Contents

- Introduction

- Maximum Loss

- Maximum Gain

- Breakeven Price

- Payoff Diagram and Profit Calculation

- The Greeks

- How Volatility Impacts the Trade

- How Theta Impacts the Trade

- Risks

- Example

- Summary

Introduction

The collar strategy is an option strategy that allows the investor to acquire downside protection by giving up upside potential on a stock that he currently owns.

You simply purchase a put on the underlying stock and finance it with the sale of a call.

In short, you are long stock, long put, and short call at the same time.

Think of it as running a covered call with a long put, or protective put with a short call.

It is commonly used in a corporate finance setting to hedge interest rate risks on floating rate assets.

For example, when an institution that has an investment portfolio of floating rate securities, it can hedge interest rate risk by buying interest rate floors (a series of puts) and paying for it by writing a cap (series of calls).

We can apply the same concept in the world of stock holdings.

Before we begin, let me emphasize that one can place a collar at the same time as entering the stock position, or simply step into a collar at a later point.

Typically, investors step into a collar after their stock holdings have appreciated and they want to protect their unrealized profits.

But that is not the only reason. Other reasons include:

- Your position has a low tax cost basis and selling the stock will create a huge tax bill.

- You don’t want to sell your position but want downside protection.

- Protection is costly so you can reduce the cash outlay by writing a call.

- You are holding IPO shares and the sale is restricted by lockup agreement.

- Your view on the stock is bullish, but you are nervous it will tank after lockup expiration.

- You want to continue owning the stock for its dividend.

Collar Strategy Trade Mechanics

Let’s look at the mechanics of the trade and understand how to set it up.

Consider the investor who bought shares of Uber at its all time low of $14.

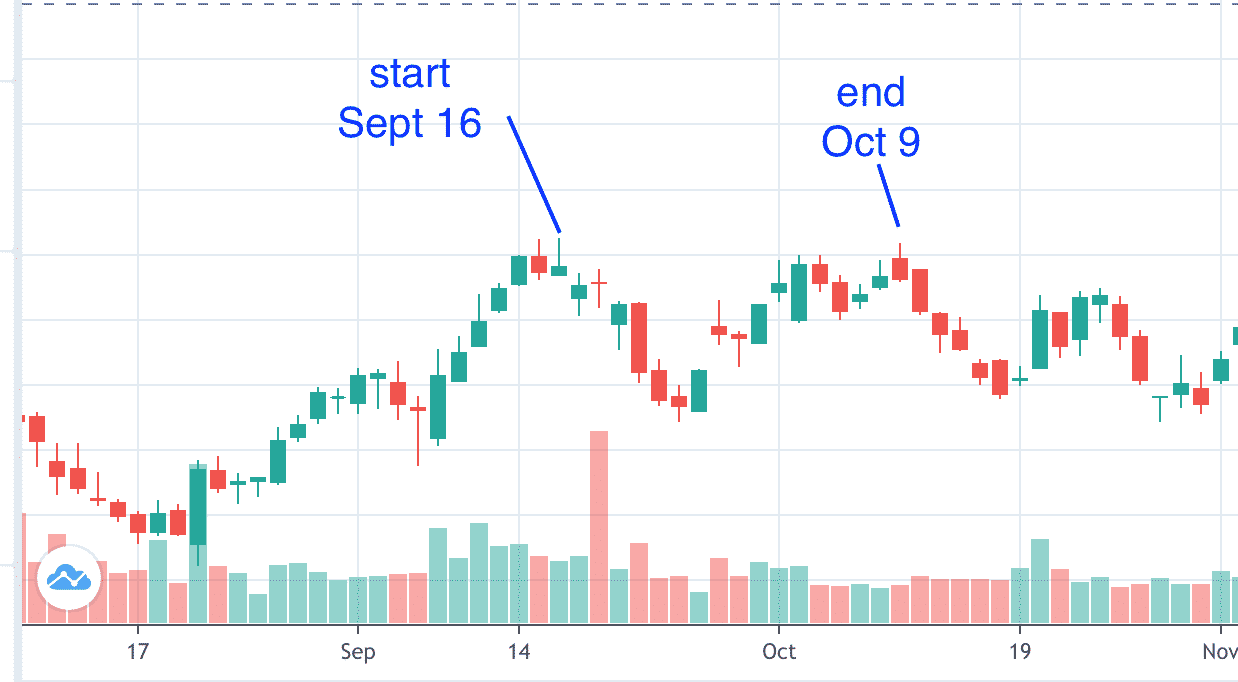

As of September 16th, 2020, it is trading at $37.66. An unrealized gain of 169%.

The investor believes there is more room for the stock to run up but wants to safeguard the position against a downturn.

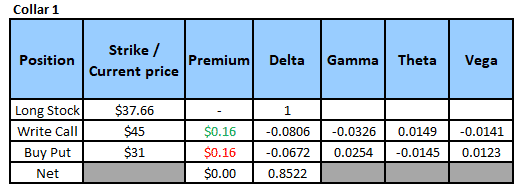

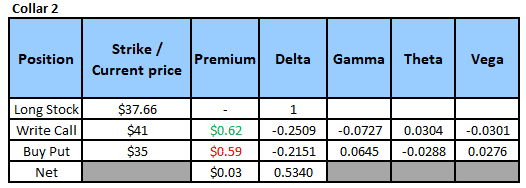

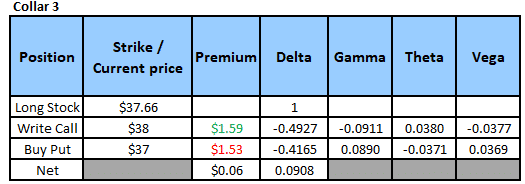

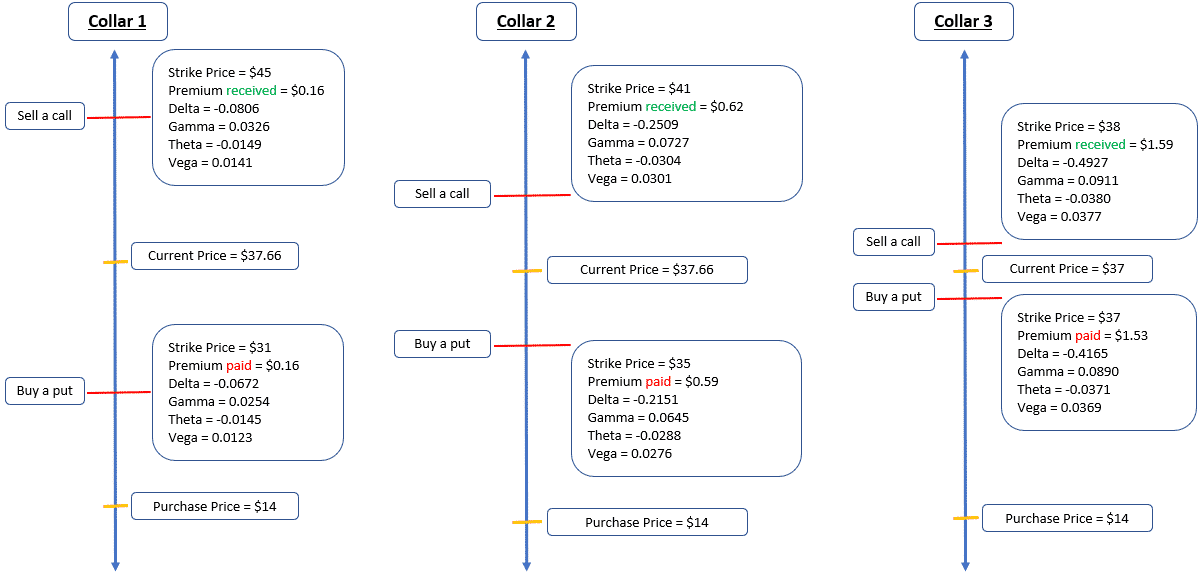

Let’s look at three different collar trades he can enter and discuss the differences.

The goal is to enter a zero cost collar i.e. premium paid for put and proceeds received from call should offset each other (as much as possible).

To set up a collar, you must write a call above the current price and buy a put below the current price.

Both options should have the same expiration date. In the examples below, the expiration date is October 9th, 2020.

Let’s look at the three collars pictorially.

We will use them to understand a point about the greeks later.

Maximum Loss

If the stock closes below the put strike, the trader can exercise the put and receive the proceeds from the sale at the put strike.

The most you can lose on this trade is the current stock price minus the put strike.

Remember to also factor in the small premium paid or received to enter the trade, plus commissions.

In our collar 2 example, lets assume the stock price closes at $33 on expiration.

Then our maximum loss is $37.66 – $35 + $0.62 – $0.59 = $2.69.

That being said, maximum loss does not mean this is a losing trade.

In fact, we bought the stock at $14 so we still made a nice profit.

Maximum Gain

If the stock closes above the call strike, the call will be exercised against us and we will have to sell our stock.

The gain is limited to the call strike.

Again, remember to factor in the premium paid or received to enter the trade.

In our collar 2 example, lets assume the stock price closes at $42 on expiration.

Then our maximum gain is $41 – $37.66 + $0.62 – $0.59 = $3.37.

Even though the stock closed at $42, our upside is capped at the call strike of $41.

Breakeven Price

The breakeven depends on the price you paid to enter the collar.

But remember, depending on how you set it up, you could either have a net debit or a net credit or a zero cost collar.

In the collar 2 example, we received a net credit of $0.03 to enter the trade.

Therefore, our breakeven is the current stock price minus net credit received.

That’s because we pocketed 3 cents to enter the trade, so we have a small buffer, which may be enough to cover the transaction fees.

Payoff Diagram and Profit Calculation

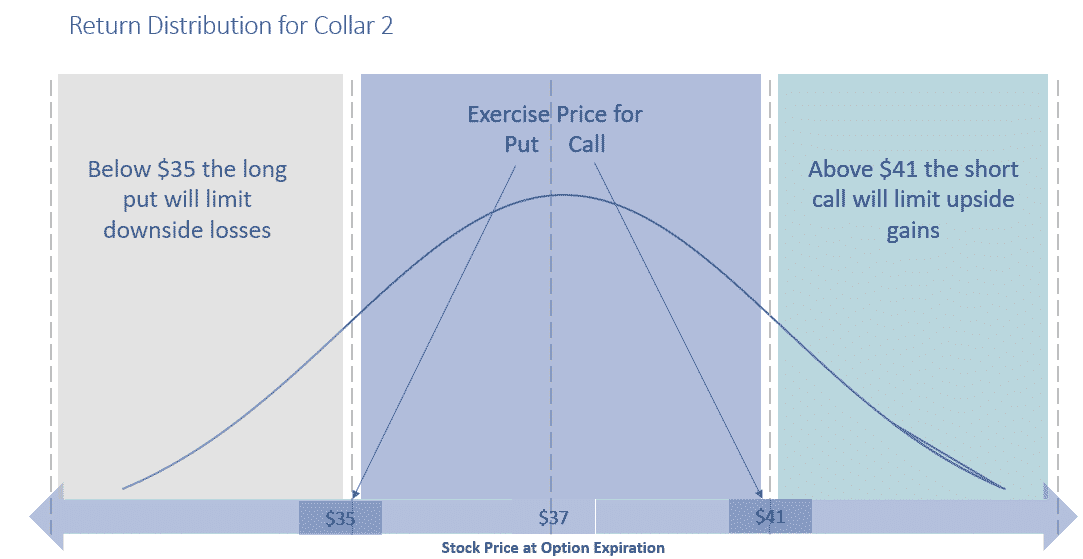

Let’s understand the value and profit payoff of a collar at a high level before diving into the calculations.

Value of our position:

If the stock closes below the strike price of the put, we will exercise our put and receive the strike price.

So, value of our position is the strike price of our put.

If the stock closes between the strike price of the put and the strike price of the call, both options expire worthless.

We are still holding the stock, so value of our position is the price of the stock.

If the stock closes above the strike price of the call we wrote, then the stock will get called away from us.

So, the value of our position will be the strike price of the call.

Profit on our position:

Profit is simply the value of our position minus what it cost us.

We have two costs – The price at which we bought the stock, and the price of the collar.

Remember, the goal of this strategy is to create a zero cost collar so typically the price of the collar will be zero and the profit would simply be value of the position minus the price at which we bought the stock.

However, it is difficult to find a completely zero cost collar and sometimes we might have a small net debit or net credit to enter a collar.

In this case the profit of the collar will be:

Value of our position

– The price at which we bought the stock plus

+ Proceeds from the sale of call

– Premium paid to buy the put

Now let’s apply this to our collar 2 example. Let’s do the calculations for multiple stock prices at expiration.

Graphically, the payoff is a combination of long stock, short call, and long put.

The Greeks

Delta

Remember the pictorial representation of the three collar examples from above. Let’s revisit it again.

We know that delta on calls is always positive and delta on puts is always negative.

But in the above pictures we see call delta is negative. Why?

Delta is positive for long calls.

It measures the change in option price for the change in underlying stock.

Since we are short the call, as price moves up, we will lose money. Therefore, delta on the short call is negative.

Now let’s look at the three collars and discuss how their delta differ and what it means for our position.

In collar 1, both the short call and long put are set up out of money.

The delta on both is very small. The long stock has a delta of 1.

Position Delta

Combining the three gives a position delta of 0.85.

This means we haven’t created a solid hedge on our position.

With every $1 change in the stock price, the value of our position will change by $0.85

In collar 2, both the short call and long put are set up near money.

The delta on both will be closer to 0.5.

Combining the three gives a position delta of 0.53.

Our hedge is slightly better.

For every $1 change in the stock price, the value of our position will change by $0.53.

Finally, in collar 3, we set up the collar so close to the current price that we are bound to exit out of the position for a small change in price.

If the price decreases slightly, we will exercise our put.

If the price increases slightly, the shares will be called away.

In collar 3 we are almost delta neutral with total position delta of 0.09.

Our portfolio will only be slightly affected by stock price movement.

Gamma

Gamma measures the rate of change in delta with respect to the change in stock price.

We know that delta of the collar will approach zero the closer the collar is setup to the current stock price.

Essentially at this point you have a long stock position and an offsetting short synthetic.

More on this in the synthetic strategy article.

At this point, changes in stock price will not change delta. And that is why gamma will also be near zero.

How Volatility Impacts the Trade

Long put options are long vega trades. The long put piece of the trade will benefit if volatility rises after the trade has been placed.

Short call options are short vega trades. The short call piece of the trade will suffer if volatility rises after the trade has been placed.

Looking at collar 2, the long put has a vega of 0.0276 i.e. the value of the long put option will increase by $.0276 if implied volatility increases by one point.

The short call has a vega of 0.0301 i.e. the value of the short call option will decrease by $0.0301 if implied volatility increases by one point.

Net effect of volatility is basically neutral.

How Theta Impacts the Trade

Theta works against the long put part of the trade. A long put decays with each passing day.

On the other hand, you are also short a call. Theta works in your favor because the buyer of the call will suffer the time decay.

In the collar 2 example, the long put has a theta of -0.0288 and short call has a theta of +0.0304. Therefore, the net effect of theta is basically neutral.

Risks

We have discussed the risks of covered calls and protective puts in other articles.

A collar is essentially holding both these options along with a long position in the stock.

Essentially a collar sacrifices the upside of the return distribution in order to remove the downside.

With the short call, you have sold the right tail of the distribution and with the long put you have protected your position from left tail risk.

A collar option strategy is a risk reduction strategy but in exchange your return also has limited potential.

The sweet spot is when the stock price ends slightly below the call strike. In such case you can put on another collar.

To understand the risks in terms of greeks, refer to the section above.

Example

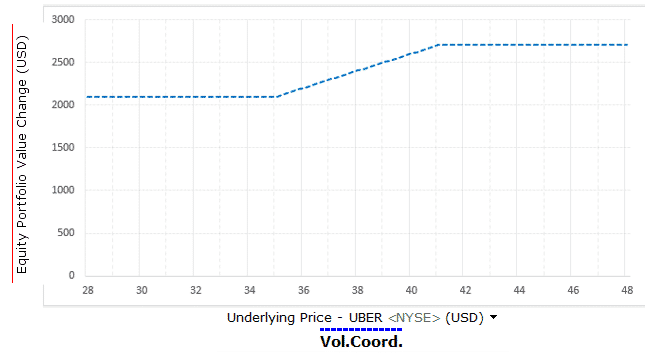

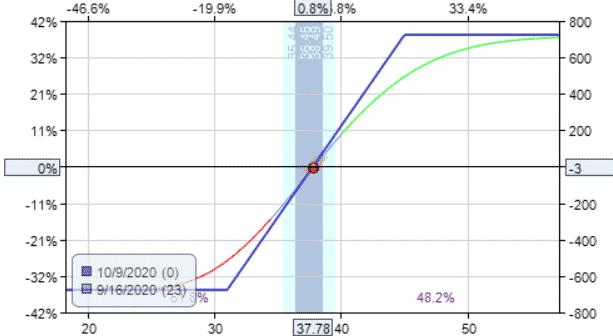

This is the payoff diagram at the start of Collar 1 on September 16.

Basically, Uber moved sideways in a range from that time until expiration on Oct 9 at which point UBER closed at $37.27

For all three collars, the call was not assigned, and the put was not exercised at expiration.

The investor lost $39 from the drop in the stock price from $37.66 to $37.27.

The investor neither gained nor lost on the zero-cost Collar 1.

Since the investor received a credit of $3 for initiating Collar 2, the investor would keep that credit.

Since the investor received an initial credit of $6 at the start of Collar 3, this is the extra amount that the investor profits from the collar options.

Summary

A good time to place a collar trade is after your long stock position has increased in value and you want to protect your gains.

Remember, there is no free lunch. Downside protection comes at a cost of limited upside.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Good morning, Gav.

I hope that you and your family are well.

I recently found your website. Very well done with good information in a very well-organized manner.

I have been running a thought experiment and will likely try to formulate a Monte Carlo simulation on collar trade management/adjustment to quantify finding the optimal conditions (for the purpose of creating a trading algorithm) for either closing one or both legs and.or selling the underlying or rolling one or both legs. Before I do so, I would like to know if you have formulated an algo for this purpose. By the way, I received an MBA in Finance from the University of Chicago and have discussed this concept without a satisfactory response.

Thank you for considering this question,

Don Machen

Hi Don, thanks for the kind words. No I haven’t built any trading algorithms. Keep me posted on your progress, I would be interested to hear the results.

If I decide to set up my hedge as a synthetic short with the strike and expiration the same, I’m able to choose whether the trade is a Net Debit or Net Credit. Which one should I choose? Does it really matter?

Net credit would be nice, but usually the put is going to be more expensive than the call, so it will be a debit most of the time.