Contents

A trader adjusting a non-directional broken-wing butterfly often increases the margin or capital requirements.

Suppose it exceeds the capital allocated for the strategy.

In that case, the trader may need to perform what is known as a capital reduction adjustment to reduce the capital used in the trade.

This applies to all non-directional broken-wing butterfly trading including the Rhino, M3.4u, the A14, etc.

Let’s look at an example:

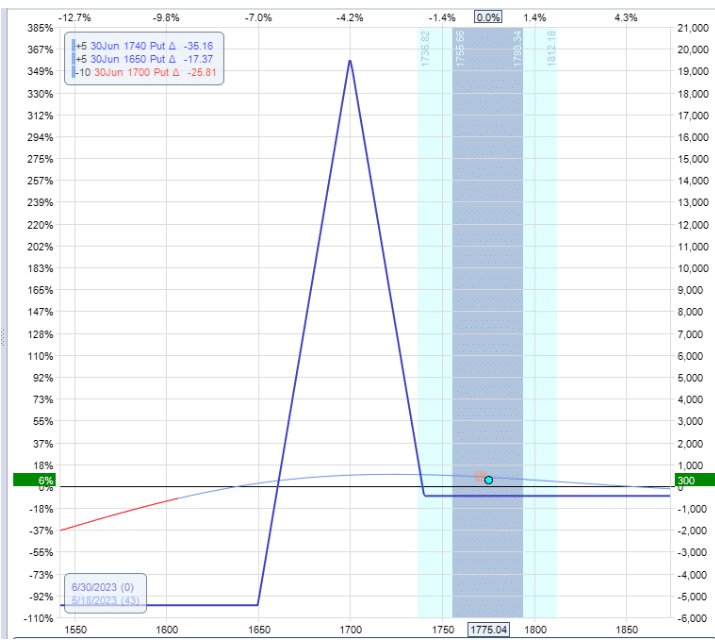

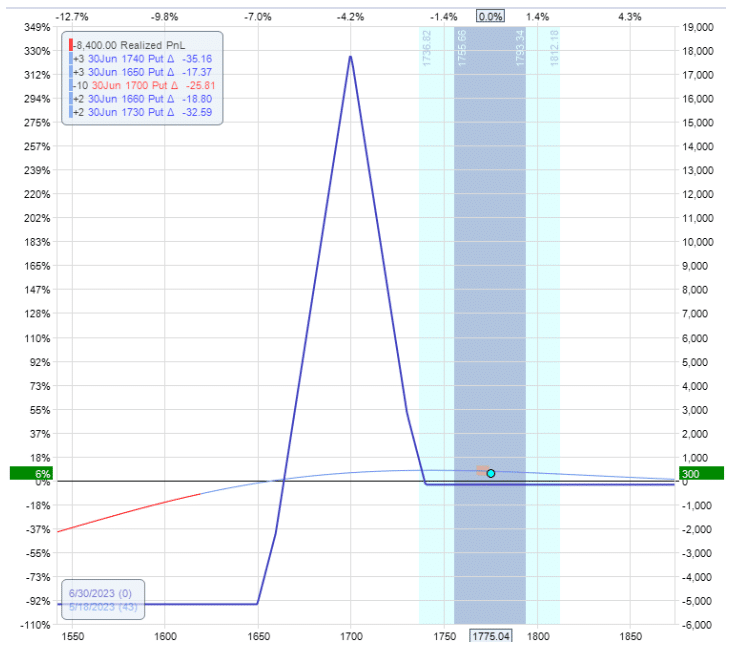

Suppose we have a butterfly like this with the price going up.

The center strike is at 1700 on the RUT (Russell 2000 index).

The upper strike is 1740, and the lower strike is 1650.

Note that the max risk in this trade is $5500, as seen from the expiration graph.

Just for reference, the Greeks are:

Delta: -5

Theta: 19

Vega: -59

If the price continues to increase, you can see from the T+0 line that we will lose some profits.

Suppose we feel this is too much negative delta and want to make the butterfly bullish by narrowing the upper wing.

This can be done in two ways:

- Roll up the short leg of the butterfly

- Roll down the upper long leg of the butterfly

We choose to do the latter in this case.

We roll the upper long leg down by selling the 1740 and buying the 1730 leg at a lower strike.

Sell two June 30 RUT 1740 put @ $32.50

Buy two June 30 RUT 1730 put @ $29.80

Net credit: $540

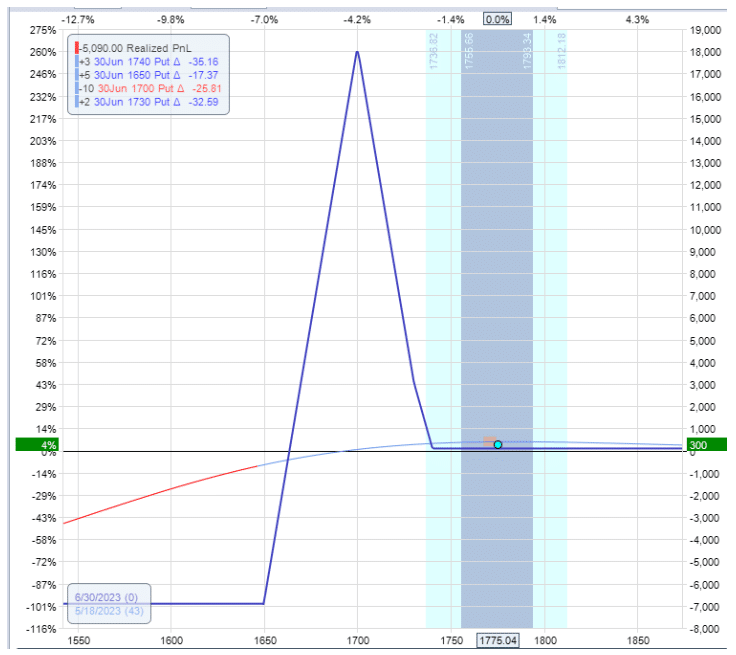

The resulting graph looks like this with a decrease in the magnitude of our delta from a five delta to something less than 1.

Delta: 0.4

Theta: 19

Vega: -72

However, as seen on the risk graph, our risk in the trade increased to $7000.

The margin or capital usage of the trade has increased.

It would not have mattered which of the two methods we had chosen to make the butterfly bullish.

In both cases, we essentially are selling a put spread.

As you may know, when you sell a put credit spread, the market gives you a credit.

You are required to accept some level of risk in return.

This is why selling a put credit spread as an adjustment increases the risk in the trade.

We increased our downside risk by selling a put spread, this raises the overall risk of the trade while also increasing the margin.

But suppose that you only have $6000 in the account, many brokers will not let you perform the adjustment, increasing the risk to more than your account can handle.

How Can We Fix This?

In that case, it is necessary to reduce the capital usage before adjusting.

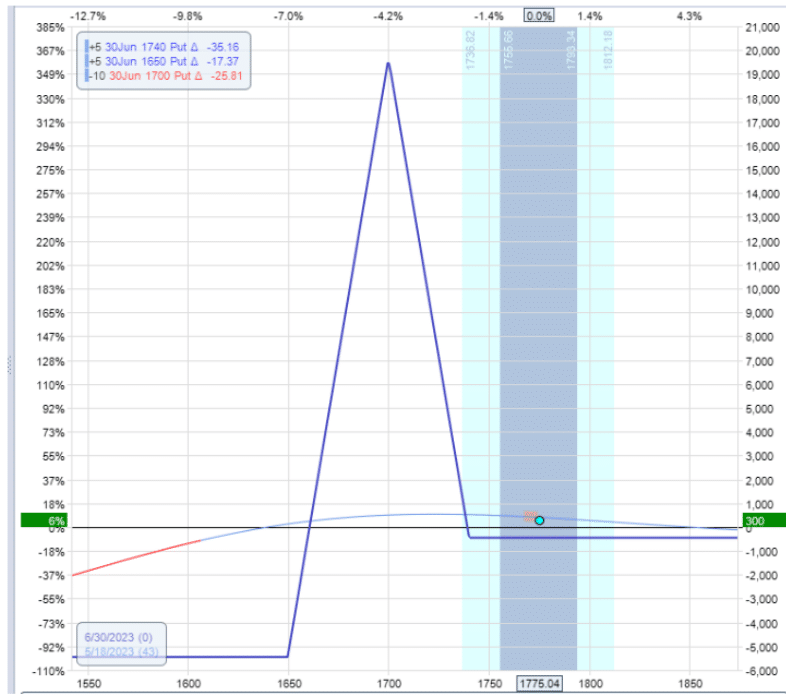

Okay, let’s go back to our original butterfly before the adjustment:

This time we first reduce the capital in the butterfly by rolling the lower leg up like this:

Buy two June 30 RUT 1660 put @ $16.05

Sell two June 30 RUT 1650 put @ $14.70

Net debit: -$270

This trade is a put debit spread because we buy and sell puts at a lower strike.

We do it in such a way as to close the lower put option.

We had a 1650 put option.

But now it is gone because we had bought to close the 1650 option when we performed the put debit spread.

The resulting graph:

Delta: -7.6

Theta: 16

Vega: -42

Note how it reduces the risk in the trade from $5500 down to $3750.

This did make our delta more negative.

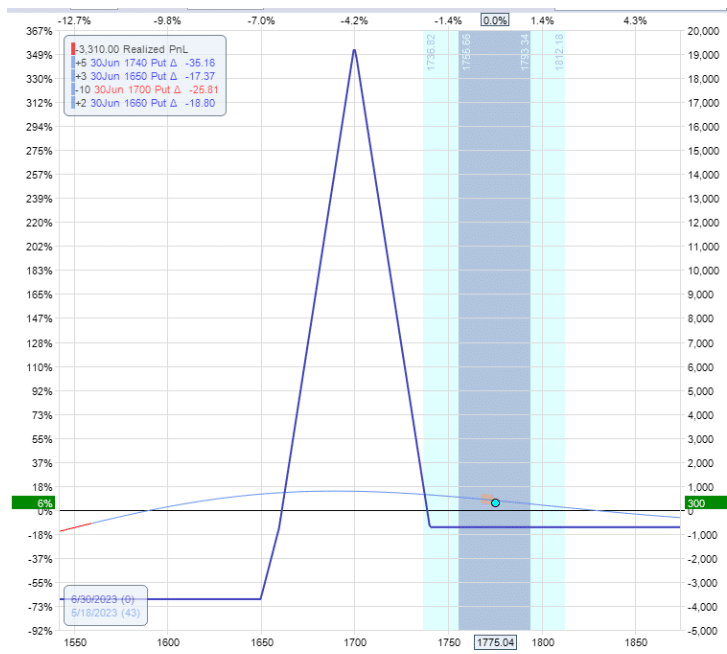

But we will fix that in the next step: perform our adjustment by rolling the upper long leg down.

Sell two June 30 RUT 1740 put @ $32.50

Buy two June 30 RUT 1730 put @ $29.80

Net credit: $540

In selling the put credit spread, we sold our existing 1740 put option and bought one lower at 1730.

This is also known as rolling the 1740 strike down to 1730.

We exchanged the 1740 put for the 1730 put because the 1740 put was more valuable than the 1730 put, and we got a credit for the exchange.

In the resulting graph, we see that we have contained our risk in the trade (or capital usage) to around $5000.

And the Greeks are:

Delta: -2.5

Theta: 16

Vega: -56

We have reduced our original delta of -5 to -2.5.

FAQs

Why do we need to perform the capital reduction adjustment before the other adjustment?

Because if you sell the put spread first, it might increase the margin to what your account allows.

If you have lots of available capital, you can adjust in either order.

Can the two orders be done as a single order?

Yes.

Alternatively, the above two transactions can be combined into one order like this:

Sell two June 30 RUT 1740 put @ $32.50

Buy two June 30 RUT 1730 put @ $29.80

Buy two June 30 RUT 1660 put @ $16.05

Sell two June 30 RUT 1650 put @ $14.70

Net credit: $270

This transaction is known as a condor adjustment.

But it is not an iron condor but an all-put condor.

What does it mean to sell a put credit spread?

It means selling a put option and buying one at a lower strike with the same expiration.

You get a credit.

What does it mean to buy a put spread?

It means to buy a put option and sell one at a lower strike with the same expiration.

You pay a debit.

Conclusion

We make a butterfly more bullish by selling a put spread on the upper wing.

We reduce capital usage by buying a put spread on the lower wing.

We do these in such a way as to close an existing strike of the butterfly.

This is the best way to remember it.

No need to understand the condor adjustment. It is the same.

We hope you enjoyed this article on reduced capital usage in butterflies.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.