In this Scanz review, we’ll explore one of the many trading platforms and services available.

Some are excellent, while others fall short.

Scanz bills itself as the ultimate scanner product built by traders for traders.

The question is, is a scanner worth a separate monthly subscription, or is the one on your broker good enough?

Let’s dig in and find out.

Contents

Software Features

Like many other trading platforms, Scanz software needs to be downloaded to your machine. As a result, it does not have a web-based version.

What it lacks in mobility, though, it more than makes up for in power and features.

Market Data

Scanz features real-time market data for all of the major and OTC exchanges.

While this may seem like a given, many products offer aggregated or delayed data unless you pay for the upgrade data yourself.

Scanz includes all major markets in the subscription fee., except for OTC data, which is extra.

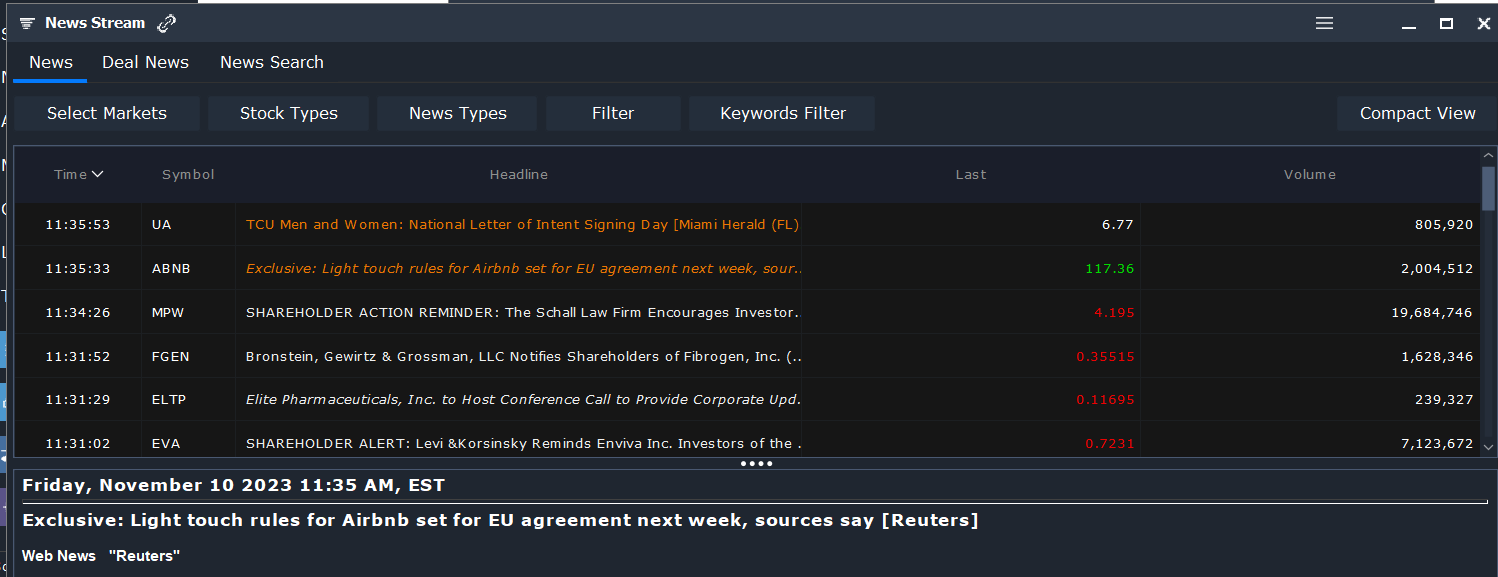

News

Another large benefit of the Scans software is the access to real-time news and alerts.

With Scanz, traders get up to the second news releases, and deal flows through the day.

All major news sites and sources are included in your subscription and accessible through the application.

It works just like the news ticker on a Bloomberg Terminal, where the news scrolls through as it comes in.

In addition to the News flow, some other things can be done with the news through Scanz.

It shows the ticker affected, the current price, and the current volume as of the moment that the news hit.

This data can also be filtered by the type of news (Deals or Headlines), filter for a specific ticker, or market.

If you are a news trader, this is one of the better news platforms out there.

Alerts

No scanning software would be complete without the ability to set alerts, and Scanz does not disappoint here.

Traders can select either a price or news-based alert through the application and how it is delivered.

Options include through the desktop app, email, or phone when the alert triggers.

While it is not particularly fancy, the functionality and customization are amazing for a trader.

Scanning

Given the name, you knew scanning would be an integral part of the application, and it is. Scanz has an incredible scanning interface and functionality.

They have three main scanners in the software: Pro, Easy, and Breakout, and after testing, of all three, Pro is my favorite.

The Pro scanner gives the trader complete flexibility to set up market scans however desired.

Scans can be configured with fundamental, technical, price, or volume data, and multiple types of scans and criteria can be mixed.

Once the scan is created, it can be saved as a layout for the next time it is needed.

In addition to building completely custom scans, traders can pick from a large list of prebuilt ones that cover many of the most common scans.

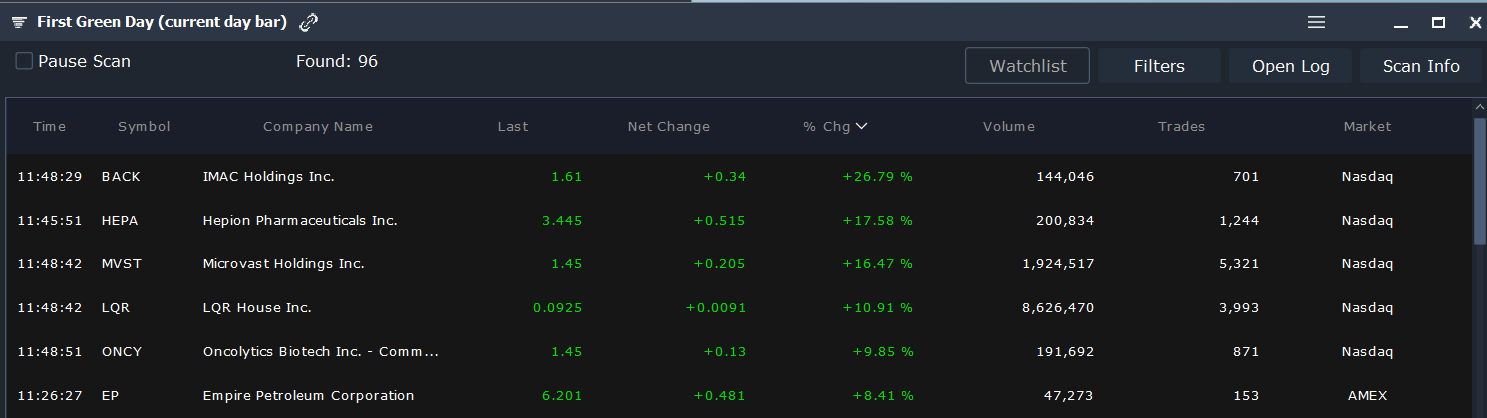

Below is a screenshot of their reversal scanner: First day green

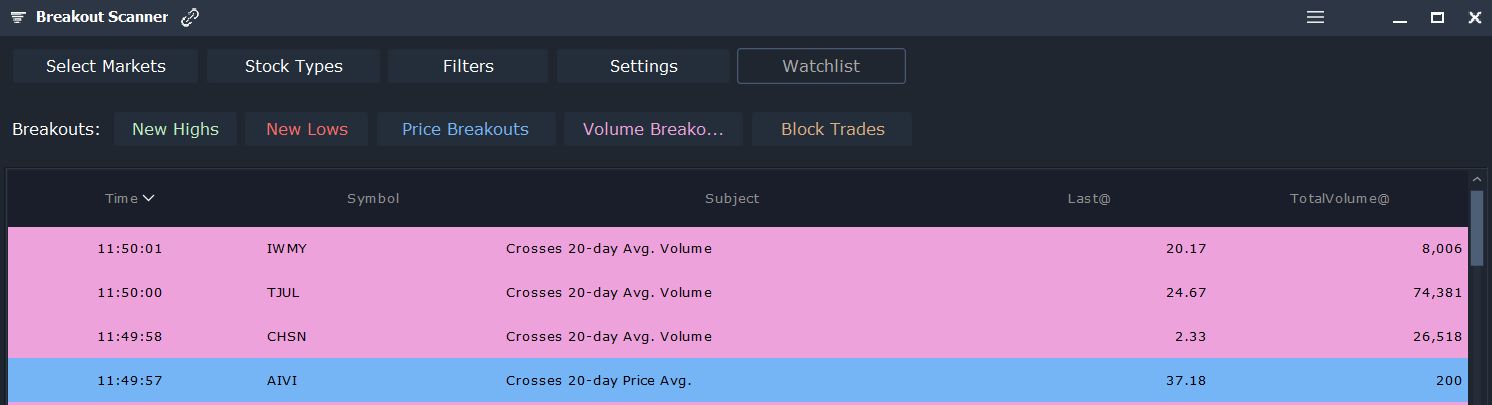

Next, we move on to the breakout scanner.

This scanner lets the trader have a constantly updating list of tickers across every market that are breaking out based on their criteria.

There are new highs, new lows, price-based, volume-based, and block trade-based scans for breakouts.

They are all color-coded so you can quickly see which criteria hit, when, and at what price.

Finally, there is the Easy scanner, which is very similar to almost any other scanner out there on the internet.

It allows the trader to pick the market, sector, prices, and other basic criteria and have a stable list of stocks that meet them throughout the day.

While the functionality is great, this is a standard scanner with nothing to write about.

Charting

For scanning software, Scanz has some incredibly impressive charting capabilities rivaled only by some of the most expensive charting platforms out there.

In addition to having multiple charts and views open, traders can also select from plenty of chart types.

These range from your standard line and candlestick charts to more exotic types like Kagi, Point and Figure charts, and volumetric candles.

Once the type and timeframe have been selected, adding some indicators to the chart is time.

Many common and uncommon indicators are included, ranging from things like the moving averages and Bollinger Bands to things like the Volume Profile and Time Series forecasting.

Their charts also allow the trader to select their scale and axis types, as well as the ability to save everything to a chart template.

Other Features

There are tons of other features included in the Scanz software.

These include market internals, level 2 data, market maker transactions, views, and a cool option called the Montage, which takes a few of the different views and snaps them all into one screen to see everything.

Lastly, several common brokers can be integrated right into the Scanz application so that trades can be placed right from inside the app.

Overall, Scanzs is a feature-packed software with many potential benefits for the active trader.

Drawbacks

Now that we discussed the features and benefits of the software let’s look at a few of the potential drawbacks of the software.

While it is an impressive suite of tools, there are several thighs to be weary of.

Target Audience

This app is not made for the causal trader or investor.

There are a lot of features, and there will be a learning curve to get used to it.

While the application is laid out nicely and functions well, even on a laptop, it’s still a tool for active stock traders.

The other portion of this drawback is that it is focused only on stocks.

Scanz will show anything you want to know about any ticker on a US exchange, but there are no instruments past that.

There is nothing here if you want to see options, futures, or bonds.

Cost

While Scanz is incredibly powerful and offers many tools, it is expensive.

For the software and regular markets, it costs $169 a month.

There is an additional $15/month addon fee for OTC markets.

This will be cost-prohibitive for a lot of traders.

One upside is that the cost will encompass everything in the software.

It would be far more expensive to go out and buy every news source, data, and individual tools to build something similar.

It will still be too expensive for the majority of traders.

Lack of Mobility

One of the benefits of modern times is that most people have all of the information and capabilities built right into the phone in their pocket.

With the popularization of Robinhood and other apps, stock trading is in the same boat.

Scanz goes against this trend; you will need a laptop or desktop to run the software, and it will have to be left open while it is in use.

Nothing here is cloud-based, so everything will be stored on the trader’s local machine.

Our Verdict

Now that the features, benefits, and drawbacks have been discussed, is Scanz worth the cost?

Well, the answer is: it depends.

New, casual, options and remote traders probably will see little benefit from the software for the cost, so the answer for them is no.

Day traders or scalpers, especially those that actively use scans or news to find trades, will find a lot of benefits from this software, so for them, the answer is a yes.

Overall, it is a fantastic piece of software with far more benefits than drawbacks to its target audience: extremely active traders.

We hope you enjoyed this scanz review article.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.