Contents

In today’s trade example, we will look at how to adjust butterfly in a whipsaw market.

This butterfly strategy is a delta-neutral non-directional strategy ideal for a range-bound market where theta decay can be generated as income.

So when this butterfly ends up in a market that goes up and then goes down in large waves, it will be tough on the butterfly.

But at least you will learn a variety of adjustment techniques by studying this one trade example.

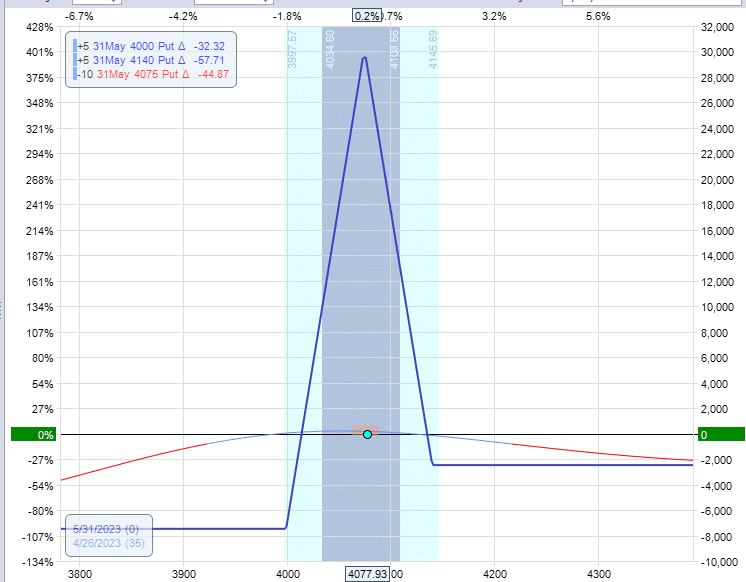

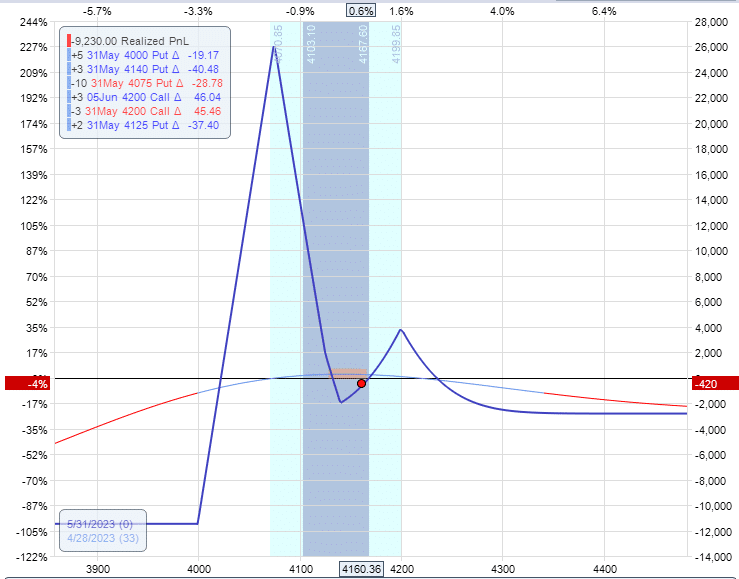

April 26, 2023 – Trade Initiated

In April, SPX (S&P 500 index) was trading at 4080.

So we decided to center the all-put butterfly at the quarter strike of 4075.

We placed the lower long put strike at a nice round number of 4000, with a lot of volume and open interest.

This gives us tighter bid/ask spreads.

Modeling various strikes for the long upper leg in an analytical software such as OptionNet Explorer, we found that the 4140 strike gave the butterfly an almost delta-neutral position (or perhaps a slightly negative delta position).

Buy five May 31 SPX 4000 put @ $50.50

Sell ten May 31 SPX 4075 put @ $72.50

Buy five May 31 SPX 4140 put @ $99.45

Net Debit: -$2,475

Delta: -2.9

Theta: 58

Vega: -266

This five-lot butterfly has a delta of -2.86 which is perfectly fine.

We like to be half a delta negative for a one-lot butterfly.

In other words, for one butterfly, we like to start it at around -0.5 delta. Why? See FAQs.

So for a five-lot, the ideal delta would be five times that, or -2.5 delta.

The breakeven prices are the points at which the expiration graph crosses the zero-profit horizontal.

The two breakeven prices fall between the one standard deviation (gray shaded area in the graph) and the two standard deviations (cyan color) of price distribution at expiration.

This setup suggests that the size of our butterfly is the right size for this underlying and volatility conditions.

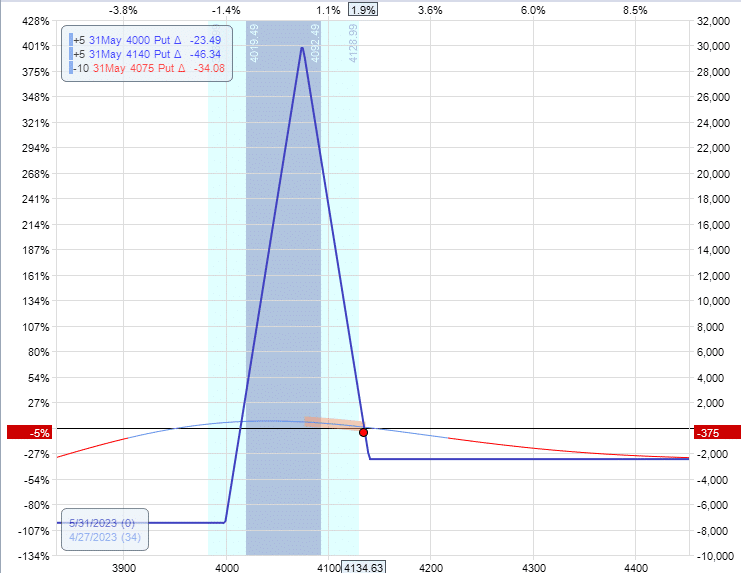

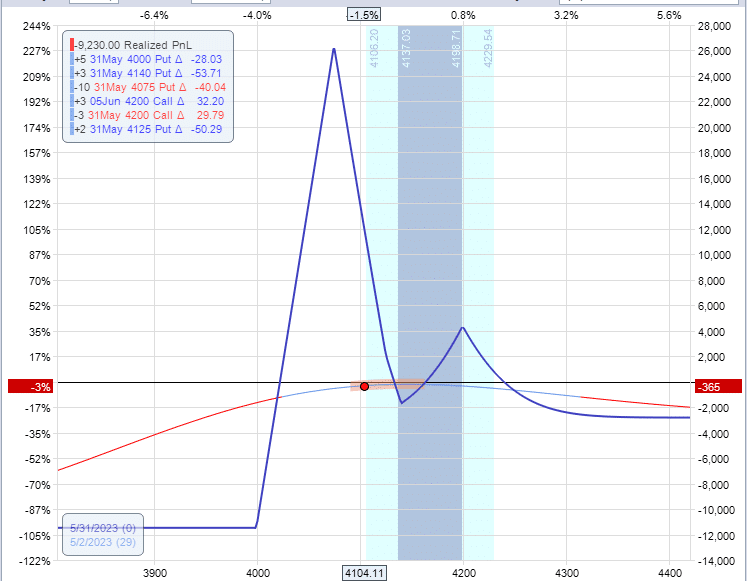

April 27 – Adding Upside Calendar

Towards the end of the next day, SPX was up at 4138, and the stock price was about to get outside the expiration graph on the upside.

Before adjustment:

Delta: -8.8

Theta: 50.39

Vega: -187

Make a mental note that the position delta is at negative 8 or 9 when we had to adjust.

We will add three call calendars at 4200, with the short calls expiring on May 31, the same expiration as the butterfly. The long calls expire on June 5.

Sell three May 31 SPX 4200 call @ $40.85

Buy three June 5 SPX 4200 call @ $47.15

Net Debit: -$1890

After adjustment:

Delta: -3.5

Theta: 51.69

Vega: -66

The calendars reduced the delta by about half.

It increased Theta ever so slightly.

But it greatly reduced the vega.

The calendar’s positive vega offsets the butterfly’s negative vega.

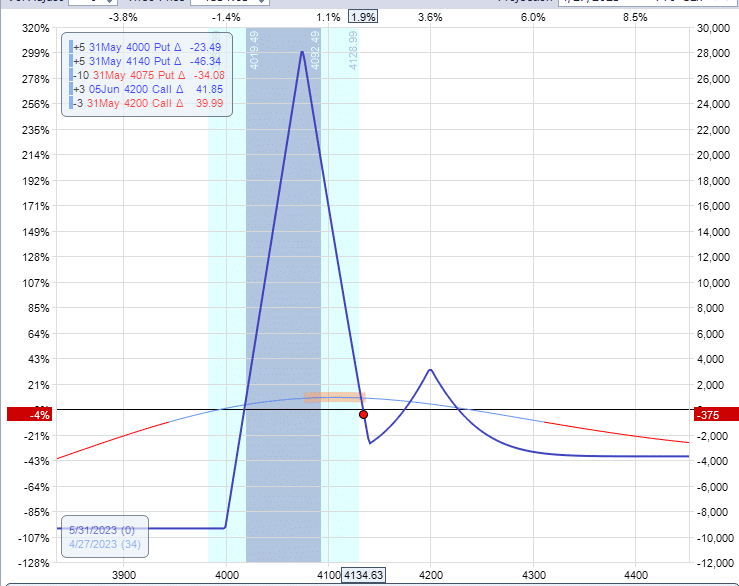

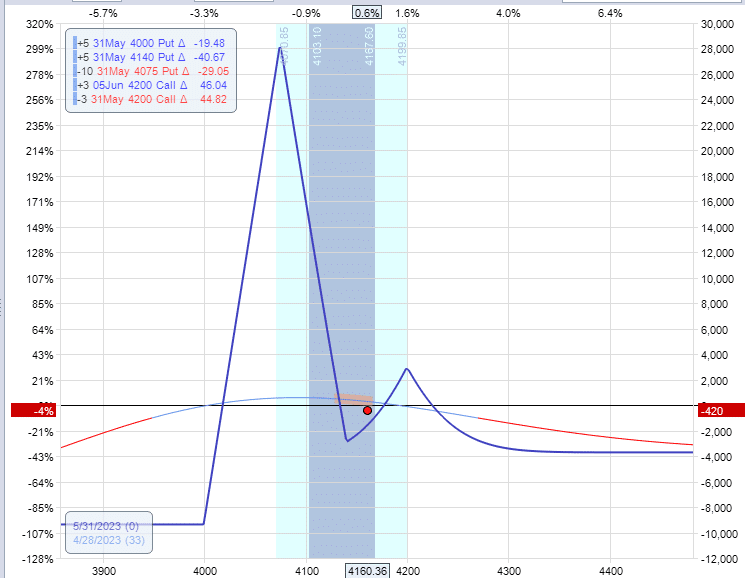

April 28 – Reverse Harvey Adjustment

The next day just before the weekend, SPX continues upward to 4166.

Before adjustment:

Delta: -8.15

Theta: 54.3

Vega: -19

Previously we used the expiration graph as the point of reference for when to adjust.

We adjusted when the price was about to go outside the graph.

We saw that when that happened, the delta was at -8.

Well, the delta is at -8 again right now.

Time to adjust.

We need to make the butterfly more bullish by performing the Reverse Harvey adjustment where we roll the upper legs down in strike.

In this case, we only need to roll two of the five put options from 4140 to 4125.

Buy two May 31 SPX 4125 put @ $48.85

Sell two May 31 SPX 4140 put @ $53.30

Net Credit: $890

After adjustment:

Delta: -2.2

Theta: 51

Vega: -41

The position delta is now back down to acceptable levels.

Now the strikes of the butterflies are not all the same.

You have to think that we have two sets of butterflies:

Two-lot bullish butterfly at 4125 / 4075 / 4000

Three-lot neutral butterfly at 4140 / 4075 / 4000

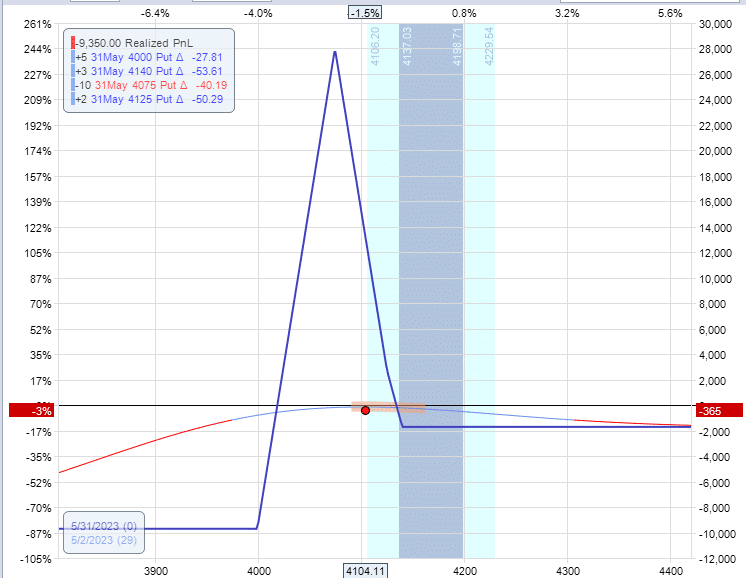

May 2 – Remove Calendars

A few days later, the market came back down to 4104 and back inside the butterfly expiration graph.

Delta: 5.4

Theta: 77.2

Vega: -104

We don’t need the calendars anymore.

Make a mental note of the position delta when we make this adjustment.

It is just above 5. And we have a 5-lot butterfly.

Coincidence?

Perhaps not.

Suppose you backtest or paper trade the same type of butterfly across the same DTE (days to expiration) timeframe over many market conditions and make mental or physical notes as to what the position delta is at when you make your various adjustments.

In that case, you will come to learn or suspect that when the position delta is between -1 and +1 for a one-lot butterfly, it is in good shape.

It is when the position delta becomes larger than -1 and +1 that adjustment is needed.

We are selling all three calendars because our modeling software tells us that would get the delta down to neutral.

Buy three May 31 SPX 4200 call @ $26.80

Sell three June 5 SPX 4200 call @ $32.70

Net Credit: $1770

After adjustment:

Delta: -0.13

Theta: 62

Vega: -237

Without the calendars, our vega becomes a large negative number again.

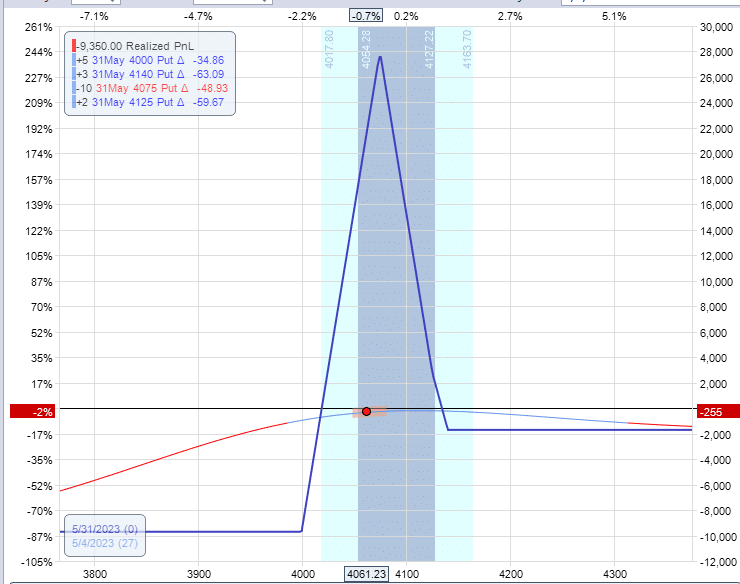

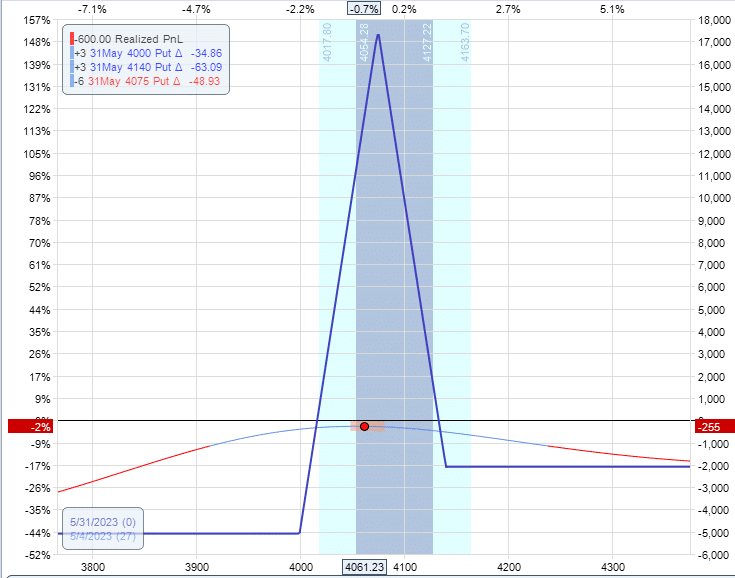

May 4 – Thin Butterfly

A couple of days later, SPX is down to 4061.

Position delta is at positive 6 – getting outside the favorable range.

Delta: 6

Theta: 67

Vega: -264

The butterfly is too bullish for this bearish move.

Recall that we have two sets of butterflies in this trade, a bullish butterfly and a more neutral butterfly.

We make the overall trade less bullish by closing our two-lot bullish butterfly with strikes of 4125 / 4075 / 4000.

Sell two May 31 SPX 4000 put @ $52.00

Buy four May 31 SPX 4075 put @ $76.35

Sell two May 31 SPX 4125 put @ $98.80

Net Debit: -$380

Note that we have to pay a debit to close this butterfly.

This can happen when adjustments have been made to it.

After adjustment:

Delta: -0.5

Theta: 49

Vega: -172

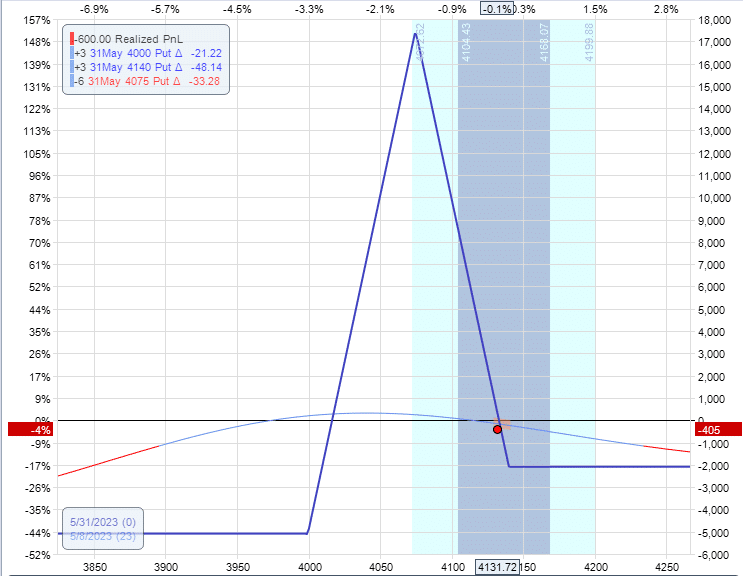

May 8 – Roll shorts up

The market reverses back up to 4131.

SPX is going outside the expiration graph again.

Delta: -9

Theta: 52

Vega: -121

Perhaps we should not have sold our two-lot bullish fly.

In any case, we need to make the fly more bullish by narrowing the upper wing.

It is the put debit spread of the upper wing that is providing the negative delta.

We decrease its negative effect by narrowing this spread.

Last time, we narrowed the upper wing by rolling the upper leg down.

We will narrow the upper wing this time by rolling the short center strike up.

We will roll two short puts from 4075 to 4100.

Buy two May 31 SPX 4075 put @ $38.55

Sell two May 31 SPX 4100 put @ $45.15

Net Credit: $1320

After adjustment:

Delta: 1.4

Theta: 50

Vega: -162

Never roll an odd number of short strikes up.

Why?

We want to keep butterflies as butterflies.

And butterflies always have two short options in the middle – at least for these types of butterflies (we are not talking about skip-strike butterflies).

P&L is down -$405 with 23 days to expiration.

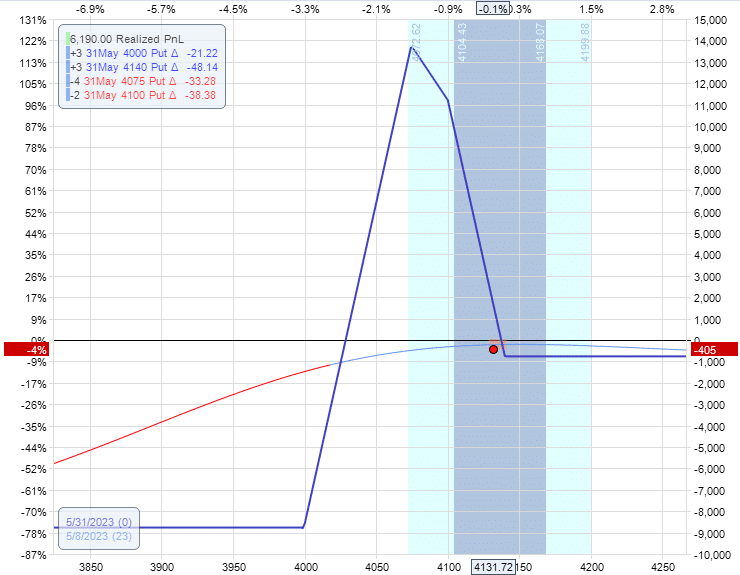

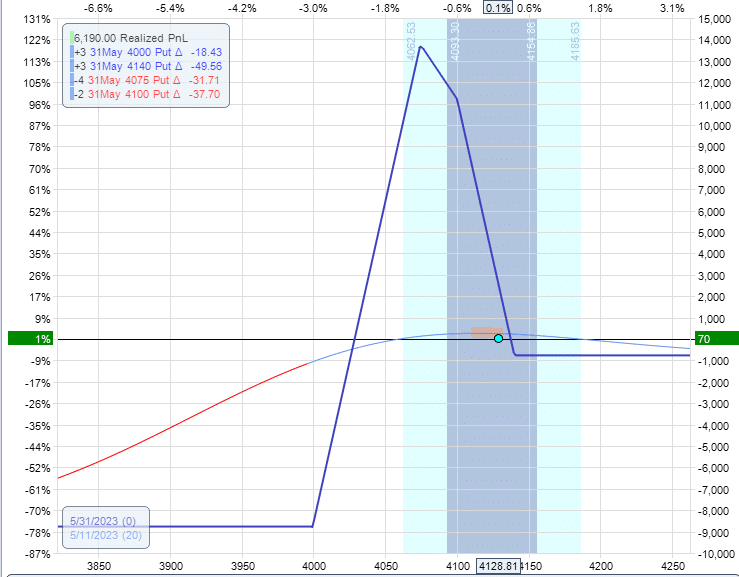

May 11 – Trade Closed

Near the end of the day on May 11, the trade came back to breakeven.

We like to trade this butterfly from 35 DTE down to about 21 DTE to give it two weeks to capture whatever profits it can.

In this case, it was not able to capture hardly any profits.

But at least it did not lose money.

With this trade having only 20 days left to the expiration day, we close the trade while it is at a $70 profit (call it breakeven).

We can re-use the capital to start a new trade at 35 DTE.

You may need to put in two separate orders to sell all the butterflies.

You have three butterflies all together.

Sell the two-lot butterfly with strikes 4000 / 4075 / 4140.

And then close the butterfly with strikes 4000 / 4100 / 4140.

First order:

Sell two May 31 SPX 4000 put @ $17.20

Buy four May 31 SPX 4075 put @ $30.45

Sell two May 31 SPX 4140 put @ $50.85

Net Credit: $1430

Second order:

Sell one May 31 SPX 4000 put @ $17.20

Buy two May 31 SPX 4100 put @ $37.00

Sell one May 31 SPX 4140 put @ $50.85

Net Debit: -$595

Summary

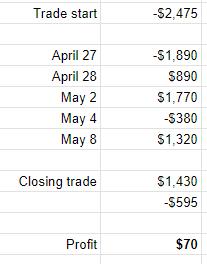

If we did not have OptionNet Explorer tracking out P&L, we would tally up all our credits and debits to track our profit and loss.

Frequently Asked Questions?

Is there a reason why you first sold the 400/4075/4140 fly when exiting the trade?

Yes, because I modeled what my resulting position delta would be if I sold this butterfly first versus if I sold this butterfly last.

If I sell this butterfly first, my remaining position will have a delta of 7.

If I sell the other butterfly first, my remaining position will be -9.

I picked the one that gave me less position delta since I don’t have a market direction opinion.

If you have an opinion on whether the market is going up or down, you might choose to exit the fly that is against your opinion.

If you fill both orders relatively quickly, then it doesn’t matter which one you do first.

Why are we getting out of the trade at 21 days to expiration?

It depends on the trader’s availability to monitor the trade.

A trader that can watch the screen all day can trade shorter DTEs.

A trader who can only look at the position once or twice a day has to trade longer DTEs.

The trader can continue with this trade if he or she has the availability to monitor it more frequently.

Keep in mind that the next day can bring the P&L back into negative.

Then it may take another two weeks to bring it back to breakeven.

And by that time, the trade would be at about a week till expiration, where it becomes increasingly more difficult to manage.

We also like to exit trades that have incurred a lot of adjustments.

Why do you start a non-directional butterfly with a slightly negative delta?

Two reasons. A negative delta is a hedge to the butterfly’s negative vega.

Two: we want to be a bit more protective on the downside.

What does that mean?

A butterfly has a negative vega, meaning it loses money if volatility increases.

The likely scenario where volatility goes up is when the market goes down.

Therefore, we give it some negative delta so that if the market goes down, we profit a bit from the directional move, which offsets the loss from the volatility increase.

Looking at the risk graph, we see that risk is greater on the downside.

When the market goes down, it goes down faster than it goes up.

So the negative delta protects our P&L if the market goes down.

We are less concerned if the market goes up because we can adjust more easily on an up move because the market moves up slower and we have less risk up there.

Why is the max risk on this butterfly not the initial Debit paid?

The max risk of a butterfly is equal to the initial Debit paid only in symmetrical butterflies where the wing widths are the same.

This is a broken-wing-butterfly with an upper wing of 65 points and a lower wing of 75 points.

The max risk for a broken wing butterfly is not equal to the Debit paid.

How is the max risk of a broken-wing butterfly calculated?

Imagine if the price of SPX is 3900 at expiration (way below the butterfly), and the trade incurs the max loss. In that case, all the put options are in-the-money.

The upper wing of the butterfly is the put debit spread that incurred a max profit.

The lower wing is the put credit spread that incurred the max loss since the butterfly’s lower wing is 10 points wider than the upper wing.

There is a net loss of 10 points (or $1000) per lot. Since we have a five-lot, we incur a loss of $5000.

Plus, we incur the additional loss of the initial Debit of $2,475.

The max loss is, therefore: $5000 + $2475 = $7475, which is the number shown in the initial risk graph.

How do you know how far to let the position delta go before adjusting?

That depends on the strategy, the butterfly size, the DTE, and the trader’s style.

By trading the same type of butterfly at the same DTE, the trader will come to know at what delta to adjust.

For a 65 x 75 butterfly on the SPX with about 35 days to expiration, a rough guide is to keep the position delta between -1 to +1 for a one-lot.

So, we should keep the position delta between -5 to +5 for a five-lot butterfly. \

There is some leeway here, and more aggressive traders can let the delta go a little bit further.

When you narrow the upper wing of the fly, is it better to roll the long option down? Or is it better to roll the short options up?

Rolling the long option down is an easier adjustment to think about because you can roll any number of legs down.

Because this option is closer to the current price of the underlying, it is slightly more heavily traded and should have a tighter bid/ask spread.

For liquid underlying, this is barely any effect.

Rolling the short options up is more complicated because you are splitting up the short strikes and need to roll them two legs at a time.

However, this option moves your short legs closer to the current price of the underlying and hence gets a bit more Theta.

You can go back and look at the theta effects of both adjustments and see how much of a theta effect difference it is.

Not much. So either way, it doesn’t matter too much.

We are really splitting hairs

Conclusion

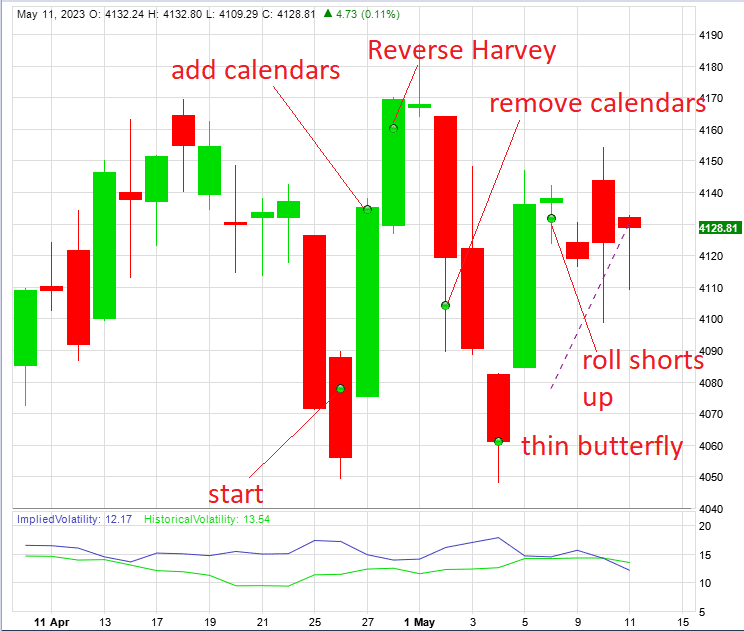

Let’s look at what this poor butterfly had to go through in this windy market.

Source: OptionNet Explorer

First, the market screams up with one of the largest green candles we see on the chart.

This forced us to add some calendars.

It went up some more, so we made our position more bullish with a Reverse Harvey adjustment.

After tricking us into making all the upside adjustments, the market went back down to where we had originally started.

Now we had to remove our calendars and reverse our upside adjustments.

The market went up again after we removed all our upside structures.

Now must make another upside adjustment by rolling some of the center shorts up.

We lose a little on slippage and commission every time we adjust.

We need the market to settle down long enough in order for Theta to recoup this cost.

This butterfly barely got out alive.

You wouldn’t learn anything if we showed you an easy trade where the butterfly just sits there and accumulates Theta.

It is through these tough trades that we hone our skills as traders.

We hope you enjoyed this article on how to adjust a butterfly in a whipsaw market.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.