The calendar straddle strategy consists of two straddles.

A long LEAP straddle and a short near-term straddle.

The original concept was advanced by Serge d’Adesky in the Internet article entitled “Milking The Cow – Using Options In The Time Of The Coronavirus.”

You can search for and read this article for background information, but we’ve done extensive backtesting and made significant improvements.

I know this strategy might seem intimidating, but rest assured I’m going to break it down so you too can put this one in your toolbox and be confident in using it.

So, settle in and read on.

Contents

- Fundamental Principles

- Opening the LEAP Straddle

- Understanding the LEAP Straddle

- Managing the LEAP Straddle

- Exiting the LEAP Straddle

- Live Trade Walkthrough

Fundamental Principles

Before we get into the juicy bits, we have to get everyone on the same page regarding the way we’re putting these options together.

As you know, there are many ways to look at groups of option contracts.

For example, a put credit spread can be viewed as a spread and simultaneously viewed as a long put and a short put.

Everyone can agree, right?

This even extends to the more complex positions as well.

Take the double diagonal spread used in this strategy, for instance.

Unless you’re a professional broker, managing this position could be a real chore.

But wait, Gav, you said in the intro that this strategy consists of two straddles not a double diagonal! I hear you, and you’re right about me saying that.

A double diagonal can also be viewed as a long straddle and a short straddle.

If you’re not familiar with straddles, you can read more at Ultimate Short Straddle Guide and Ultimate Long Straddle Guide.

Looking at the position this way makes it easier to understand and manage, you’ll see soon, I promise.

Now, I have to ask you to stretch a little further. We need to briefly cover calendar spreads.

Trust me, you’ll see how this ties-in soon.

On a calendar spread, we sell near-term (front month) options while simultaneously buying longer-term (back month) options.

These guys make money based on the fact that the theta on the front month options decays faster than the theta on the back month options.

If this doesn’t make a lot of sense, please review here: What is a Calendar Spread and Double Calendar Spreads.

Opening the LEAP Straddle

The LEAP Straddle strategy is constructed using four options and it really is a double diagonal spread, but I’m asking you to look at it as two straddles.

I’m also asking you to view those two straddles as a calendar spread as well.

It sounds more complicated than it actually is.

We have done a tremendous amount of backtesting on all aspects of opening this strategy, managing the position once it’s open and ultimately the best way to close it out.

I won’t bore you with all the details but suffice it to say that we spent well over 80 hours analyzing, backtesting and improving this strategy.

I’m going to give you the trade rules that tested the best.

I’ll also share some results and trades from an actual trade that’s been underway since July 2020 in a cash account.

Only two tickers tested well using this strategy, SPY and SPX.

From what we can tell, it has to do with the liquidity in the options as well as the underlying.

These tickers also have Monday, Wednesday, and Friday expirations.

Bear in mind that you need a very large account to trade SPX because it’s like trading 10 SPY options with each SPX contract.

In case you’ve never dealt with LEAP options before, it’s just a fancy way of saying the expiration is greater than 1 year out.

Your straddles must both use the same ticker: SPY or SPX depending on how much you want to allocate to this strategy. The ideal days to entry (DTE) and strike price selection criteria for opening the strategy are:

- Short Straddle: ATM, 5 – 15 DTE

- Long LEAPs Straddle: ATM, 335 – 425 DTE

Don’t those steps look exactly like a calendar spread setup?

A calendar spread with straddles, crazy!

That’s it to opening a LEAP Straddle position. Simple, right?

The real chore is managing this guy once you open it.

Understanding the LEAP Straddle

Up to this point our discussion has been rather mechanical.

Now it is time to move on to the conceptual.

It is vital to look at what’s going on here in the proper context so making the right decisions going forward are easier and more profitable.

It will also be extremely important to understand how this strategy makes money.

Conceptualizing this strategy begins with an understanding of how calendar spreads make money.

Basically, it’s about the difference in implied volatility (IV) of the expiration cycles.

We are holding price and volatility constant for the sake of our discussion. If you stop and think about it, it makes perfect sense.

Near-term options have a higher decay in extrinsic value, mainly due to theta decay, as we approach expiration than longer-term options.

Whoa, Gav, what did you just say?

In simple terms, options expiring tomorrow don’t have much time left before expiration and therefore aren’t worth much from a time standpoint whereas options expiring next month are still valuable from a time standpoint.

Now, let’s look how the passage of time affects these two option expirations.

As time passes, both options are suffering from theta decay, but the rate of decay is higher for near-term options because they are literally running out of time.

The options we bought have negative theta decay meaning we are losing money on them while the options we sold have positive theta decay and are making us money.

The key is that the short-term sold options make more money than we’re losing on the options bought.

If this is still unclear, please refer to the calendar spread links above in the Fundamental Principles section.

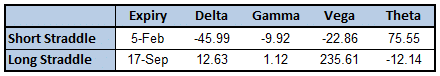

Have a peek at the current position in the screenshot below.

Pay particular attention to the Theta column.

Without putting too fine a point on it, it shows how much we make and or lose with each passing day.

Okay, longer-term (LEAP) options we buy lose less money over time than short-term options we sell make money.

I hear your question, why bother with buying the options if they just lose money?

It’s about risk management. If we just sell naked options, then our risk exposure is huge.

This risk management is the whole basis of spread trading.

In fact, the margin we are required to hold for this strategy is simply the difference in strike prices of the two straddles times $100.

We’ll get into the details of this later.

Here is how I view the strategy. In essence, with our LEAP straddle purchase, we bought a bucket of SPY expiration days expiring in about 1 year at wholesale.

For the current trade we have on that would be about $0.17/day ($59 paid for LEAP straddle / 352 DTE).

Then I sell those expiration days at retail using the short straddle.

Again, for the current trade the average is about $1/day.

Then going forward, I buy to close the expiring short straddle and sell another short straddle, all at retail.

If the market price of SPY never moved then we have no issue, but as you all know, that rascal moves quite a bit.

Now this is where our challenge surfaces.

One point that is really important here, the straddles are offsetting each other.

This is reflected in the way margin requirements are set on this position.

This basically means that if the underlying price changes drastically then one straddle increases in value while the other decreases in value.

This is good for us since it provides a rudimentary doomsday hedge in case of a black swan event.

Managing the LEAP Straddle

This is a very robust and flexible strategy. In the first part of this section, I will lay out the basic management rules that were used in the backtesting.

After the basics are presented, I will reveal some advanced techniques that we have been using to enhance the strategy’s performance.

You should not feel compelled to use the advanced techniques and I encourage you not to use them if you’re just starting out with this strategy or the discussion of them is not crystal clear in your mind.

This strategy is perpetual in nature.

That means you can keep it going forever or as long as you feel like it.

Remember earlier when I said that you should view this strategy as a combination of two straddles?

Well, we are now to the point that it will make sense.

We have two sets of criteria for these straddles:

Long LEAP Straddle

Roll Criteria:

- Less than 335 days expiration (DTE).

- When underlying price moves more than 6.5% from strike price.

- When rolling, select strikes ATM and DTE = 335 – 425.

Short Straddle

Roll Criteria:

- 1 day to expiration (DTE).

- When underlying price moves more than 5% from strike price.

- When rolling, select strikes ATM and select the minimum DTE to yield a net credit, maximum DTE = 30.

Let’s examine the short straddle roll event in a little more detail.

The idea with rolling the short straddle is that you always try to roll it for an overall credit. You have a 30-day maximum roll DTE restriction here as well.

If you can’t get a credit under those constraints, then close it and take the loss.

Immediately open a new ATM short straddle 5-15 DTE.

As long as we’re on the topic of rolling issues; what if you get assigned?

First, keep calm since it’s no big deal.

Simply close out the shares assigned, close out the other option in the short straddle and just reopen your short straddle using the guidelines.

No strategy discussion would be complete without mentioning risk management.

One of the 3 pillars of account risk management is ticker allocation management.

That is no more than 5% of your account should be invested in any one ticker.

With respect to this strategy, I allow a maximum of 10% or 1 position.

Note: your allocation to this position is a combination of the LEAP straddle cost and the margin required on the position.

If your account can handle multiple positions and not exceed the 5% limit, then awesome.

This also means that if you play some other strategies that you must limit yourself to not using SPY or SPX as appropriate.

Trust me, this is for the best.

There is no worse feeling than when a short option from one strategy steps on a long option with the same expiration and strike from another strategy.

You end up with a real mess and wind up having to close out a trade before you were ready.

Unless you want to take a peek at the advanced techniques, go ahead and jump to the next section “Exiting the LEAP Straddle.”

There are two advanced techniques that we are using that are producing some very positive contributions to our overall profit on this strategy.

The first involves varying the short straddle roll criteria based on the short straddle days to live (DTL) and the distance between the short straddle strike prices and the underlying spot price.

What I’m getting at here is that if the short straddle options are expiring soon (< 2 days or so) and the distance between the short straddle strikes and the underlying spot price is very close (within $1 or so) then we’ll go ahead and roll the short straddle out 8-10 DTE.

Short straddles with strikes ATM have the best pricing for our purposes and this also allows to lock in a good profit on the short straddle roll.

I tell you that it’s painful to watch the spot price move hard against your short straddle strikes on Friday morning just before expiration!

The second technique involves using implied volatility (IV) and its affect on the LEAP straddle.

Let’s review how IV affects option pricing.

Without digging into the Black-Scholes model, if IV goes down then option prices go down; conversely, if IV goes up then option prices go up.

This is a general rule and does not account for other things like price movement.

Now, let’s consider our LEAP straddle and the bucket of expiration days.

If IV goes down, then it is cheaper for us to add expiration days to the bucket (roll the LEAP out in time).

This opportunity is vital for us to keep the strategy going since we need to keep pushing the LEAP straddle out in time.

I will provide more details when we start walking through our live LEAP Straddle trade.

The other, and more exciting, aspect of this advanced technique comes into play when IV rises.

If IV goes up, then those expiration days in our bucket and our LEAP straddle become more valuable.

Why, you ask? It goes back to our discussion of rising IV causing option prices to rise.

Don’t we love to sell options when IV shoots up?

Basically, we roll our LEAP straddle in, sacrificing expiration days, when IV rises and then buy them back when IV declines.

Seems like a lot of trouble, huh? I promise to showcase this very move when I get to the live trade walkthrough, but let me give you a sneak peak, we made over $500 on just this technique.

Exiting the LEAP Straddle

There are two instances in which you will close out this strategy rather than keeping it going.

Obviously, one is if you just want to stop messing with this strategy, the other is if your short straddle indicates over a 325% loss.

Backtesting has revealed this point to be the best strategy play.

Bear in mind that your total investment has not experienced this loss, just the short straddle has.

You may indeed exit the whole strategy for a profit. You can also start over with a new strategy position if you like.

If you want to close down the strategy, then just close both straddles.

If you want to let it wind down, then be certain to close both straddles at a minimum of 30-35 days to expiry (DTE) of the LEAP straddle.

The theta decay curve starts an exponential move heading toward 0 at around 30-35 DTE.

Throughout the whole lifetime of the strategy the theta decay of the LEAP has been offset by the larger theta decay on the short straddle, but in the last month, the LEAP theta decay is no longer offset by the short straddle.

Live Trade Walkthrough

Now for the part you’ve all been waiting for.

I could positively hear the clamoring from you guys, “Ok, Gav, show me the magic!”

Before I do, I need to inform you that we are indeed making a good profit on this strategy, but that in no way guarantees your success if you trade it.

Furthermore, you may see things done during the lifetime of this trade that are not necessarily in keeping with all of the rules presented.

Like I said earlier, this trade has involved lots of testing and trying different approaches to management of the position.

All that being said, I think you’ll find what follows very illuminating and exciting.

I hope it allows you to bring together all you have read so far and make clear sense of it. So, without further ado, let’s dive in!

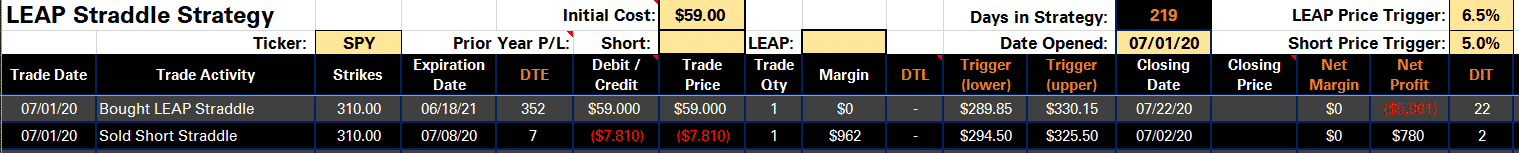

We opened our LEAP Straddle position in July 2020

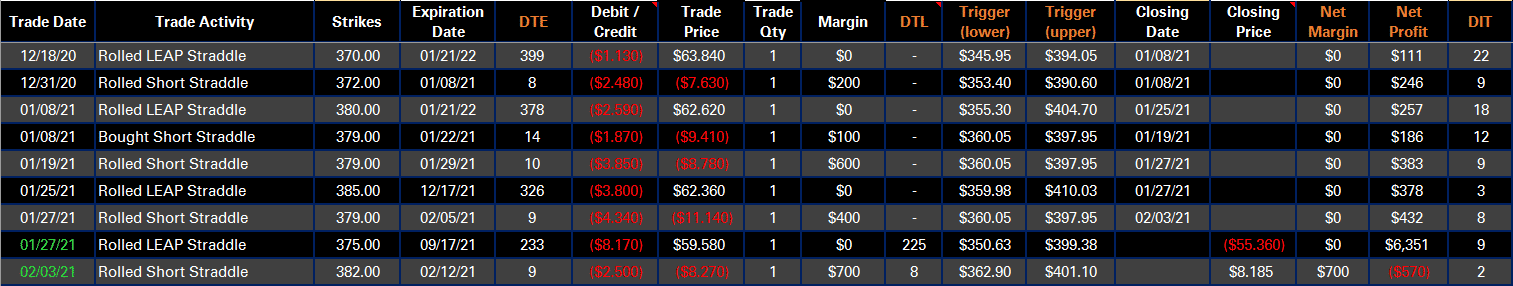

What you’re looking at here is the trading journal we used to track our progress and activity. Most of the columns are self-explanatory.

I need to make some clarifications here:

- DTE is the DTE at opening of the transaction and DTL shows the DTE shrinking day-by-day as we approach expiration. We need to know both pieces of data.

- Debit/Credit is the actual proceeds from the roll and the Trade Price is just a reference to what the price would have been if it were a straight open as opposed to a roll.

- The Trigger fields are based on the straddle price triggers defined earlier.

- Margin is the margin required on opening the trade and is adjusted as we roll and close straddles. The Net Margin is just a way to track current margin. If the trade is closed, then margin required is $0.

- DIT stands for days in trade.

I need to mention one more thing; the numbers will not add up exactly if you try to follow along with a calculator.

The reason is that our trading journal accounts for commissions and knows exactly how many contracts are involved with each trade and adjusts the Net Profit field.

I wanted you to understand what you’re looking at here because I will post many screenshots of our strategy as we move through the walkthrough.

Alright, as you can see, our LEAP Straddle was opened on 7/1/20 and cost $5,120 ($5,900 debit for the LEAP straddle – $780 credit for the short straddle) to enter the position.

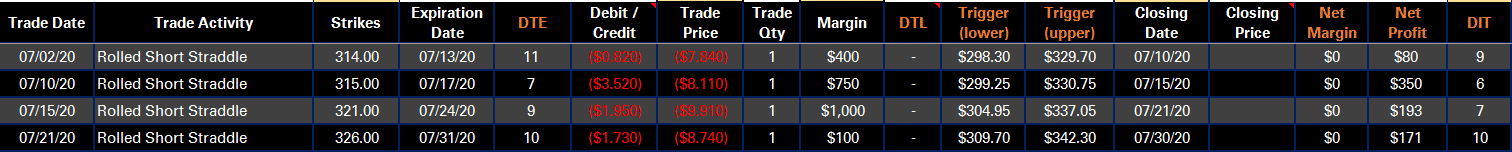

July went well and we racked up some nice profits on the short straddle rolls.

That’s the sunshine and puppy’s version, let’s move on and see what Murphy has in store. As it turns out, we didn’t need to wait long.

The date was 8/27/20. SPY was trading at $349 that morning.

The Fed was set to deliver announcement at 2:30 pm and our short straddle expired in 1 day and had strikes $20 away from the market ($349 – $329 = $20) and was flashing a price trigger of 5.7%.

Let’s look at the LEAP first. Notice the DTE on the LEAP on the 8/11/20 trade date.

It was opened with 311 DTE, as of 8/27/20 there were 295 DTL.

I will get to why it was this way in a minute. It was clearly outside the 335 – 425 DTE window and primed to roll.

Since the strikes were at $336 and the market was at $349, we took advantage of the opportunity to recapture 75 DTE by rolling out from 311 to 386 DTE.

Why did we let the LEAP get outside the DTE window?

We were taking advantage of changes in pricing of the LEAP during the rolls; see advanced strategy management above. You may notice that we paid $3.30 on last LEAP roll out to SEP 2021.

What you should take a closer look at is that on 7/22 and 8/11 we rolled the LEAP without changing the DTE.

This allowed us to sacrifice DTE days on the back end when they were expensive. Notice we took in $4.52 and $2.36, totaling $6.88 from those rolls.

Now combine all the LEAP rolling $6.88 – $3.30 = $3.58 and you see that we got paid $358 to roll out the LEAP from 6/18/21 to 9/17/21.

Now, the short straddle.

This guy was hurting. It was outside the 5% price trigger, 5.7% as of the morning of 8/27/20, and it expired the next day.

Oh boy, this was not good.

It looked like a big hurt was a comin! We basically had 2 choices here:

- We could close it and reopen it ATM, 5-15 DTE. That would have cost dearly and leading to about a $1,200 loss. Now, this is exactly what the backtest code would do and it had a very nice return over time. So, there is evidence that this choice was viable albeit with a sour after taste for sure.

- We could roll up to ATM and out far enough to get a credit. This would certainly make us feel better since we were following the mantra of the strategy to always roll the short straddle for an overall credit. The downside was the number of DTE days it would cost us; 85 as it turns out. This was the choice we ultimately went with.

The thought of trying to roll back in if the opportunity presented itself was present in our minds.

We got our chance; take a look at the 9/11/20 timeframe on the screenshot above.

We made a couple trades to recapture some of those expiration days that we had to sacrifice in late August.

- Closed SPY 350 EXP 20 NOV short straddle @$29.85, theta decay ~20

- Opened SPY 337 EXP 18 SEP short straddle @ $9.85, theta decay ~63

If you are paying close attention, then you may have noticed that this is essentially a roll for a $2,000 loss and you’d be right. we were in trouble the moment SPY went hard against us and the roll out to NOV was an effort to buy time, literally, to see the best way to proceed.

Again, we had two choices:

- Hold on to the NOV short straddle with 70 DTE as of 9/11/20. We took in a nice credit on selling this straddle and we could sit and wait. This would most likely produce some nice gains. Net Profit was down to -$2,241 from -$5,900 in 73 days. The tradeoff is that we’re losing out on the 70 days that we must sit on the sideline and not reap the profits from selling short straddles. Some of you may be okay with this approach, but we think we have a better path.

- Close and reopen the short straddle. By rolling the short straddle out to NOV, we were able to minimize the loss and wait to see what the market would do next. What happened next was that volatility went up and that was good for us and price went down, which was not great. The price of the near-term straddles went up more than the longer-term straddles (read SEP vs. NOV). This opened the window for us to roll in about 63 days and down about $13 for roughly about a $2,000 loss. This turned out to be a very good move. Now, going forward we can sell 6-8 more short straddles than if we sat on those NOV straddles. We also traded a short straddle position with a theta decay of about 20 for one with about 63. This strategy is all about the disparity of theta decay between the LEAP and short straddles. Again, we think this is the right move.

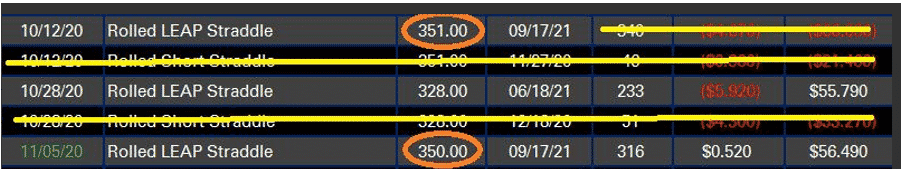

I want to focus specifically on the advanced LEAP rolling techniques here. This is an actual trade where we made $540 just wiggling the LEAP straddle a bit.

- Look at the screenshot above, notice that on 10/12 we started with a LEAP straddle (strike $351, Exp 9/17/21)

- On 10/28/20 we rolled it down and in (strike $328, Exp 6/18/21) for a $5.92 credit.

- On 11/5/20 we rolled the LEAP back up and out (strike $350, Exp 9/17/21) for a $0.52 debit.

Conclusion: we basically have the same LEAP straddle on 11/5/20 that we had on 10/12/20.

Yes, there is a $1 difference in the strike price, but in reality, it’s essentially the same.

So, what did we gain, you ask?

Well, we took in an overall credit of $5.40 ($5.92 – $0.52) for free.

We have basically the same LEAP straddle that we started with AND $540 for sitting at our computers.

I know the LEAP straddle is still a little short on DTEs at 316, but the Dec 21′ expirations were a little too expensive at the time, we’ll get there.

The above screenshot is the trades we’re made so far this year.

It’s looking pretty good.

You can see another IV play on the LEAP straddle roll on 1/27/21.

That roll credit was enormous since IV was so high.

Now, we’re waiting for IV to come back down in a couple weeks and I’ll wager we recapture 120 expiration days for about half the credit we received.

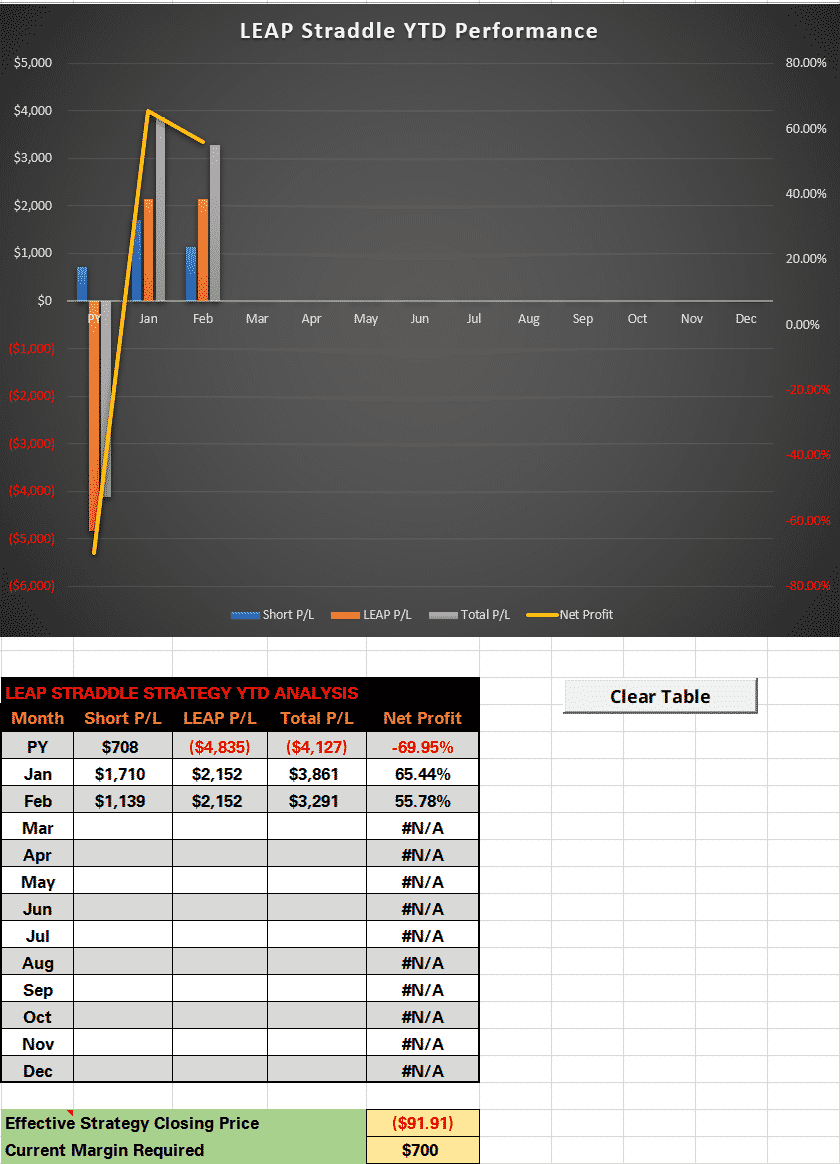

So, I assume you’re all interested in the bottom line.

Where does the strategy position stand today (2/4/21)?

I plugged in the closing prices of the straddles and here is a screenshot of the overall P/L. To recap, we’re into this trade for 219 days and if closed right now, our total profit is 55.78%!

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Have you thought about buying the Long Straddle ,LEAPS but selling a Short Strangle?

Seems that would allow you more room for the underlying to move without needing adjustment while sacrificing some max profit.

Using a short strangle instead of a short straddle would not yield very good extrinsic value decay since ATM options have the highest extrinsic value. This strategy’s focal point is based on the disparity of theta decay between the LEAP and short straddles. It’s true that you could manage price fluctuations a little better with a strangle, but over the long term it’s very likely your overall performance would suffer due to the reduced overall theta decay.

This is one of the most interesting things I have read all year. I have been doing a similar trade with 30 Delta positions, or straddles basically.

Do you mean strangles? But yes, glad you liked it. Assume the trade has been working well for you?

Yes, sorry, strangles. It has worked well, but I picked GM, which has really low IV. I think it would work better if I chose an underlying like AAPL with a bit higher IV and great liquidity. It will be the next test I think.

When you say you roll 1 DTE, you mean Thursday, for a standard weekly, right?

Yes.

Yes, sorry, strangles! It has been working well for me, but it does require a stock with a bit higher IV. Also, if you trade something too large it will eat up a ton of capital.

How about but long strangle leap and short straddle it will require margin but it will cost much less to start.

Yes, that’s not a bad idea actually Nasser.

Great article, Gavin!

Are you still seeing similar results with trade?

Given SPY or SPX is already a diversified ETF covering 500 companies in different sectors, what are the risks to use this strategy with more than 10% of capital?

I would recommend starting small until you get a feel for it.

Wonderful material, Gavin. Thank you. Is the strategy still performing well since the March writing of this article?

Very exciting indeed,

wouldn’t the strategy work as well with 6 months DTE instead of 1 to 1.5 years? even with less DTE ?

Yes, it’s worth looking at that as well.

Hey Gavin – it’s literally the last trading day of 2022 and I’ve just come across this now. Wondering two things, please:

1) Did you stay in this trade throughout 2022’s big moves? How did it go?

2) Any chance you’d share the results of your backtesting? As a trader, I will assign a certain monetary “goal” to long-term strategies such as this. What’s your expectation for this strategy’s long-term performance based on backtesting?

I haven’t continued with the testing unfortunately, been too busy. If you try it, please let me know how it goes.

Hi Gavin. Are you using calls or puts on this strategy ? many thanks, its a great strategy

If it’s placed at the money, you can use either.

awsome. thanks for the speedy reply

Any time.