Today we’ll discuss how to find historical options prices. Let’s know in the comments your preferred sites.

Contents

- Why Are Historical Options Prices Important?

- Where Can I Find Historical Options Data?

- FAQ

- Concluding Remarks

In a world where data is at our fingertips, it is easy to find past stock prices.

We can see decades of historical information on stock prices in almost any location online.

Despite this, it is a lot more challenging to find historical option prices.

The reason for this is simple.

For every historical stock price, we have multitudes of options strikes and expiries, all with different values.

Furthermore, as these options are less liquid than the underlying, providing historical data can be even more challenging.

However, the good news is that there is an ever-growing number of choices for finding historical options prices.

This article will look through a few of them.

Why Are Historical Options Prices Important?

Before we talk about some of the sources to find historical options prices, it is crucial to understand why this information can be valuable to us.

The most important reason is that in order to evaluate the success of a strategy, a significant litmus test is the strategy’s performance in the past.

For example, we have statistical proof that equities go up over time.

If we didn’t have this proof and equities had stayed at the same level for a hundred years, it would be hard-pressed to argue that equities should go up, even if it makes theoretical sense.

The same goes for options data.

Another reason is that we can specifically check what happened after certain events to better quantify how options should change in the future.

This is especially important with volatility, which tends to be a mean-reverting process.

So while a novice investor may get away with reading a few papers and back-tested strategies, for a more active trader having specific historical options data is more critical.

This helps both evaluate past trades and back-test different approaches.

Where Can I Find Historical Options Data?

Think Or Swim

Think or Swim (TOS) is a platform developed by Tasty Trade’s Tom Sossnoff and now owned by TD Ameritrade.

The good news is that despite being a good brokerage, you do not even need to be a client of TD Ameritrade to get historical data. Simply sign up for a free paper account.

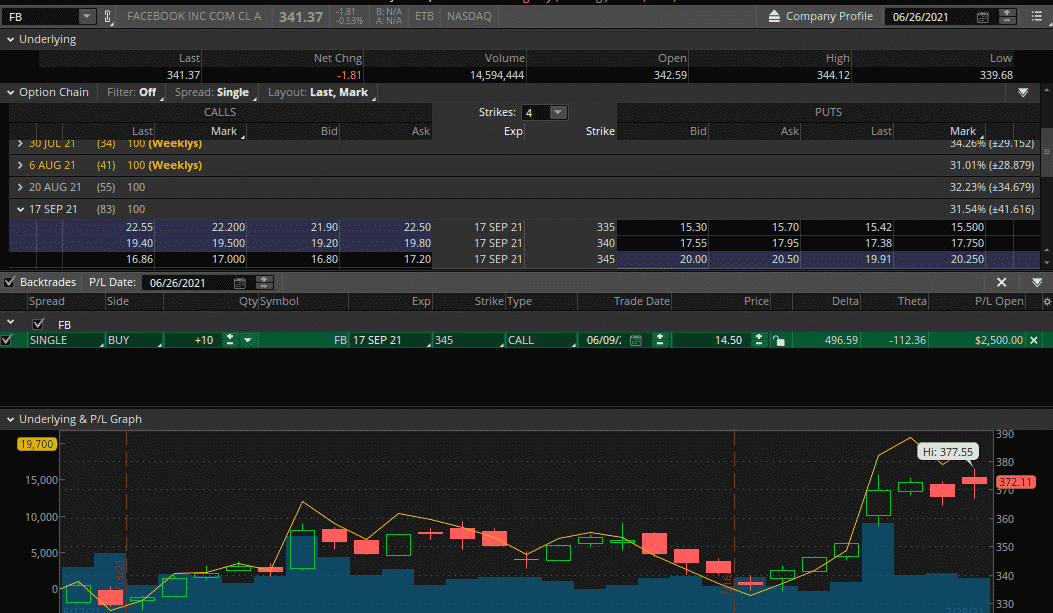

Once you do so, you can use the ThinkBack feature in the Think or Swim terminal.

This allows you to see historical options prices and simulate trades.

For example, below, I went three weeks in the past and bought a 345 Facebook call.

We can then see the cost of the stock after I entered the position and the value of the call option over this time.

Source: Think or Swim

Option Net Explorer

Option Net Explorer is a software that allows traders to design monitor and back-test strategies.

This is one of my personal favorites, especially with its easy-to-use interface.

If you would like to see a full review of Options Net’s Software, check out this article.

Bloomberg

Bloomberg’s terminal offers a 90-day lookback of historical options prices.

Bloomberg excels in having the best data and is the most reliable for price and quote information.

I have found it very useful for finding nitpicky intraday fills if an event that you were trading just happened.

Despite this, if you are not a student or are a professional at a firm, you are out of luck with the hefty price tag.

Orats

Orats offers a wealth of options data. It can be an excellent tool for scraping options data using an API for those interested in coding.

This allows for some unique testing abilities.

FAQ

What Are Historical Options Prices?

Historical options prices are the prices of options contracts in the past, typically recorded in a database or dataset for analysis and backtesting purposes.

Where Can I Find Historical Options Prices?

Historical options prices can be found in various sources, such as financial data providers, brokerage firms, or online databases. Some popular options include Yahoo Finance, CBOE, or Quandl.

Why Would I Need Historical Options Prices?

Historical options prices can be useful for various reasons, such as backtesting options strategies, analyzing market trends and patterns, or estimating future options prices based on historical data.

How Do I Access Historical Options Prices On Yahoo Finance?

To access historical options prices on Yahoo Finance, go to the Options tab of a particular stock or index, select a specific options contract, and click on the Historical Data link.

Then, you can adjust the date range and other parameters to view the historical options prices.

Can I Download Historical Options Prices From CBOE?

Yes, you can download historical options prices from CBOE by using their Historical Options Data service, which provides daily options prices and other related data for a fee.

You can also access some limited historical options prices for free on their website.

What Are Some Limitations Of Historical Options Prices?

Some limitations of historical options prices include the availability and accuracy of the data, the lack of information on implied volatility and other Greeks, and the potential for survivorship bias or other biases in the data.

Concluding Remarks

Having access to historical options data can be useful in back-testing strategies and seeing how positions would have performed after certain events.

Depending on your need, multiple different platforms can offer some historical options data.

This can help you evaluate the effectiveness of a strategy and improve trading.

Do you have any other sites you like to use to get historical option prices?

If so, please let us know below in the comments!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Thank you for showing these resources. Tastytrade have developed a very good past analysis tool called ‘Lookback’.