Contents

The investing world can be intimidating, but the basics of risk and return are essential for any investor to master. One of the core concepts is the risk free rate of return.

A risk-free rate is what is at the basis for most decisions in the professional finance world.

It is the opportunity cost evaluated before entering into an investment.

Despite its seemingly easy name, there are a few nuances to know before you execute anything based on it.

In this article, we’ll dive into the nitty-gritty of the risk-free rate of return, exploring what it is, why it matters, and how to calculate it.

So, buckle up and prepare to learn about this essential element of the investing world.

Risk-Free Rate Of Return – An Overview

Let’s start with the basic question: what is the risk-free rate of return?

When it comes to investing, the risk-free rate of return is an important concept. It refers to the hypothetical rate of return an investor would obtain from a “no-risk” investment within a specified time frame.

In other words, this figure provides insight into what one could expect from a completely secure investment.

While it is pretty generally accepted that there is no such thing as a risk-free investment, the closest thing would be the U.S. Government Short term debt.

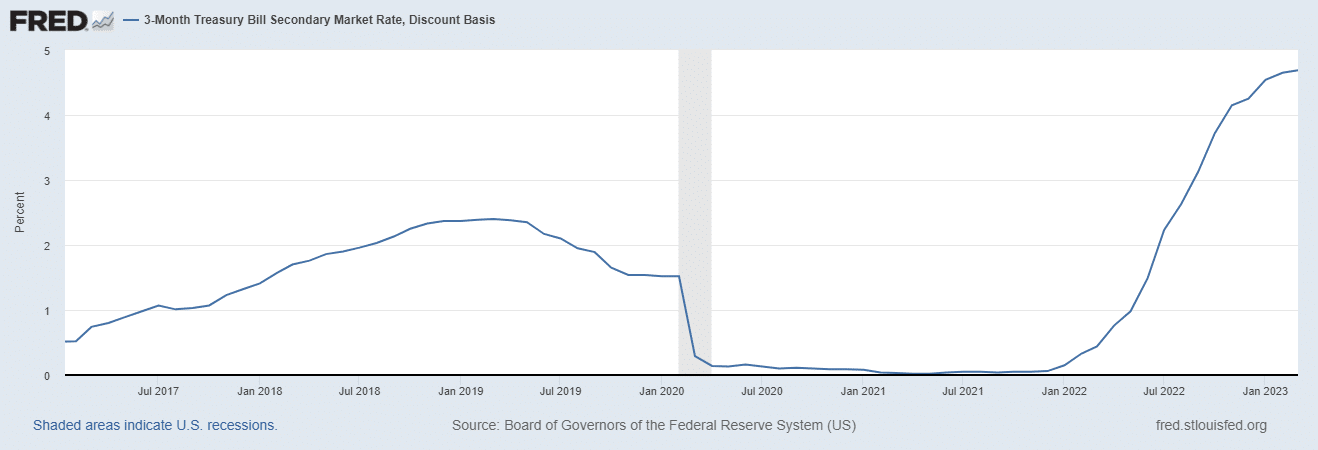

Typically the risk-free rate is based on the 3-month T-bill, and this is for a few reasons.

First and foremost is the fact that the U.S. has never defaulted on short-term debt.

Second, it is one of the most liquid markets in the world, so it’s on the safer side regarding investments.

In addition to the risk-free rate, there is also a concept known as the “real risk-free rate,” and this rate also accounts for inflation.

This rate serves as a base for constructing multiple valuation models illustrating how extra risk might affect earning potential.

Those willing to accept a greater risk than a U.S. T-bill may earn a higher rate of return.

This additional profit is known as the ‘risk premium,’ which is the difference between the estimated return and the risk-free rate.

How Is The Risk-Free Rate Of Return calculated, and why is it important?

When assessing investment opportunities, it is beneficial to consider what a risk-free return could be. As a benchmark for gauging other types of returns, this can help investors decide whether or not an opportunity is worth pursuing.

This opportunity cost of investing helps investors look at the risk/return of potential investments through a much more conservative eye.

The risk-free rate is used in various financial models, such as the Capital Asset Pricing Model (CAPM), to calculate the expected return on investment.

There are numerous methods for calculating the risk-free rate of return. Here are a few:

1. Treasury Bills Method

T-bills (Treasury bills), which serve as a stand-in for the risk-free rate, are widely considered to be virtually devoid of default risk. As the U.S. government has yet to default on its debt, investors rest assured that T-bills provide sufficient financial protection when held over short maturities. No interest rate risk is also associated with these as they rarely gap a Fed decision.

T Bills are considered to be a True Risk-Free rate.

2. Real Rate Method

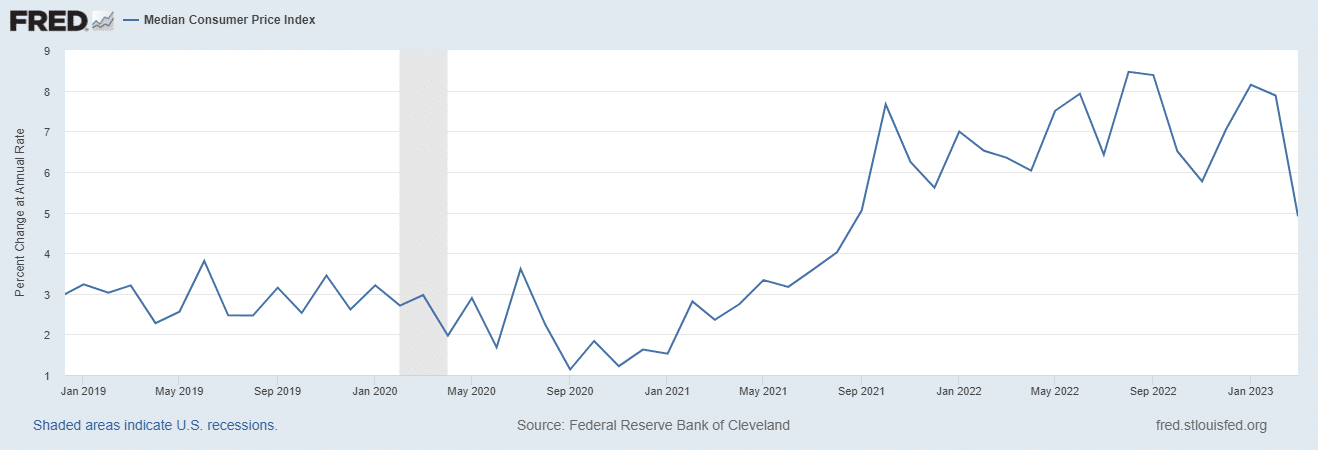

The real risk-free rate of return is the risk-free rate after inflation has been taken into account.

This is determined by subtracting the rate of inflation from the yield of Treasury bills/bonds with a corresponding investment duration.

This rate is typically in line with the length of time cash flows are expected of the desired investment.

The 10-year U.S. Treasury note is what many investors use as the default risk-free rate for longer-term investments.

The 30-year can also be used but is often foregone due to lack of liquidity on occasion.

Real Risk-Free Rate = Risk-Free Rate – Inflation Premium

Let’s look at an example: let’s say the T-bills risk-free rate is currently 3.00%, while the inflation rate is around 7.0%.

In that scenario, the real risk-free rate of return would be -4.00%, meaning if you invested in the risk-free rate, your buying power would be shrinking by 4% per year.

This is the cost of taking on near-zero risk on your money.

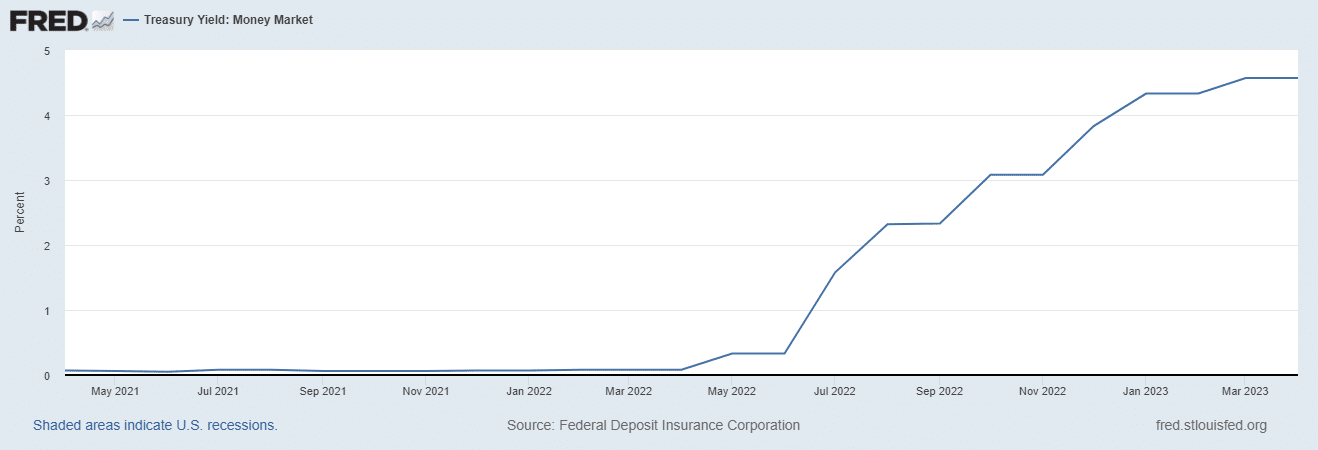

3. Yield On Money Market Account Method

In addition to a Savings account, many institutions also offer Money Market accounts.

These are similar to savings accounts in so far as they offer a yield to their investors.

They often come with a few caveats, like a minimum deposit amount or a minimum length of time to hold.

The main benefit to a Money Market account is that they typically offer a significantly higher yield than a savings account would (significant being a relative term in today’s low-rate environment).

Because these are highly liquid, they can sometimes be used as risk-free rate measurements because they often come with strict regulations about liquidity and yield.

Some investors chose to use this risk-free rate because it is as easy to calculate as the T-bill; most institutions just post what the APR and APY for a money market account are.

If yours does not, or you are looking at investments over a longer time horizon, the formulas are as follows for determining what the money market and holding period yield will be:

The formula for the money market yield:

Money market yield = Holding period yield x (360/Time to maturity)

The formula for the holding period yield:

[(Face value – Purchase price)/Purchase price] x (360/Time to maturity)

4. Yield On Certificate Of Deposit Method

A Certificate of Deposit from a Bank is similar to the method of using the Money Market for the risk-free rate.

Because they are secured by the FDIC for anything under $250,000, this is as close to a guarantee on your money as you can get.

While CDs often have both minimum deposits and holding periods, it is fairly easy to see your return rate over the course of your investment.

You would do the calculation below to determine your total rate of return over your expected holding period.

A = P(1 + r/n)^nt

To work out how much interest you have earned, first, determine the final balance.

The equation mentioned above requires knowledge of the original balance (P), the interest rate (r), and the number of times that interest is compounded each year (n).

This will give you (A) the final balance on your CD. You can then extrapolate the rate you received from there.

Factors That Impact The Risk-Free Rate Of Return

Several factors impact the risk-free rate of return, which are as follows:

1. Inflation Expectations

Inflation occurs when the rate of price increase for goods and services is high, which ultimately reduces the value of a currency.

As prices rise, the purchasing power of money decreases, which means that the same amount of money will buy fewer goods and services than before.

This has serious implications for investors who must consider the impact of inflation on their investments.

Given the reduction of purchasing power caused by inflation, investors must take it seriously and factor it into their investment decisions. Inflationary expectations play a crucial role in determining the risk-free rate of return.

When investors anticipate a higher price level due to inflation, they seek greater returns on their investments, which leads to an increase in the risk-free rate of return.

2. Central Bank Policies

A country’s financial authority, particularly its central bank, also influences the risk-free rate. Raising interest rates makes it harder for people to obtain loans and credit.

It increases the risk-free rate of return as investors demand a higher return to compensate for the higher cost of borrowing.

3. Economic Growth And Stability

The risk-free rate is closely tied to the growth and stability of the economy.

When an economy experiences rapid development, it often leads to an increase in demand for investment, driving up interest rates and resulting in a higher risk-free rate that is required.

Conversely, in a stable economy, investors are more likely to opt for low-risk investments, which can lead to a lower risk-free rate of return.

Therefore, the level of economic growth and stability plays a critical role in determining the risk-free rate of return.

4. Default Risk

Not surprisingly, default risk is also closely tied to the rate of return required by an investor.

The risk-free rate is usually backed by the U.S. government, either bonds, banks, or the FDIC, so anything with more risk than this will require a higher risk premium.

One of the largest drivers of the risk premium is the default risk.

5. Liquidity Risk

Finally, there is liquidity risk.

This is second only to default risk, and that is how easily your investment can be turned back into cash.

The lower the liquidity an investment has, the higher the liquidity risk and the higher the required rate.

An example is real estate; private investors usually charge between 10 and 20% in the U.S. for real estate deals.

This is because it will take at least 30 days to turn that loan back into cash, and often significantly longer (this has been highly simplified to make the point).

So liquidity will always play a role in the risk-free rate and the amount of risk premium required on an investment.

In Conclusion

It’s important to remember that a risk-free rate of return exists when considering your investment options.

This rate is achievable by taking on almost no financial risk and is a benchmark when evaluating other potential returns.

It plays a vital role in theories such as CAPM and MPT, but it’s important to be aware of certain restrictions regarding this type of return.

The term ‘risk-free’ is a bit misleading, as even government bonds – generally considered a secure investment – carry some risk.

Thus, the risk-free rate represents the lowest possible return an investor can expect from any investment.

For organizations to attract investors and stay in line with ROI, they must offer higher returns than the risk-free rate, which usually requires adding a risk premium on top of the risk-free rate when investing in other areas.

Additionally, in assessing the cost of capital, it’s necessary to consider that the risk-free rates are subject to change throughout the life of your investment.

The rate is determined by analyzing the yield on short-term government securities, which can fluctuate due to external forces like inflation, economic growth, or political unrest.

Therefore, investors must be aware that the perceived risk-free rate may not always accurately reflect what an investor should consider a minimum rate of return.

While the risk-free rate offers a certain degree of security, some investors are willing to take on more risk in pursuit of potentially higher returns.

These investors sacrifice that security for greater yields, which contrasts with the risk-free rate of return concept. A great example of this is the stock market.

While T Bills are relatively risk-free, equities are not.

As a result, investors demand significantly more returns from the general market than they would from short-term government bonds.

Ultimately, investors must evaluate their investment options and determine the appropriate level of risk based on their financial goals.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.