

Theta: 1.88

Vega: -2.14

I have turned on the display of the theta histogram in the modeling software OptionNet Explorer.

We see that the underlying price is at $209.41, which is above the blue theta histogram with theta of positive 1.88.

So we have theta working in our favor as time passes.

Theoretically speaking, the trade should increase its profits by $1.88 per day if nothing else changes in the trade.

Of course, everything changes.

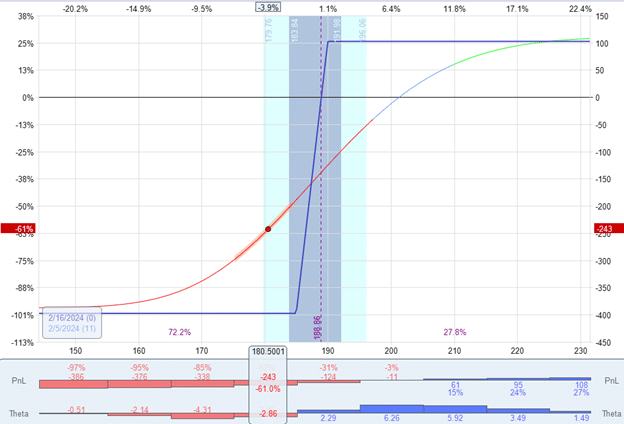

Let’s see what happens if the price of TSLA goes down to $180.50, as it did on February 5th, 2024:

The theta has become negative at -2.86.

The price is now over the red theta histogram.

Now, the trade is losing $2.86 per day if nothing else changes.

The other Greeks of the trade are:

Delta: 11.52

Theta: -2.86

Vega: 1.44

If the price continues down, the trade will lose money due to the delta and theta.

When Do Credit Spreads Become Theta Negative?

At the start of the trade, the credit spread was “out-of-the-money.”

For put options, it means that the strikes of the options ($190 and $185) are below the current price of the underlying ($209).

The credit spread will become negative theta when the spread goes “in the money.”

For put options, “in the money” means that the strikes of the options ($190 and $185) are above the price of the underlying (which is now at $180 in the second picture).

What About Debit Spreads?

A credit spread has an equivalent debit spread.

And vice versa.

The TSLA put credit spread above behaves just like the following call debit spread:

Sell one Feb 16 TSLA $190 call

Buy one Feb 16 TSLA $185 call

This debit spread uses call options.

For call options, the spread is “out of the money” when the strikes are below the current price.

Therefore, since credit spreads can be positive or negative theta, debit spreads can also be positive or negative.

When a credit spread has a negative theta, the equivalent debit spread will also have negative theta.

They are equivalent.

Conclusion

It is not true that credit spreads are always positive theta.

It can easily become negative theta.

And we don’t want that to happen.

Credit spreads are theta-positive if they are out of the money and theta-negative if they are in the money.

Most income traders sell credit spreads to get positive theta.

That is the reason why most credit spreads are initiated out-of-the-money.

Debit spreads are different.

They are theta negative if they are out of the money and theta positive if they are in the money.

We hope you enjoyed this article on the theta of a credit spread.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.