As options traders or investors, we must be aware of the trade risks and learn how to control them.

Whether we are trading a short-term credit spread or investing in a long-term LEAPS, there are times when the trade goes against us.

If it goes against us hard enough that we think the trade is not salvageable, we may shut down the trade entirely.

If we are in a slight drawdown and want to reduce the risk in the trade, then this is what we are going to talk about today.

Take, for example, a bull put credit spread where we are expecting the price of the underlying to go up.

Date: March 28, 2024

Price: QQQ @ $444.65

Sell two contracts May 3, 2024 QQQ $420 put @ $1.95

Buy two contracts May 3, 2024 QQQ $415 put @ $1.47

Credit: $94

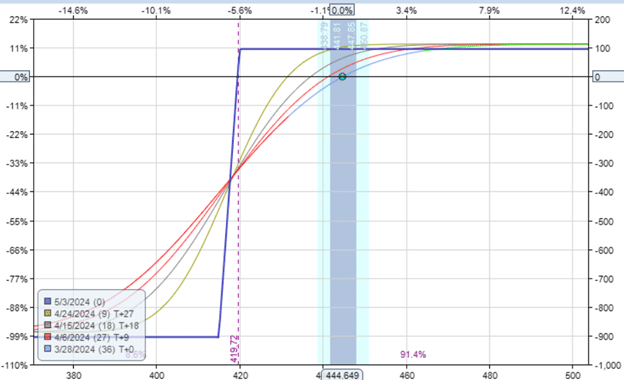

The payoff graph looks as follows.

This graph is also called the risk graph. It shows that the maximum risk in the trade is around $900.

This max loss occurs if the price of QQQ is below $415 at expiration.

We can also calculate this risk by taking the width of the spread multiplied by the number of contracts times 100 and subtracting the credit received.

$5 x 200 – $94 = $906

We must be aware of this risk and comfortable with it when we initiate the trade.

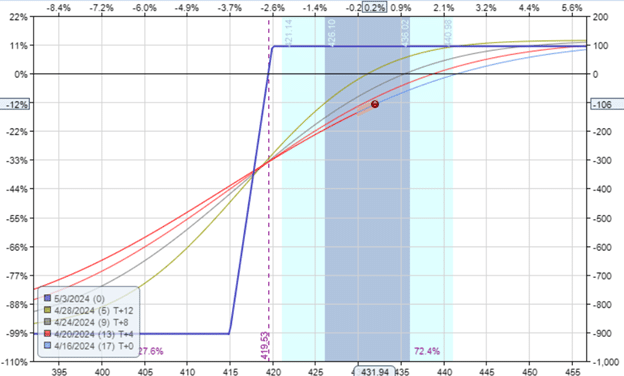

Nineteen days into the trade, the price of QQQ dropped down to $432, and the P&L of the trade is now -$106.

The Greeks at this time are:

Delta: 13.5

Theta: 4.82

Vega: -8.58

We feel that our initial thesis was wrong.

Is there a way we can decrease the risk in this trade?

Yes, there are.

There are multiple ways.

Today, we will just give you one way.

We can sell a call credit spread with the same expiration.

For example,

Date: April 16, 2024

Price: QQQ @ $432

Sell two contracts May 3rd QQQ $453 call @ $1.25

Buy two contracts May 3rd QQQ $456 call @ $0.86

Credit: $78

Now, look at the risk graph.

The max risk has gone down to $828.

It had gone down by the amount of the credit received from selling the bear credit spread.

This is because if the price goes down through both strikes of the put options, we will have the maximum loss of the bull put spread.

We still keep the credit from the bear call spread to reduce that loss.

And the Greeks have improved:

Delta: 6.61

Theta: 9.46

Vega: -15.93

The Delta decreased by about half.

Because we are selling additional credit spreads, the theta and vega increased.

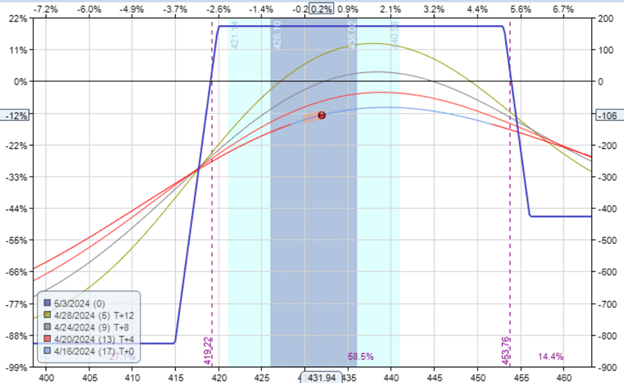

What happens if the call spread loses?

For example, if the price goes above $456?

Then, we keep the credit of the put spread, which compensates us for the loss.

The three-point wide bear call spread loss is $3 x 200 = $600.

Loss is reduced by the credit of the put spread and the call spread.

$600 – $94 – $78 = $428

The max loss is $428 if the price of QQQ rallies hard to breach the call spread.

You can also see this from the risk graph, where the blue expiration line on the upside is horizontal at the -$428 loss level.

We cannot lose on the put spread, and the call spread at the same time.

The credit on one helps compensate for the loss on the other.

In Summary

We can reduce the risk in a credit spread by selling another opposing credit spread.

In our example, we reduced the risk of a threatened bull put credit spread by selling a bear call spread, turning the trade into an iron condor.

It is not a balanced iron condor because the call spread is smaller than the put spread.

The call spread is 3 points wide, whereas the put spread is 5 points wide.

At the trader’s discretion, they can sell a call spread with the same width as the put spread to have equal risk on both the upside and downside.

They can even sell a call credit spread that is wider than the original spread.

However, this is not normally done because it increases the risk in the trade.

If this is not at first clear, try it out as an exercise in your modeling software and examine the risk graph.

We hope you enjoyed this article on decreasing the risk of credit spreads with iron condors.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Wouldn’t this be a BEAR Put DEBIT spread?

Take, for example, a bull put credit spread where we are expecting the price of the underlying to go up.

Date: March 28, 2024

Price: QQQ @ $444.65

Buy two contracts May 3, 2024 QQQ $420 put @ $1.47

Sell two contracts May 3, 2024 QQQ $415 put @ $1.95

It’s a bull put spread, I just had the buy and sell the wrong way round. Fixed now.

Oh ok. And would the 420 put be cheaper ($1.47) than the 415 put ($1.95)?

Nope. Also fixed now. Thanks!

LOVE your stuff, by the way!

Thanks. I really appreciate you saying that!