Today, we talking about how to get a free hedge for your portfolio.

We recently discussed the 1-1-2 option strategy consisting of selling two puts plus and buying a put debit spread.

When this structure gets to a certain level of profitability, it can be converted to a downside hedge with no more risk.

Essentially you get a put debit spread with no net cost.

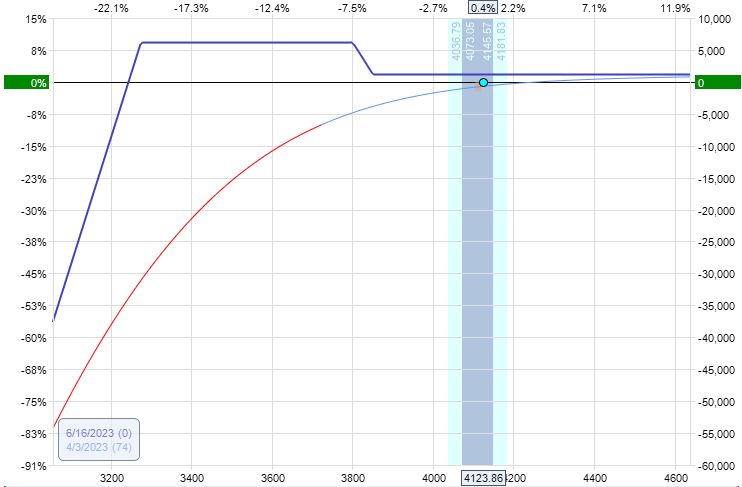

Let’s set up a 1-1-2 on April 3 to see how this would work.

Date: April 3, 2023

Price: SPX @ 4124

Buy one June 16 SPX 3850 put @ $51.35

Sell one June 16 SPX 3800 put @ $43.90

Sell two June 16 SPX 3275 put @ $9.50

Net credit: $1155

As per the 1-1-2 setup objective, the trade has no upside risk.

This trade’s downside risk is due to the two naked short puts.

As soon as we can buy back to close the two short puts, this trade will no longer have downside risk as well.

Since we had collected an overall credit of $1155 at the initiation of the trade, if we can use this credit to buy back the two short puts, we would achieve a riskless trade with no upside or downside risk.

We cannot buy back the two short puts right now.

They are still too expensive. We have to give the trade some time to accumulate some profits and wait until the price of the 3275 put drops to $5.77 or lower.

We can set a good-to-cancel limit order to buy back the two short puts as soon as their price reaches that level.

The put value will drop when the price of SPX goes up.

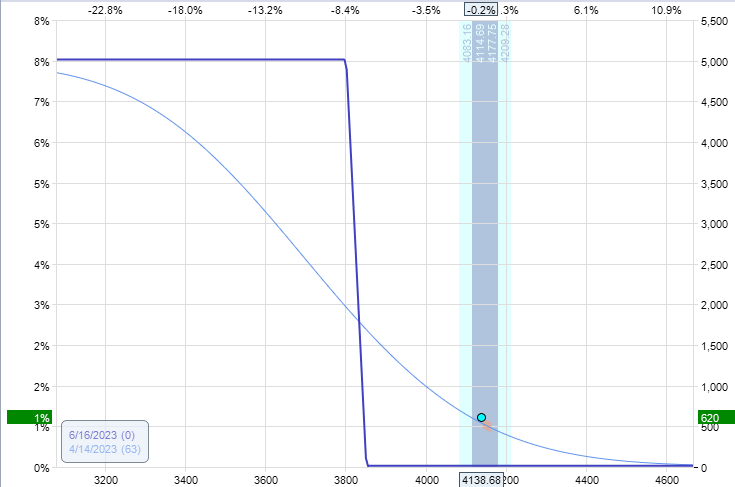

About two weeks later, on April 14, the order would have triggered because the price of the 3275 put dropped to $5.70 due to the market rising and the passage of time:

So we buy back the two short puts.

Date: April 14, 2023

Price: SPX @ 4139

Buy to close two June 16 SPX 3275 put @ $5.70

Debit: -$1140

The new risk graph looks like this:

We should not call this a risk graph because this trade has no more risk.

Okay, payoff diagram.

If the market continues to go up, the put debit spread will expire worthless.

Since we got a credit of $1150 to start and paid $1140 to close the two short puts, we keep the $10 credit (to pay for commissions, perhaps).

But if the market goes down, the put debit spread will increase in value.

People call this a hedge to offset the losses in any long position.

If the market crashes, the put debit spread can balloon in value up to $5000.

So people can call this a “black swan hedge.”

A black swan hedge makes money if and only if the market crashes, which is not a likely event (but can still happen).

“Black swans” are not likely but can still appear.

We hope you enjoyed this article on how to get a free hedge.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Hi Gavin,

Could you please explain how you calculate that 2 naked puts must drop to $5.77 or below?

1155 is the credit you get

Correct.

2 x 5.77 x 100 = 1,154 which is roughly the same as the original credit received. Therefore, you have no risk left in the trade.

Thank you.