Contents

Positive skew is an atypical condition where a near-term expiration’s implied volatility (IV) is higher than a further-dated expiration. It is not an unusual condition because you can find it if you know where to look.

However, it is not the typical condition. The more common condition is negative skew.

Today we will talk about horizontal skew, not to be confused with vertical skew.

Horizontal skew is the difference in IV between the near-term expiration cycle and a further dated expiration cycle.

Vertical skew is the difference in volatility skew of different strike prices of options contracts with the same expiration date.

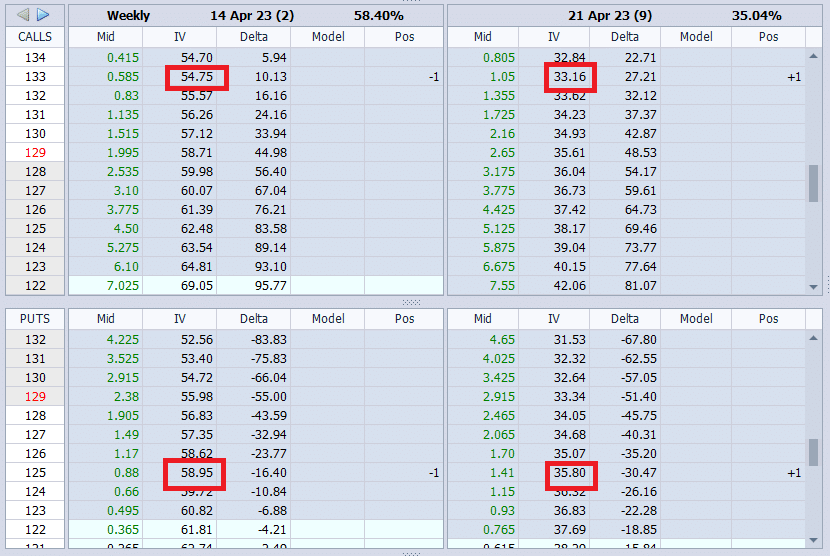

Focusing on the horizontal skew, look at the IV of the $133 calls for this particular underlying (the ticker symbol of which is unimportant).

Horizontal Skew

See that the $133 call option for the April 14 expiration is at 54.75%.

Then look horizontally to the April 21st expiration. (Now you understand why they call it horizontal skew).

The $133 call option for the later April 21 expiration is at 33.16% – a lower number than the April 14 expiration.

This situation shown in the screenshot is not a typical condition.

Normally, the later-dated expiration should have a higher IV because there is more time for bad things to happen, which creates greater uncertainty (and hence IV) for the later-dated option.

In this particular case, the IV of the near-term April 14 expiration of this underlying is pumped up unusually high because there is an earnings announcement just prior (could be that morning or a few days before) to this expiration.

The uncertainty of the earnings outcome drove the IV of the April 14 expiration to be high.

When the earlier expiration has a higher IV than a later expiration, we call this “positive skew.”

Another term that people use to mean the same thing is “backwardation” because it is backward than what it normally is.

Each individual strike (calls and puts) has its own individual IV.

But they tend to be high all together or low all together.

This applies to both calls and puts.

I have highlighted the $125 put option above, and you can see that it, too, is in backwardation – because 58.95% is higher than 35.80%.

If you want an average IV for all the strikes of the April 14 expiration, just look at the 58.40% IV number shown next to the expiration date.

Similarly, the 35.04% IV is the average IV of the April 21st expiration.

Negative Skew

Under normal conditions, the later expiration has a higher IV than the earlier expiration.

This is called negative skew. Hence “negative skew” is “normal skew.”

Another term that people use to mean the same thing is “contango.”

Think of contango as the opposite of backwardation, and that contango is the condition that exists most of the time.

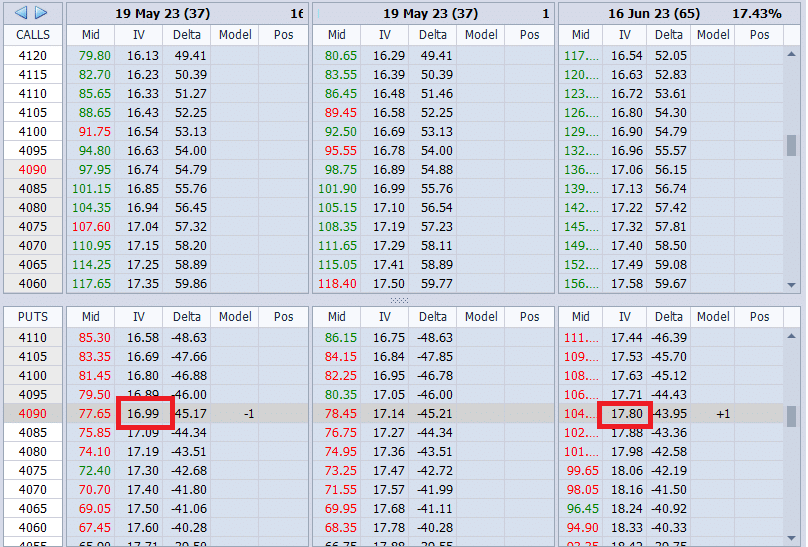

Here is an example of normal negative skew on an SPX calendar:

IV of 17.80 is higher than 16.99.

Percent Skew

What is the percent negative skew in the above SPX calendar?

Answer: 16.99% – 17.80% = -0.80%

Even though OptionNet Explorer analytical software does not put the % sign in its column of numbers, we know that IV values are in percentages.

Sometimes it is difficult to remember which is a positive skew and which is a negative skew.

If you remember to take the IV on the left and minus the IV on the right to compute the difference, then the sign of the result will tell you a negative or positive skew.

When the difference is negative, you have a negative skew.

If the difference is positive, then you have a positive skew which is when the left IV is greater than the right IV.

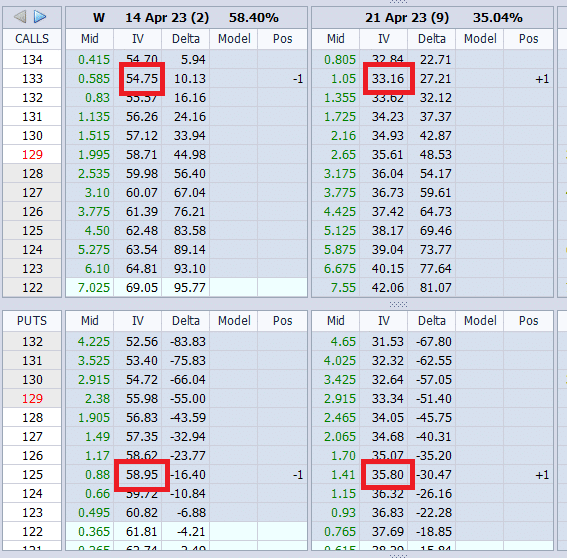

How much positive skew percentage is in the JPM double calendar earnings trade shown her

For the call calendar, it is 54.75% – 33.16% = 21.59%

For the put calendar, it is 58.95% – 35.80% = 23%

That is quite a large skew caused by the upcoming earnings event.

Where Do You Find A Positive Skew?

You don’t need to have an earnings event to have a positive skew.

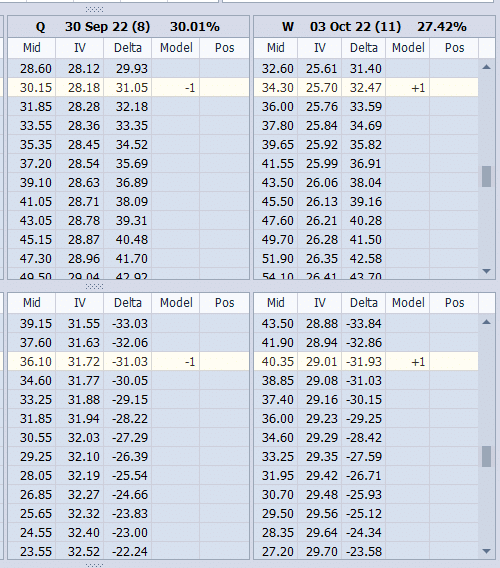

Here is an example of a positive skew in the SPX index with no earnings events.

Call calendar: 28.18% – 25.70 = 2.48%

Put calendar: 31.72% – 29.01 = 2.71%

This is a short-term double calendar with only eight days to expire for the short options. And it is a narrow-spread calendar with only three days between the short and long options.

There is a tendency to be able to find positive skews in shorter-term and narrow-spread calendars.

Why Do People Look For Positive Skew?

Positive skew is beneficial to calendars because you are selling the front expiration with a high IV and buying a later-dated expiration with a low IV.

You can think of IV as the “extra value” in the option. It is the amount that will have to decay out by option expiration. Hence, you want to sell high IV.

When buying options, you want to buy a lower IV so that you don’t have to pay for all that extra IV value.

This is not to say that calendars are only profitable during positive skew.

Certainly, calendars can also be profitable under normal conditions such as negative skew.

Is Positive Skew A Sign Of Danger?

While some people see positive skew as an advantage, others may see it as a sign of danger.

The IV is high in the near term for a reason.

It is high because the market feels uncertain of a potential large move in the underlying price.

If the underlying does, in fact, make a large move, the calendar trade may suffer. So there is some extra risk of a large move when you have a positive skew.

Positive skew means there is immediate “danger” now. More “dangerous” than in the future. High volatility implies uncertainty.

People are always fearful of uncertainty.

Volatility is high now because people are aware that they are in a dangerous situation.

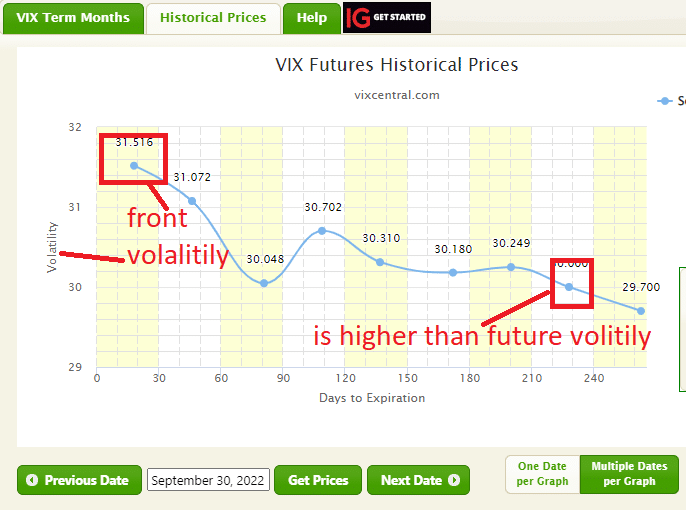

Some investors like to look at vixcental.com to see the skewness of the market based on the VIX futures term structure.

If they see backwardation where volatility is higher in the near-term than later-term, such as this:

They know that the marketplace is in a potentially dangerous period.

We say that the market is in backwardation.

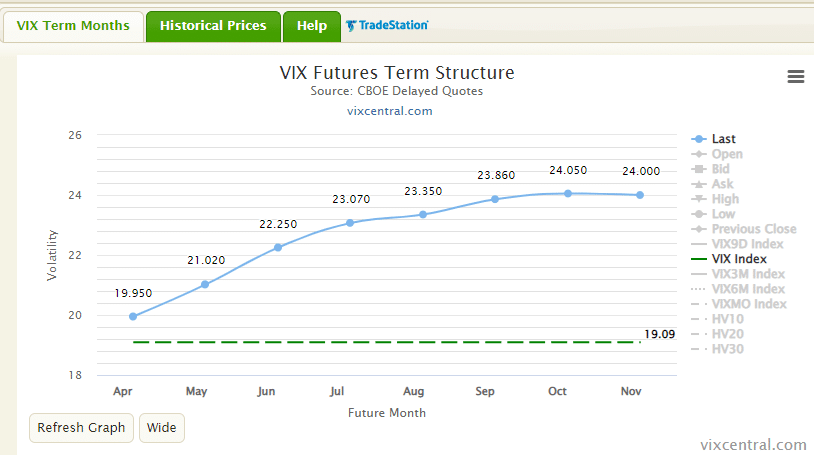

Under normal calm situations, volatility should be lower than future volatility.

We say that the market is in contango, such as shown here:

The future months (Oct and Nov, for example) have higher volatility than the near months (May and June, for example).

This is normal and how it is most of the time.

We use the words “backwardation” and “contango” when referring to the VIX Futures Terms structure.

Although they mean the same as “positive skew” and “negative skew,” we reserve the words positive/negative skew for when referring to IV in the options chain.

Frequently Asked Questions

Will the market crash when the VIX futures term structure is in backwardation?

No, just because the VIX futures term structure is backward does not mean the market will crash.

The market may not do anything at all.

However, most market crashes were preceded by the VIX futures going into backwardation.

Are double calendars better than single calendars?

No.

There are pros and cons.

Double calendars provide a larger profitable range.

However, they have smaller theta, meaning you have to be in the trade longer to reach the profit target.

Being in the trade longer means that there is more time in the trade where an adverse event will cause an adverse price move that draws down the P&L.

Why is the vega value of calendars reported by analytical software not accurate?

The vega value for trades with different expirations does not reflect what really will happen.

The analytical software assumes that the IV of the front and back expiration cycle goes up by the same amount.

In reality, this is not accurate.

Depending on the severity of the risk event, which drives volatility up, the near-term IV may often increase to a greater extent than the IV of the far-term expiration.

Remember that calendar traders want the front option to drop in price more than the back expiration option.

While calendars are reported as positive vega, which is supposed to benefit if an event spikes volatility, it may not always behave as such in real life.

Summary

In summary, positive horizontal skew (also known as backwardation) is when the near-term volatility is higher than the future-term volatility due to uncertain risk events close at hand.

Otherwise, the future-term volatility is higher under normal conditions than near-term volatility.

This is called negative skew, which is also known as contango.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.