Contents

Some traders like playing the volatility drop after earnings announcements – a common strategy known as the earnings volatility crush trade.

The question that many people wonder about is whether this strategy is profitable.

I asked an AI engine this same question, and it did not give me a definitive answer.

I didn’t know that AI engines are smart enough these days to dodge difficult questions.

We are going to look at both sides of the debate.

And then look at one trader’s earnings results.

But first, let’s review the premise of this strategy.

During earnings announcements, options prices tend to increase due to increased uncertainty and expected volatility.

This results in higher implied volatility, which inflates option premiums.

However, after the earnings report is released, the uncertainty decreases, leading to a drop in implied volatility and, subsequently, a decrease in option prices.

Traders can employ non-directional strategies such as short straddles or short strangles to take advantage of the volatility drop.

These two are undefined risk strategies and therefore are not recommended unless you know what you are doing.

Defined-risk versions of these are the butterflies and iron condors.

Other defined-risk earnings trades are time spreads such as calendars, double calendars, and double diagonals.

Earnings trades are inherently risky.

The market’s reaction to earnings can be unpredictable, and a stock’s price can experience significant and sudden moves.

It is easy to take a max loss on even these defined trades, so size the position in a way where you account for the fact that you can lose the entire capital of the trade.

Make enough trades (about 20 trades would do it), and it is likely that this would occur.

Because we cannot size these trades very large, earnings trades do not scale well.

Those who trade earnings might dabble in them here and there in small sizes but certainly not allocate their entire portfolio to earnings trades.

There are two views on whether earnings trades are profitable or not.

Why Earnings Trades Can Be Profitable

Earnings trades are profitable because there is a statistical edge in the volatility crush and an edge in selling premiums.

Selling options have a slight edge because the premium is slightly higher than what the anticipated move is priced in.

Some traders have developed specific strategies that go beyond just selling and buying back the next day.

They look at other metrics and historical data to stack additional edges on their side and techniques for limiting loss should an adverse move occur.

Why Earnings Trades Might Not Be Profitable

Earnings trades are not profitable because no statistical edge can be exploited in a phenomenon that everyone already knows about.

The market is efficient.

Everything is priced fairly, and it is a zero-sum game.

You cannot make money by selling something when everyone knows what the fair value of that something is.

Everyone knows that the option you sell will drop in value the next day.

No one will buy it from you unless you sell it at a fair price.

And if you do sell it at a fair price.

I got a fair deal.

And you got no profit.

At best, earnings trades are a break-even strategy.

You win some, and you lose some. It is a coin flip.

Flip that coin enough times, and you come out break-even.

Trade earnings every season for a lifetime, tabulate your results, and they will come very close to breaking even.

Any strategy where a trader can initiate the trade based on a fixed setup and take the trade-off based on a fixed rule without human discretion or judgment will not work over the long run.

Because if it did work, hedge fund “A” would write a computer program that would automatically perform that trade all the time and win lots of money.

And then hedge fund “B” would do the same. Hedge fund “C,” “D,” “E,” and everyone else will follow.

And they would all win.

Clearly, the market cannot give out money to everybody because there is no such thing as “free money.”

For every dollar of money won by someone, that dollar has to be lost by someone.

Options traders are profitable only in strategies that require trader discretion, and the trader has practiced the strategy so many times that he or she knows when to enter, exit, adjust, and by how much.

One Trader’s Earning Results

Ultimately, the profitability of earnings trades varies from trader to trader and depends on their skills, experience, and the effectiveness of their strategies.

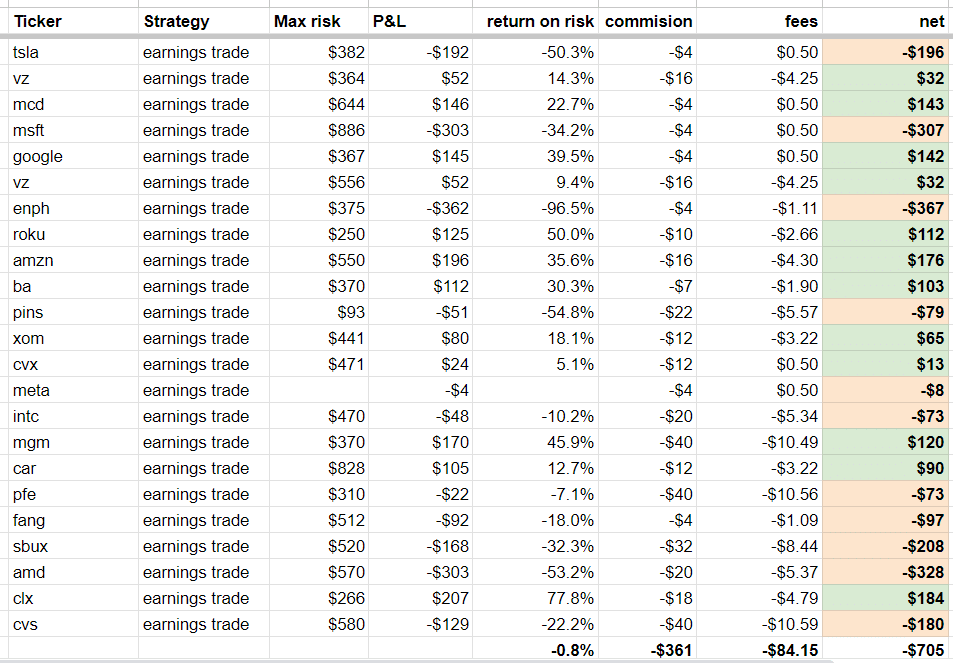

Speaking of which, one of my students sent me the results of his earnings trades that he did during the April 2023 earnings season.

Uh, oh. I’m afraid to look.

It is quite well organized, with notes on commissions and fees as well.

Except, he forgot to fill in one data point regarding the capital used on META.

Since that trade was essentially break-even, it would not affect our calculations much.

I’ve reprinted his results here with his permission.

There were a total of 23 earnings trades, which I suppose is a good enough sample size to draw some conclusions for our purposes.

There were 11 losses and 12 wins.

All in all, a net loss of $705 accounted for commissions and fees.

In fact, more than half of that loss is from the $361 in commission and the $84 in fees.

The strategy that he was using was the calendar, where the front expiration expires right after earnings. And the back expiration expires one week after that.

Since the cost of these calendars are low for low-priced stocks, as many as 20 contracts might have been used to size the trade up where the return is significant enough.

You need a lot of calendars to do a calendar on VZ (which is priced at $40/share) or PINS (whose stock price was $27 before the earnings crash).

The average loss amount on each of his losing trades was -$174.

The average winning amount of each trade is $101.

Since the trade size is not consistent, it is still difficult to say which is larger in percentage terms.

If we take the average percentage return on the risk that each trade returned, we get an average of -0.8%.

Although close to zero, the negative sign implies that the losses slightly outpaced the wins.

Frequently Asked Questions?

Do you think earnings trades are profitable?

Based on the length of my explanation of why they are not profitable versus the length of my explanation, you can see that I’m leaning on the side that earnings trades are not profitable over the long run for most traders.

They are likely to be break-even.

While the results of this one trader’s earning trade seem to support my conclusion, a result set of one is hard enough, and further study is required.

But I saw other traders’ results showing that they are profitable.

I had intentionally phrased my above answer to say, “Not profitable over the long run for most traders.”

This is to allow for the possibility that a few minority of traders may have found a way to consistently profit from earnings.

They might have found a particular edge.

Or it could be that they are performing post-earnings adjustments that turn some of their losing earnings trades back into profit or at least reduce the loss.

But then it is their skill trading price action post-earnings that make them profitable rather than profitable on the volatility drop event.

Conclusion

Obviously, we cannot conclude based on one trader’s result during one earnings season.

Since I personally don’t trade earnings much, I thought it was interesting to see some actual results from live trading.

It is just one data point in our heads to counteract all the hype about big earnings trade returns we might encounter on the Internet.

For example, they might advertise the fact that they got a 77% return in one day by trading CLX.

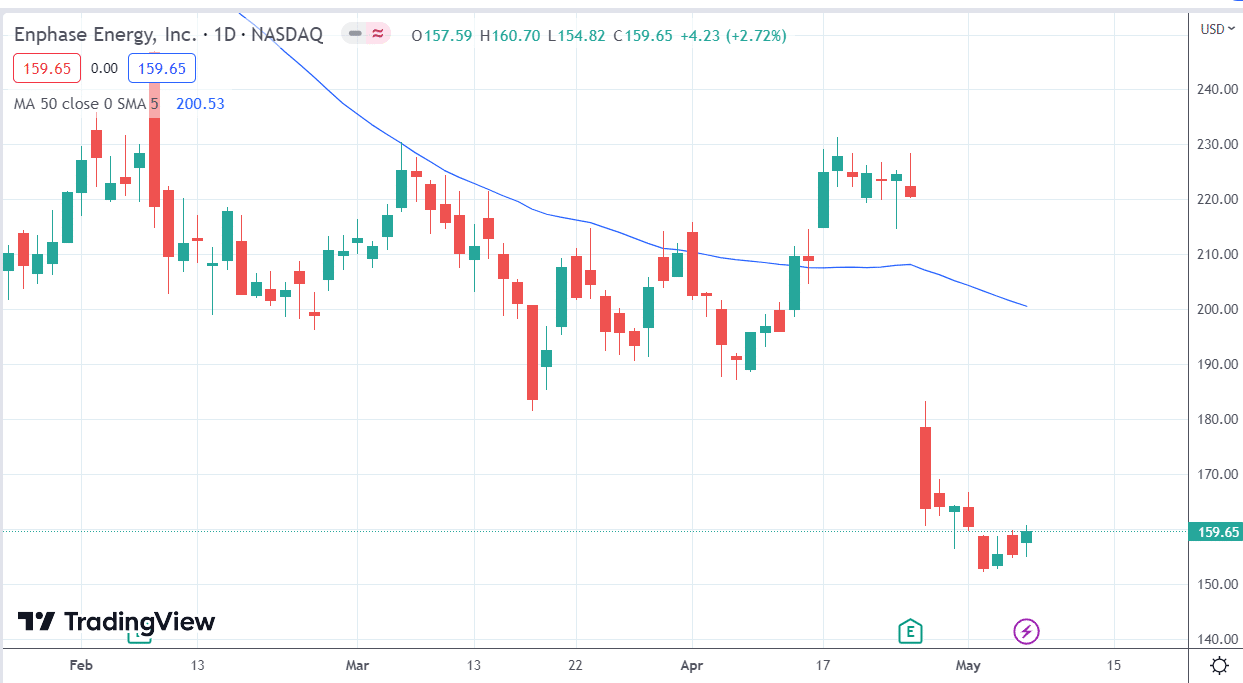

But they don’t tell you that they lost 97% of the capital allocated for the ENPH trade.

Essentially this was a max loss because the chart looked like this post-earnings:

When the price moves like that, it doesn’t matter if you use a calendar, iron condor, or a butterfly to harvest the profits from the volatility drop.

All those strategies are range-bound strategies, and this is not a range-bound move.

We hope you enjoyed this article about whether earnings trades are profitable or not.

If you have any questions, please send an email or leave a comment below.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.