When the price goes against your long call or put option, the option can lose value and may even become worthless at expiration.

There are ways to reduce this loss and certainly not take the max loss of the option.

Contents

SBUX Example

Suppose an investor is bearish on Starbucks (SBUX) and buys five contracts of the $105 put option when SBUX was trading at $99.57 on March 14, 2013.

The cost of the $105 put is $1.25. The total debit paid is $625 (from 5 x $125).

There are about 31 days to expiration on these options, and if SBUX does not close above $105 on April 14 expiration day, the entire $625 will be gone.

To be profitable, the trader needs SBUX to be above $106.25 to account for the cost of the options.

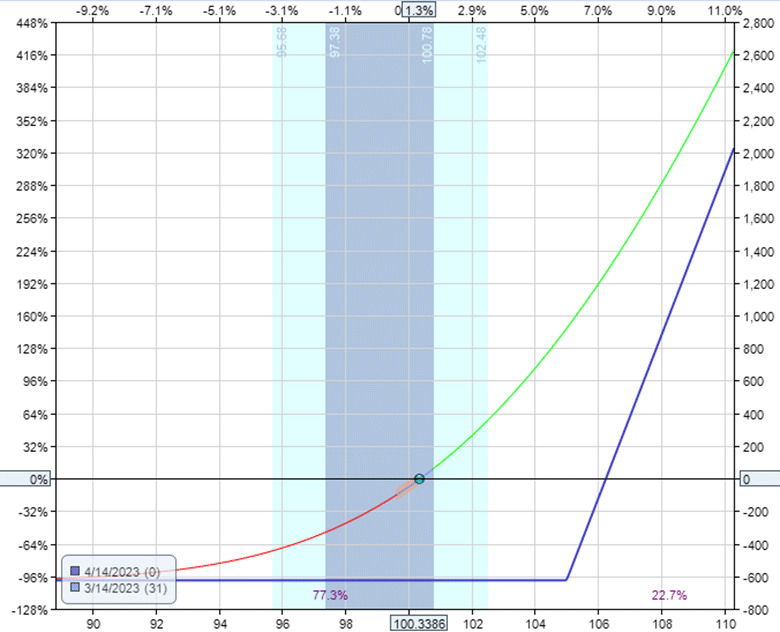

The payoff graph looks as follows:

Three days later, on March 17, the price of SBUX was down, and the option lost 45% of its value with the P&L of the trade at -$282.50, as shown below.

The trader wants to exit this trade because he was wrong about the direction.

How much of the $625 can he get back and salvage?

Close Entire Position

If he sells all five call options at a value of $0.69 now, he will get a net credit back of $345.

This would exit the entire trade with no possibility of getting back to profitability.

But at least it would limit his loss, and he will not have the possibility of max loss on the trade.

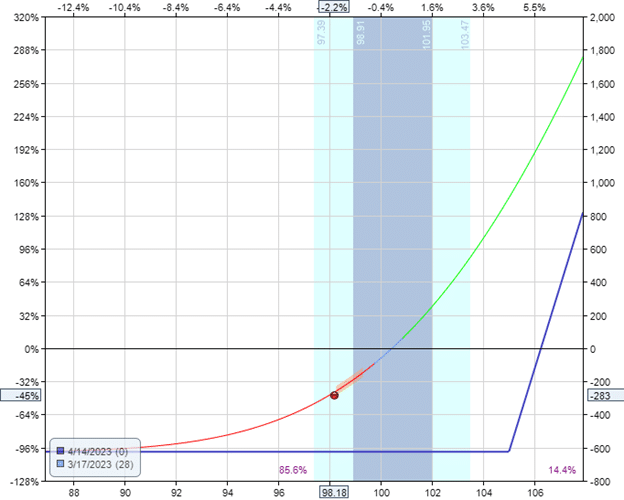

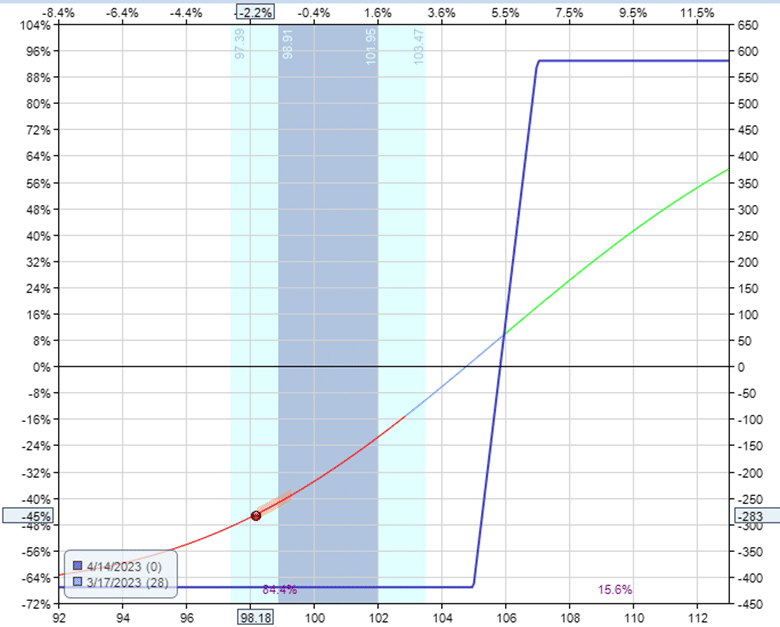

Spread Off The Long Option

If he thinks that ultimately SBUX can still go back up, he can reduce the risk in the trade by selling the $107 call option.

This will cap the profits of the $105 call option.

However, it will also reduce the trade’s max loss, as seen from the resulting payoff graph.

The max loss is at -$420 as opposed to -$625 previously.

The $107 call options are selling for $0.41.

So selling five contracts would bring in a credit of $205.

By pulling this amount out of the trade and back into his bank account, he reduces the max risk of the trade by exactly that amount.

Looking at the graph, we can see if there is still a possibility that the trade can become profitable again.

If not, then at least the price can go up the T+0 curve high enough to reduce the loss a bit more before the trader closes the trade entirely.

ADBE Example

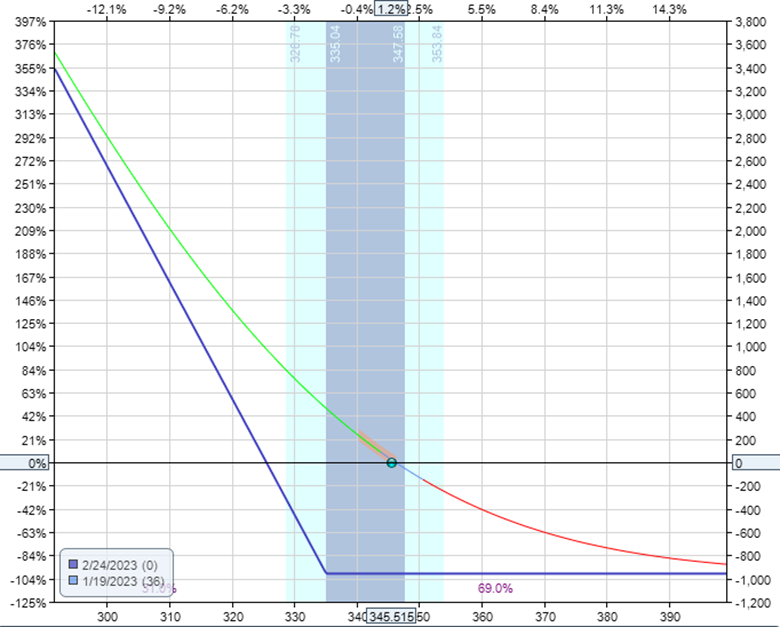

On January 19, 2023, suppose an investor is bearish on Adobe (ADBE) and buys the $335 put with a February 24 expiration (about a month away). The cost is $957.50.

The following Monday, with Adobe going up instead of down, the put option lost half its value.

Many investors at this point would cut the trade and exit by selling the put option for $463 and at least get back half of their investment back.

The resulting P&L for the trade would be a net loss of $957.50 – $463 = $494.50.

Alternatively, investors can sell weekly put options instead of selling the original put option that expires in four weeks.

For example, they might sell the $335 put that expires on February 3 to collect $166.

The resulting payoff graph is a calendar:

The max loss of the trade (looking at the graph) is about $800.

The max loss is $957.50 – $166 = $791.50.

The nice thing is that the tip of the calendar graph is above zero, which means there is a small possibility that the trade can still come out positive.

But no such luck.

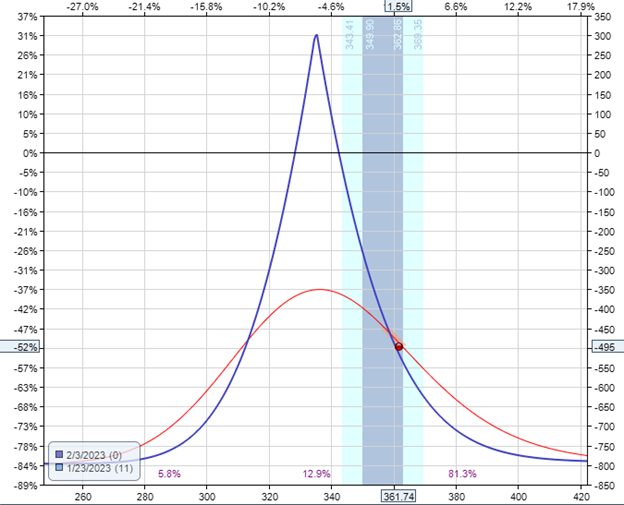

On February 3, on the day of the expiration of the short put, the trade is down -$700.

The investor can buy back the short put for $1 and sell another $335 put, expiring one week later on February 10.

This rolling trade gives the investor an $11 credit and a new payoff graph:

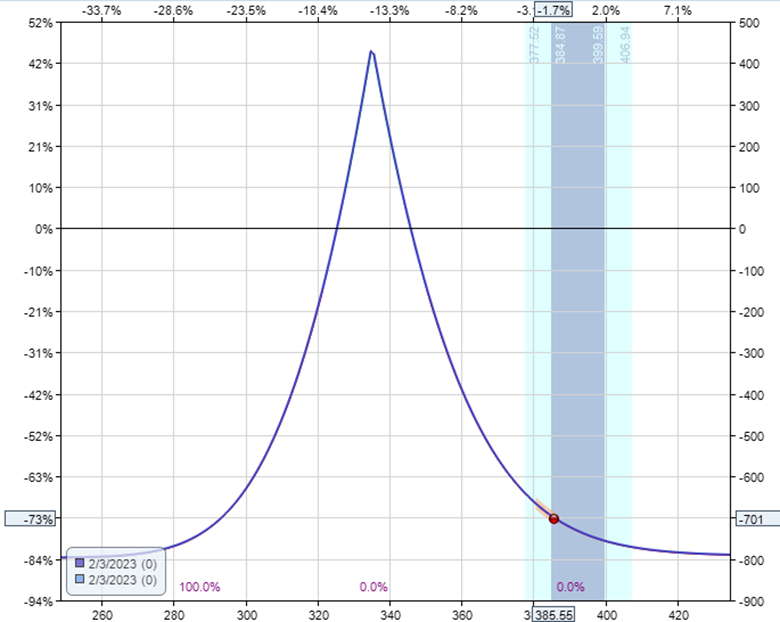

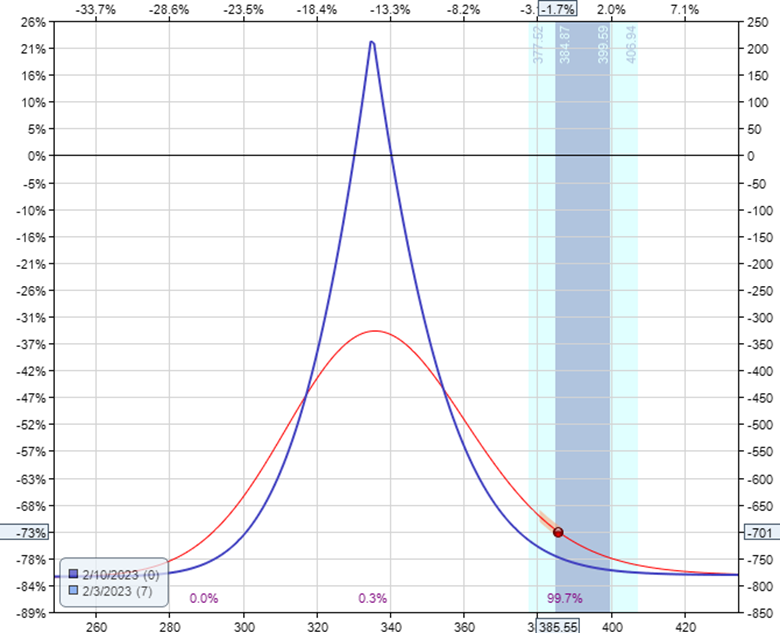

On February 10, the investor buys back the short put and sells another $335 put.

This one expires on February 17. This gives a $63 credit.

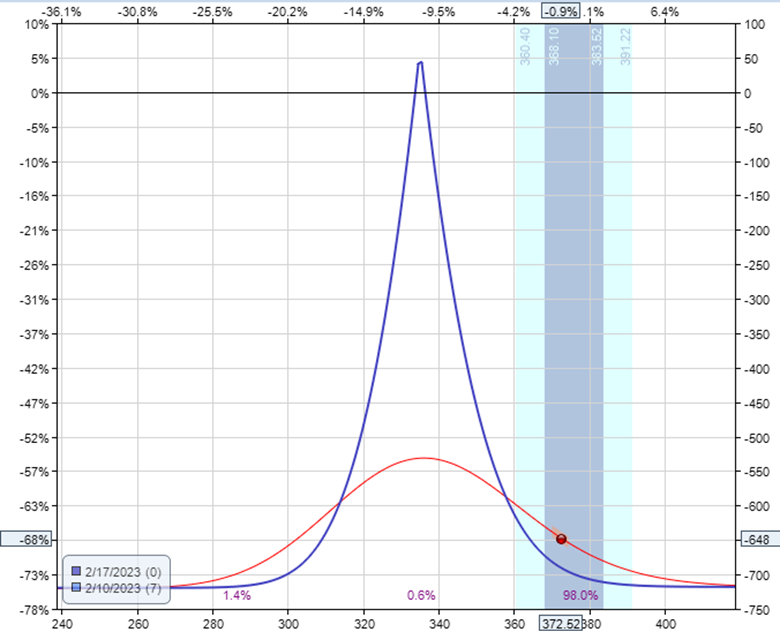

The max loss of the trade is now reduced to $718 with the new payoff diagram:

On February 17, the day of the short put’s expiration, the investor can no longer roll the short put further out in time.

The long put expires only one week later.

The investor closes the entire trade by buying back the short put and selling the long put, collecting $74.50 in credit.

The net P&L loss on the trade is $643.50.

In this case, because the short puts were far from the strike price, selling the three short puts each week did not bring in as much credit as if the investor had just sold the long put in the first place.

However, this does not always turn out to be the case.

Sometimes, selling the three short puts may bring more than selling the original long call.

It all just depends on how the price of the underlying moves.

We keep selling the short puts at the $335 strike because this is the strike where the long put is.

We want to have the short and long strikes be the same to have a calendar.

Calendars have the characteristic that their max risk is the debit it took to get into the trade.

An investor may be tempted to sell a short put closer to the money, but they must be careful because that would be a diagonal instead of a calendar.

Diagonals do not have this characteristic and can increase the trade risk to more than the risk of the long-put option itself.

This would be counter to our goal of limiting the risk of the long option.

By only using calendars, we will always decrease the trade risk.

By getting into diagonals, that will not be the case.

Another point to watch out for when selling the short puts is the risk of assignment and the possibility of early assignment.

Whether it is worth it to reduce the risk of the trade with calendars or spreads or whether it is better to just exit the long option as soon as we know we are wrong is up to the trader’s discretion.

FAQs

What are the Greeks of a long call option?

A long call has a positive delta, which benefits if the underlying price goes up.

A long call has negative theta, meaning it loses money as time passes (with all other things being equal).

They are also positive vega, which means it benefits if implied volatility of the underlying increases.

What are the effects of positive gamma?

A long call has positive gamma, which means that if the underlying price goes up, the delta will increase to further favor an upside move.

Essentially, if the trade goes in your favor, the delta will change to further enhance your profits if the price continues to move in your favor.

Conversely, if the trade goes against you, the delta will change to reduce your loss.

Are there profitable strategies for trading long calls and long puts?

Yes, some successful techniques that traders use are:

- buy enough time in the option so that the theta decay is not excessive.

- limit the loss of the long option as soon as it is not going favorably.

- let the profits run and lock in profits as appropriate.

The successful strategy will either be one where the average dollar won is larger than the average dollar loss when the win rate is 50-50.

Or it will be one where the win rate is high enough that the number of wins can offset the amount of the losses.

What is meant by asymmetrical returns of the long option?

It means that the reward and risk profiles are not symmetrical.

Looking at the payoff graph, we see that the long option has an unlimited reward.

However, it does not have unlimited risk. Its risk is capped.

Its reward is not capped.

Conclusion

The long call and the long put are defined-risk strategies with limited loss.

Its max loss is limited to the amount paid for the option.

However, we prefer not to take this max loss.

Hopefully, this article gave you some ideas so you never have to take this max loss.

For further study, see the article on how to lock in profits of your long option.

We hope you enjoyed this article about losing money on long options.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

I believe you may want to edit this article titled:

‘Stop losing money on long options’

The article begins with a SBUX example where a bullish investor buys 5 puts…. However a bullish investor will not buy puts rather he will buy calls or sell puts… please correct me if I am wrong.

I find it interesting that of the 427 people that read this article did no one else question it?

Thanks Paul. Fixed now.