Butterflies come in all sizes, wide or narrow. Today, we’re looking at a specific butterfly setup known as “thinning the butterfly”.

It is possible to adjust a wide butterfly into a more narrow butterfly mid-trade.

Some will call this thinning a butterfly for lack of a better term.

Others may call it “harvesting.”

When and why might one want to do this?

Here is an example.

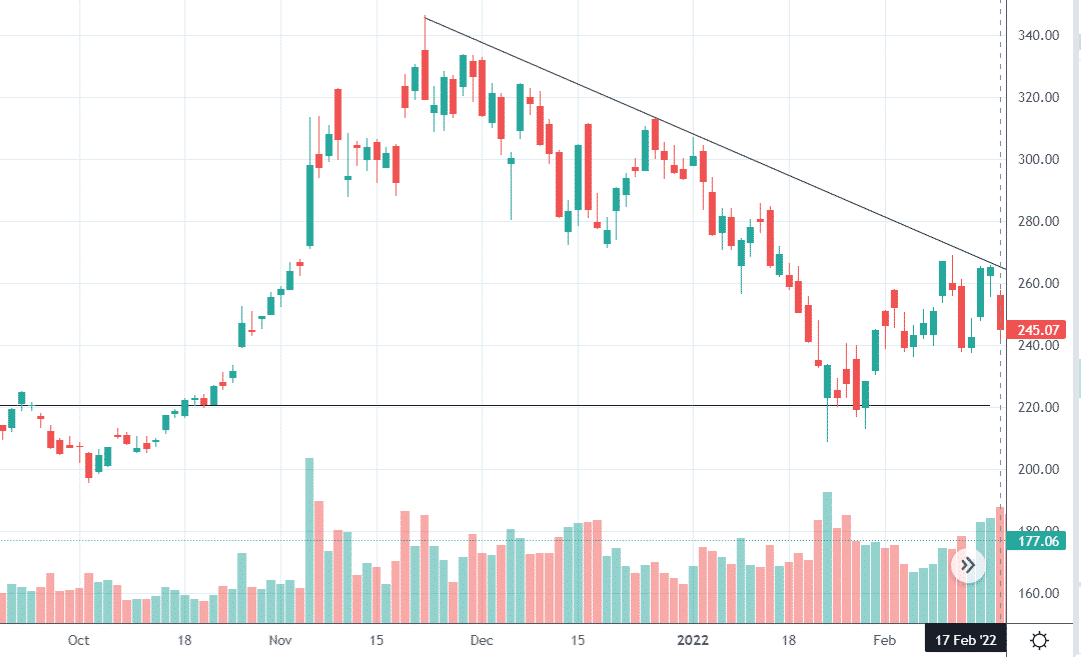

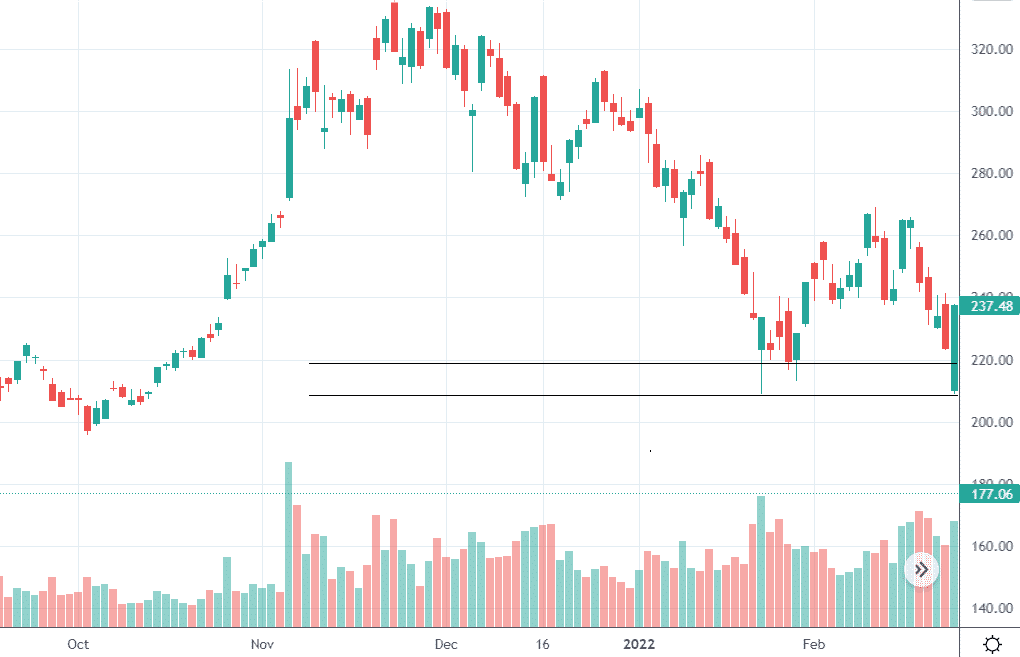

In February 2022, Nvidia (NVDA) is in a downtrend, and the investor believes it will go back down to its support level of $220.

source: tradingview.com

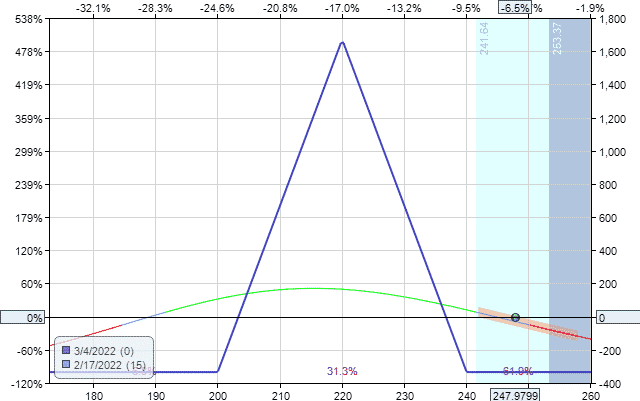

The investor puts on a wide butterfly with short strikes centered at $220.

Butterfly Setup

Date: Feb 17, 2022

Price: NVDA @ $248

Buy one Mar 4 NVDA $200 put @ $1.12

Sell two Mar 4 NVDA $220 put @ $3.30

Buy one Mar 4 NVDA $240 put @ $8.83

Debit: –$334.50

The payoff graph at the start of the trade looks like this.

source: OptionNet Explorer

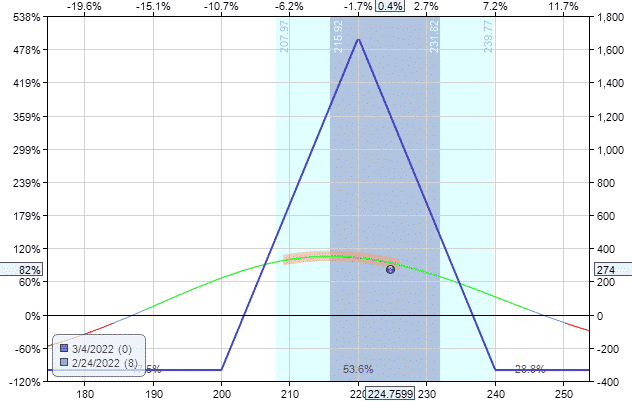

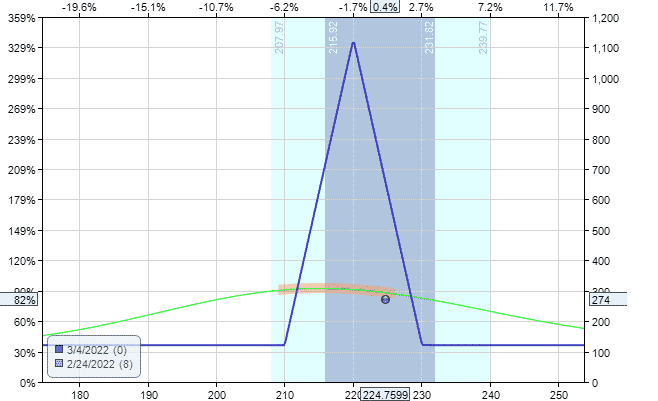

One week later, on February 24, it looked like this.

The price landed in the center of the butterfly when the price came back to the $215/$220 support zone.

The current P&L is $274, or an 82% return on invested capital.

The investor wants to stay in longer to see if more profits can be squeezed out.

But they don’t want to risk everything if the price makes a big move out of the payoff graph tent.

It is a good time to take some profits.

Half of them could be closed if there were more than one butterfly.

However, since there was only one butterfly in the trade, we needed to harvest profits out of this one butterfly without closing it completely.

The adjustment that can be made is to “thin” the butterfly by moving both long legs closer to the center of the butterfly.

Trade Details

Date: Feb 24, 2022

Sell to close Mar 4 NVDA $200 put @ $2.46

Buy to open Mar 4 NVDA $210 put @ $4.38

Sell to close Mar 4 NVDA $240 put @ $18.58

Buy to open Mar 4 NVDA $230 put @ $12.10

Net Credit: $455.50

By rolling the long strikes 10 points in, we collect a credit of $455.50.

Note that this amount is greater than the amount initially paid for the butterfly by $121.

Hence, the resulting payoff graph is above zero.

Even if the price goes outside the tent, we still will make at least $121 profit from the trade.

On the morning of expiration day on March 4, the P&L reached $384, and the trade could have been taken off before expiration.

Conclusion

If you see the price come into the middle of your butterfly tent, you can lock in some profit by thinning your butterfly.

Thinning the butterfly enables you to stay with the trade longer for more theta decay and the possibility of even greater profits.

By harvesting profits out of the butterfly, you reduce the max risk in the trade.

If the adjustment generates a credit greater than the debit paid for the butterfly, you will have a risk-less trade.

Note that this only applies to symmetrically balanced butterflies.

Because these are the only ones where the debit paid is your max risk.

It only works if you start out with a wide butterfly.

If your butterfly is too thin to begin with, there will not be enough meat on it to harvest.

We hope you learned something from this specific butterfly setup article, and if you have any questions, please send us an email or post a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thanks for this Valuable Wide Butterfly Setup. I just paid for a B’fly course using a Narrow Wing B’fly that’s very hard to enter for a Credit with NO RISK. We need to TALK.