The long call option strategy is one of the first strategies used by beginner options traders.

Let’s explore the basics of a long call, why rookie traders fall for it’s get rich quick trap, understanding the mechanics of the strategy, and learn how to use it like an option veteran.

Contents

- Introduction

- Maximum Loss

- Maximum Gain

- Breakeven Price

- Payoff Diagram

- The Greeks

- How Volatility Impacts the Trade

- How Theta Impacts the Trade

- Risks

- Long Call Option Examples

- Summary

Introduction

A long call is an option that gives you the right to buy the underlying stock at a predetermined strike price.

The buyer of the call option expects the stock price to rise above the strike price before option expiration.

The buyer pays a premium to buy the upside without suffering from any of the downside in case the stock price drops.

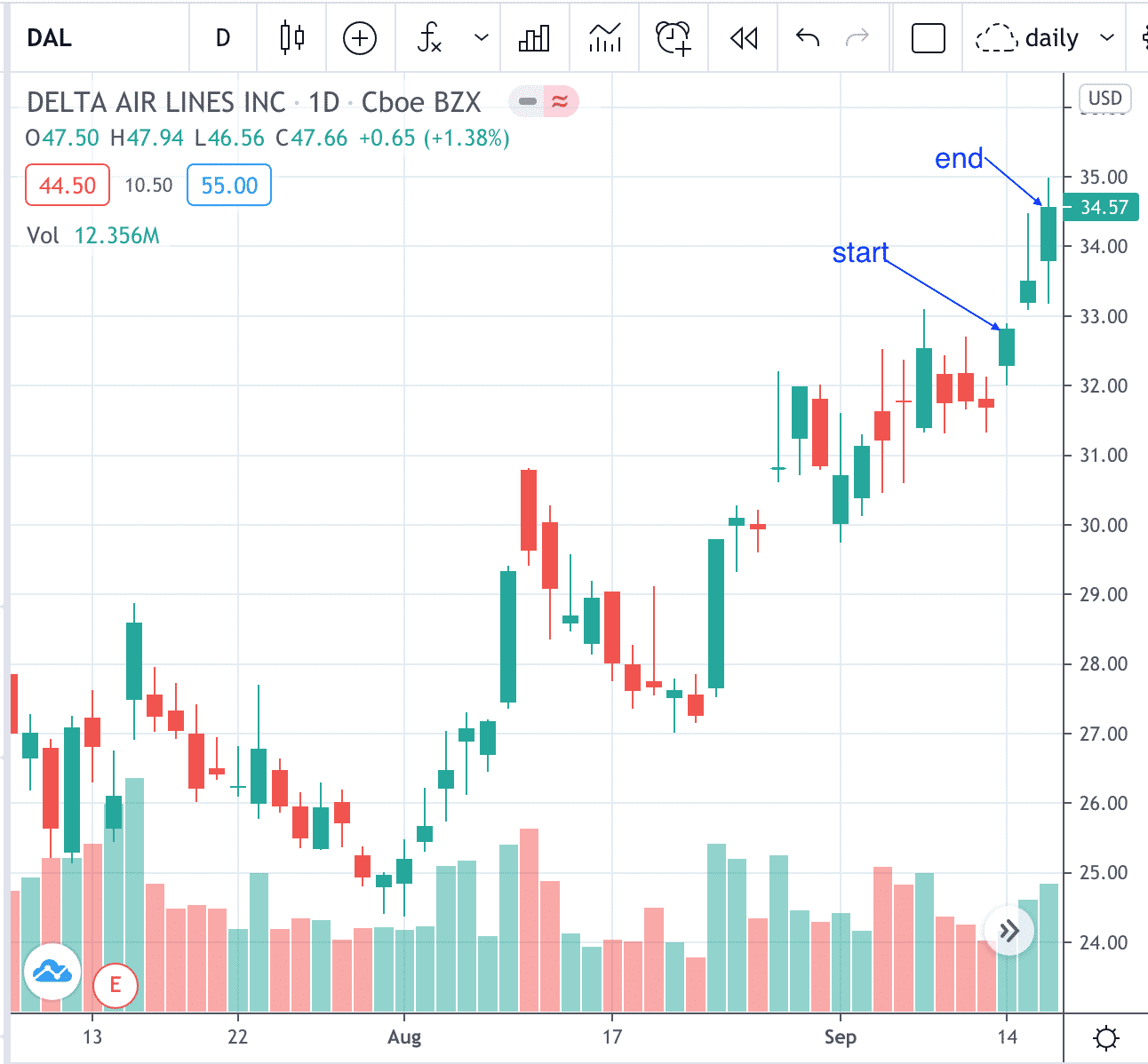

Consider the example of Delta Airlines stock, which trades at $32.73 as of September 14th, 2020.

It lost 50% of its value after travel demand declined due to rise in COVID-19 cases.

The trader believes news of vaccine development will hit the market soon and send the stock soaring.

He can directly purchase shares of DAL stock but at $32.73 a share he does not have enough capital to profit heavily from a positive move in price.

He looks at call options and realizes he can gain a much larger exposure to the positive price movement at a fraction of the price of owning the underlying stock.

That sounds like a great deal. The problem is that beginner option traders tend to purchase short term calls that are deep out of the money.

That’s because they are cheap, and you can afford to buy lots of them.

In reality they just appear to be cheap to an untrained eye.

Let’s build on the delta stock example by gathering the option values.

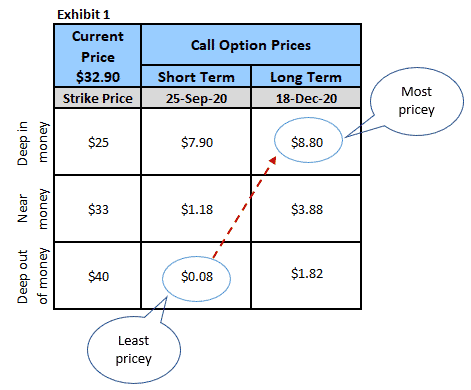

The exhibits below show call prices and the greeks for at-the-money and deep out-of-the-money options.

Looking at the call option prices (Exhibit 1), the short term deep out of money option with strike of $40 and expiration of September 25th will appear the least expensive.

The trader can buy 110 ($8.80 / $0.08) calls for the same price as 1 long term deep in the money option with strike of $25 and expiration of December 18th.

Let’s look at the payoffs in more detail below.

Maximum Loss

They most a trade can lose on a long call is the premium paid to enter the call if the stock price closes below the strike price on expiration.

In the above example, the trader who bought the deep out of the money call will lose $8 for each call if the stock price closes below $40.

The stock would have to rise by 22% (Strike price ($40) / Current price ($32.90) just for the option to be in the money.

The trader who bought the deep in the money call will lose $880 for each call if the stock price closes below $25.

But remember the stock is currently trading at $32.90 so it can fall by 24% before the trader loses the entire premium.

But is premium paid the only loss? If the stock goes through the roof after expiration, you’ll miss the opportunity to profit from that move.

You can be right about the direction but wrong about the timing.

Solution – buy a longer dated call to give yourself some room to profit from your directional views.

You can always sell the call later if you change your views.

Maximum Gain

The long call is a strategy to keep all the upside without exposing yourself to any of the downside so maximum gain is technically unlimited.

The stock can skyrocket to infinity but remember the long call option has an expiration, so your gain is limited to the price on expiration.

Breakeven Price

The breakeven is the strike price plus the premium paid to buy the call.

The priciest call at $8.80 will have a breakeven of $33.80 ($25 + $8.80). That’s a required gain of 3.27% to reach the breakeven price.

The least expensive call at $0.08 will have a breakeven of $40.08 ($40 + $0.08), a gain of 22.46% from the stock price.

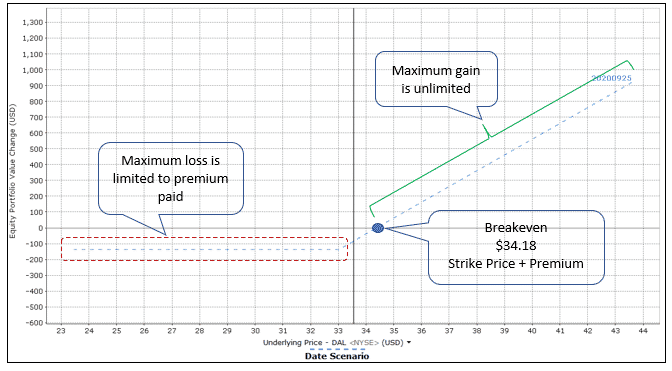

Payoff Diagram

The long call payoff has unlimited upside potential. But its downside is limited to the premium paid.

The payoff diagram below is of the $33 strike September call that was trading for $1.18.

The Greeks

Delta

Let’s quickly glace at delta now.

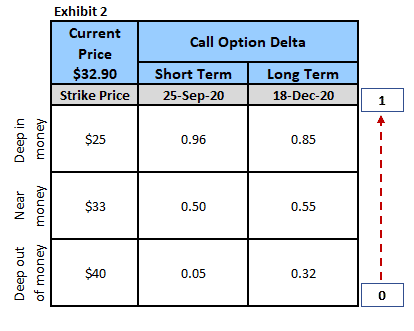

The least expensive option has a delta of 0.05 and the most expensive option has a delta that approaches 1.

Delta is directly proportional to moneyness.

Deep in the money options have a delta of 1 and the payoff behaves like the stock payoff.

Deep out of money calls have a delta closer to 0 and its payoff isn’t impacted much by changes in the stock price.

Note that delta is not just related to moneyness but also to time to expiration.

For the $25 call strike in our example, the delta is 0.96 (higher) for the September and call 0.85 (lower) for the December call.

Both options are equally in the money but one has more time to expiration than the other.

Think about it. The $25 call is deep in the money and let’s assume there was only one day left until expiration.

What is the likelihood that stock will close below $25?

Probably zero.

Therefore, the payoff of the call option will very closely mirror the payoff of the stock.

On the other hand, there is a lot of time until the December call expires and a higher probability of a stock decline before then.

For the priciest call in our Delta Airlines example, the price of the call option will move by $0.85 for each dollar move in the stock price.

For the least expensive call, the price of the call option will barely move an inch ($0.05) for each dollar move in the stock price.

The trader who bought the least expensive, deep out of the money call will hardly see an increase in call price unless the stock price quickly reaches towards the strike price.

Gamma

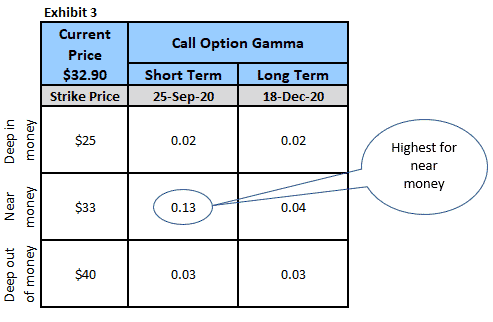

Gamma is always positive for long options. It measures the rate of change in delta with respect to the change in stock price.

Gamma is the second derivative of the value function with respect to the stock price – Delta being the first derivative.

It is highest for at the money options because that is the point where delta changes fastest with changes in the stock price.

As the stock price moves away from the strike price (in either direction), gamma approaches zero and delta becomes less sensitive to changes in the stock price.

In our Delta Airlines example, gamma of the deep in the money and deep out of the money are both near zero (Exhibit 3).

It means change in delta will be negligible as the stock price changes.

For at the money option, the price will change more significantly than the price of deep in or out of the money option.

How Volatility Impacts the Trade

Long call options are long vega trades. So, you will benefit if volatility rises after the trade has been placed.

Our long call example with strike price of $33 and expiration date of December, the position starts with a vega of 0.06.

In other words, the value of the option will increase by $0.06 ($6 per contract) if implied volatility increases by 1%.

How Theta Impacts the Trade

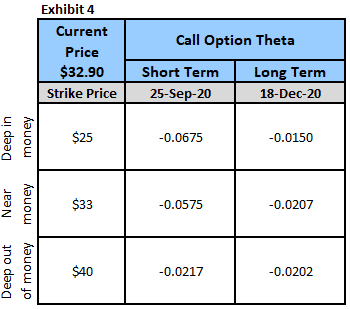

Theta measures how sensitive the option price is to the passage of time – i.e. how much value does the long call option lose each day as the trade approaches expiration.

Remember, time is your enemy unless you use it wisely.

The call price will decrease by 5% with each passing day (theta of (.0575) / call price ($1.18)) for the call with strike price of $33 and expiration date of September.

Compare this with the call with strike price of $33 and expiration date of December. It will only lose 0.5% with each passing day (theta of (.0207) / call price of ($3.88))

If the trader believes Delta stock will rise by September expiration, he can still purchase the December call and sell it in September.

Risks

The risk of buying the call option, as opposed to simply buying the stock, is that you could lose the entire premium you paid for the option.

One way to hedge this risk is to sell another call option with a higher strike price and same expiration, turning the trade into a bull call spread.

Let’s assume the trader in the our example believes the stock will rise above $33 before December but does not think it will rise above $40 by then.

The $3.88 premium for the $33 strike call gives him all the upside above $33. But he does not want all the upside because he does not think stock will rise above $40.

He can sell the upside above $40 to someone else for $1.82. By doing this he will reduce his premium to $2.06.

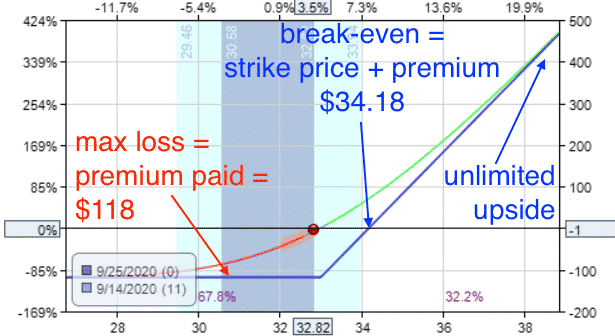

Long Call Option Examples

The payoff diagram below is that of the $33 strike September 25th call that was trading for $1.18.

Suppose an investor bought this call on September 14, 2020.

Further, suppose that the investor’s plan is to take profit if a 75% return on capital is achieved.

If the call losses half of its value, the investor plans to exit the trade.

So, the take profit amount is 0.75 x $118 = $88.50 And the stop loss amount is 0.5 x $118 = $59.00

The investor was lucky, DAL went up immediately upon purchase of the call making a 5.6% price increase in two days.

The value of the call option went up by 80%, giving the investor a $94.50 profit at the end of the trading day on September 16.

Since this met the profit amount, the investor closed the trade to lock in the profit.

The payoff diagram looked like this…

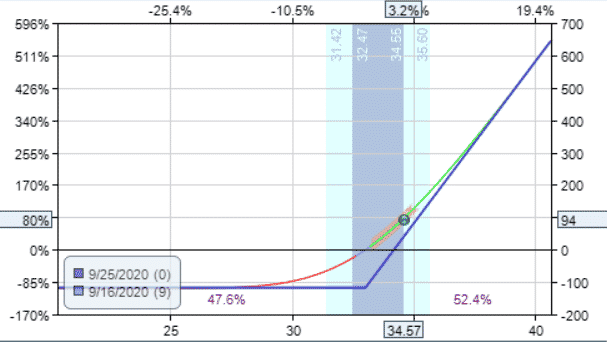

To look at another example, the below is that of the $33 strike call expiring on Dec 18th trading for $3.88.

Suppose an investor bought this call instead. In that case, the 75% take profit amount is $291. And the stop loss amount is $194.

Watching the profit-and-loss at the end of each trading day, we see that at the end of the trading day on September 16, the value of this long call is up 33% with a profit of $127.50.

This however was not enough to take profit per the trading plan.

So, we continue watching until on Oct 28, the stop loss amount was hit, and the investor exited the trade with a loss of $224.50.

Here is what the payoff graph looked like at the time…

The underlying price movements do not affect the value of longer-term options as much as they do for shorter-term options.

This is why the initial DAL rally reached the profit target of the shorter-term option and not the longer-term option.

This however can go both directions.

If the investor was wrong on the direction initially, the shorter-term option also takes on a larger percentage loss.

Summary

Long call options allow traders to gain bullish exposure to a stock for much less than buying the stock outright.

The nice thing about long calls is they give the trader control over a large number of shares for a fraction of the price.

However, be careful as they are a levered bet and to make money you have to be right about the direction as well as timing.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.