Backtesting is one of the most complicated steps in creating a reliable options strategy.

Due to the complexity of the data, finding reliable historical options for pricing data can be expensive.

Once you find it, it can be difficult to utilize unless you are familiar with the data structure.

Optionstack comes in here; they have a drag-and-drop interface that makes it easy to backtest your option strategy.

Below, we will dive into the pros and cons of using Optionstack, how to use it, what it costs, and more.

Contents

What is Optionstack

Before we get too far into the details, let’s first look at Optionstack, how to access it, and what you can do with it.

Optionstack is a web-based backtesting software that can help traders look at the historical performance of their trading strategy.

While you can access stock and options data through them, they are best known for their automated backtesting of options.

Through their platform, you can create your strategy with entry and exit criteria through their coding language or an easy-to-use drag-and-drop editor.

After you set up your strategy, you can just sit back and let their platform run the tests and analyze the results, where you can view a report with many different profitability metrics.

Setting Up a Backtest

Now that we have a little background data let’s go right into how to access the software and set up a backtest.

To access Optionstack’s software, you only need to head to their website, optionstack.com, and create an account.

Once you are signed up and have selected your membership level, you will be directed to your email to complete your account setup and sign in for the first time.

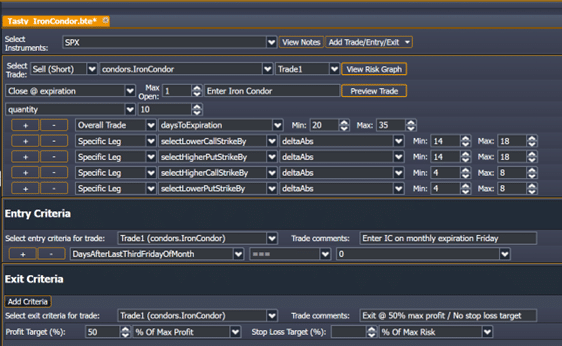

Once you are signed in, you will be greeted by a page with a sample strategy ready to test. You can see an example of that here.

Congratulations, you are now ready to start backtesting.

The next step will be to select a pre-existing strategy or create your own from scratch.

While it’s possible to completely create your own, it is recommended for newer users to take an existing strategy and modify it.

This will significantly reduce how long it takes you to get started.

After you have selected your strategy, instrument, and timeframe and made any tweaks or additions, you can click the “Run Backtest” button and wait for the software to work for you.

Depending on your strategy, the amount of historical data, and symbol count, this can take anywhere from a few seconds to a few minutes.

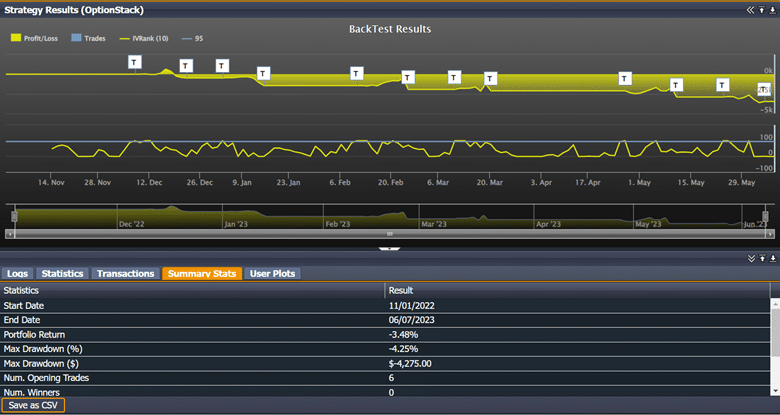

Once it’s done, you will see a graph pop-up showing the overall profit and loss over time, where trades were placed, and any other indicators or benchmarks you wanted to display.

You will also see some tabs across the bottom that display custom plots, trade data, backtest logs, and both summary and trade base statistics.

Pros and Cons of Option Stack

Pros

Now that you know how to use it, let’s review some pros and cons of using this software to backtest.

The largest pro is that there are many pre-written scripts for the most common options strategies.

This saves time and energy having to create a backtest script for something they already have.

Another huge pro of Optionstack is its customization.

If you start with pre-written strategies, you can change things until they match your strategy perfectly.

If they don’t have what you are looking for, you can always create your own using their drag-and-drop editor or Scala, the coding language used on the platform.

The third powerful pro of using Optionstack is the data.

While some equity, future, or forex data can be found online fairly inexpensively or for free, historical options data is extremely expensive.

It is not out of the realm of possibility to spend $10,000 plus for ten years of option data for the S&P500 constituents.

You would always use another API provider and get the data as a service for far less.

However, you would still need to create and test homemade scripts in Python or another data manipulation language.

This can be time-consuming and requires a deep knowledge of both the language used to code and the data used.

The last pro we will go over is their support.

They have a large library of support articles, videos, and FAQs to help you set up backtests exactly how you want them to be, and if you can’t find what you are looking for, you can always email them.

They have a fairly responsive support team.

Cons

While there are many pros, there are also a few cons to using Optionstack.

First, there are some limits on the accounts for the number of instruments and the number of backtests per day.

In addition to this, there is a limit to how far backtests can look depending on your plan level.

This is not limited to Optionstack, though, as was mentioned above; data is expensive and space-consuming, so every platform will have limits.

This is still a potential con, though.

The other major con that Optionstack has is that while it’s incredibly powerful, it does have a mild learning curve.

Even with the pre-written scripts, things are not always intuitively placed, and some practice and learning are required to get used to the platform.

This will be the case with almost any platform, but Optionstack’s learning curve is a bit steeper than some other backtesting software.

It’s a more powerful software, but the learning curve is still a potential con.

Pricing

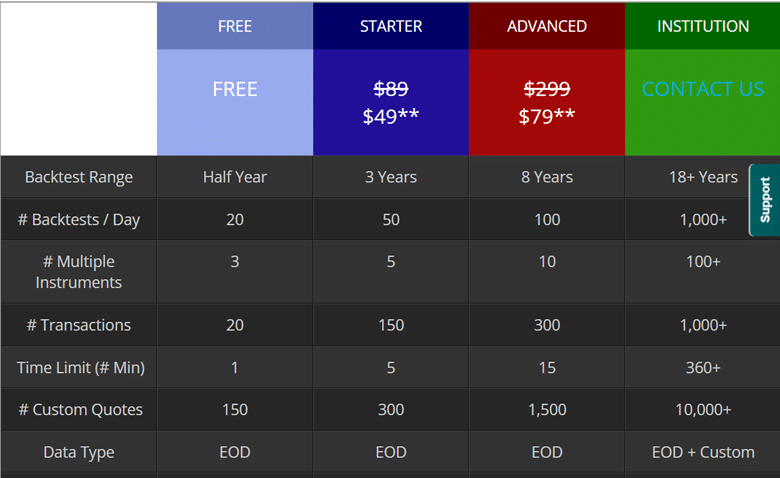

The last thing we will look at in the Optionstack review is the account types and pricing.

It was mentioned above how expensive data can be, so you may think that the cost of Optionstack will be insane to cover it, but that’s not the case.

In addition to their free plan, they have a Starter, Advanced, and Institutional plan.

Each of these has different levels of restrictions, data limits, and options.

Free – The free plan is the most basic. It allows backtests with up to 6 months of historical data on at max three symbols at a time. You are also limited to 20 backtests per day.

Starter – This is their first paid tier and comes in at $89/month ($49 per month if you pay for the yearly subscription). This plan allows up to 50 backtests daily on up to 5 instruments. This plan also allows the user to test three years of historical data.

Advanced – The top level most retail traders will use is the Advanced tier. This comes in at $299/month if you pay monthly or $79/month for the yearly subscription. This allows the user to have 100 backtests per day on up to 10 symbols at a time. It also allows for eight years of historical data to test off of.

Institutional – Finally, there is the institutional level plan. Anyone can purchase this; it is just a custom quote for each item they offer. The institutional level can go back over ten years of options data with custom quotes that even include intraday options data. This, however, can get very expensive very quickly, so it’s not recommended unless you know what you are doing and what you need.

The Verdict

Now that you have all of the information on Optionstack, is the platform worth it?

Seeing that they have a free tier for smaller backtests and testing, the answer is absolutely.

If you want a larger dataset or more options, their paid plans are also very reasonable for the features and data you receive.

Mix that with their support and knowledge base, and Optionstack is a very powerful backtesting software.

The verdict here is that it’s 100% worth the price if you need to backtest almost anything options-related.

We hope you enjoyed this review article on Options Stack.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.