When to roll covered calls is a decision that every trader will face at some point.

Today, we will look at some parameters to consider when rolling covered calls.

Contents

- Introduction

- When Stock Goes Down

- Unwinding The Covered Call

- When Stock Goes Up

- Rolling The Call

- Holding Call Till Expiration

- Exiting The Call On Expiration Week

- If Stock Moves Sideways

- FAQ

- Summary

- Related Articles

Introduction

The covered call is an options strategy where an investor owns shares of stock and sells call options against those shares.

Look at the previous article on covered calls and the exit strategies if you are new to this strategy.

We will be applying those concepts in the examples in this article by looking at what happens when:

- The stock goes down

- Stock goes sideways

- The stock goes up

When Stock Goes Down

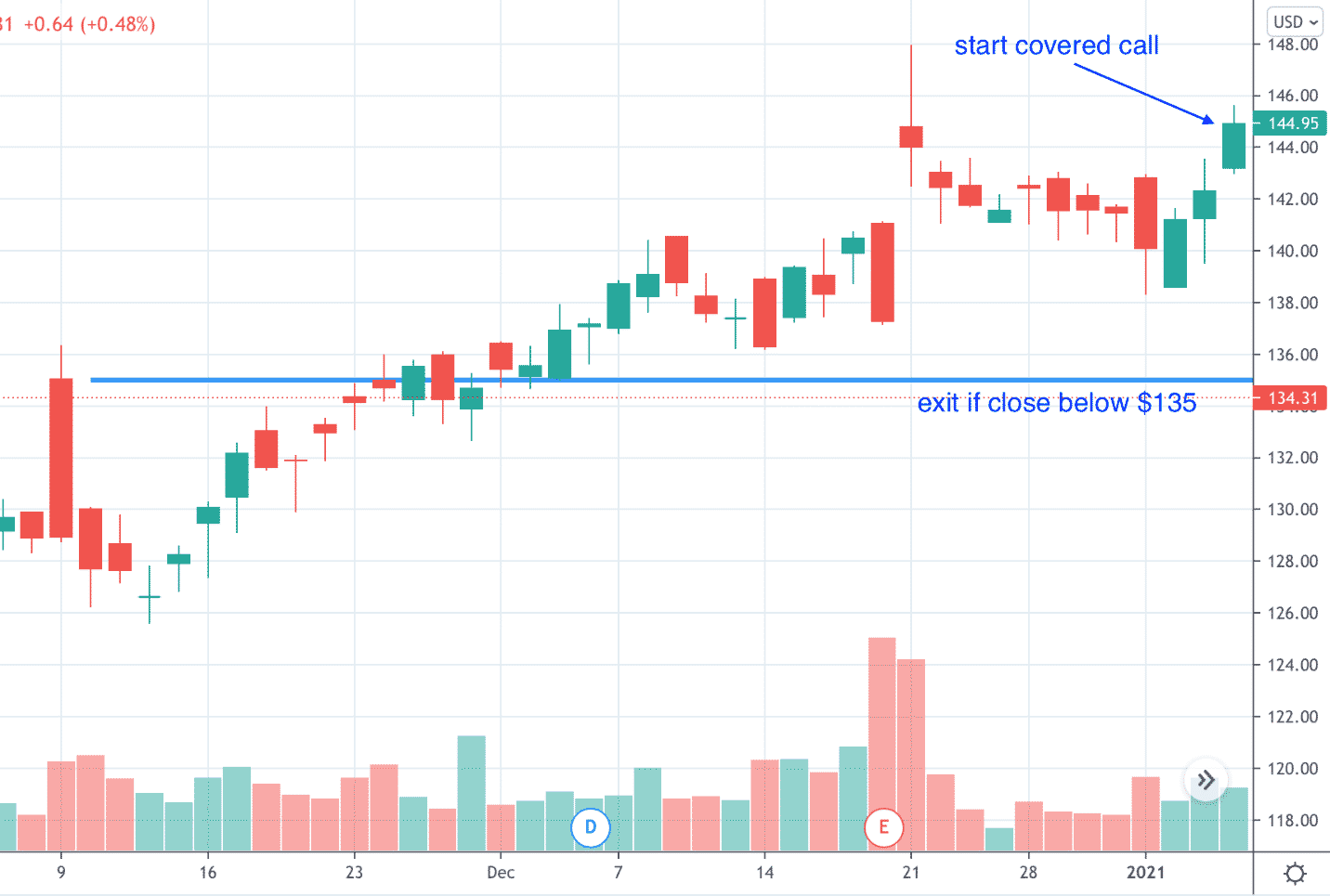

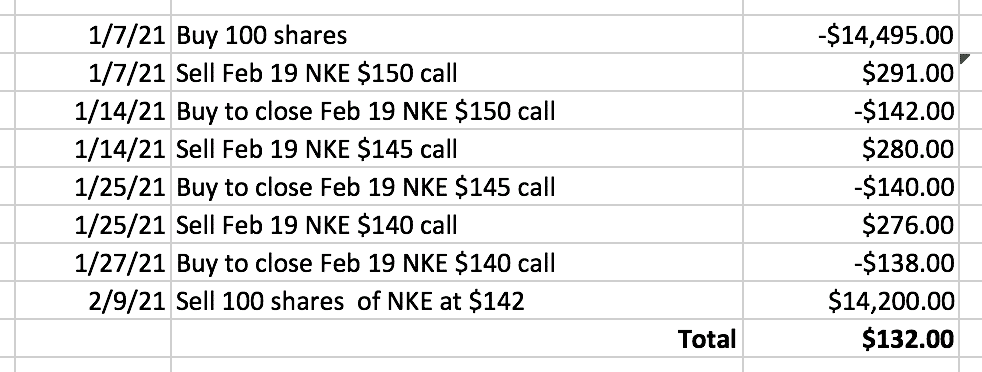

Suppose an investor owns the following covered call position on Nike (NKE):

Date: January 7, 2021

Price: NKE @ $144.95

Buy 100 shares of NKE @ $144.95

Sell one Feb 19 NKE $150 call @ $2.91

Initial capital outlay: $14,204

Max profit potential: $796

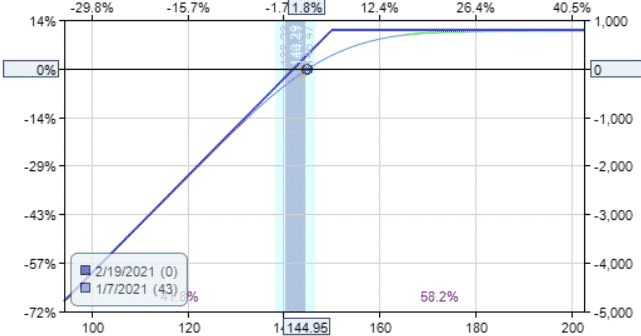

The position has the following payoff diagram:

As you can see, in a covered call position, the investor would like for the stock price to go up.

If it gets to be above $150 at expiration on February 19, the investor will make $796, or 5.6% of the initial capital invested.

The price of Nike can drop to $142.04 at expiration, and the investor will not lose any money.

Refer to this covered calls article which shows how to calculate max profit and break-even price.

A covered call is an undefined risk strategy. Its theoretical maximum loss can be the entire capital investment of $14,204 in the unlikely event that Nike’s price goes to zero.

We have to keep in mind that the stock position is the primary position.

The short call is the secondary position.

Hence, we have to manage it like a stock position and decide how far we are willing to let Nike drop before we exit the trade.

The investor decides in advance to exit the trade if Nike closes below $135.

The investor puts in an automatic buy limit order of $1.45 to exit the short call if the option’s value drops by 50%.

When to Roll Covered Calls

The rule of thumb for taking profits on the short call is to repurchase it if the percentage profit divided by the percentage of time passed is greater than 1.

To avoid daily calculations and adjustment of the buy limit order, the investor uses a simplified version of the rule and decides to take profit at 50% of max profit if it comes before January 29 (the first half of the trade duration).

After January 29, the investor will take profits of 80% of max profit.

This is to say that in the second half of the trade, the investor will pay up to 20% of the premium received to buy back the short call for a profit.

Sometime during the trading session of January 14, the short call was automatically repurchased when its price dropped below $1.45.

The investor sells to open another call near the end of the market day.

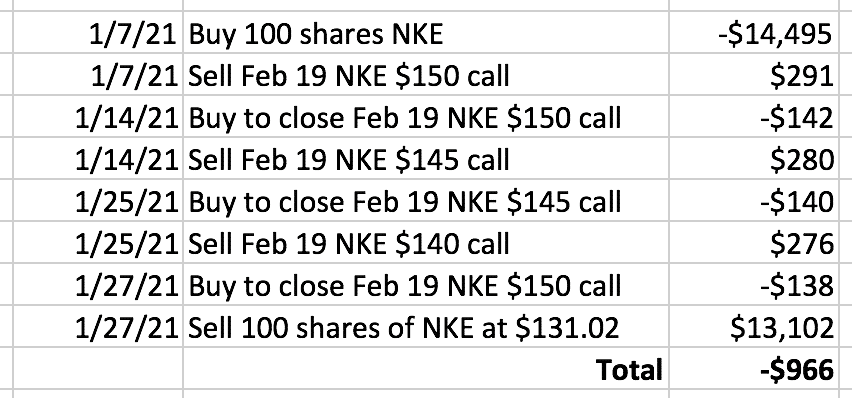

Rolling Covered Calls Down

Date: Jan 14, 2021

Price: NKE @ $141.30

Buy to close one Feb 19 NKE $150 call @ $1.42

Sell to open one Feb 19 NKE $145 call @ $2.80

With 36 days left for this NKE $145 short call, the investor will take profit on the short call if it drops below $1.40 by February 1. And it did on January 25.

Rolling Down Again

Date: Jan 25, 2021

Price: NKE @ $137.55

Buy to close one Feb 19 NKE $145 call @ $1.40

Sell to open one Feb 19 NKE $140 call @ $2.76

Once the short call is bought back, the investor sells another call at the $140 strike, picking up a premium of $276.

Once the $140 call was sold, the investor puts in an automatic buy limit order to pay up to $138 to buy the call back.

The next day on January 26, Nike traded below $135 but did not close below it. So, the investor is still in the trade.

On January 27, Nike gapped down, causing the short $140 put to be bought back at $1.38.

Date: Jan 27, 2021

Price: NKE @ $131.02

Buy to close one Feb 19 NKE $140 call @ $1.38

On this day, Nike closed below $135, so the investor does not sell another call. As per the plan, the investor exits the whole position by selling the 100 shares of Nike at $131.02.

Because the stock had gone down, the investor lost $966 overall in the strategy:

The loss would be less than what would have been lost without the covered call, which would have been –$1393 from the stock depreciation.

Unwinding The Covered Call

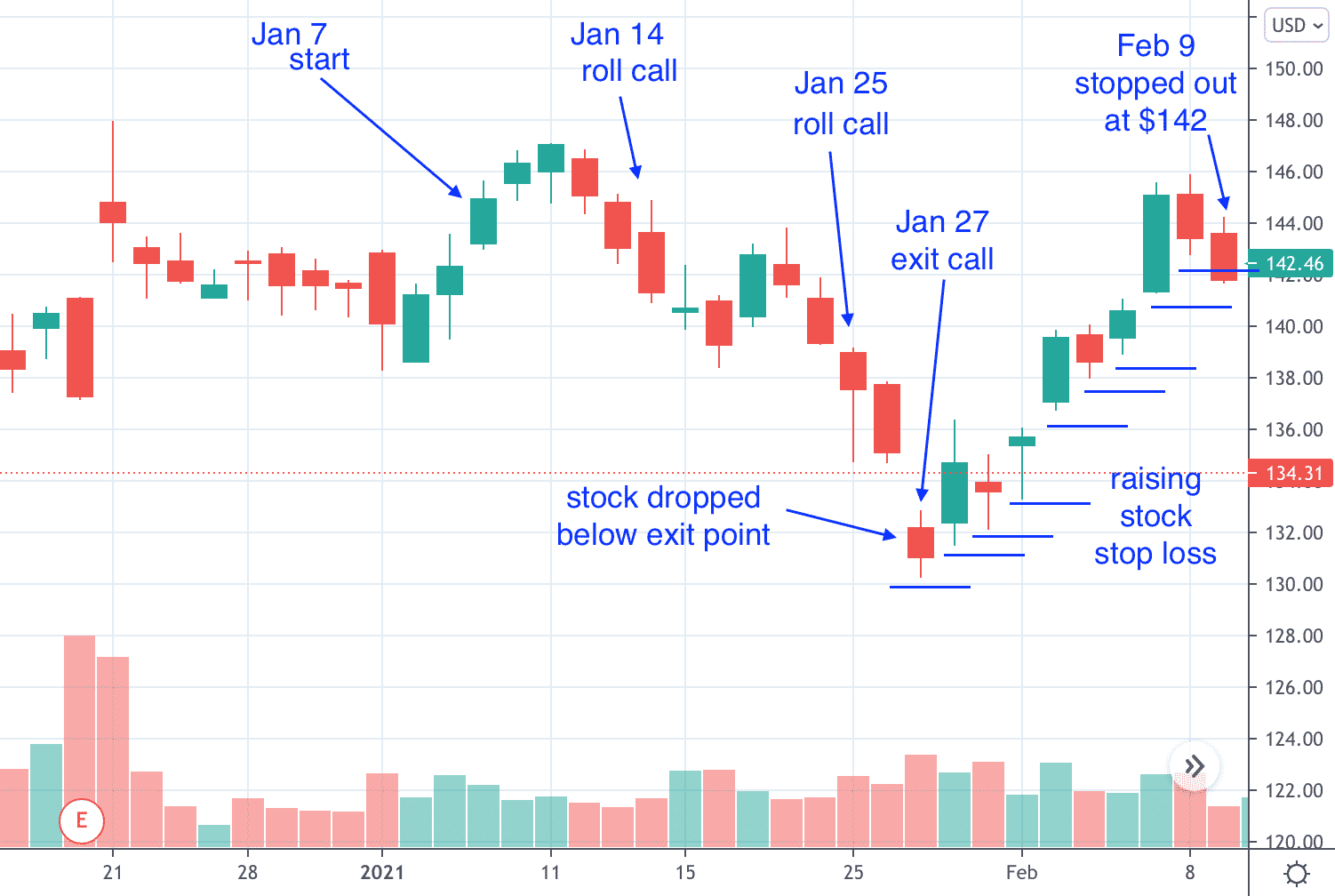

Instead of simply selling the 100 shares on January 27, the investor could put in a stop-loss order on the stock just underneath the low of that day’s candle.

You should not put a stop-loss order on stocks if there are short calls against that stock. Otherwise, if the stop was triggered, you will end up with a naked short call.

In certain brokerage accounts, this is not allowed.

But since the investor has no short calls in place, the investor puts a stop-loss order to sell 100 shares of Nike if it drops below $130.

The next day, the stop loss is not triggered because the stock rallied the next day.

The investor raises the stop loss to be just underneath the candle of that day.

And so on.

As luck has it, Nike continues to rally, and the investor does not get stopped out until February 9, when it triggered the stop loss set at $142.

Overall, the investor made $132. The stock lost $295.

But the call options made back $427.

Had Nike not made that impressive rally, or if the investor got stopped out on the first stop loss, the net loss would be –$966.

Unwinding the position by exiting the short call and then raising a stop loss on the stock is a great way to exit a covered call position.

When Stock Goes Up

To avoid the unpredictable price movement of stocks during earnings announcements, many investors will avoid putting on covered call strategies where the short call expiration spans across the earnings date.

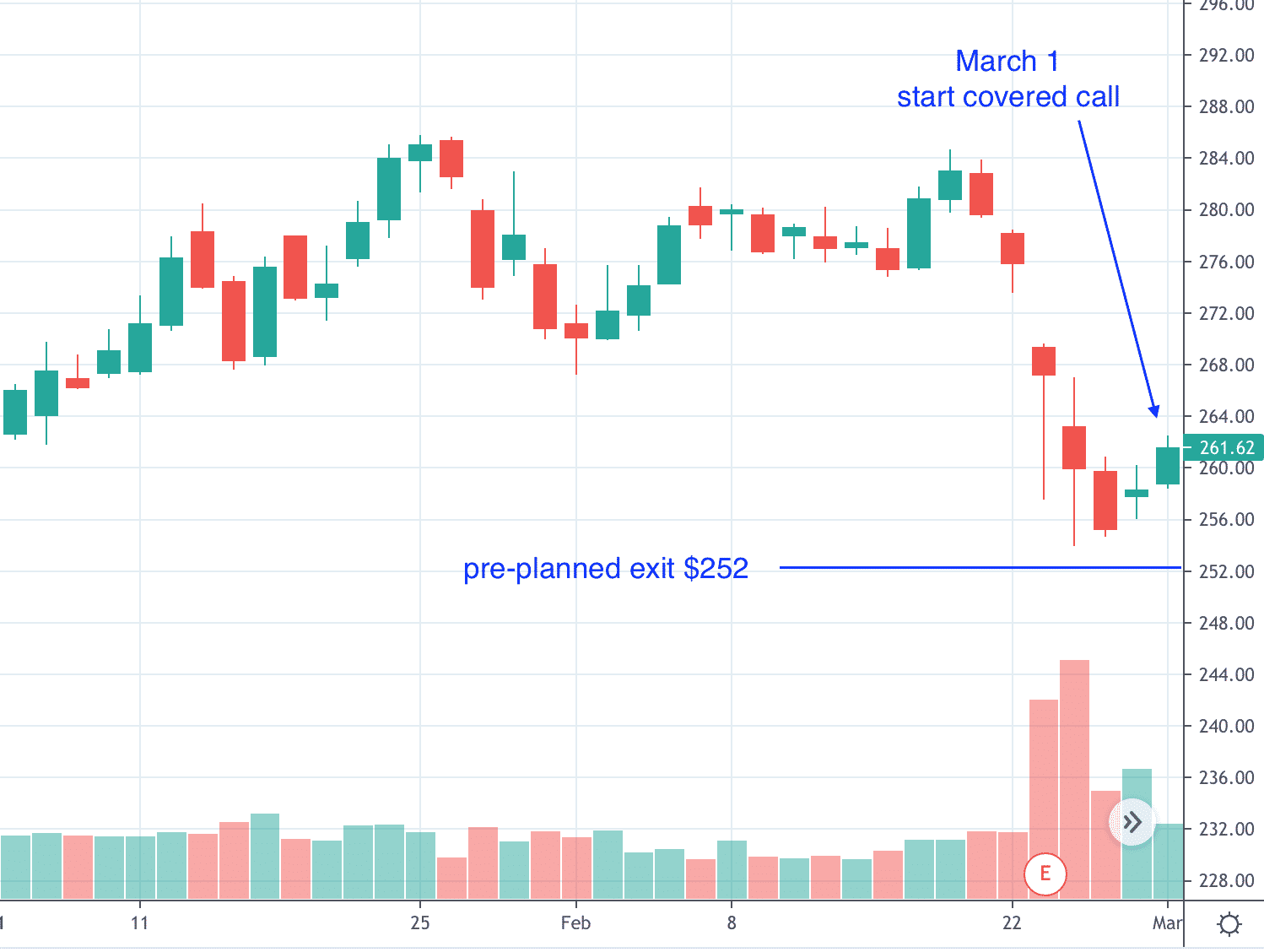

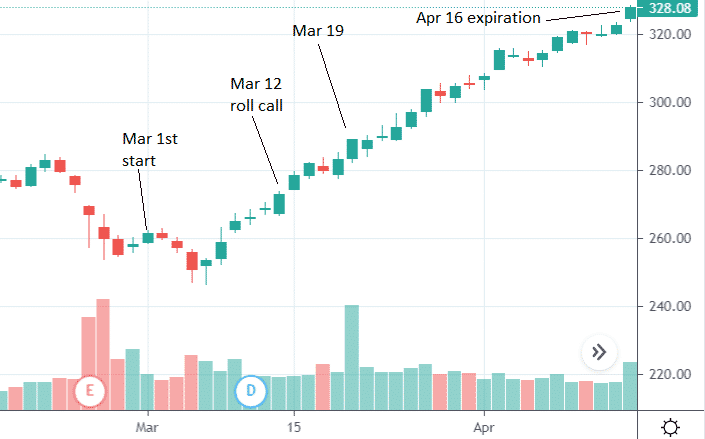

In the following example, the investor enters a covered call in Home Depot (HD).

Price had stabilized after its significant drop during earnings.

The planned exit is if HD drops below $252.

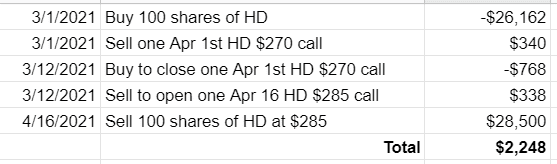

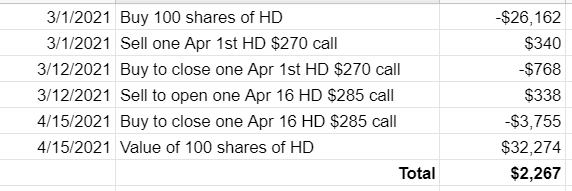

Date: March 1st, 2020

Buy 100 shares of HD @ $261.62

Sell one Apr 1 HD $270 call @ $3.40

Initial Capital Outlay: $25,822

Max Profit Potential: $1178, or 4.6% of the initial capital outlay

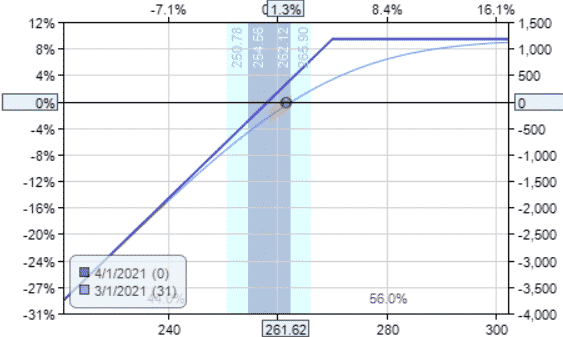

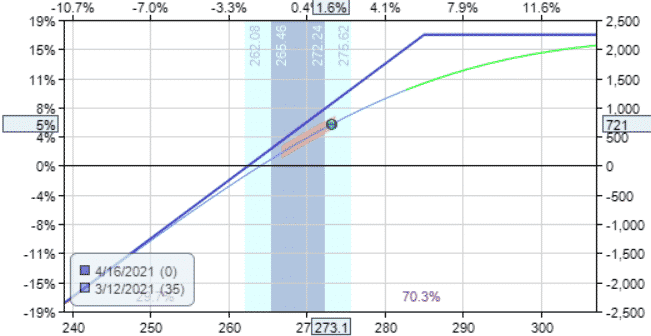

The payoff diagram:

On March 12 (well before half the trade is over), the covered call position sees a profit of $720.50, or 61% of the max profit potential.

The investor can unwind the position and take profits at this time.

Or the investor can hold for more profits. It is like managing a winning stock position.

If the stock keeps going up, the longer you hold onto the trade, the more money you will make.

You can see that there is an upward slope on the T+0 line.

Watch The T+0 Line

However, that upward slope is not as steep as it reaches around 80% of max profit.

Taking profits anywhere between 50% to 80% of max profit is the sweet spot.

It also depends on how fast the gains come.

If profits come faster than expected, it is more reasonable to take the profits even lower.

Newer investors will probably enjoy taking profits earlier because doing so increases the win rate, builds confidence, and avoid the frustration of seeing profits disappear due to untimely market corrections.

More seasoned investors may hold trades longer for more significant gains because it requires less monitoring and management.

In short, it depends on the investor’s preference.

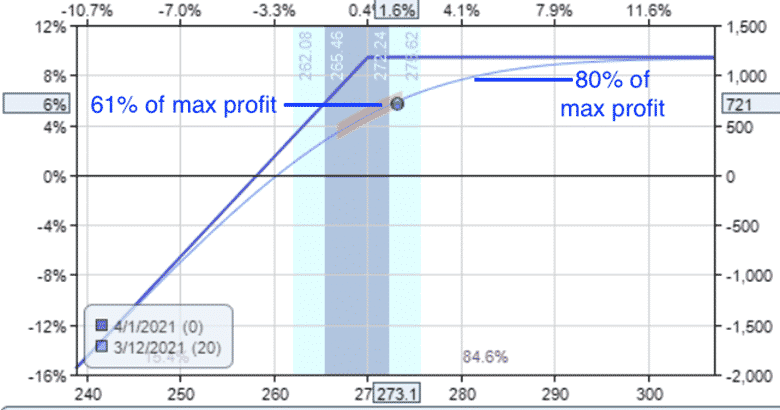

Rolling the Call

This particular investor decides to take profit at this time but wants to immediately sell another covered call without giving up the stock.

Date: March 12, 2021

Price: HD @ $273.10

Buy to close one Apr 1 HD $270 call @ $7.68

Sell to open one Apr 16 HD $285 call @ $3.38

Debit: $430

This adjustment is known as rolling the strike up and out.

It costs a debit of $430.

More money is put into the trade to increase the profit potential.

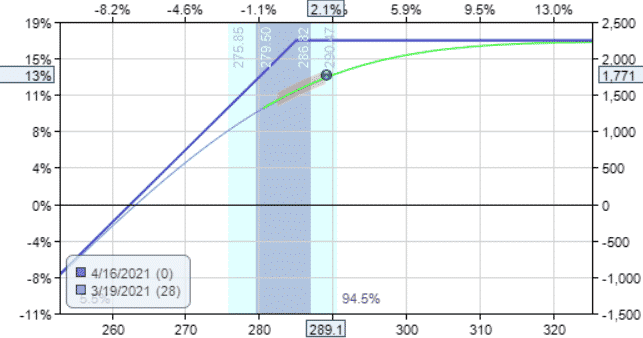

The new payoff diagram looks like this.

On March 19, with almost a month more till expiration, Home Depot went up like a skyscraper and closed at $289.10.

The payoff diagram looks like we are at a good percentage of the max profit, and it is undoubtedly reasonable to take profits.

The short call is now in-the-money, and it costs $888 to buy it back.

We had sold it for $338. That is a loss of $550.

Yet this should not be a concern because when the stock price goes up, the stock appreciation will be more than the loss of the short call.

During that same time, the stock gained $1600 as Home Depot went from $273.10 to $289.10.

Holding Call till Expiration

The investor wouldn’t mind if the stock continues to go up more and the short call loses more money.

The net effect would still be a gain. We have an upward sloping T+0 line.

Some aggressive investors will continue to hold until expiration instead of taking profits at 50% or 80%.

This is another valid strategy.

Let’s see what happens if the investor holds till expiration.

On April 16 expiration, Home Depot closed at an incredible $328.08.

The short call is very much in the money. And we are obligated to sell our 100 shares of stock at $285.

In total, the investor made $2248 from this strategy.

Exiting The Call On Expiration Week

It may not sound very palatable that we had to sell our Home Depot stock at $285 when its market price is $328.08.

What if the investor had exited the short call just before expiration to release the obligation? Would that make any difference?

From a P&L standpoint, it wouldn’t have made much difference.

The only difference is that the investor would still own the stock instead of being called away.

Selling stock does sometimes have tax consequences, so check with your financial advisor.

Suppose the investor had bought to exit the short call at the end of market day on April 15 (one day before expiration).

That call would cost $3755 to buy back.

Now the investor keeps the 100 shares which closed at $322.74 on April 15.

The P&L would be pretty similar:

In comparison, a stock investor who bought Home Depot at $261.62 and sold it at $328.08 would have made $6646.

If Stock Moves Sideways

Apple, Microsoft, Facebook, and Intel all have earnings in January of 2021.

Instead, the investor can do a covered call on the XLK ETF if they are bullish on the technology sector.

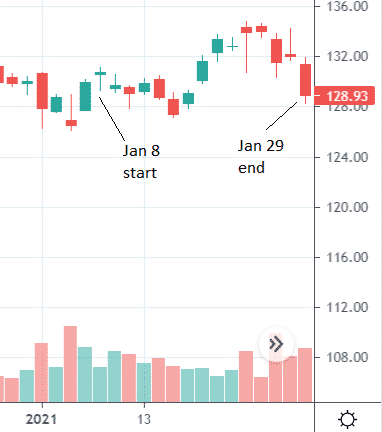

Date: Jan 8, 2021

Buy 100 shares of XLK @ $130.54

Sell one Jan 29 XLK $135 call @ $1.18

Initial Capital Outlay: $12,936

Max Profit Potential: $564, or 4.3% of the initial capital outlay

Planned Exit: if XLK drops below $125

During the first half of the trade duration, this trade never reached profits of $182, which is 50% of the max profit potential.

For the second half of the trade duration, we will take profits at 80% of the max profit potential, which is $451. This never came either.

The planned stop to exit if XLK dropped below $125 never occurred.

On expiration January 29, XLK closed at $128.93. The call expired out-of-the-money, and the investor keeps the initial premium received and the underlying XLK shares.

When the underlying moves sideways, there is nothing to do. Just let the call expire, collect the premium, and sell another call.

FAQ

What Is A Covered Call?

A covered call is a popular options trading strategy that involves selling call options against a long stock position.

The trader collects a premium for selling the call option, which can help to offset the cost of holding the stock.

If the stock price rises above the strike price of the call option, the trader may be required to sell their stock at a profit.

What Is Rolling A Covered Call?

Rolling a covered call involves closing out an existing call option position and simultaneously opening a new call option position with a later expiration date or a different strike price.

This allows the trader to continue collecting premium income while potentially avoiding being assigned and forced to sell their stock at a loss.

When Should I Consider Rolling A Covered Call?

There are several factors to consider when deciding whether to roll a covered call.

These may include the current stock price, the time until expiration, and the current implied volatility of the options.

Generally, rolling a covered call may be appropriate when the stock price is approaching the strike price of the call option, or when there is still significant time remaining until expiration and the trader wants to continue collecting premium income.

How Do I Roll A Covered Call?

Rolling a covered call typically involves buying back the existing call option and simultaneously selling a new call option with a later expiration date or a different strike price.

The trader should evaluate the potential costs and benefits of the new position before making the trade, taking into account any transaction fees and the potential impact on their overall risk-reward profile.

What Are The Risks Of Rolling A Covered Call?

Rolling a covered call involves risk, just like any options trading strategy.

The trader may incur transaction fees, and the new position may have a different risk-reward profile than the original position.

Additionally, if the stock price declines significantly, the trader may be forced to sell their stock at a loss if they are assigned on the call option.

Summary

Covered calls bring in additional premiums to reduce the cost basis of stock purchases.

The tradeoff is that it caps the upside potential of the stock.

If the stock happens to be very bullish, the covered call position will profit less than if the investor had owned the stock itself without the short call.

To increase the profit potential in this case, the investor can roll up the short call.

On the other hand, if the stock drops, the covered call position would lose less than if the investor had owned the stock itself.

If the stock continues to fall, the investor can roll the short call down closer to the stock price.

At what point the investor decides to roll will be dependent on where in the trade duration we are.

If, during the first half of the trade, the investor is willing to pay up to 50% of the premium received to buy back the short call.

If, during the last half of the trade, the investor is willing to pay up to only 20% of the premium received.

The net effect of adding covered calls to an investor’s portfolio is that it reduces the volatility of the portfolio’s equity curve and reduces the portfolio’s drawdown.

Trade safe!

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with exchange traded options. Any readers interested in this strategy should do their own research and seek advice from a licensed financial adviser.

Related Articles

Selling Covered Calls – A Detailed Guide

How To Write Covered Calls: 2024 Ultimate Guide

Weekly Versus Monthly Covered Calls

How To Make Money With Covered Calls

Covered Calls 101

Selling Deep In The Money Covered Calls: Why Do It?

Covered Calls For Dummies

Covered Calls With LEAPs Options Strategy

Supercharge Your Covered Calls Using LEAPS

Selling Weekly Covered Calls

Covered Calls: How to Adjust to Changing Market Conditions

Gav, Thanks for a very helpful review of the covered call. I trade mostly naked puts and put credit spreads, but now I will incorporate the covered call in my trading also. Your presentation has changed my view of the use of the covered call and helped get my trading brain working at a different level. Thank you. Dick

You’re welcome, glad it helped you.