Contents

OptionNet Explorer is the closest alternative to OptionVue in terms of feature-by-feature basis, especially for those who are looking for historical option pricing data to perform manual backtesting of options strategies (which I think many users of OptionVue and OptionNet Explorer are using them for).

Although the “stable” version of OptionNet Explorer has many of the same features as the beta version, the screenshots and descriptions in this article refer to the “beta” version of OptionNet Explorer, which has been out for many years now.

If you are just looking for software that will render the payoff diagram (or risk graph) and display the Greeks, then in addition to OptionNet Explorer, there are many alternatives such as OptionStrat, ThinkOrSwim, Option Trader’s Assistant, and others.

Suppose you are looking for software that allows you to go back to a past date so that you can simulate manually trading an option strategy.

In that case, you need to find software that has historical option data and then be able to generate the payoff graph and the Greeks based on those data.

In that case, I think OptionNet Explorer is the best alternative.

I couldn’t find another software that could do the same task.

Because of the cost of historical data, both OptionVue and OptionNet Explorer require a paid subscription.

Let’s look at some software that can generate payoff graphs. And then, we’ll look at using OptionNet Explorer for backtesting options strategies.

Payoff Graphs

OptionNet Explorer

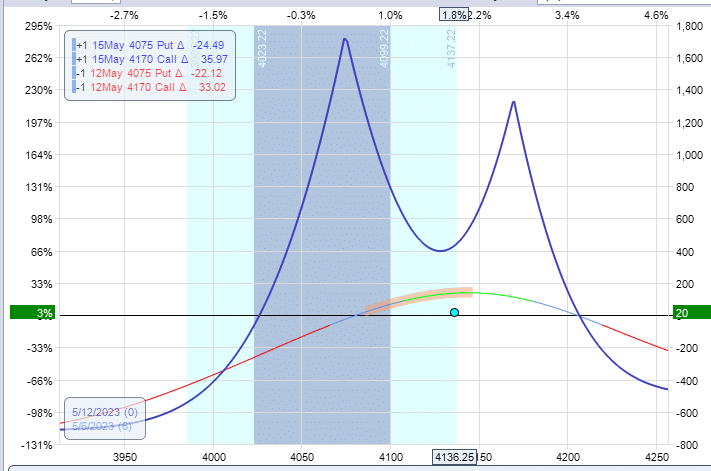

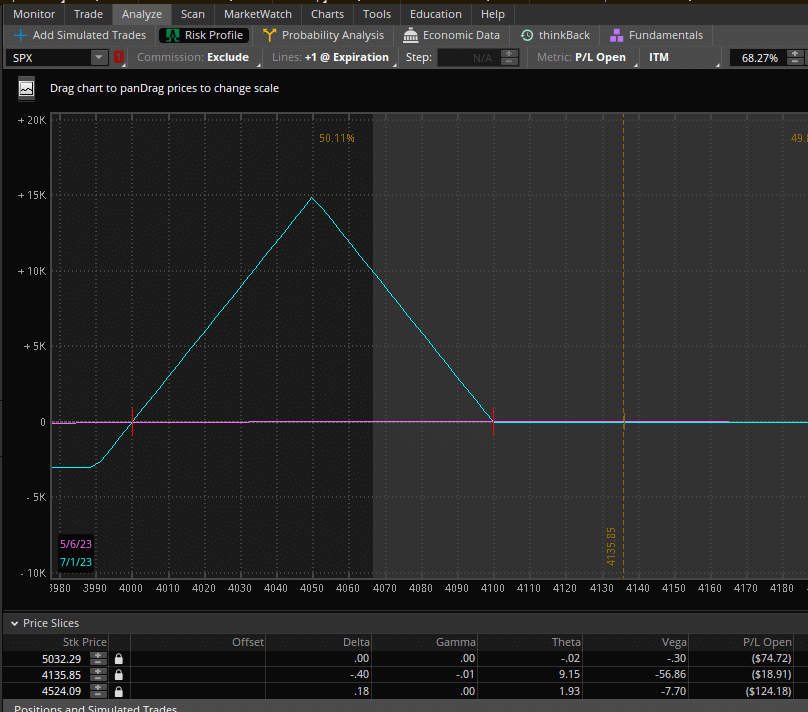

Here is the payoff graph of a double calendar using OptionNet Explorer:

The nice thing about OptionNet Explorer is that it displays an info panel on the graph showing the options used to construct the graph.

And these are the corresponding Greeks of the position:

It tracks the P&L for you based on the initial debit you said you had paid to enter into this trade in relation to current options prices that it gets from your connection to a live data source.

It also calculates the theta/delta (T/D) ratio for you.

Knowing the Greeks of a position is important for option traders.

For example, the implied volatility information displayed in the option chain can tell you that the below call calendar on the 4170 strike of the SPX is in backwardation because the IV of 12.85 is higher than that of 11.58.

ThinkOrSwim

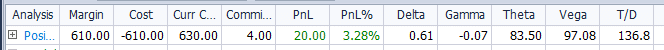

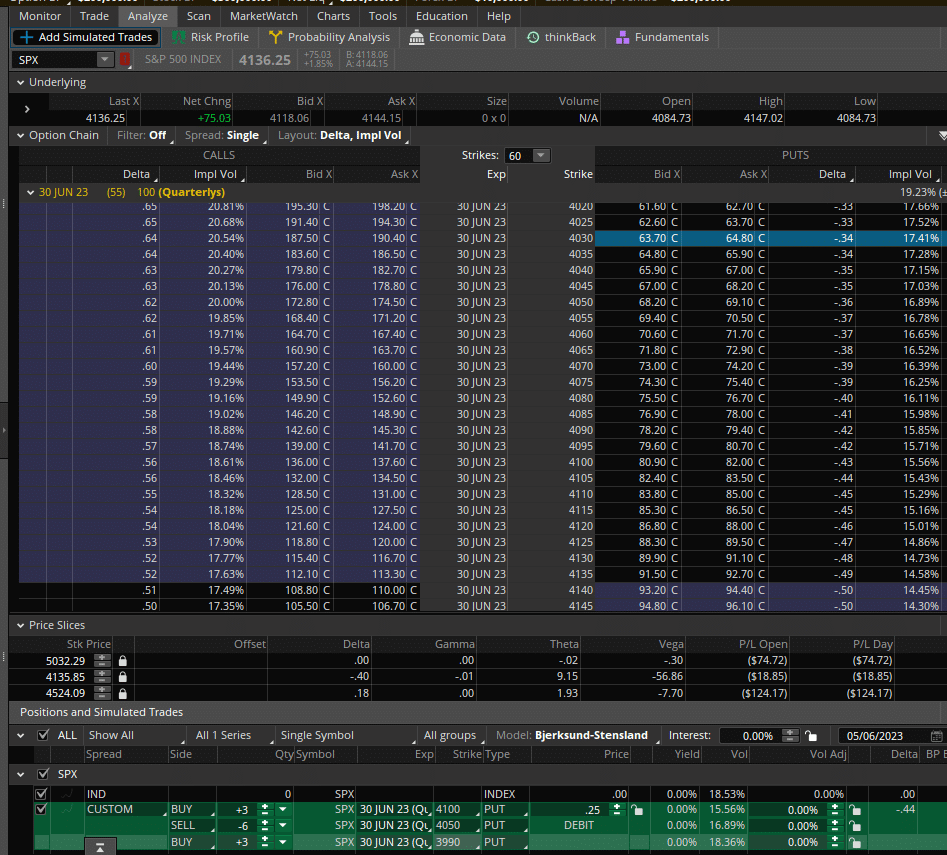

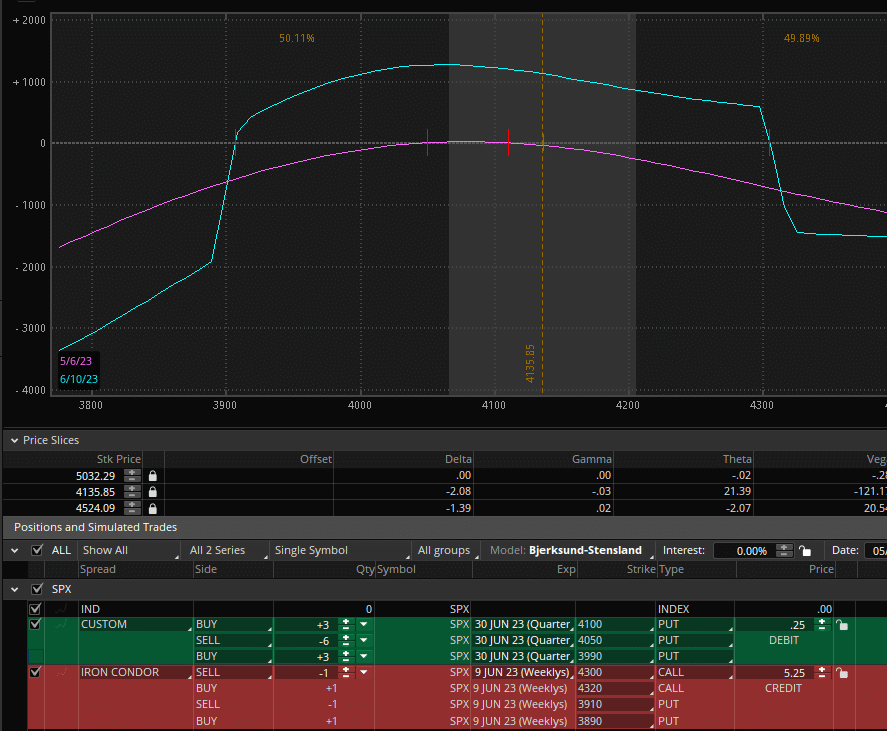

TD Ameritrade’s ThinkOrSwim (known as ToS) can do the same by “Add Simulated Trades” in its “Analyze” tab:

Click on the “bid” (to sell) or “ask” (to buy) in the option chain to build the legs of your option structure in the bottom panel.

You need to hold down the Ctrl key as you click to group the options into one position.

Here we have built an all-put broken-wing-butterfly below the current price in SPX with center strikes at 4050 and wings at 4100 and 3990.

We have a three-lot butterfly, and ToS shows that we would have to pay a debit of $0.25/share for each lot – or a net debit of $75 to enter this three-lot butterfly.

You will see the payoff graph by clicking on “Risk Profile”.

The Greeks of the position at the current price of 4135 is shown in the “Price Slices.”

If you have multiple options structure on the same underlying, ThinkOrSwim can display the combined positions’ risk graph or the individual position.

Below is the combined payoff graph of the butterfly along with an iron condor.

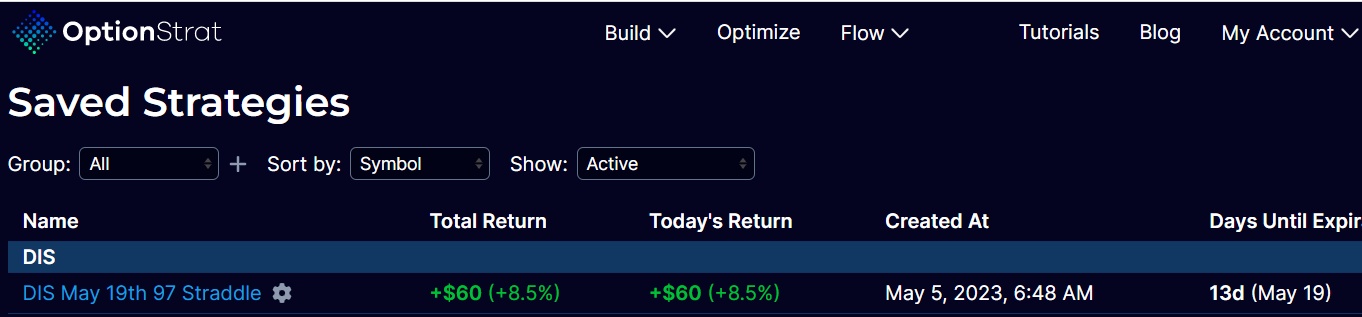

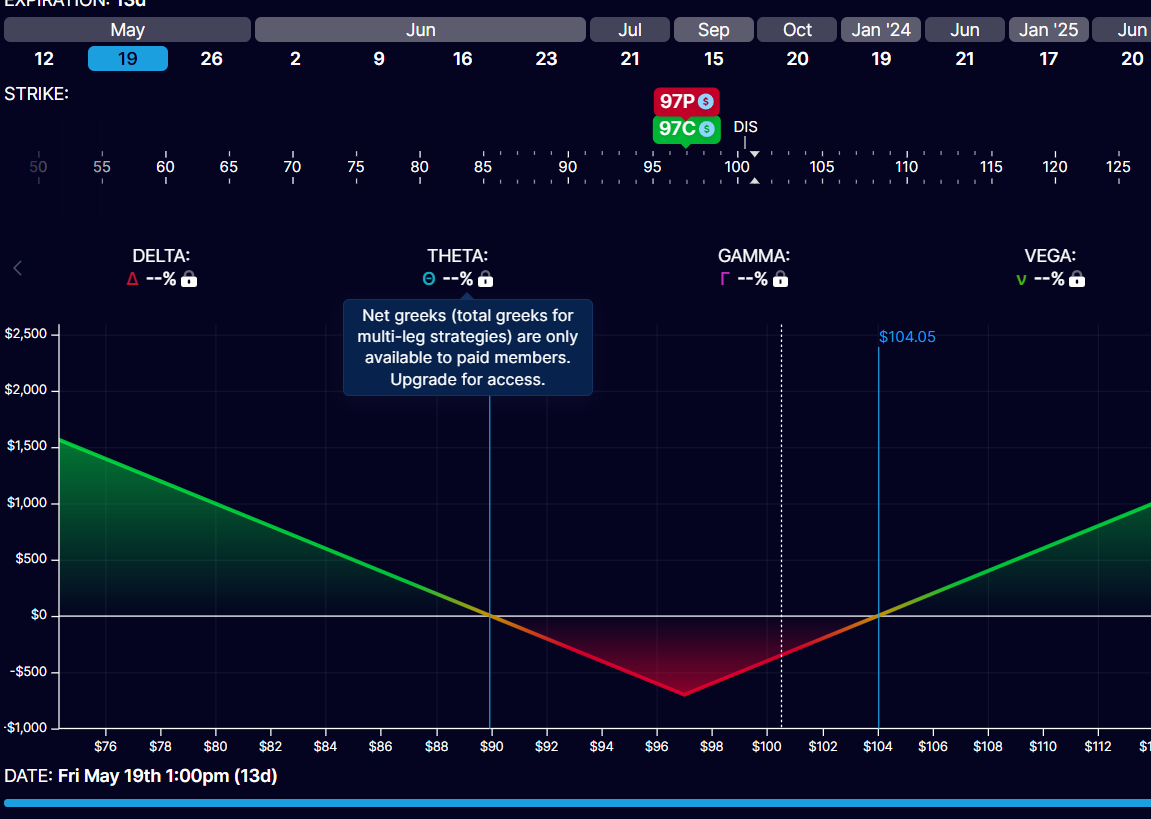

OptionStrat

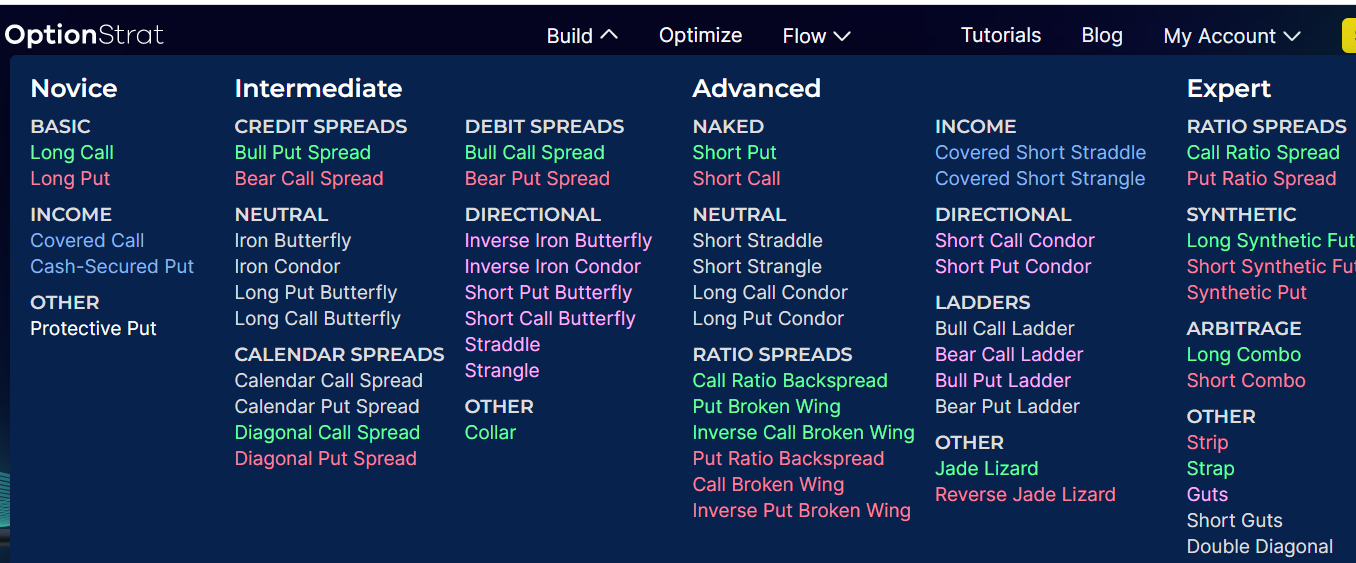

If you are just starting out and just want to see the risk graph of an options position, OptionStrat is the easiest to learn because of its intuitive and user-friendly interface.

Just click your option strategy in the “Build” tab.

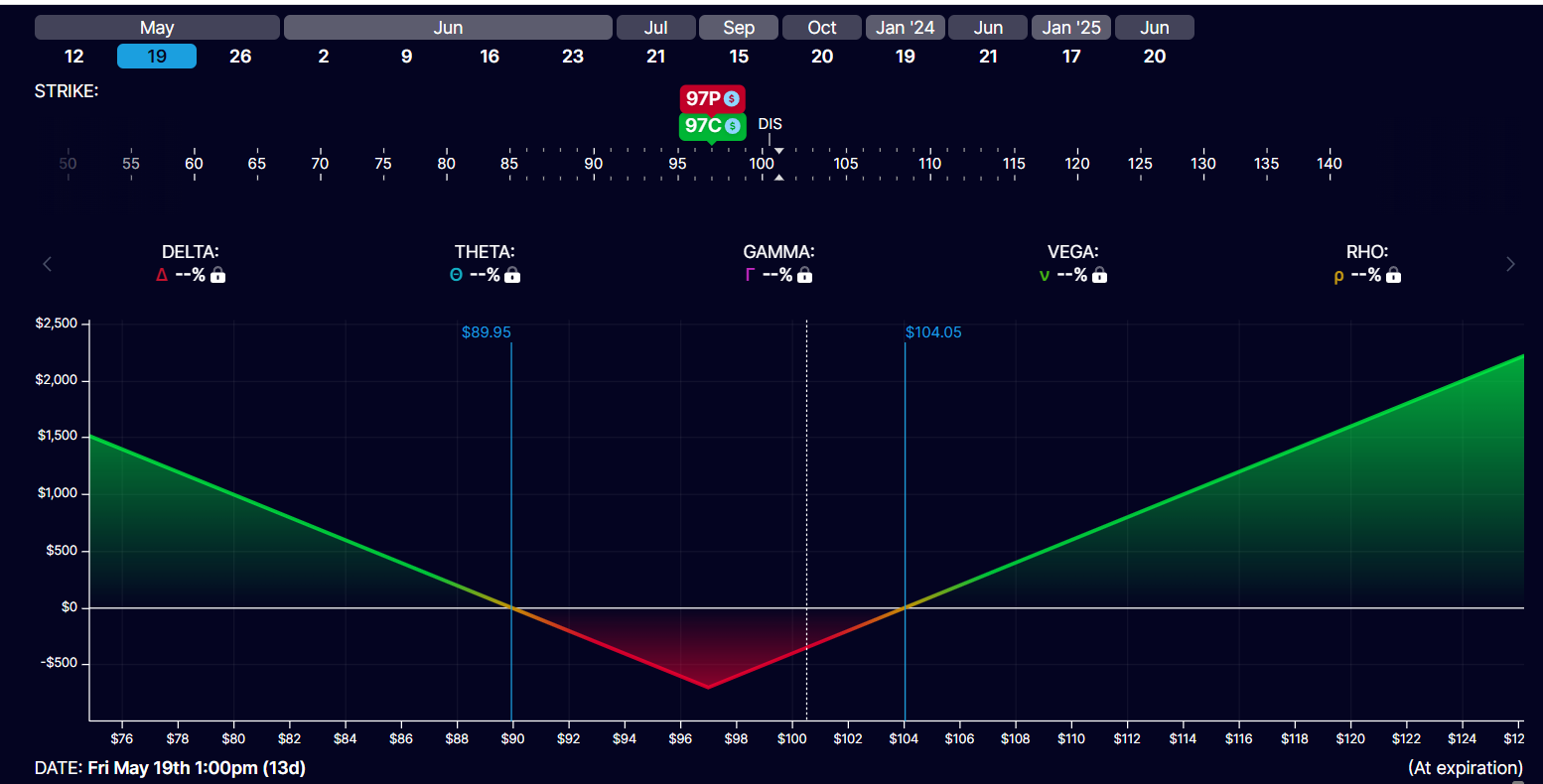

And it will display a payoff graph for you:

This is the payoff graph of a long straddle in Disney (DIS).

You can adjust the strikes, of course. And you can input the actual fill price you paid for the long call and put options.

That way, you can save your position and check its current P&L.

The free signup is using delayed data.

But with a paid subscription, you have live data so that you get real-time P&L and the ability to see the Greeks of your position.

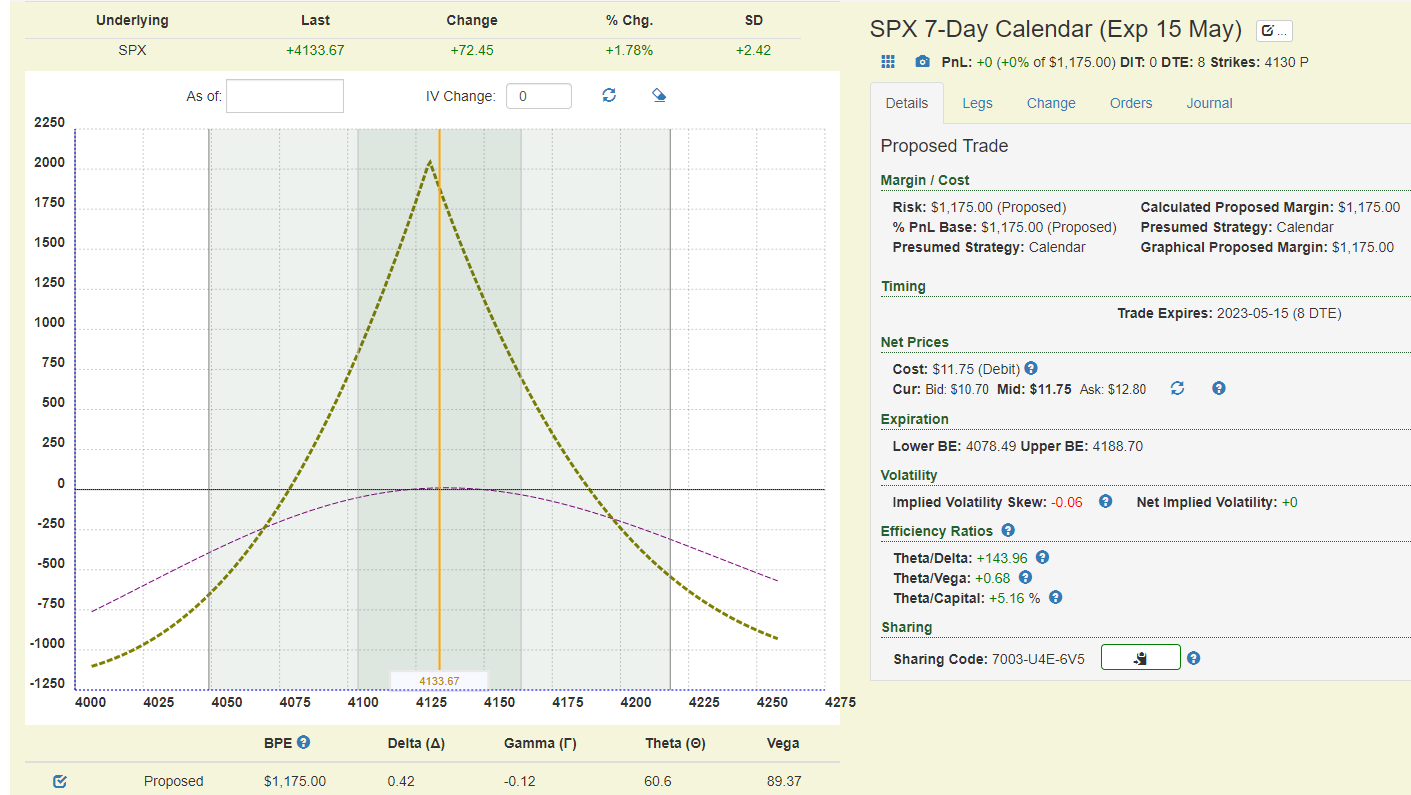

Option Trader Assistant

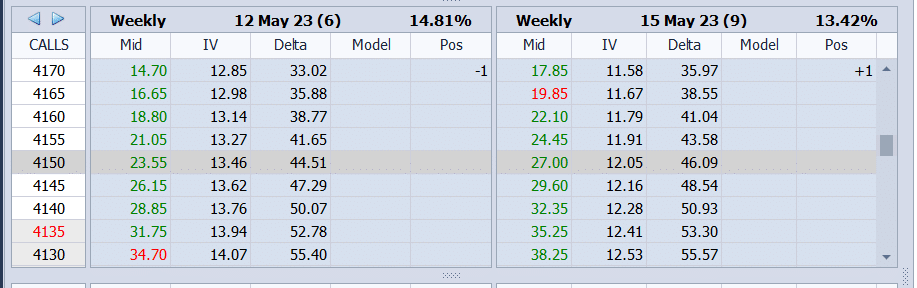

Here is the trade analysis page of a calendar trade in SPX in Option Trader Assistant.

You can see the current Greeks at the bottom of the page.

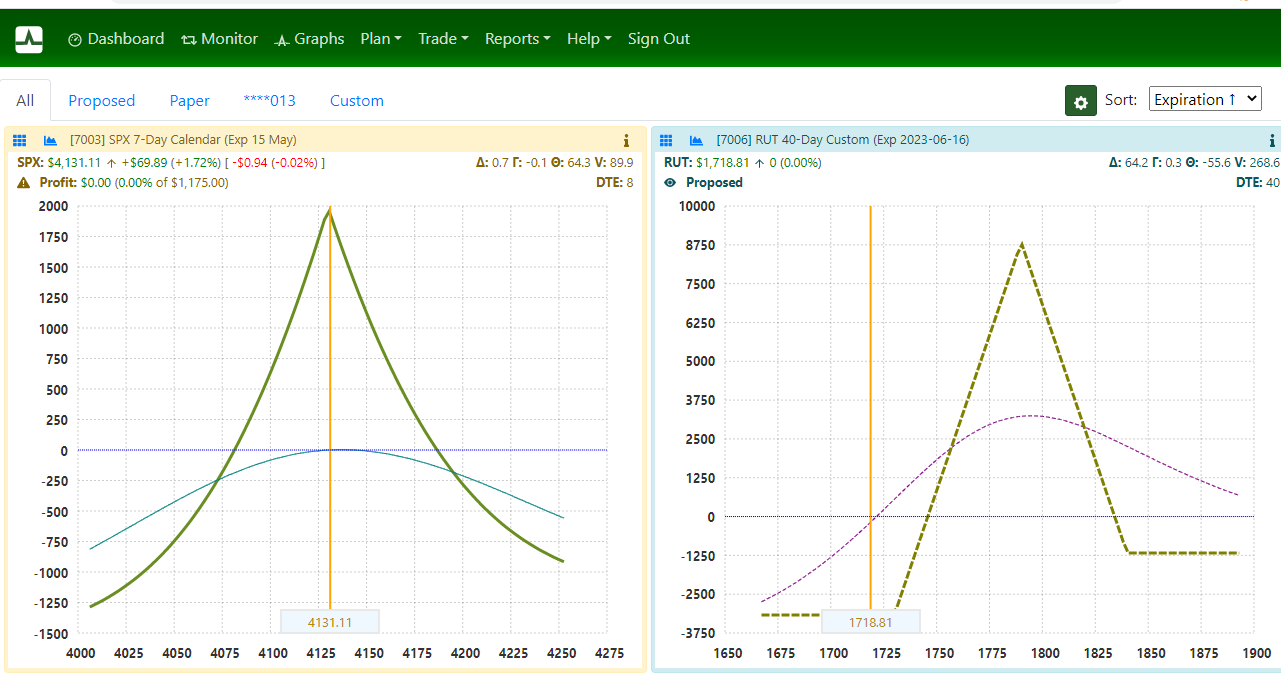

Tracking Multiple Position

Many people use OptionVue to track multiple positions.

You’ve seen how OptionStrat has “Saved Strategies.”

Option Trader Assistant can show you all your trades on one page with thumbnail views of the risk graph of each trade.

You see all your trades in OptionNet Explorer with the “Monitor Grid” window.

Backtesting with OptionNet Explorer

Like OptionVue, OptionNet Explorer has historical options pricing and IV data so traders can turn back the clock and manually backtest their strategies.

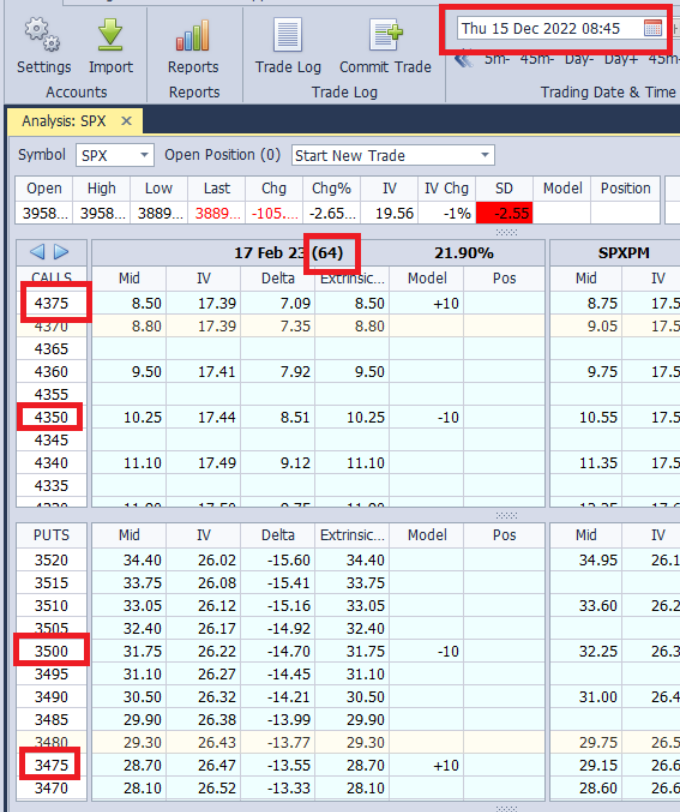

Here we have turned back the clock to last year, December 15, 2022, at 8:45 am.

The data that you see are the option prices, IV, the Greeks, and intrinsic and extrinsic values back on that date.

OptionNet Explorer has historical data at 5-minute intraday increments.

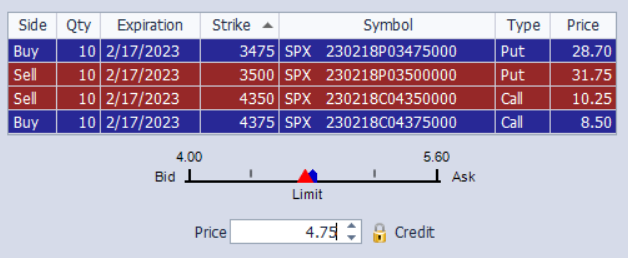

Hence, we can model an iron condor as if we were placing an iron condor on that day.

It will tell you what credit you can get if you get filled at mid-price on that day.

If this was to model a live position that you had placed with your broker, then you can change that price to your actual fill price in the above, and OptionNet Explorer will keep track of the P&L as you advance the time day by day or at 5-minute intervals.

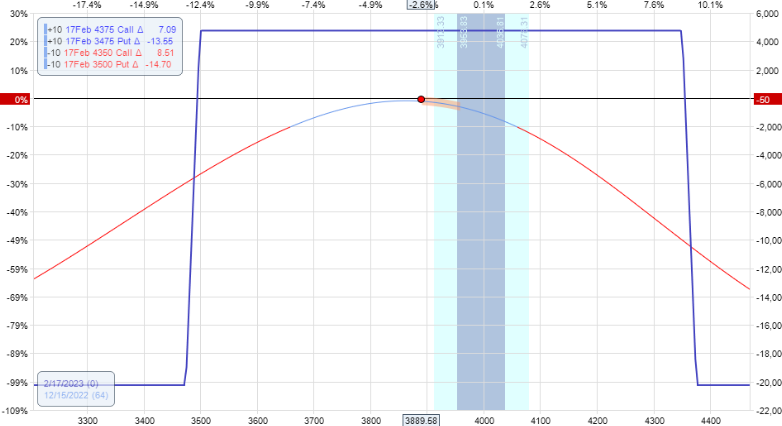

As the trade progresses, you can see the changes in the T+0 line and the risk graph.

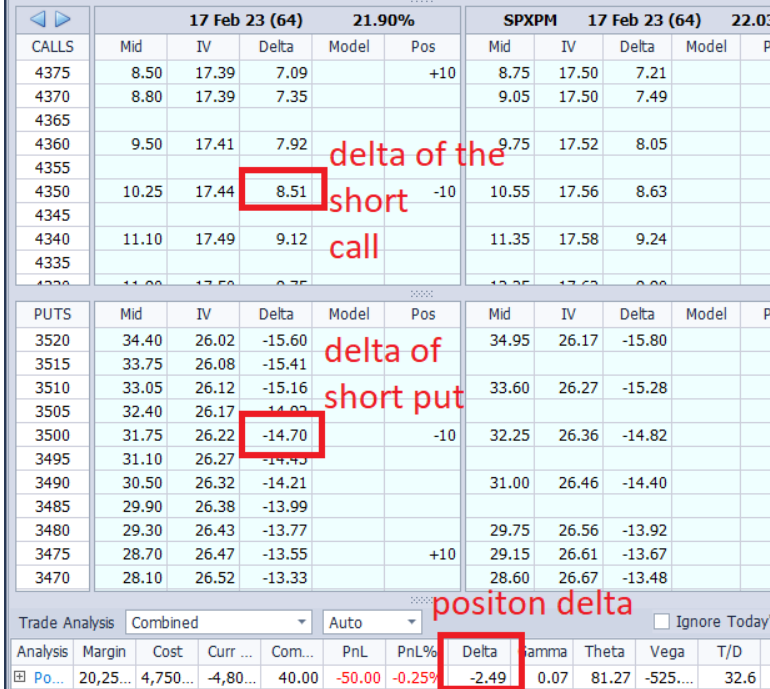

You can see the position delta and the delta of the short call and short put as well:

This is so that you might decide to hypothetically make an adjustment if the short put reaches a certain delta.

You can then model that adjustment, and OptionNet Explorer will account for any adjustment credits and debits in its P&L.

In the above screenshot, the current P&L is -$50.

While ThinkOrSwim can do some limited backtesting with historical data, it is not nearly as robust as OptionNet Explorer.

OptionNet Explorer and OptionVue simulate what it was like trading a strategy in the past because all the data and graphs are there for you.

Frequently Asked Questions:

Does OptionNetExplorer run on Mac?

Like OptionVue, OptionNET Explorer is a desktop-based software that runs on the Windows operating system.

However, you can use virtualization such as Parallels, VMware Fusion, or Windows under Apple Boot Camp to run Windows programs on a Mac machine.

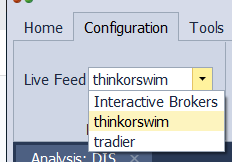

Does OptionNet Explorer have live data?

Yes, but only if you connect OptionNet Explorer to the live feed of your Interactive Brokers, ThinkOrSwim, or Tradier account.

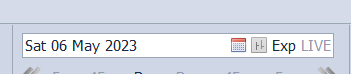

And then make sure to click the “LIVE” button to turn the live feed on…

For ThinkOrSwim, you may need to have the ThinkOrSwim desktop application running in the background in order for ONE to get the live data.

For Tradier, you do not need to.

What are the differences between the stable version and the beta version of OptionNet Explorer?

The beta version is a complete rewrite of the OptionNet Explorer software.

It has pop-out panels and multiple open windows, which make it more suitable for users with multiple monitors.

You can also better configure the option chain to show more data on each of the options.

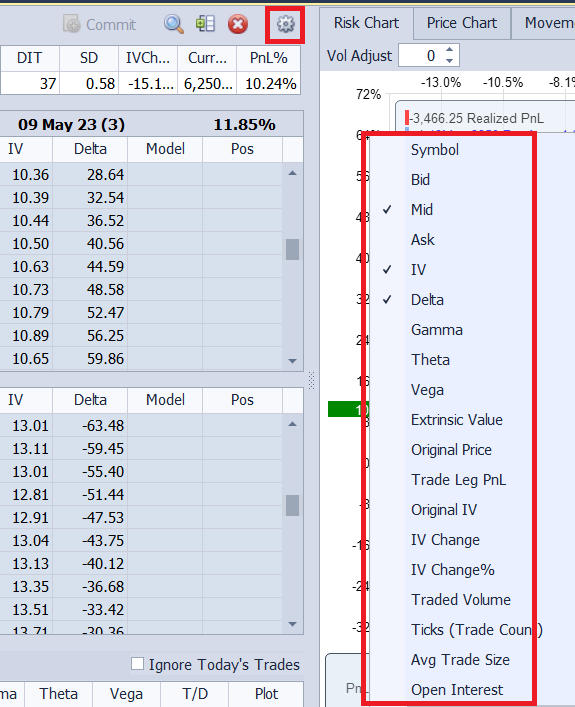

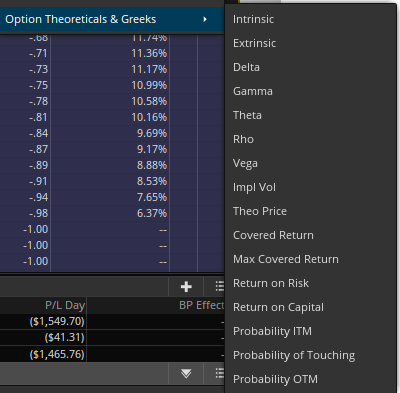

What are some of the data that is available on the options in the option chain with OptionNet Explorer?

For the beta version of OptionNet Explorer, you have the following data available:

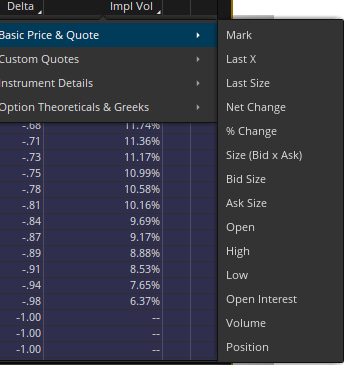

What are some of the data that is available on the options in the option chain with ThinkOrSwim?

And

Summary

Unfortunately, OptionVue is no longer available.

Learning a new software program is a bit of work because each piece of software does things a little differently and has different functionalities.

Suppose you are in need just to see the risk graph and the Greeks. In that case, there are many alternatives, including OptionNet Explorer, ThinkOrSwim, OptionStrat, Option Trader Assistant, and others that we have not mentioned here.

But if you also need to do manual backtesting with historical options data, the best alternative is OptionNet Explorer.

OptionNet Explorer has only a desktop app for Windows.

So it is a hassle for Mac users to use a Windows virtualization in order to run it.

ThinkOrSwim has both a desktop app for Mac and Windows.

OptionStrat and Option Trader Assistant are both web-based and, therefore, can run anywhere.

We hope you enjoyed this article optionvue alternatives.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.