Seasonality is a phenomenon in trading where certain times of the year seem to correlate with specific moves in some securities.

Some well-known examples include the winter energy trade, where traders look to capitalize on higher demand for energy for heating in the winter, and the Santa Claus Rally, which sees strong market surges heading into Christmas.

There are several potential strategies that traders can look to implement throughout the year to capitalize on these correlations.

Still, it requires understanding historical price movements and actively monitoring market conditions to see if seasonal movements will happen.

A trader can boost their yearly returns by monitoring market action and looking for these correlations.

Contents

What Is Market Seasonality?

First, let’s look at what seasonality is: Market Seasonality is characterized by a predictable pattern or trend that occurs at specific times throughout the calendar year.

These recurring trends can be influenced by different factors such as economic cycles, investor behavior, seasonal events, and even weather conditions and patterns.

Now that we have a basic understanding of what a seasonal trade might look like and the factors behind it let’s look at a few examples.

The Energy Trade

The first trade we will look at is the Winter energy trade.

During winter in the Northern Hemisphere, the energy demand is typically higher as people need to heat their homes to fend off the colder weather.

It is an example of both a seasonal and weather-based trade.

Many traders will start looking at long-term forecasts in June and July to try and gauge whether a colder or warmer winter is expected and trade accordingly.

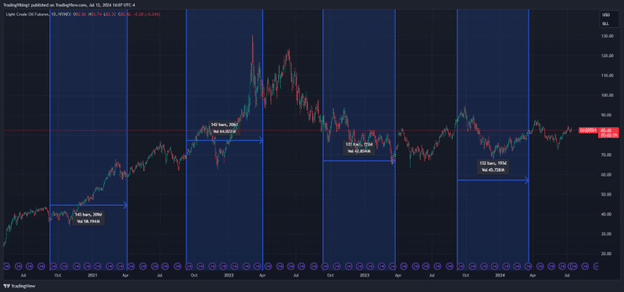

Above is an example of common energy trade timeframes, usually from September to March.

As you can see, this is not a foolproof trade and is largely impacted by the weather, as the two most recent winters were milder than normal.

Other factors impacting this trade are geopolitics, domestic oil production, and new green energy infrastructure.

Summer Trading

Another seasonal trading regime is summer trading.

This is often a time of significantly lower volatility, especially in futures markets and large-cap stocks. This is often attributed to the “Sell in May and Go Away” philosophy.

The theory here is that many large banks and trading desks see many traders on vacation, causing lower trading volumes.

This might not be the case with the rise of automated trading, but there is a definite slowdown in the summer months.

The Santa Claus Rally

The last and perhaps best-known seasonal trade is the Santa Claus rally, the notion that stocks rally during December heading into Christmas.

This is the most repeated seasonal trading event, but it has the least data backing it up.

As you can see by the chart below, it appears to not be the case that every December has a rally.

If you plan on trading this, it would be best to do so selectively.

How To Implement A Seasonality Trading Strategy

As you can see above, seasonal strategies are far from foolproof, but knowing they exist can be another way to look for potential trades.

These trades can be done simply by holding the security that you are trading, so for the Winter trade above, you could buy an Oil contract, which would be expensive, or you could simply buy and hold oil stocks.

This could sometimes work for some of the instruments, but these trades are where options shine.

The same trade we just discussed could be done with options in several different ways.

First, you could just long a call and wait and see if the weather and seasonal factors cooperate and oil increases, but this still requires you to be correct in the magnitude and timing of the trade.

Spreads would be a better choice here; credit or debit verticals and ratio trades such as backspreads could work.

These types of spreads can be very lucrative on futures, and since there is already a time component in the trade, the seasons change, so you know what strike and contract you should be looking at.

These spreads would also work well for the Santa Claus rally because you are looking for a directional move with a fixed end date.

One of the best parts of using spreads is clearly defined risk, so if this is a year that the trade doesn’t work, you are not exposed to more downsides than you are comfortable with.

It also could allow you to make money as long as stocks don’t fall.

The last example would be for summer trading.

Vertical spreads, condors, and butterflies can work well for sideways action.

Look to identify a range and ensure the contracts expire before September starts.

Weeklies could also be very effective to avoid being in a trade when news is pending.

Pros And Cons Of Using Seasonality

So far, we have looked at what seasonality is, some examples, how to trade it, and how to use options to benefit from it.

A lot of information has been given, so let’s look at all the pros and cons of using seasonality in trading.

The Pros:

Predictability: The seasons will always change, and holidays will always be coming around, adding predictability to the action; this can be very helpful if you use seasonality to time trades.

Adaptability and Return Potential: These trades are not a system; they are what is called a thematic trade. They trade based on a theme, and because of this, they are not made to be an instant action. This makes it perfect for many different types of trading strategies; while looking at a general theme, you can use your system inside that context.

-Simple Management: Once a seasonal pattern is identified, there is less need to monitor it, given that the trade ends when the season/holiday does.

The Cons:

Its a Theme: Just as it being a theme is a positive, it is also a negative. If you are looking for a system to execute blindly, these are not your trades. We see it as an overarching concept, which can be difficult for some investors/traders.

Correlation: Many of these trades are based on either anecdotal evidence or loose correlations at best, making it difficult for these types of trades to be consistently profitable. Because of this, it’s often best to allocate small amounts of capital to them.

Timing: Timing on these trades is also a potential issue. Let’s take summer trading for example; who is to say when summer starts? Is it Memorial Day or the summer solstice? Similar to the correlations above, it’s tough to pinpoint when to start some trades.

Conclusion

Market seasonality provides a lens through which the markets can be examined.

Several trades or times of year are anecdotally trending or slow, and this can produce potential opportunities.

By exploring these seasonal themes, traders can look for opportunities to trade in line with what is “supposed” to happen.

Whether it’s stocks, futures, or options, it doesn’t hurt to look at market seasonality.

We hope you enjoyed this article on seasonality in trading.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.