Using options as a hedge is one of the most sophisticated tools in a trader’s arsenal.

They have risen in popularity recently as a trading instrument and as a way for some traders to “YOLO” into a position, hoping that the underlying stock explodes.

One of the original uses for options was indeed as a hedge.

Today, we will explore this aspect, using these versatile instruments to offset some of the potential risks inherent in market participation.

Contents

What Are Market Risks?

Before we jump into how to use options to hedge your portfolio, let’s first look at what risks exist.

Portfolio risk refers to the potential for financial losses or underperformance of an investment portfolio due to various factors.

It is fundamental in finance and investment management because all investments come with risk.

Preserving your capital should be one of the primary focuses of a long-term investor.

There are seven main types of risk, with only five relevant to most US investors.

Those seven are:

-

- Systematic Risk: Sometimes referred to as Market risk, this type of risk is associated with the overall market performance. It encompasses economic conditions, inflation, and geopolitical events that affect general prices. A great current example would be the COVID-19 Selloff. No sector was spared from it once it started.

-

- Company-Specific Risk: As the name implies, this risk is only relevant to individual names. This type of risk contains things like profitability, company moat, and public perception. This is the type of risk that is most easily diversified away and is usually done through a method called sector weighing.

-

- Currency Risk: This is one of the two types of risk that don’t apply to most investors. Currency risk is mostly relevant when you invest across country borders. To calculate your profit and loss, you will need to convert the foreign dollars into domestic dollars, which is subject to an exchange rate. Currency risk refers to the potential loss of profit due to adverse conversion rates.

-

- Credit Risk: This is the second type of risk that doesn’t apply to most investors. It is only relevant when you are a fixed-income investor. This is the risk that one of the company or country bonds you invest in could default. This is not often an issue in equities as it frequently falls under the company-specific risk category.

-

- Liquidity Risk refers to how easily you can move into or out of a security on the open market. A company is open to liquidity risk if its stock or options have wide spreads and/or low market participation rates. This is often something that is easily overcome by company selection.

-

- Interest Rate Risk: Next is interest rate risk, which is particularly important given the current Fed regime of raising rates. This refers to the risk associated with a bond or equity as rates increase or decrease. This affects borrowing at a company level, so while not all sectors are hit the same by this risk, they are somewhat affected.

-

- Event Risk: Finally, there is event risk. This is the risk of a one-off event, such as earnings or economic news, potentially impacting the price of your position. This is usually also company-specific.

Risks like these are inherent in all investments, and it is the investor’s job to strike a good balance between the risk and the potential reward.

Knowing how to effectively utilize options will help make that job easier.

How To Use Options To Hedge

One can use several strategies to hedge against investment risk, and one of the simplest and most popular is buying a put option.

A put option gives you the option but not the obligation to sell 100 shares at a predetermined price (strike) and by a predetermined time (expiration).

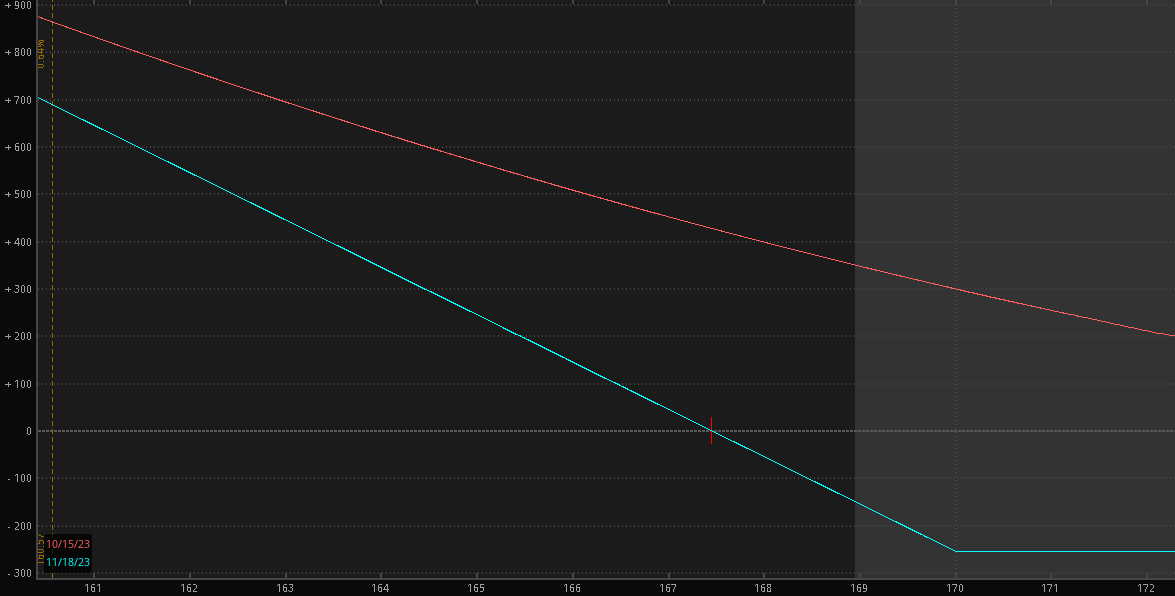

The risk profile for a purchased put is seen to the right.

In this example, the trader purchases an AAPL 170 Put.

So, as the price moves below $170, the trader’s position continues to increase.

This will allow him to do one of two things before expiration: Either exercise the option and sell his 100 shares at $170 per share or close his options position, pocket the profit, and keep the shares.

The put is a straight hedge against falling prices and is perhaps the easiest protection to purchase.

Next up is a little more complex strategy involving a put option: the cash-secured put; this is also a common income strategy, but it works very nicely as a hedge.

With a CSP, you sell a put option at a strike that you are happy owning the stock.

If, at expiration, the stock is at or below your strike, you are assigned the shares and paid the strike amount for each share.

This is a powerful hedging strategy because if you want to own a stock but are afraid of some potential risk, you will be paid to wait to purchase it at a lower price.

While it’s not a hedge in the traditional sense, it is a very effective way to help offset some of the market and company risks when purchasing.

The credit/debit spread is also a potential option strategy to help hedge your portfolio.

These spreads involve buying and selling a contract simultaneously and, based on your selection, could give you your potential profit upfront upon execution.

The strategies so far have been dynamic with the potential profit involved; this is a fixed risk/reward strategy, which means your maximum gain and loss are predetermined from the moment you execute the trade.

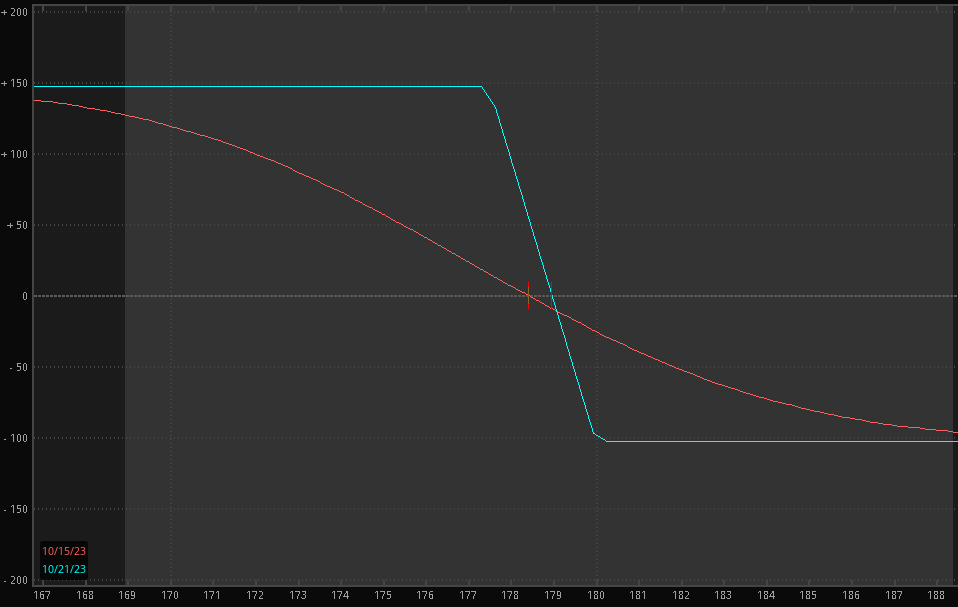

You can see an example of this here.

The trade is a Call Credit Spread on AAPL.

As the price continues to fall, you can see that your maximum profit is capped at the $150 you received when you placed the trade.

With this strategy, your shares are never at risk, but your downside protection is capped.

This is a great potential strategy if you don’t expect a lot of price movement or stock selling to be short-lived.

Other Considerations

Before you run out and just start opening puts with reckless abandon, let’s look at a few other potential factors that will impact your decision to hedge.

1. The Greeks are the other factors that go into an options price outside the underlying. They include things like the time value (theta), how much you can expect your option to move compared to the stock (delta), and how much volatility is expected in the price (implied volatility). Understanding how these interplay with your options price will affect your strike and expiration selection is especially true in the hedges that involve selling options.![]()

2. Duration: Another potentially important factor to consider is the hedge duration you are looking for. The hedge duration will directly impact your choice and the cost. If you are hedging out an event like earnings, you can choose an option that will be less expensive since your risk has an end date. If you are concerned about market risk or something larger like interest rates, then your hedge should be something that will protect you sufficiently for an extended length of time.

3. Profit Impact: Lastly, you should consider the potential impact on your future profit. Where something like a purchased put can call your shares away and remove any future profit potential on your position, a credit spread will mitigate your risk slightly but keep the underlying shares in your control. This is very similar to understanding the duration of your risk but also makes you consider the future potential of your trade.

Tying It All Together

Options are an extremely versatile tool in a trader’s arsenal, and as you can see, there are several simple ways to hedge your portfolio with them.

Whether you are looking for something simple like a purchased put or you want to get creative with a spread trade, options offer a great way to mitigate portfolio risks.

Just remember to look at the Greeks and the type of risk you are trying to hedge out before you enter your trade.

Just always remember it’s impossible to hedge against all risks all the time.

Keep your trades as simple as possible and enjoy the results of your newfound protection through options hedging.

We hope you enjoyed this article on using options as a hedge.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Question: I know this probably isn’t the most appropriate article for it, but you have mentioned in the past buying a put as a hedge for a flash crash for 5-10 lot iron condors. Do you also consider doing this when you trade a large number of bull put spreads?

Thanks.

Here are a couple of articles that might be of interest:

https://optionstradingiq.com/how-to-protect-iron-condors-from-a-flash-crash/

https://optionstradingiq.com/vix-hedge-strategy/

https://optionstradingiq.com/options-hedging-example/

https://optionstradingiq.com/buying-protective-puts/